Commercial real estate continues to suffer despite the Federal Reserve’s attempt at ameliorating the capital markets with a 50-basis point rate cut in September.

The pain is especially apparent in the so-called “CRE-CLO” bond market. CRE-CLO bonds are packaged commercial real estate mortgages comprising short-term floating rate loans. These bridge loans were recently, and most notably, used to facilitate the biggest apartment investment bubble in history, but were also used in financing other commercial real estate sectors including office, retail, hotel, industrial, and self-storage.

Most of the current batch of bridge loans originated in the 2020-2022 period—when benchmark rates were near zero and commercial real estate prices were peaking—and carried maturities of three to five years. Benchmark rates are now much higher, prices much lower, and property performance far worse than anticipated. Thus, a wall of maturities is staring borrowers, lenders, and bondholders in the face, all while underlying property performance disappoints.

Despite attempts by lenders to extend and pretend—kicking the can down the road in the short term to avoid defaults until the Federal Reserve lowers rates enough to bail them out—their delusions of reprieve may be fading fast.

Apartment Investors Play Checkers Instead of Chess

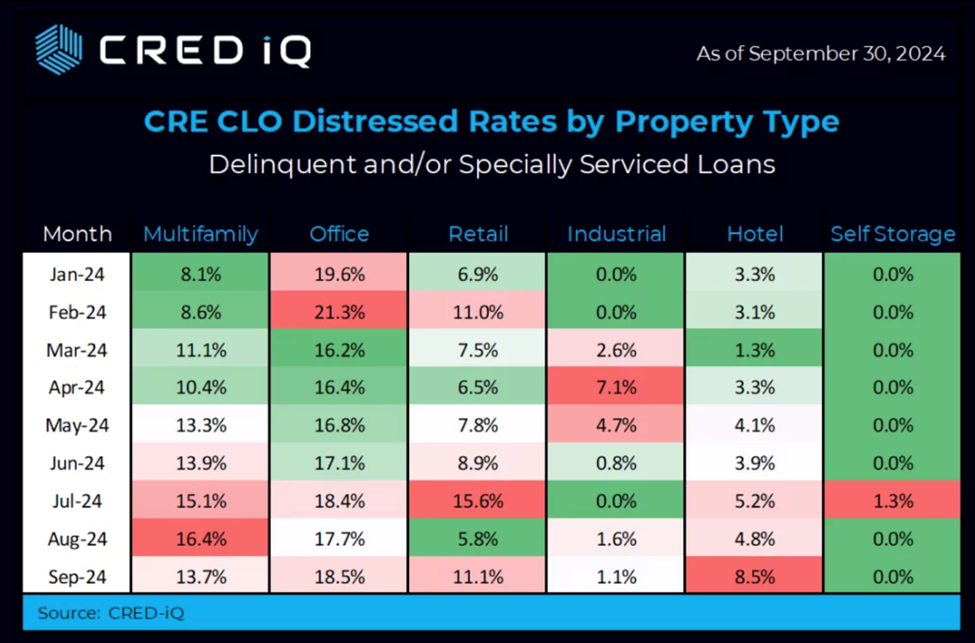

At the end of Q3, the distress rate for CRE-CLO loans across all commercial real estate sectors reached 13.1 percent, an all-time high. Distress in this instance is defined as any loan reported 30 days or more delinquent, past the maturity date, in special servicing (typically due to a drop in occupancy or a failure to meet certain performance criteria), or any combination thereof.

Figure 1

While roughly one in seven loans meets these criteria, the weakness is concentrated in two or three sectors.

Unsurprisingly, office properties have the highest rate of distress, with nearly one in five CRE-CLO office loans experiencing current distress. This is to be expected after the covid panic of 2020, subsequent to which various “work-from-home” directives essentially made the office market obsolete.

For similar reasons, distress is also high in the retail segment, as all but the most well-heeled retailers were forced under by the maniacal and criminal government edicts of the time.

However, the real story here is in the apartment, or multifamily, sector. Seen in Figure 1, the distress rate for apartments touched 16.4 percent in August. An astonishing number, indicating that one in six apartment bridge loans were distressed. The improvement to 13.7 percent shown for September is seasonal, as renters settle in at the start of the school year.

While this picture is bad enough, the reality under the surface is far worse. As reported by the Wall Street Journal, using Q2 data from MSCI, the batch of currently distressed apartment bridge loans comprise roughly $14 billion in total loans, but there exists an additional $81 billion in potentially distressed loans. MSCI categorizes loans as “potentially distressed” if they have seen delinquent payments, forbearance (when the lender lets interest payments accrue rather than taking a default action), or where key performance metrics like occupancy and net operating income are dangerously low.

Figure 2

The arithmetically-aware will note that if the $14 billion of currently distressed apartment bridge loans comprise a roughly 14 percent distress rate at the end of Q2 (as shown in Figure 1) and there are an additional $81 billion in potentially distressed loans not yet categorized as “currently distressed” (as shown in Figure 2), then MSCI data implies that 95 percent of all apartment bridge loans are either currently distressed or in imminent danger of distress.

While astounding, this level of distress will come as no surprise to veterans of the apartment market. In the 2020-22 period, bridge loans of this variety were ubiquitous above a certain minimum loan size. And, because of the extreme and reckless nature of money printing undertaken by the Federal Reserve during this time—when interest rates were effectively zero—lenders underwrote property acquisitions with a 1.0x debt service coverage ratio (“DSCR”), meaning the initial net operating income of the property was projected to just cover interest payments, with nothing left over.

Bridge loan interest rates floated at a spread (typically around 350 basis points, or 3.5 percent) to the Secured Overnight Financing Rate (“SOFR”), which was essentially 0 percent until mid-2022. Because of the 1.0x DSCR standard, a property acquired during this period that had net operating income of $1 million would have also had interest payments of $1 million at the then-prevailing interest rate of 3.5 percent.

SOFR is now 4.9 percent, indicating a total interest rate of 8.4 percent (SOFR + 3.5 percent spread). This same property now has interest payments of $2.4 million while net operating income is unlikely to have increased to any significant extent, if at all. Insurance and property tax increases in particular have damaged apartment profitability while rent increases have been difficult to execute in the face of stagnating real wages. By the same token, absurdly optimistic renovation plans have been impossible in the face of cash flows increasingly shunted towards paying interest.

The Amazing Disappearing Rate Cut

The high amount of potential distress in CRE-CLO bonds, and the loans that underlie them, indicate an expectation on the part of lenders that help is coming in the form of lower interest rates. After all, capital markets have become used to being bailed out by the Federal Reserve, all but demanding that the taxpayer—not they—be held responsible for their poor decisions. Nevertheless, the Fed’s recent rate cut is proving not to be the magic bullet on which lenders relied.

By August of this year, futures markets had fully priced in a 25-50 basis point Fed rate cut in September, and were expecting additional 25 basis point cuts in November and December. This expectation for the Fed Funds Rate carried over into Treasury yields, a key benchmark for the commercial real estate industry. Particularly important in the case of distressed bridge loans since any hopes of refinancing are placed not on more bridge loans—which are now much less pervasive—but on the fixed-rate agency market comprising Fannie- and Freddie-backed apartment loans, which prices loans off a spread to treasuries.

At the beginning of August, as markets priced in 75-100 bps of Fed rate cuts by year-end, 10-year Treasury yields reacted accordingly, dropping from 4.30 percent in late July (they had been 4.70 percent in April) to 3.65 percent in the middle of September. As of early November, most of that move had been erased—with yields back near 4.30 percent—roughly where they were prior to market pricing in this year’s Fed rate cuts.

Fear and Trembling

Undeniably, participants in the commercial real estate market—apartment bridge lenders in particular—are relying on loose monetary policy for their immediate salvation. They may get their wish. While Treasury rates have moved stubbornly higher, market forces only mean so much if the Fed decides to supplement rate cuts with purchases of treasuries, driving yields lower—another round of quantitative easing.

Nevertheless, to the extent they’re allowed to be heard, market signals are unmistakable. A regime that can’t stop spending and continues to appropriate the property of its citizens through inflation will provide upward pressure on Treasury yields, all else equal. In a free market context, the rent-seekers that comprise the commercial real estate market will have to work out their own salvation.

Originally Posted at https://mises.org/