Money-Supply Growth Accelerates as Wall Street Demands Even More Easy Money

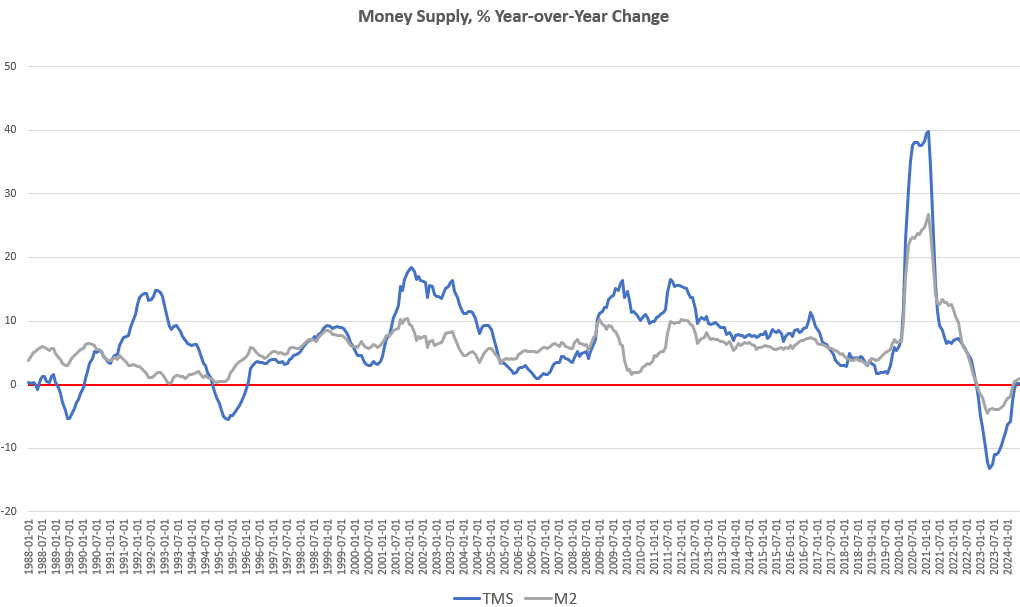

Money-supply growth rose year over year in June for the second month in a row. This is the first time the money supply has grown for two months in a row since October of 2022. The current trend in money-supply growth suggests a significant turnaround from more than a year of historically large contractions in the money supply that occurred throughout much of 2023 and 2024. As of June, the money supply appears to be, for now, in a period of stabilization.

The money-supply growth of May and June ends an eighteen-month period during which the money supply repeatedly contracted, year over year. In June, YOY growth in the money supply was at 0.24 percent. That’s the same as the May 2024 increase, and was a large reversal from June 2023’s YOY decline of 12.5 percent. Until recently, the US money supply was experiencing a period of the the largest drops in money supply we’ve seen since the Great Depression. Prior to 2023, at no other point for at least sixty years had the money supply fallen by so much.

Those dramatic drops in the money supply appear to be over for the time being. Indeed, when we look at month-to-month changes in the money supply, we find that the money supply was flat from May to June, increasing by 0.002 percent. In month-to-month measures, money supply growth has been positive during seven of the last twelve months, further suggesting that the new trend in money supply is either flat or returning to sustained upward growth..

The money supply metric used here—the “true,” or Rothbard-Salerno, money supply measure (TMS)—is the metric developed by Murray Rothbard and Joseph Salerno, and is designed to provide a better measure of money supply fluctuations than M2. (The Mises Institute now offers regular updates on this metric and its growth.)

In recent months, M2 growth rates have followed a similar course to TMS growth rates, although TMS has fallen faster than M2 in the year-over-year measures, and M2 has rebounded faster. In June, the M2 growth rate was 0.983 percent. That’s up from May’s growth rate of 0.58 percent. June’s growth rate was also up from June 2023’s rate of -3.8 percent. Moreover, M2 also shows more overall growth than TMS, with M2 increasing by 0.55 percent from May to June this year.

Money supply growth can often be a helpful measure of economic activity and an indicator of coming recessions. During periods of economic boom, money supply tends to grow quickly as commercial banks make more loans. On the other hand, two or three years before a recession begins, we tend to see periods during which money supply growth slows or turns negative.

It should be noted that the money supply does not need to actually contract to signal a recession. As shown by Ludwig von Mises, recessions are often preceded by a mere slowing in money supply growth. But the drop into negative territory we’ve seen in recent months does help illustrate just how far and how rapidly money supply growth has fallen. That is generally a red flag for economic growth and employment.

All that said, recessions tend not to become apparent until after the money supply has begun to accelerate again after a period of slowing. This was the case in the early 1990’s recession, the Dot-com Bust of 2001, and the Great Recession.

In spite of last year’s sizable drops in total money supply, the trend in money-supply remains well above what existed during the twenty-year period from 1989 to 2009. To return to this trend, the money supply would have to drop another $3 trillion or so—or 15 percent—down to a total below $15 trillion. Moreover, as of June, total money supply was still up more than 30 percent (or about $4.6 trillion) since January 2020.

Since 2009, the TMS money supply is now up by more than 185 percent. (M2 has grown by 145 percent in that period.) Out of the current money supply of $18.8 trillion, $4.6 trillion—or 24 percent—of that has been created since January 2020. Since 2009, more than $12 trillion of the current money supply has been created. In other words, nearly two-thirds of the total existing money supply have been created just in the past thirteen years.

With these kinds of totals, a ten-percent drop in the money supply only puts a small dent in the huge edifice of newly created money. The US economy still faces a very large monetary overhang from the past several years, and this is partly why so many months of negative money-supply growth, total employment has only stagnated while showing no large contractions. (For example, full-time job growth has turned negative while the total number of employed workers has been flat since late 2023.) Moreover, CPI inflation remains well over the two-percent target rate, and mainstream economists’ predictions of significant “disinflation” have been wrong.

Wall Street Wants More Money-Supply Growth

As economic indicators continue to weaken, we should expect to hear an increasing chorus of demands for inflationary monetary policy designed to accelerate money supply growth.

For example, last week’s weak jobs report led to numerous calls from Wall Street pundits for more dovish policy from the Federal Reserve. On Monday, economist and longtime Wall Street “expert” Jeremy Siegel seemed nearly hysterical as he demanded the Fed hold an emergency meeting and slash the target policy interest rate by 150 basis points over the next two months. This can only be described as “panic.” This followed a cloud of other establishment economists who declared on Friday that the Fed should have begun cutting rates many months ago.

Remote video URL

Even a small downward drift in the markets demands an aggressive policy response in the minds of Wall Street boosters. In other words, the Greenspan put remains as essential as ever in the minds of Wall Street’s “elites.” Now, of course, the Greenspan put has been replaced by the Bernanke put, the Yellen put and the Powell put. Even with the total money supply well above trend and still bumping around 19 trillion, people like Jeremy Siegel would have you believe the Fed has been aggressively hawkish. For the nation’s banker class, it is always the right time to push more easy money in order to keep asset prices as levels that keeps “the 1%” awash in riches.

The Fed and the Federal Government Need Lower Interest Rates

Part of the reason that banker class never tires of easy money, however, is that the wealthiest have many ways of dealing with mounting consumer price inflation. So long as prices in real estate, stocks, and other asset classes continue to inflate faster than prices for food and other basics, then inflation presents no real problem for the wealthiest among us.

For those who don’t own immense stockpiles of assets, however, consumer price inflation can be devastating.

Thus, the only real restraint on easy money is the fact public opinion will turn against the regime when easy-money fueled price inflation accelerate for ordinary people. Regimes fear high levels of price inflation because high inflation is known to lead to political instability.

One way that central banks fight price inflation is to allow interest rates to rise, but this means public dissatisfaction with rising prices must compete with incessant calls for lower interest rates coming out of Wall Street—as we see above—and also out of the regime itself.

Central banks are not expected only to keep Wall Street happy. A regime’s central bank is also expected to help the regime issue debt and engage in deficit spending. Central banks’ main tool in offering this help involves keeping interest rates on government debt low. How do central banks do this? By buying up the government’s debt, thus artificially boosting demand for the government’s debt and pushing interest rates back down. The problem is that buying up government debt usually involves creating new money, thus putting upward pressure on price inflation.

Given all these pressures from the easy-money interests, it’s rather surprising that money-supply growth did not turn positive sooner than it did and that the central bank has not been more aggressive in pushing growth rates up faster.

What the Fed is doing now is probably best described as a “wait and hope” strategy. The Fed is refusing to allow interest rates to rise, but the Fed is still proceeding slowly on forcing interest rates down even further.

While the Fed is certainly responsive to Wall Street historically, the Fed’s larger concern right now is likely the need to push down interest rates on government debt. It appears the Fed is holding the target rate steady just hoping that something will happen to bring Treasury yields back down without the Fed having to print more money to buy more Treasuries and risking a new, politically damaging surge in price inflation. “Hoping” is not much of a strategy, however, and the likely outcome is that the Fed will err on the side of keeping interest rates low so the regime can borrow more money. This will mean more price inflation for ordinary people.

Originally Posted at https://mises.org/

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers: