The UN Climate Change Conference, known this year as COP29, kicked off on Monday and will last through the 22nd of this month. Many of the usual climate grifters have skipped the event as de-growth ‘green’ policies in the US are being prepared to be rolled back to some degree under a Trump presidency. Even Swedish far-left activist Greta Thunberg skipped the event (pre-occupied with pro-Palestine protests?).

On Tuesday, UN Secretary-General António Guterres told the world leaders who attended the event that last year’s meeting was a “master class in climate destruction,” adding, “The sound you hear is the ticking clock.”

Guterres also said the transition to clean energy “won’t be stopped by no group, no business, and no government.” He was likely referring to Trump’s plan to roll back certain climate policies that are strangling the economy and simultaneously boosting inflation, making US companies unable to compete in international markets. At the same time, China operates free of these de-growth policies.

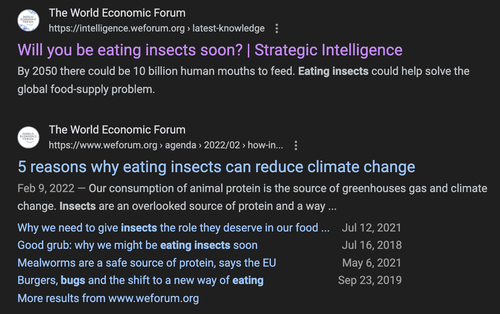

One particular speech by Willem Branten, the public affairs officer of True Animal Protein Price (TAPP) Coalition, a non-profit foundation focused on taxing real meat out of existence to reset the global food supply chain into a planet-based future, caught the internet’s attention given radical far left and their billionaire funders have been pushing fake meat and insects as a way to solve the so-called ‘climate crisis.’

LoL.

WEF propaganda non-sense.

TAPP’s Branten said the quiet part out loud: using policy warfare, such as the “greenhouse gas emission price mechanism” – or a meat tax – to fund their climate crisis agenda and eventually end the overconsumption of animal protein.

At U.S. taxpayer-funded #COP29Baku, @tappcoalition‘s Willem Branten calls for taxing meat to reduce its consumption: “Our current food systems are incompatible with the Paris climate accords … vegan diets are projected to have only half of the the climate footprint as meat… pic.twitter.com/HY5x4NcQn8

— Tom Elliott (@tomselliott) November 12, 2024

Calling for a meat tax while US retail ground beef prices are soaring shows just how out-of-touch liberals are with concerns of the working class. That’s why they lost the election in the US.

In other words, the themes of de-growth and de-population promoted by the UN are being pushed by radical leftists who want to control every facet of life—what you eat, drive, and how you live. Trump’s victory last week was a vote by the American people that rejects radical climate grifters and their Marxist friends that have sparked the worst inflation storm in a generation.

Loading…

Originally Posted at; https://www.zerohedge.com//