Americans are outraged. Gas prices have risen over 30 percent in four years, electricity has risen by over 30 percent in the last four years, and groceries have risen by over 20 percent. This is infuriating and Americans are well in the right to be disgusted by it. Now, imagine living in a country where gas prices have risen by 350 percent—yes, 350 percent!—in the last year, electricity prices have doubled in one year, and egg prices doubled in the last year.

That’s the reality for the 200 million people that live in Nigeria and similar stories are the reality in many African countries (e.g., Ghana). As you can imagine, it has led to increases in crime, substandard products, depression and mental health issues, unemployment; the list is endless.

One important thing for Americans and the Western world to understand is that Americans, especially the working class Americans, in some form bear the repercussion of these happenings in that many Nigerians have been forced to emigrate towards Western nations and, out of sheer desperation, are willing to do the same jobs in those nations for much lower wages. This can quickly result in a global downward spiral to serfdom. Just like Americans are outraged at their government for inflation, Nigerians are also outraged at their government. Unfortunately, many people do not know how the government is actually making their lives miserable, with many offering more government-backed “solutions” that would even make things worse. So how did Nigeria get here?

The first thing one needs to understand about government is the various tools the government has to influence the economy and people’s lives in general. There are three major tools: 1) money or government spending (taxation, debt, and money printing); 2) laws or regulations; and, 3) coercive enforcement (guns). In this case, how has the Nigerian Government deployed these tools?

Government Spending

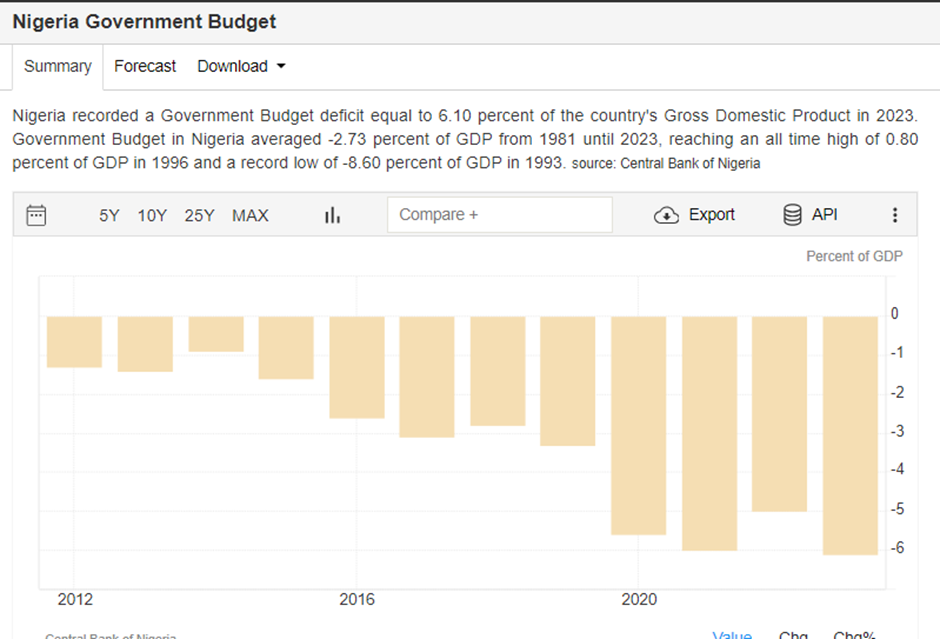

There is a wonderful quote about government that removes any ambiguity about government spending: “The government has no money to give to somebody; the government must first take from another.” In Nigeria, government spending has continued to balloon, with deficits rising steadily since 2012. The chart below shows the government deficit as a percentage of GDP since 2012:

Now, many people—especially from the Keynesian school of thought—would be okay with such deficits under the assumption that the deficits are being used to fund infrastructure which will later lead to growth. However, most of the budget is being used to fund debt repayment (45 percent) and other recurrent expenditures (43 percent) of which 60 percent of the recurrent costs are for government workers salaries. For context, in the US, there are 15 federal departments and prominent people like Elon Musk are calling for a reduction. In Nigeria, there are 25 federal ministries; in Ghana, 21. This is not to mention the numerous ministries and agencies going into thousands. Very little of the spending goes to actual infrastructure and security. A lot of the spending goes into frivolous purchases like cars, airplanes, new government houses, phantom projects, etc. How does the government in Nigeria fund their spending?

Taxes

One would think in a time of economic upheaval—with people crying that there is “no money”—the first thing that the government would do is to reduce the tax burden on the people. Oh no! Just like the biblical Rehoboam did, the government has increased taxes over the last year. The government has continually increased the USA Dollar-Naira (USDNGN) exchange rate used in setting import duty and other custom taxes—making essential imports and raw materials for food production such as poultry business to rise astronomically. The government even brags about the increased revenue from customs taxes,

“The NCS has been able to generate revenue from January to September 2024 to the tune of N4.28tn while in the corresponding year, 2023, the service was able to generate a revenue sum of N3.21tn as also compared to the year, 2022 when the service was able to generate the sum of N2.60tn,” the document stated.

In the document, the service said that the year-on-year improvements in import duty collection show a marked improvement by measures put in place by the Central Bank of Nigeria and commercial banks in the adoption of digital infrastructure.

The government has also continued to implement new taxes. It has introduced a new “cyber-security” charge, paid by people who make bank transfers. It doesn’t matter that such a transfer is not even profit from doing business, if the money is transferred, the fee is charged. This is in addition to another charge, called “electronic money levy,” being charged on all bank transactions. Some people, due to this levy, decided to flee traditional banks and to Financial Technology (Fintechs) and other neobanks. In response, the government passed a directive to charge the fee on those platforms as well. It’s more and more taxes, thus squeezing the already-squeezed people.

It’s not just the federal government, state and local governments are also piling on the taxes. In Lagos state (the “New York” of Nigeria in commercial terms), some local governments charge TV license fees. The TV license fee is charged in Britain to pay for the BBC television network, but those local governments have no television network. And they still charge TV licenses? How are businesses supposed to create wealth and jobs with such taxes?

Debt

Debt has been another major tool that the government has been using to fund its spending. Government borrowing in the last one year is 117 percent higher than last year—ballooning to NGN 20 trillion—almost 10 percent of nominal GDP. For a less developed nation, this is a lot. As readers of this site know, those who are closest to the government enjoy this debt cash flow the most, followed by those who receive interest on the debt. For instance, top tier Nigeria banks have roughly 30 percent of their assets in government debt and they are reaping 80 percent interest returns, some even more than 100 percent. However, those who are further from the injection points, and do not own government bonds (the supermajority of the population), receive very little from the debt and are heavily taxed to fund government ability to service the debt.

Money Printing

Herein lies the main cause of the price inflation. The previous government—prior to the current one (although they are from the same political party)—was printing money at a rate of NGN 3 trillion per year. The current government, which has been in office for one year, has continued at a higher pace—printing NGN 7 trillion in one year. The charts below show the growth of base money (directly caused by the central bank alone and M2). Base money has increased by 38 percent in one year:

Source: Central Bank of Nigeria

Source: Central Bank of Nigeria

Is it surprising that price inflation has skyrocketed?

Regulation

Finally, there is regulation. The regulations in Nigeria (and most African countries) are choking. A friend who registered a company over 30 years ago, which he kept dormant if and when he had the time to pursue it. He recently wanted to use the company to start a new business line, create jobs, and produce goods and services. The federal government came out in the newspaper and mandated that companies cannot use a company name unless they have filed all their annual reports since the company name was registered. Additionally, a yearly fee of NGN Naira 20,000 (about $12) per each year was required. Now my friend has to pay about N600,000($360) just to get the company registered to even think of beginning his business. In a country where the minimum wage in a month has just been raised to $50 (yes, $50 or NGN 70,000). Think of the opportunity cost of that regulation. Now that money must go to government bureaucrats and politicians.

With these regulations also come flagrant disdain and disrespect of private property rights. Businesses that produce food and poultry products can get demolished with little to no notice because they are situated on lands without the “right permit.” Here is the Minister of the Nigerian capital (aka “The mayor of Washington DC”) bragging about how he took away one of the landed properties of the biggest construction company in Nigeria without even informing them, and turned it over to be used to build houses for the members of the country’s judiciary.

If the top construction company in Nigeria can have their property seized with no warning, who would bring their capital into Nigeria? Does the average citizen or businessman even stand a chance of his investments being safe? And if you want to seek legal justice for property seized by the government, you would be asked to “go to court”—likely a court filled with judges who are direct beneficiaries of the property seizure.

This is Nigeria’s economic problem in a nutshell. Unfortunately, nothing has changed and the situation is likely to continue.

Originally Posted at https://mises.org/