by Wolf Richter, Wolf Street:

A hot question for an iffy situation. So here are the holders as of Q3.

The US national debt keeps ballooning at an amazing rate and has now reached $36.16 trillion. These are Treasury securities that private and public entities in the US and foreign countries hold as interest-earning assets. The question is: Who holds this debt? Who bought it even as the Fed has been unloading its holdings? At the end of Q3, the time frame here, the total debt was $35.46 trillion.

TRUTH LIVES on at https://sgtreport.tv/

Who held this $35.46 trillion in Treasury securities at the end of Q3?

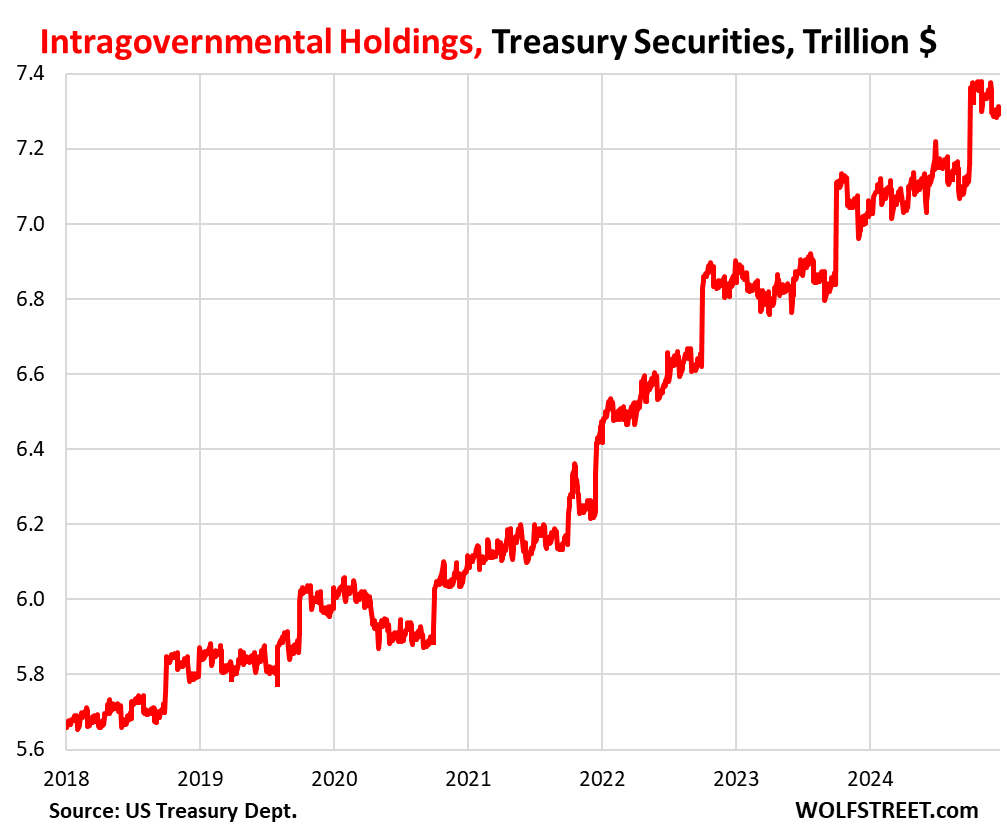

US Government entities: $7.16 trillion. This “debt held internally,” also called “intragovernmental holdings,” consists of Treasury securities held by various federal civilian and military pension funds, the Social Security Trust Fund (we discussed the Social Security Trust Fund holdings, income, and outgo here), the Disability Insurance Trust Fund, the Medicare Trust Funds, and other funds.

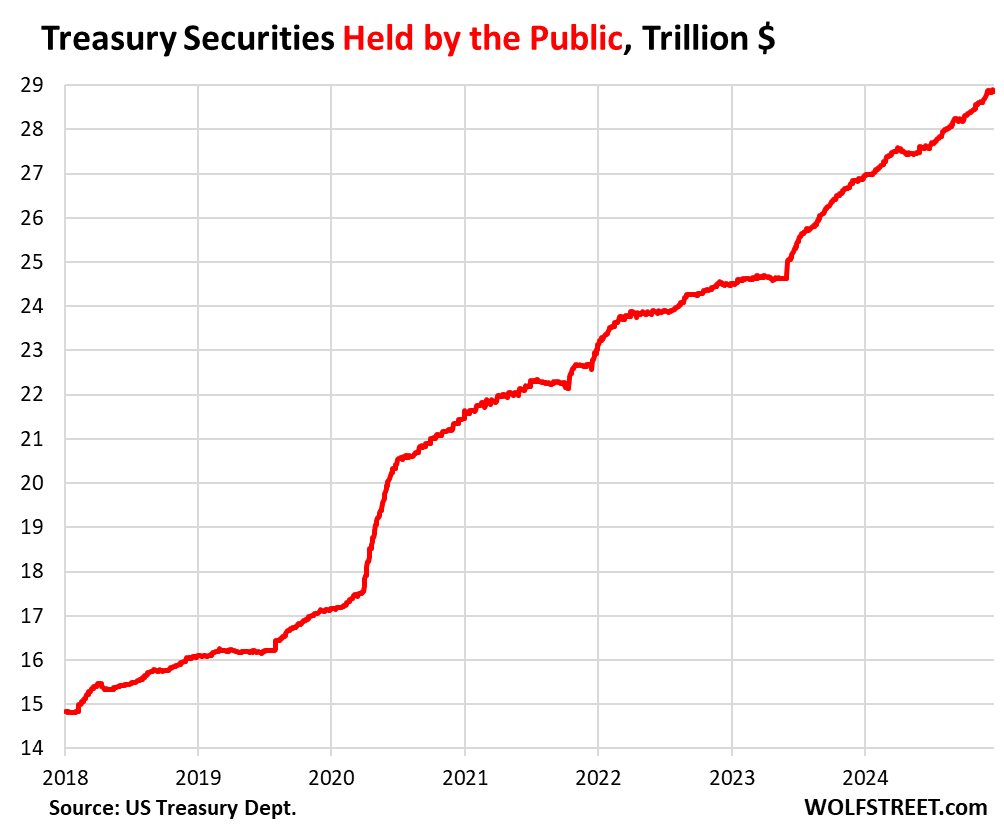

The “public” held the remaining $28.31 trillion at the end of Q3. It’s these holdings we’re going to look at in a moment.

Who is this “public?”

Foreign holders: $8.67 trillion, or 30.6% of the debt held by the public, including foreign private sector holdings and foreign official holdings, such as by central banks, according to Treasury Department data.

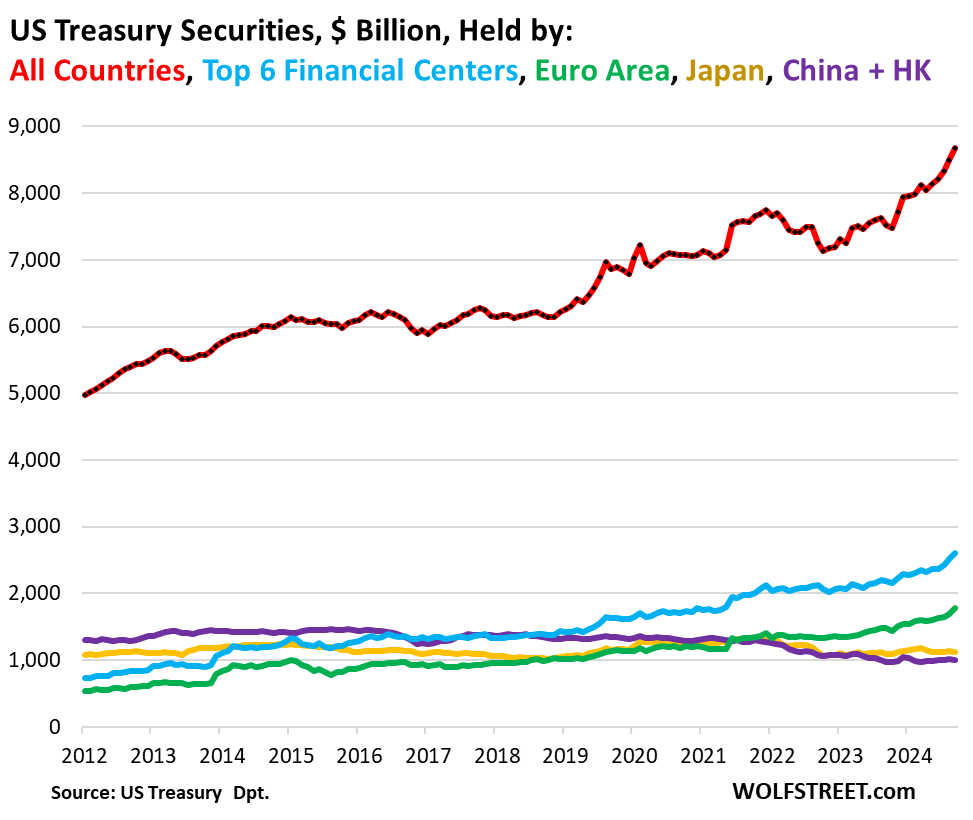

Overall foreign holdings of Treasury securities have continued to rise from record to record. The biggest holders are the top six financial centers ($2.60 trillion), the Euro Area ($1.78 trillion), Japan ($1.12 trillion), China and Hong Kong combined ($1.0 trillion).

Other big holders with rapidly growing holdings include Canada ($370 billion), Taiwan ($288 billion), and India ($247 billion). We discussed the details here:

While China has reduced its holdings of Treasury securities, the Euro Area has more than made up for it:

Originally Posted at https://www.sgtreport.com