It’s Bitcoin’s birthday: The very first Bitcoin block was mined 16 years ago today.

Bitcoin’s first block was mined on January 3, 2009.

Known as the “Genesis Block,” Decrypt reports that Bitcoin’s pseudonymous creator Satoshi Nakamoto minted 50 BTC into existence with the move.

Since then, 877,665 blocks have been mined and added to the network’s long ledger. On a blockchain, blocks contain data on transactions.

Only miners can add data to the network, and the difficulty level helps prevent unauthorized additions or edits to the chain, as it would take an incredible amount of computational power to take over the network.

And the network is stronger than ever, with mining difficulty reaching a new all-time high mark as the biggest cryptocurrency rides into the new year.

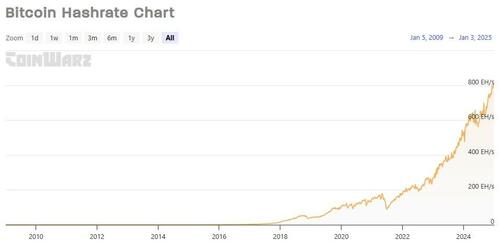

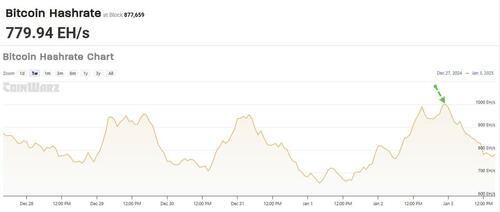

As CoinTelegraph’s Alex O’Donnell reports, Bitcoin’s hashrate – the total computing power securing the Bitcoin network – reached a new all-time high on Jan. 3 of over 1,000 exahashes per second (EH/s), according to data from CoinWarz.

Source: CoinWarz

That is nearly double the network’s hashrate 12 months ago. According to CoinWarz, Bitcoin’s hashrate hovered around 510 EH/s in January 2024. At the time of this article’s publication, Bitcoin’s hashrate had retraced to approximately 780 EH/s.

The network’s rising hashrate indicates Bitcoin miners are devoting more computational resources to the blockchain, thus improving the network’s security.

Miners are continuing to expand production even after Bitcoin’s April halving reduced mining rewards from 6.25 BTC to 3.125 BTC per block.

Source: CoinWarz

Overcoming headwinds

In 2024, Bitcoin’s strong performance partially offset headwinds from the halving, especially for cash-heavy mining companies like Riot Platforms and CleanSpark.

Mining firms “acquired other miners with turn-key facilities to increase near-term hashrate and increase their power pipeline,” JPMorgan said in a Dec. 10 research note shared with Cointelegraph.

Miners have also prioritized accumulating BTC on balance sheets. In December, JPMorgan raised price targets for four Bitcoin mining stocks to reflect value from the miners’ electrical power assets and BTC holdings, JPMorgan said.

JPMorgan cited the stock performance of MicroStrategy, a software company turned de facto Bitcoin fund, which traded at a roughly 2.4x multiple to the value of its BTC treasury as of Dec. 10.

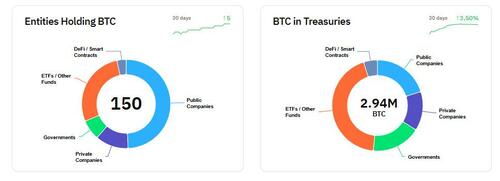

Bitcoin miners, including Marathon, Riot and CleanSpark, hold BTC treasuries worth approximately $4.4 billion, $1.7 billion and $910 million, respectively, according to the BitcoinTreasuries.net data service.

Source: Bitcointreasuries.net

Institutional inflows

Bitcoin’s rising hashrate — and the resultant improvement in network security — is especially important as institutional investors pour capital into BTC exchange-traded funds and other regulated cryptocurrency investment vehicles.

In November, Bitcoin ETFs broke $100 billion in net assets for the first time, according to data from Bloomberg Intelligence.

Asset manager Sygnum expects this dynamic to accelerate in 2025 as large institutional investors, including sovereign wealth funds, endowments, and pension funds, add Bitcoin allocations.

“With improving US regulatory clarity and the potential for Bitcoin to be recognized as a central bank reserve asset, 2025 could mark steep acceleration for institutional participation in crypto assets,” Martin Burgherr, Sygnum’s chief clients officer, said in a statement.

However, BlackRock’s iShares Bitcoin Trust (IBIT) spot Bitcoin exchange-traded fund (ETF) just saw record-high outflows on Jan. 2.

Isaac Joshua – the CEO of token launch platform Gems – also told Decrypt yesterday that the recent downturn “can largely be attributed to end-of-year tax-loss harvesting by investors,” he explained.

Founder of Obchakevich Research Alex Obchakevich told Decrypt that “the main reason for the outflow is profit-taking by investors in early 2025.”

“At the end of the year, investors and funds often review their investment portfolios, which can lead to the sale of some shares,” he explained.

Though, bear in mind, IBIT surpassed $50 billion in assets under management just 228 days after its launch – more than five times faster than any other ETF in history.

Loading…

Originally Posted at; https://www.zerohedge.com//