Samantha Dart, co-head of global commodities research at Goldman Sachs, said colder-than-average weather across the EU “is a stronger driver” than the halt in Russian NatGas exports via Soviet-era pipelines running through Ukraine, which will, in turn, pressure EU NatGas prices higher. By Friday, EU NatGas prices reached levels not seen in over a year, exceeding 50 EUR/MWh.

No other country in Northern Europe grinds to a halt like the British state does in reaction to a bit of cold weather. pic.twitter.com/IizvpxuFkv

— Wolf 🐺 (@WorldByWolf) January 3, 2025

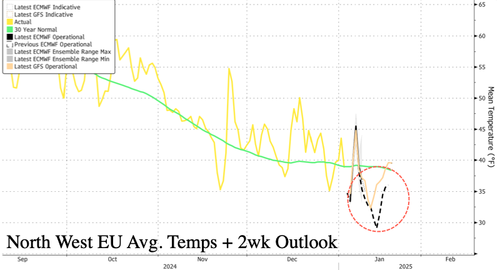

“While this week’s key headline in natural gas has been the halt in the residual Russian gas flows through Ukraine, the main tightening driver of NW European gas fundamentals this winter is in our view colder-than-average weather currently forecast for the next two weeks, aided by low wind power and Norwegian production outages observed in December,” Dart said.

She continued: “If this cold forecast realizes without other offsets, we see significant risks that TTF prices rally towards oil-switching economics in a 63-84 EUR/MWh range in the coming months, well above our 40 EUR/MWh 2025 TTF base case under average weather, to help manage European gas storage.”

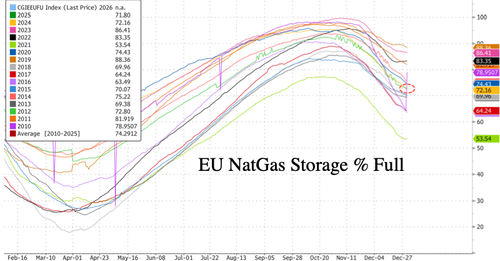

The latest data from Bloomberg shows that EU Natgas storage is 71.8% full at the start of the new year—this is well below the 16-year average of 74.29% for the same point in time. This indicates that increased heating demand and tightening supplies will force the continent to draw down supplies at the quickest rate in four years.

Here’s more from Dart’s note:

-

NW European tightening from Ukraine flow halt modest so far… We estimate that the halt in Russian gas flows from 42 mcm/d to zero from January 1st, which had been our base case and largely market consensus, represents a net tightening to NW Europe gas balances in the order of 16 mcm/d (2.7% of our 2025 expected demand in the region). To be clear, while NW Europe was not receiving any of that gas, we expect Austria to rely on pipeline imports from Germany to cover its gas demand1 and potentially additional marginal flows to complement Slovakia’s needs. Preliminary data for January 1st show German gas exports to Austria up by 9 mcm/d on the day.

-

…especially when compared to significantly colder-than-average weather forecasts. A more significant and surprising tightening driver of January gas balances are the much-colder-than-average temperatures currently forecast for NW Europe for the next two weeks, over 4°C below the ten-year average. If realized, we estimate such low temperatures would lift NW European gas demand by more than 100 mcm/d in January.

-

Stock-out risks are low, but storage refill, a challenge. To be clear, we see risks of an inventory stock-out as very low, even under such a cold weather forecast. The main challenge for Europe is that the lower that end-March storage levels are, the harder it will be for the region to refill ahead of the next winter. Specifically, under the colder-than-average scenario that is currently forecast, and assuming no offsets elsewhere in the balance, we would estimate end-Mar25 inventory levels to drop to 30% full (vs 35% under average weather). This would imply end-Oct25 storage levels in the low 80s% (vs high 80s% under average weather), well below the 90% full EU requirement. More specifically, we estimate this scenario would create a 21 mcm/d deficit in the market during the 2025 summer (relative to the 90% full EU storage target).

- G2O switching and LNG can solve 2025 tightness – at a price. Given European gas prices are already fully above hard coal generation costs, the next source of demand substitution is gas-to-oil (G2O) switching, in a 60 EUR/MWh (fuel oil) to 78 EUR/MWh (distillate fuel) range. During Europe’s energy crisis in 2022, we estimate G2O switching in industrial applications peaked at 24 mcm/d. In this higher TTF scenario we would also expect incremental LNG to be delivered to Europe (competed away from Asia). In addition to further changes to the European weather forecast, key drivers to watch from here include NE Asia weather forecasts and the ramp of the upcoming US liquefaction capacity additions. Venture Global’s Plaquemines recently exported its first commissioning cargo, while cargo loadings have remained unchanged so far at Cheniere’s Corpus Christi facility, which is undergoing a capacity expansion starting in early 2025.

Higher energy prices in the EU, particularly in Germany—the continent’s economic powerhouse—add to the continued headwinds crushing the country’s all-important automotive industry into a devastating downturn.

On the bright side, at least for the US, the EU will be forced to replace Russian LNG with US LNG during the Trump 2.0 era. Dart noted last month that this is “theoretically” possible.

Loading…

Originally Posted at; https://www.zerohedge.com//