Authored by Julianne Geiger via OilPrice.com,

-

Europe is rapidly depleting its gas reserves due to a harsh winter and the halt of Russian gas flows via Ukraine.

-

Germany faces significant economic risks due to its energy-intensive industries.

-

Refilling depleted gas storage during summer will be critical in the Spring of 2025.

Ah, Europe and its perennial energy conundrums. Just when you thought it was safe to turn up the thermostat, the specter of gas shortages once again knocking on Europe’s door as it depletes its natural gas reserves at an unprecedented rate. Are fears of tough times ahead unfounded?

The Great Gas Guzzle of 2025

We’ve arrived in January 2025, and Europe is burning through its gas reserves at a pace not seen in seven years.

Cold snaps have residents cranking up the heat, leading to a rapid depletion of stored natural gas. Storage levels, which were comfortably above 90% in November, have now dipped to just over 70%.

The accelerated gas drawdown, combined with the recent halt in Russian gas flows via Ukraine, has some analysts fearing the worst—disruptions.

Turning Off The Taps

On January 1, 2025, Ukraine decided not to renew its gas transit agreement with Russia, effectively stopping the flow of Russian natural gas to Europe through its pipelines.

Yes, the move is a bold geopolitical statement.

So much so that it has left several Central and Eastern European countries scrambling for alternative supply.

Slovakia, for one, is having to rely on gas imports from Hungary. Austria is getting more gas from Germany and Italy to compensate for the shortfall.

The Domino Effect

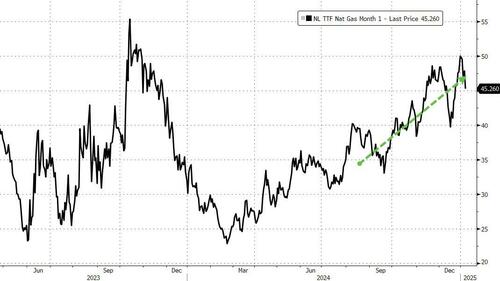

Unsurprisingly, the cessation of Russian gas via Ukraine has pushed prices for natural gas higher across Europe.

The Dutch TTF gas hub’s front-month contract reached a ten-month high of €42.57 per megawatt-hour, reflecting market jitters.

Traders are also paying a record premium for European gas for the upcoming summer, a reversal of the usual pricing trend where summer gas is cheaper.

This suggests there are significant concerns about the challenges in restocking during the summer of 2025.

The German Predicament

Germany, Europe’s industrial powerhouse, is in a particularly precarious position, and the rapid depletion of its gas reserves has led to warnings that the German economy is “acutely” at risk. Because energy-intensive industries are the backbone of its economy, any prolonged energy shortage could have severe repercussions.

A Justified Panic?

Before everyone starts stockpiling wool socks and firewood, it should be noted that the European Commission, ever the voice of bureaucratic calm, has stated that there are no immediate supply security concerns. The EC has argued that European gas infrastructure is flexible and that alternative supply routes are available.

Moreover, Europe’s gas storage levels, while declining, are still slightly higher than the average for this time of year—it’s just the pace at which they’ve depleted over the winter season that has caused the ruckus.

LNG Lifeline

Liquefied Natural Gas (LNG) has been Europe’s knight in shining armor. Liquefied Natural Gas (LNG) has been Europe’s knight in shining armor. It has beefed up its LNG import capacity over the last couple of years, helping it to diversity its supply sources and provide a buffer against the shocks from traditional pipeline disruptions.

But increased competition for LNG, especially from Asia, could drive prices up, making the safety net a costly one.

Summer’s Role in Winter’s Woes

The real test will come during the summer months when Europe needs to refill its gas storage in preparation for the next winter. The rapid depletion of reserves this winter means that the continent will have to work harder to replenish stocks. The European Commission has already set intermediate gas storage filling targets for 2025 to ensure secure supplies and market stability.

But with the current market dynamics and geopolitical tensions, achieving these targets could end up being more challenging than in previous years.

Balancing Act

Although the situation is serious, hitting the panic button at this stage could be premature. Europe has shown resilience in the face of energy crises before, and the lessons learned from past disruptions have led to a more robust and diversified energy infrastructure.

But complacency is not an option.

Policymakers and industry stakeholders will need to navigate the coming months with a keen eye on both supply and demand, ensuring that the lights stay on across the continent. While concerns over gas supplies are not entirely overblown, they are unlikely to be insurmountable. With careful planning and some good luck, Europe should be able to weather this storm—and emerge more energy-secure on the other side.

Loading…

Originally Posted at; https://www.zerohedge.com//