Risks Facing Bullish Investors As September Begins

Authored by Lance Roberts via RealInvestmentAdvice.com,

Since the end of the “Yen Carry Trade” correction in August, bullish positioning has returned with a vengeance, yet two key risks face investors as September begins. While bullish positioning and optimism are ingredients for a rising market, there is more to this story.

It is true that “a rising tide lifts all boats,” meaning that as the market rises, investors begin to chase higher stock prices, leading to a virtual buying spiral. Such leads to an improvement in market breadth and participation, which supports further price increases. Following the August decline, the chart below shows the improvement in the NYSE advance-decline line and the number of stocks trading above their respective 50-day moving averages (DMA).

Given that “for every buyer, there must be a seller,” this data confirms that buyers are increasingly willing to pay higher prices to bring sellers to market. That cycle continues until buyers willing to pay higher prices decline. While prices are rising, we are seeing a dwindling of buyers at current prices, as shown in the chart of trading volume at various price levels. As shown, buyers currently “live lower” between 5440-5480 and the recent correctional lows.

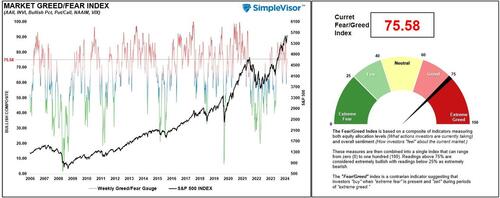

However, despite the diminishing pool of buyers at current levels, investors are becoming increasingly bullish as prices rise. As shown in our composite fear/greed gauge, based on “how investors are positioned” in the market, we are back to more “greed” based levels. While not at extreme levels, investors are becoming increasingly optimistic about higher future prices. Of course, such readings only confirm what market prices are already telling us.

However, two primary risks to the bullish advance are developing as we enter September.

Share Buyback Window Begins To Close

Over the next two months, a primary risk to bullish investors is removing a critical buyer in the market – corporations. For more on the importance of corporate share purchases on the financial markets, read the following:

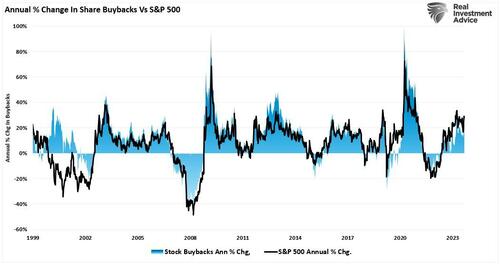

Those articles support that corporations have comprised roughly 100% of net equity purchases since 2000. In other words, the market would be trading closer to 3000 rather than 5600 without corporate share buybacks.

However, these share buybacks also pose risks to the market in the short-term as well. As Michael Lebowitz noted this morning:

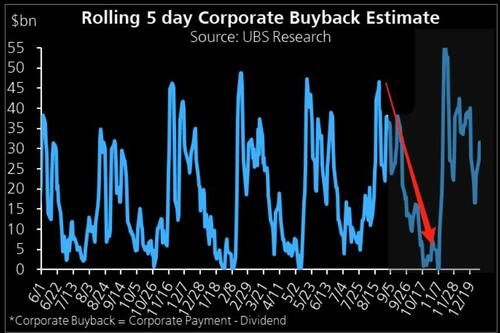

“Like the meteorological seasons, share buybacks also follow predictable patterns. Accordingly, as shown below, we are past the peak share buyback season. Following the peak, share buybacks will decline rapidly until early November. Declining share buybacks is not a bearish indicator per se. However, as the number of buybacks declines, the market, specifically the stocks conducting buybacks, will have less demand for their stock. Think of share buybacks as a tailwind.

The pattern is predictable because it directly relates to corporate earnings reports. For three reasons, most companies ban share buybacks about a month before their quarterly earnings report.

-

Insider Trading Concerns—Employees have access to non-public information regarding their earnings. Therefore, the ban helps eliminate the perception that the company might be trading its stock on such information.

-

Investor Perception– Similarly, investors might be suspicious if the company was actively buying its stock right before the earnings announcements. If the investors were mimicking the company’s purchases, this could create heightened volatility in the stock.

-

Regulatory Concerns—While the SEC does not regulate share buybacks before earnings, most companies want to avoid an investigation if the SEC suspects those buying back the shares have inside information.

As shown on Thursday, September 5th, the window for buybacks will begin to close. Corporate buying support will be non-existent by the beginning of October and through the end of the month. In other words, the primary buyer of equities will not be available to bid prices.

If you don’t believe that share buybacks are as crucial as we state, the following chart should answer any questions.

Unfortunately, removing that primary buyer will coincide with a secondary market risk.

Presidential Election Concerns

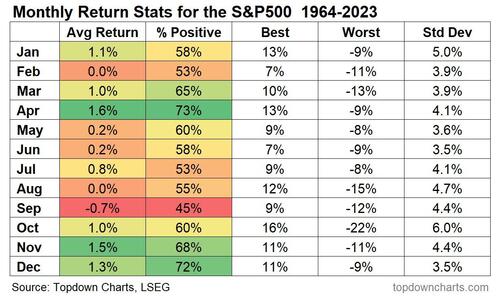

As we enter September and October, a secondary risk increases. Historically, these months have seen stock market declines, especially in years with a Presidential election. There are three primary reasons for this trend.

1. Uncertainty Surrounding Election Outcomes

Markets dislike uncertainty, and the outcome of a Presidential election is a significant unknown. Investors become cautious during election years, especially when the race is tight. They worry about potential policy changes impacting taxes, regulations, and government spending. That heightened uncertainty increases market volatility and often results in stock market declines as investors move to safer assets.

2. Policy Change Concerns

Depending on the election outcome, significant policy changes can occur. For instance, Harris and Trump have very different approaches to fiscal policy, regulation, and international trade this year. With the polls very tight, Wall Street may look to lock in gains before the election, fearing that new policies might negatively affect corporate profits via higher tax rates and, potentially, changes to capital gains rates.

3. Economic Data Releases

September and October are critical months for economic data releases, particularly since the Federal Reserve expects to cut rates in September. Key indicators from employment, inflation, and housing will potentially move markets over the next two months. Given the approaching election, the markets will scrutinize those releases closely as candidates try to leverage the data. Any negative surprises could result in a sharp pickup in volatility.

Conclusion

As we head into September, which already has a weak performance record, understanding these two risks can help investors navigate a potential pickup in volatility, particularly during election years.

However, the timing of such a consolidation or correction is always tricky.

We suggest maintaining risk controls, taking profits as needed, rebalancing portfolios, and holding slightly higher cash levels.

While these actions won’t entirely shield portfolios from a near-term decline, they will buffer increased volatility, allowing for more rational and controlled portfolio management decisions.

Loading…

Originally Posted at; https://www.zerohedge.com//

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers: