by Maryam Henein, The Tenpenny Report:

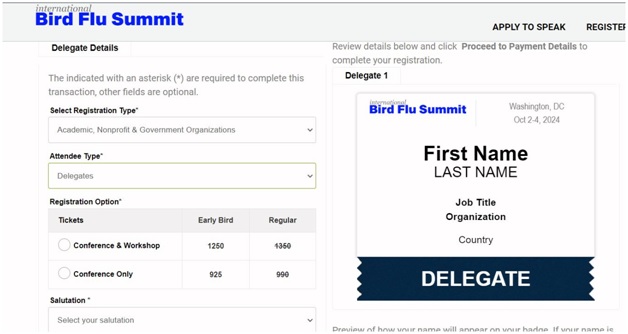

I tried to get a press pass for the 2024 International Bird Flu Summit, which wrapped in early October, but no one got back to me. And I couldn’t afford their $925 ‘early bird’ special.

Did they purposely use this pun?

TRUTH LIVES on at https://sgtreport.tv/

The bird flu summit unfolded at the Hilton Hotel in Fairfax, Virginia—a small suburban town of 24,000 located about 14 miles from Washington, D.C., and 12 miles from Langley, where the CIA is headquartered. Here is the Bird Flu Summit brochure if you want to check it out.

This is the second time that the pandemic vaccine industry has gathered. The First International Avian Influenza Summit, which focused on research, policy and industry collaboration, was held on 16-17 October 2023 at the University of Arkansas, USA. Over the two days, 23 speakers presented, and 1,842 people registered as participants from 81 countries.

The summits aim is stated “to foster collaboration and knowledge exchange to combat the spread of bird flu and its impact on human and animal health and the global economy.”

This year, the summit’s primary commercial sponsor was Ginkgo Biosecurity—a major biosecurity outfit headquartered in Boston, Massachusetts, that works closely with governments, institutions, and companies worldwide. The event was proclaimed a global event to bring together experts, innovators, and stakeholders to address the pressing concerns surrounding avian influenza.

“The summit aims to foster collaboration and knowledge exchange to combat the spread of bird flu.”

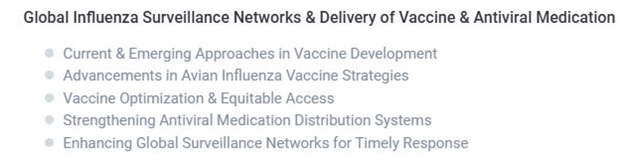

Here are some of the agenda items, packed with breakout sessions.

Topics

- Mass Fatality Management Planning

- Surveillance and Data Management

- Preparing Community Strategies

- Local Partnership & Participation

- Delivery of Vaccine and Antiviral Medication

- Medical Countermeasures

- Socio-Economic Impact on Poultry and Livestock Industries

- Benefit-Risk Assessment: Public Health, Industry and Regulatory Perspectives

- Prevention Education Efforts and Risk Communication

- Command, Control and Management

- Emergency Response Management

- Business-Based Planning

- School-Based Planning

- Community-Based Planning

The Plot Chickens (or Thickens)

Those of us who have been covering vaccine dangers for a long time, as I have, know the rinse-and-repeat script by now. For instance, the plot always involves a new “vaccine” (although now mRNA is their jab of choice). And, of course, they are spreading fear about asymptomatic spread. ‘Even if you have no symptoms, you may still be infected with bird flu’!

Unsurprisingly, the takeaway is always that vaccination is a critical tool for mitigating the spread of the virus du jour.

Isn’t it abundantly clear by now that the vector-based covid “vaccines” (Janssen or Johnson & Johnson and AstraZeneca) and the recombinant technology used in the mRNA (Pfizer-BioNTech and Moderna) and DNA (AstraZeneca) covid “vaccines” are both unsafe and ineffective? Reminder: They were the most dangerous vaccines on the face of this earth. Ever.

These summits can be added to the myriad of ways that globalists profit from the manufactured plandemic-vax industry. Critical thinkers suspect that a spillover of H5N1 into humans is imminent. The thing is, will this virus also be meddled with in a lab?

It’s all about the Zoonotic Jump, folks.

BARDA Just Ordered 4.8 Million Doses Of Avian Flu Vaccine

Fowl Play?

The first human-to-human transmission of H5N1 was detected in Missouri in September. Is it a slow creep to the elections like in 2020? There are recently confirmed cases of six dairy workers in California who are infected with avian flu. Luckily, the CDC has finished developing a “reverse genetics-generated virus” to test blood samples.

Do the participants sincerely believe that H5N1 is rapidly evolving to achieve high infection rates and virulence among humans? Do you?

According to John Leake, who is linked to the McCullough Foundation, the attendees “lacked average intelligence, education, and Machiavellian guile.” He says they are acquainted with orthodox representations of H5N1 and are unaware of the gain-of-function (GOF) fuckery that purposely threatens an evolutionary jump from birds to humans.

Read More @ TheTenpennyReport.com

Originally Posted at https://www.sgtreport.com