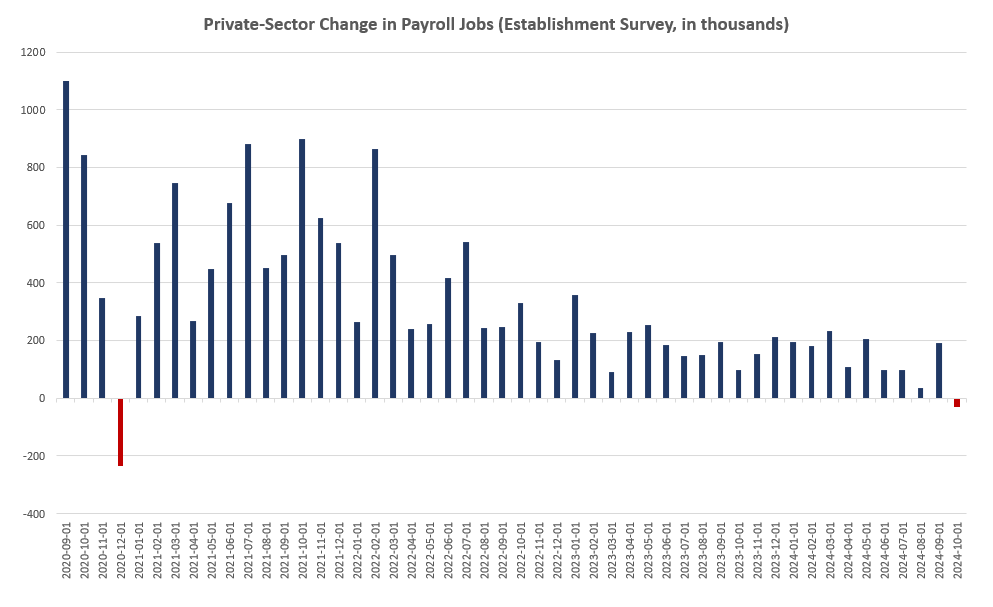

According to the most recent report from the federal government’s Bureau of Labor Statistics, the US economy added only 12,000 payroll jobs during October. This was the smallest month-to-month employment gain in nearly four years. Moreover, total private jobs fell in October by 28,000.

This is the worst employment report since 2020, and it reflects an overall downward trend in employment growth since 2022. In addition to the drop in private employment, the report also shows drops in full-time employment and ongoing stagnation in the total number of employed workers. This is an economy in which whatever lackluster growth there is in employment, it’s being driven by part-time jobs and taxpayer-funded government workers.

Government Jobs vs. Private Employment

Total government jobs grew by 40,000 during October, meaning total job growth for the month would have been negative were it not for the immense amounts of deficit spending that props up growth in government hiring. This has been a growing trend over the past year. Proportionally, government jobs over the year have grown one-and-a-half times more than private-sector jobs.

For most of the past year, however, there were—at least according to the establishment survey— some gains in private employment. But that wasn’t the case in October meaning private employment fell in October for the first time in 46 months.

But, 12,000 more people had jobs in October than in September, right? Not quite. That number comes out of the so-called “establishment” survey which counts only jobs, but not employed workers. According to the federal government’s other employment survey—the household survey—the total number of employed workers in the United States fell in October, month over month, by 368,000 workers.

Over time, this has led to stagnation in total employment in the household-survey numbers. Over the past eighteen months, total employed workers has gone nowhere, and as of October, there are 370,000 fewer employed workers in the United States than there were eleven months ago:

Yet, over this period, total jobs in the establishment survey has grown by more than 2 million jobs. So why are there job gains in the establishment survey but job losses in the household survey? One probable explanation is that much of the job growth we see is driven by part-time jobs and by people holding more than one job to make ends meet.

Not surprisingly, the household survey does indeed show that full-time employment fell in October both month-to-month and year-over year. Part-time jobs, on the other hand, continued an upward trend in growth, year over year.

In fact, year-over-year full-time job growth has now been negative for nine months in a row, for the past thirty years, that has only happened when the economy is in recession:

There is other bad news in the report, as well. Temp jobs continue their long march downward, and total temp work is now at the lowest level reported in more than a decade. Year-over-year, temp work has been down for two full years. For more than thirty years, this has only happened during recessions.

Average weekly overtime hours remained at 3.6 hours in October. For more than 30 years, average overtime has been at this level only during recessions. The total number of permanent job losers also spiked in October, rising to the highest level reported—outside the covid crisis—in 90 months.

These jobs numbers weren’t the only bad news released today, either. The PMI manufacturing index, released by the Institute for Supply Management, fell to 46.5 percent. This was the lowest reading of the year, showing “economic activity in the manufacturing sector contracted in October for the seventh consecutive month.” The report showed new orders, production, and employment were all in contraction territory during October.

Will the Fed Panic Again?

The question that now faces markets is this: what will the Federal Reserve do in response to the October job report? The bond markets may give us hint.

Today, after the release of the jobs report, the 10-year yield rose quickly to a four-month high. Overall, the yield curve steepened today as the 5-year, the 10-year and the 30-year also all experienced significantly rising yields.

This strongly suggests that bond investors expect the Fed, in the face of increasingly bad economic data, will totally throw in the towel on its alleged war against price inflation. With government debt levels at nosebleed levels, and now with this jobs report, there is every reason to believe that the Fed simply doesn’t have to stomach to do anything but lower the target policy rate in an effort to keep government debt cheap and to stimulate the job market.

That points to rising price inflation, and that points to rising yields in the longer term. Thus, we now see that rise in the 10-year and 30-year bonds.

The bond markets are probably right. At this point, it’s nearly a sure thing that the Fed will cut the target rate by at least 25 basis points as already expected. After all, at the September meeting, following a middling jobs report that was better than this one, the Fed panicked and chopped 50 basis points off the target rate. It may do so again.

This all points to a hard pivot toward more dovish policy and more price inflation moving forward. Of course, price inflation could fall in coming months. But that won’t be thanks to the Fed, it would be thanks to recession and a collapse in demand. On the other hand, given the immense amounts of monetary inflation that has occurred over the past four years, we could get both recession and ongoing inflation. Then we’ll get stagflation and Powell will go down in history as the worst Fed chairman since Arthur Burns. The bond markets seem to be entertaining the possibility.

Originally Posted at https://mises.org/