Bessent Rejects Recession Talk, Calls Market Turmoil “A MAG7 Problem, Not MAGA Problem.”

Bessent Rejects Recession Talk, Calls Market Turmoil “A MAG7 Problem, Not MAGA Problem.”

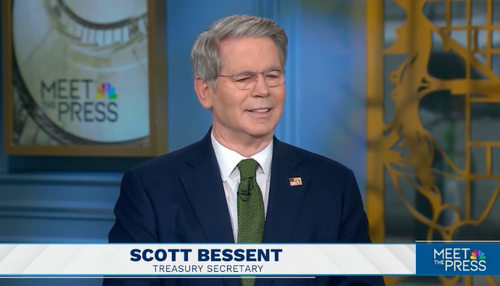

President Trump’s “Liberation Day” tariff blitz and the resulting escalation in the trade war with China and other top trading partners fueled a downgrade in growth expectations that dominated the rates market last week. Goldman analysts now expect three interest rate cuts from the Federal Reserve this year—in July, September, and October—and have raised their 12-month U.S. recession probability to 35%, up from 20%. While a pivot toward tariff de-escalation remains plausible in the near term, market turmoil and potential trade disruptions amid the grand global economic reordering won’t push the U.S. into a recession, Treasury Secretary Scott Bessent said Sunday.

NBC’s Meet the Press with Kristen Welker told Bessent the stock market just experienced the biggest two-day crash since early Covid, asking: “How long will Americans hang tough” with current market gyrations?

“I see no reason that we have to price in a recession,” Bessent responded to Welker.

We should also note that in a recent interview with Tucker Carlson, Bessent pointed out: “The distribution of equities across households—the top 10% of Americans own 88% of equities, 88% of the stock market.”

So when Welker asked Bessent about Americans weathering the stock market turmoil, the question really applies only to a small segment of the population—those who have seen massive gains over the past couple of decades—while much of the Heartland, as some have noted, has been stuck in a recession and never fully recovered since the early 2000s.

Bessent told Welker, “What we’re looking at is building the long economic fundamentals for prosperity, and I think the previous administration put us on a course for financial calamity.”

“Again, this is an adjustment process – we saw with President Regan when he brought down the great inflation and brought down President Carter’s malaise. There was some choppiness at that time, but he held the course,” Bessent noted.

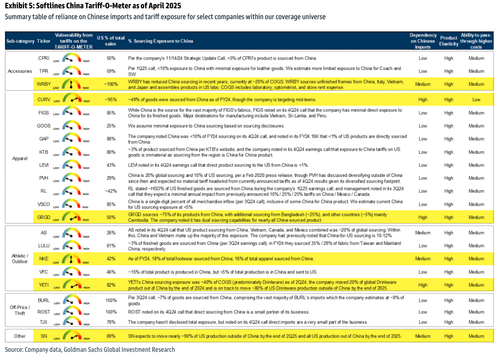

Bessent then described Trump’s economic re-ordering of the global economy that will fulfill the ‘America First’ agenda and urgently resolve the “National Security problem” of critical supply chains in overseas economies run by foreign adversaries. He said there was one good outcome of Covid: “It was a beta test for what would happen if our supply chains were broken,” adding that the president would fix and re-shore supply chains back to the Homeland for a “more stable future.”

Welker, suffering from extreme “Trump derangement syndrome,” tried to trap Bessent with a question about how last week’s market turmoil resulted in Americans’ “lifetime savings drop significantly.”

Before we provide readers with Bessent’s response, here’s a chart of the WILSHIRE 5000 over 15 years versus Welker’s claim that Americans were somehow financially paralyzed last week by the stock drop.

Bessent called Welker’s comments a “false narrative” and said, “Most Americans have 60/40 accounts and have a long-term view.”

He continued: “Oil prices went down almost 15% in two days, which impacts working Americans much more than the stock market does. Interest rates hit their low for the year, so I’m expecting mortgage applications to pick up.”

So much for Welker’s ‘gotcha moment’…

Bessent…