Originally Posted at La Reina Creole’s Youtube Channel/

News

De-Dollarization Was Always More Of A Political Slogan Than A Pecuniary Fact

De-Dollarization Was Always More Of A Political Slogan Than A Pecuniary Fact

Authored by Andrew Korybko via substack,

The three-year-long NATO-Russian proxy war in Ukraine contributed to the belief that the international community had bifurcated into the West and the World Majority respectively, with the outcome of the aforesaid conflict determining which camp will most powerfully shape the global systemic transition. This paradigm predisposed observers to imagine that BRICS, which represents the World Majority, is actively coordinating de-dollarization policies in order to decouple themselves from the West’s financial clutches.

That perception persists to this day despite last October’s BRICS Summit achieving nothing of tangible significance at all, including on the de-dollarization front, and leading members like India and Russia subsequently confirming in response to Trump’s tariff threats that they’re not creating a new currency. As it turns out, even before Trump initiated the nascent Russian-US “New Détente”, the international community wasn’t as divided over the past three years as many multipolar enthusiasts thought.

Complex interdependencies kept most of the main players together, including Russia and the West after Russia continued selling oil, gas, and critical minerals like uranium to the West in spite of their proxy war. Similar interdependencies account for why Indian External Affairs Minister Dr. Subrahmanyam Jaishankar declared in mid-November that “India has never been for de-dollarization” and then reaffirmed this position last week when he said that “we have absolutely no interest in undermining the dollar at all.”

He also said that “I don’t think there is a unified BRICS position on [de-dollarization]. I think BRICS members, and now that we have more members, have very diverse positions on this matter. So, the suggestion or the assumption that somewhere there is a united BRICS position against the dollar, I think, is not borne out by facts.”

The reason why it’s important to draw attention to his latest words is because of the global context within which they were shared as regards the nascent Russian-US “New Détente”.

Putin’s recent invitation to American companies to cooperate with Russia on strategic resources, including energy in the Arctic and even rare earth minerals in Donbass, will lead to Russia using more dollars in international trade if anything comes of this. That would in turn discredit the perception shared earlier in this analysis of Russia actively de-dollarizing, which Putin himself always said that it was forced by sanctions into doing and thus wouldn’t have ordinarily happened on its own.

A thaw in their tensions brought about by the US brokering an end to their proxy war in a way that meets most of Russia’s interests would therefore naturally see Russia using the dollar yet again. To be sure, it’ll still support the creation of platforms like BRICS Bridge, BRICS Clear, and BRICS Pay, but these would be aimed at preventing dependence on the dollar more so than advancing de-dollarization per se. The ruble will also continue to be used as Russia’s preferred currency in conducting international trade.

Nevertheless, any breakthrough in Russian-US relations would inevitably disappoint those multipolar enthusiasts who bought into the most ideologically dogmatic narratives of the New Cold War and consequently believed that Russia would forever eschew the dollar out of principle….

Classified X-37B Spaceplane Returns To Earth

Classified X-37B Spaceplane Returns To Earth

About two weeks after the Secretary of the Air Force Public Affairs published the first-ever in-orbit image captured by Boeing’s X-37 spaceplane, the US Space Force revealed early Friday that the top-secret spaceplane has returned to Earth.

Space Force announced the X-37B Orbital Test Vehicle-7 (OTV-7) “successfully deorbited and landed” at Vandenberg Space Force Base, California, on early Friday around 0222 local time.

Images posted on X by the space agency show military personnel in laboratory protective suits, like NBC and/or BSL-4 suits, approaching the X-37 after touchdown at Vandenberg.

More images were posted on X of the X-37B, which concluded its seventh mission in orbit.

This time, X-37B remained in space for 434 days.

“While on orbit, Mission 7 accomplished a range of test and experimentation objectives intended to demonstrate the X-37 B’s robust maneuver capability while helping characterize the space domain through the testing of space domain awareness technology experiments,” Space Force wrote in a statement.

USAF Public Affairs posted this image from X-37B late last month during a series of “experiments in a highly elliptical orbit in 2024.”

With each successive top-secret mission, the X-37B spends long and longer time in orbit:

OTV-1: launched on Apr. 22, 2010 and landed on Dec. 3, 2010, spending over 224 days in orbit.

OTV-2: launched on Mar. 5, 2011 and landed on Jun. 16, 2012, spending over 468 days in orbit.

OTV-3: launched on Dec. 11, 2012 and landed on Oct. 17, 2014, spending over 674 days in orbit.

OTV-4: launched on May 20, 2015 and landed on May 7, 2015, spending nearly 718 days in orbit.

OTV-5: launched on Sept. 7, 2017 and landed on Oct. 27, 2019, spending nearly 780 days in orbit.

OTV-6: launched on May 17, 2020 and landed on Nov. 12, 2022, spending over 908 days in orbit.

OTV-7: launched on Dec. 29, 2023 and landed on Mar. 7, 2025, spending over 434 days in orbit.

. . .

Tyler Durden

Fri, 03/07/2025 – 23:00…

Former NIH Director Francis Collins Sings Song at Science Rally

Francis Collins, the former Director of the National Institutes of Health (NIH), sang a song at a “Stand up for Science” rally in Washington, DC, on Friday.

The post Former NIH Director Francis Collins Sings Song at Science Rally appeared first on Breitbart.

Kristi Noem: ‘Two Leakers’ of DHS Operations Information Identified

Department of Homeland Security (DHS) Secretary Kristi Noem announced that two people who had leaked information regarding the operations of DHS had been identified.

The post Kristi Noem: ‘Two Leakers’ of DHS Operations Information Identified appeared first on Breitbart.

Consumer Credit Jumps More Than Expected In January, Back Over $5 Trillion

Consumer Credit Jumps More Than Expected In January, Back Over $5 Trillion

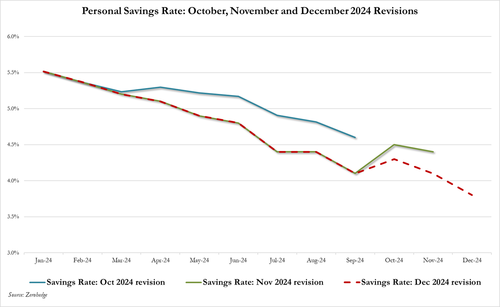

We have repeatedly warned that with their savings – and especially “emergency covid savings” – gone or nearly gone, Biden admin’s residual savings data manipulation notwithstanding…

… US consumers had no choice but to max out their credit cards in order to “extend and pretend” their moment of purchasing greatness, or as we called it three months ago, their last hurrah (see In “Last Hurrah”, Credit Card Debt Explodes Higher Despite Record High APRs As Savings Rate Craters), a hurrah that would last very briefly as it was only a matter of months if not weeks before said cards were denied.

One month later, that’s exactly what happened, when to our surprise, revolving credit cratered at the fastest pace since the covid crash, contracting a whopping $13 billion, an event which for a country that lives on debt – literally – is unheard of outside of a recession.

Commenting on the plunge, we said that “we don’t know what sparked this sudden reversal in the favorite American pastime – i.e., to buy stuff one can’t afford and hope to pay it back some time in the future for a modest 29.95% APR – but we know what didn’t: falling rates… because they didn’t.” We then proceeded to show that the average interest rate on credit card balances were at the second highest on record ever though the Fed had already cut rates by 100 bps.

And while it would have been normal, if not expected, for credit card balances to continue declining with savings rates near record lows and with credit card rates at record highs, trust the US economy to do precisely the opposite of what is logical and according to the latest just released consumer credit data, US consumers exited 2024 with a bang after Consumer credit soared by a record $40.8 billion in December, a complete reversal of the November drop, and a month that sticks out like a sore thumb in the history of consumer credit as shown below.

And while one would expect that the record December surge in credit would quickly reverse at the start of the year amid the ongoing drawdown in savings – and the lack of holiday spending – the US consumer has a habit of doing just the opposite of what is expected, and according to the latest NY Fed data, in January consumer credit surged again, rising by $18.084 billion (from a downward revised $37.1 billion vs $40.8 billion previously), and the third highest monthly increase since June 2023…

… which sent the total back over $5 trillion.

Taking a closer look at the number, revolving credit – i.e., credit card debt – increased by $9 billion or roughly half of the near record $21 billion surge in December.

Non-revolving debt (i.e. student and auto loans) rose almost by the same amount, up $9.1 billion and also down from the $16.2 billion the previous month.

Looking at the composition of nonrevolving credit, the Fed reported that in…

JACK POSOBIEC and ROGER STONE: Zelensky’s meeting with Trump in the Oval Office was a set up

It has been reported that Zelensky met with Democratic lawmakers before his Oval Office meeting with President Donald Trump.

Exclusive—Sen. Lindsey Graham: Congress Should Pass a ‘Rescission’ Package to Enact DOGE Spending Cuts

I urge the White House, in collaboration with the House and the Senate, to put together a rescission package using DOGE’s work product as soon as possible.

The post Exclusive—Sen. Lindsey Graham: Congress Should Pass a ‘Rescission’ Package to Enact DOGE Spending Cuts appeared first on Breitbart.