Originally Posted To Our YouTube Channel At This Link

10 stories of people who were punished for wrongthink in 2024

by Rhoda Wilson, Expose News: Online news outlet Modernity has compiled a list of the 10 craziest stories in 2024 of people being punished for wrongthink. Top 10 Thought Crime Stories of 2024 By Modernity News 10. Chapelle Resisted Re-education Back in April, comedian Jim Breuer claimed that Dave Chapelle told him he was once “visited” by an […]

On China’s Massive Hacking Campaign Targeting The US

On China’s Massive Hacking Campaign Targeting The US

Authored by Andrew Thornebrooke via The Epoch Times,

China has dramatically increased its cyberattacks against the United States since Chinese Communist Party leader Xi Jinping came to power in 2012.

From espionage to intellectual property theft to sabotage, here is a look at 20 of the largest Chinese cyberattacks against the United States in the last 10 years.

August 2014: Community Health Systems Hack

A state-backed hacking group in China—referred to as APT18—launched an advanced malware attack against Tennessee-based Community Health Systems, one of the nation’s largest hospital health care services.

The group succeeded in exfiltrating the sensitive personal information of more than 4.5 million patients, including their Social Security numbers, phone numbers, addresses, names, and birth dates.

(Left) FEMA Administrator Deanne Criswell addresses the media from the National Hurricane Center in Miami on May 31, 2023. (Right) United States Postal Service trucks in Farmingdale, N.Y., on April 12, 2020. Joe Raedle/Getty Images, Madalina Vasiliu/The Epoch Times

November 2014: NOAA and USPS Hacks

State-backed hackers in China launched malware and DDOS attacks against several government entities, including the U.S. Postal Service (USPS), the National Oceanic and Atmospheric Administration (NOAA), and the Office of Personnel Management.

The personal information of more than 800,000 employees at USPS, as well as that of customers who had called customer services, was exfiltrated. NOAA officials reported that they were immediately able to restore service to four affected websites but had not reported the incident for months, which was a violation of U.S. policy.

The entrance to the Theodore Roosevelt Federal Building that houses the Office of Personnel Management headquarters in Washington on June 5, 2015. U.S. investigators have said that at least four million current and former federal employees might have had their personal information stolen by Chinese hackers. Mark Wilson/Getty Images

June 2015: Office of Personnel Management Hack

The federal government’s primary hiring agency was hacked by state-backed cyber actors in China. More than a million users’ personal information, including names, addresses, and Social Security numbers, were stolen.

Those affected included current and former federal employees and contractors, as well as applicants for federal jobs and individuals listed on background check forms.

The attack was the third and largest of its kind in a matter of weeks and appeared to have specifically targeted data and applications related to U.S. security clearances. As such, the data stolen also included the financial histories and family information of those undergoing federal background checks at the time.

A Belgian plant of the U.S. chemicals group DuPont de Nemours in Mechelenon on April 13, 2004. Herwig Vergult/AFP via Getty Images

January 2016: Dupont Chemical Hack

Pangang Group, a Chinese state-owned steel manufacturer, was charged by the U.S. government for stealing trade secrets from DuPont, a major chemical corporation. The group had obtained access to information on the U.S. company’s computers.

Pangang worked with unidentified hackers to purchase trade secrets from a long-time DuPont employee, who stole the company’s method for manufacturing titanium dioxide, a white pigment used in many applications, including semiconductors and solar panel cells.

The Aviation Industry Corporation of China (AVIC) logo is seen in during the International Paris Air Show in Le Bourget on June 25, 2017. Eric Piermont/AFP via Getty Images

April 2017: FAA, NASA Spearfishing Campaign

Song Wu, an employee for China’s state-owned aerospace and defense corporation AVIC, allegedly began a multiyear spearfishing campaign against targets in the Federal Aviation Administration (FAA), National Aeronautics and Space Administration (NASA), U.S. Air Force, Navy, and Army.

Wu was later charged in 2024 for creating email accounts impersonating U.S.-based researchers and engineers to obtain restricted software used for aerospace engineering and computational fluid dynamics.

The U.S. government alleged that the software obtained could be used to develop advanced tactical missiles and aerodynamic designs for other weapons.

A sign depicting the four members of China’s military indicted on charges of hacking into Equifax Inc. and stealing data from millions of Americans is on display shortly after Attorney General William Barr held a press conference at the Department of Justice in Washington on Feb. 10, 2020. Sarah Silbiger/Getty Images

May 2017: Equifax Hack

Chinese military hackers breached the Equifax credit bureau in the largest-known theft of personal information.

More than 145 million Americans’ sensitive personal data, including Social Security and driver’s license numbers, were stolen. The hackers also obtained roughly 200,000 American credit card numbers.

The hackers routed traffic through approximately 34 servers located in nearly 20 countries to obfuscate their true location.

The United States later indicted four members of China’s military for the hack in 2020. As in most such cases, the hackers remain in China and have never been arrested.

January 2018: Navy Personnel, Technology Hacks

Chinese state-backed hackers allegedly compromised the computers of a U.S. Navy contractor and stole a large amount of highly sensitive data on undersea warfare, including U.S. plans for a supersonic anti-ship missile known as “Sea Dragon” for use on submarines, The Washington Post reported.

The hacked material also included signals and sensor data, information about submarine cryptographic systems, and electronic warfare documents from the Navy’s primary submarine development unit.

A sign depicting Chinese government hackers who allegedly targeted scores of companies in a dozen countries, at a press conference about Chinese hacking at the Justice Department in Washington on Dec. 20, 2018. Nicholas Kamm/AFP via Getty Images

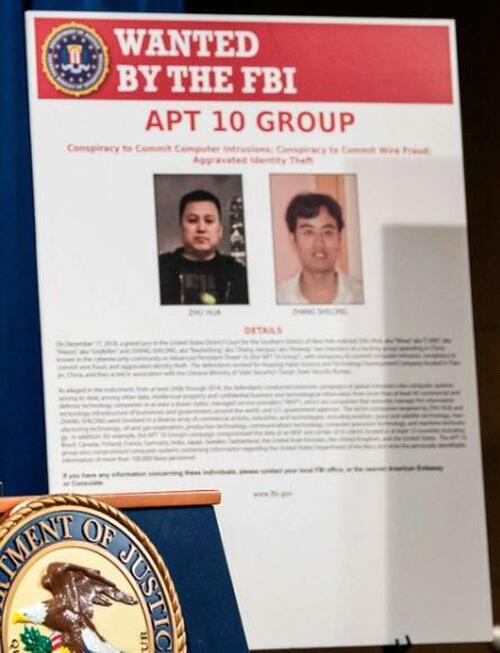

June 2019: APT10 Utility Spearfishing Campaign

APT10, a hacking group directed by China’s Ministry of State Security, began a massive spearfishing and hacking campaign targeting U.S. aerospace, engineering, and telecommunications firms.

By using stolen passwords and malware, the hackers were able to steal records related to 130,000 Navy personnel.

Huntington Ingalls Industries, the largest builder of U.S. military ships and nuclear-powered submarines, acknowledged that it was targeted in the attack, and that computer systems owned by one of its subsidiaries were discovered connecting to a foreign server controlled by APT10.

Acting U.S. Attorney for the District of Columbia Michael R. Sherwin speaks to the media about charges and arrests related to a computer intrusion campaign tied to the Chinese government by a group called APT 41, at the Department of Justice in Washington on Sept. 16, 2020. Tasos Katopodis-Pool/Getty Images

August 2019: APT41 Hacks Revealed

China-based hacking group APT41 penetrated and spied on global tech, communications, and health care providers for China’s Ministry of State Security.

The group deployed rootkits, granting itself hard-to-detect control over computers, by compromising millions of copies of a utility called CCleaner. APT41 also hijacked a software update pushed by Asus to reach 1 million computers, targeting a small subset of those users.

A nurse prepares a dose of the Moderna vaccine against COVID-19, donated by the United States, at a vaccination center in San Juan Sacatepequez, Guatemala, on July 15, 2021. Johan Ordonez/AFP via Getty Images

May 2020: Moderna COVID-19 Vaccine Espionage

Chinese regime-linked hackers targeted biotech company Moderna as it conducted research to develop a vaccine for COVID-19.

The effort involved conducting reconnaissance in order to steal proprietary research needed to develop a vaccine for the disease, which Moderna received nearly half a billion dollars to create from the U.S. government.

A U.S. indictment alleged that the China-based hackers probed public websites for vulnerabilities and scouted accounts of key personnel after gaining access to a network used by Moderna.

Paul Nakasone, director of the National Security Agency, looks at a hearing with the House Armed Services Subcommittee on Cyber, Innovative Technologies, and Information Systems in the Rayburn House Office Building in Washington on May 14, 2021. Anna Moneymaker/Getty Images

February 2021: Chinese Access to NSA Hacking Tools Revealed

Israeli researchers discovered that Chinese spies had stolen and deployed code first developed by the U.S. National Security Agency (NSA) to support their hacking operations.

The NSA hacking tools were leaked online in 2017. Still, cyber investigators found evidence that the Chinese communist-backed APT31 hacking group had deployed an identical tool as early as 2014. This suggests that China-based hackers had persistent access to the nation’s best national security cyber tools for years.

People walk by a Microsoft store in New York City on July 26, 2023. Samira Bouaou/The Epoch Times

March 2021: Silk Typhoon

A cyber-espionage group associated with China’s Ministry of State Security stole emails and passwords from more than 30,000 organizations by exploiting flaws in Microsoft Exchange Servers.

The group, dubbed Silk Typhoon by Microsoft, worked closely with China-back APT40, leveraging a flaw in Microsoft’s software to gain full access to emails hosted on more than 250,000 servers in the United States.

Among the organizations most affected by the hack were American pharmaceutical companies, defense contractors, and think tanks.

Attendees pass by an Alibaba.com display at a consumer technology trade show at the Las Vegas Convention Center in Las Vegas on Jan. 8, 2019. David Becker/Getty Images

December 2021: Log4j Hacks

APT41 returned to action, leveraging a previously unknown vulnerability in commonly used open-source logging software Log4j. The group used the vulnerability to hack into at least six unspecified U.S. government agency networks over a nine-month period.

The vulnerability allowed APT41 to keep track of user chats and clicks and follow user link clicks to outside sites, allowing hackers to control a targeted server.

The hackers then used the hijacked networks to mine cryptocurrency, create botnets, send spam, and establish backdoors for future malware attacks.

Notably, the China-based company Alibaba first discovered the security flaw and privately reported it to Apache Software, which created the affected software. The Chinese Communist Party afterward punished Alibaba by revoking an information-sharing deal, as Chinese law requires security flaws to be reported to the regime.

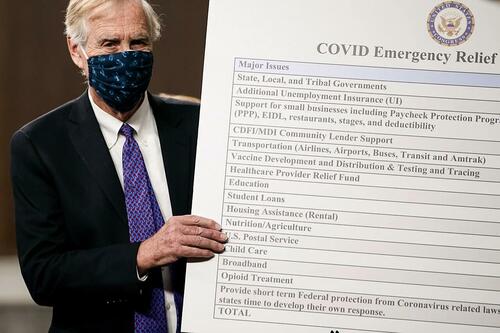

Sen. Angus King (I-Maine) sets up a sign alongside a bipartisan group of Democrat and Republican members of Congress as they announce a proposal for a COVID-19 relief bill on Capitol Hill on Dec. 1, 2020. Tasos Katopodis/Getty Images

December 2022: COVID-19 Relief Fund Theft

APT41 stole millions of dollars worth of U.S. COVID-19 relief benefits, which were intended to help Americans who were negatively impacted by the government’s economic shutdowns during the 2020 pandemic.

The sum was part of a staggering estimated $280 billion in stolen COVID-19 relief, which was illicitly intercepted by foreign hackers and domestic fraudsters who used the Social Security numbers and personal information of deceased and incarcerated Americans to claim benefits illegally.

To date, the Justice Department has only successfully recovered about $1.5 billion of the stolen funds.

May 2023: Antique Typhoon

Antique Typhoon, a Chinese state-backed hacking outfit, forged digital authentication tokens to access the webmail accounts of 25 organizations, including numerous U.S. government agencies.

The hackers were able to obtain the emails of government officials, including Commerce Secretary Gina Raimondo, and members of Congress, including Rep. Don Bacon (R-Neb.). The hackers used persistent access to the email accounts only for exfiltrating data, suggesting that their purpose was primarily espionage.

Taiwanese Vice President Lai Ching-te gives a speech at the CommonWealth Semiconductor Forum in Taipei, Taiwan, on March 16, 2023. Annabelle Chih/Getty Images

August 2023: HiatusRAT

China-backed hackers began targeting U.S. and Taiwanese military procurement systems, as well as semiconductor and chemical manufacturers.

The hackers leveraged a remote access tool to breach the system used to coordinate arms shipments from the United States to Taiwan. International open-source reporting suggests that the hackers’ goal was to gain intelligence on future defense contracts between the two powers.

September 2023: BlackTech Router Attack

China-backed hacking group BlackTech began targeting major corporate headquarters throughout the United States. The group appeared to focus its attacks on gaining access to American and Japanese companies working in the defense sector.

U.S. and allied intelligence agencies announced that having penetrated the international subsidiaries of major companies, BlackTech was now using its access to grant itself entry to major corporate networks within the United States in order to exfiltrate data.

January 2024: Volt Typhoon

U.S. intelligence agencies announced that Volt Typhoon, a Chinese state-backed hacking group, was pre-positioning malware in critical infrastructure throughout the United States, including water, gas, energy, rail, air, and port infrastructure.

Unlike most other Chinese hacking efforts that focus on espionage or intellectual property theft, Volt Typhoon sought to position malware in U.S. infrastructure in order to sabotage it in the event of a conflict between the two nations. Such sabotage would result in mass casualties among American citizens.

U.S. intelligence agencies said that they have removed Volt Typhoon malware from thousands of systems but that it remains embedded in some privately owned infrastructure and has been present since at least 2021.

(Left) A sign is posted in front of an AT&T retail store in San Rafael, Calif., on May 17, 2021. (Right) A man on his cell phone walks past a Verizon Wireless store in Washington on Dec. 30, 2014. Justin Sullivan/Getty Images, Jim Watson/AFP via Getty Images

November 2024: Salt Typhoon

U.S. intelligence agencies acknowledged that Salt Typhoon, a Chinese state-backed hacking group, has compromised the infrastructure used by eight major telecommunications companies, including AT&T, CenturyLink, and Verizon.

Salt Typhoon appeared to have gained access to the backend infrastructure used to accommodate the U.S. government’s own wiretapping efforts and thus gained access to virtually all calls and texts made using the affected networks.

Despite the wide-ranging access, China-based hackers appeared to have used the persistent access to target high-profile individuals, including President-elect Donald Trump and Vice President-elect JD Vance.

Congressional leaders have described the hack, which likely began in 2022, as among the most significant breaches in history. It is unclear how Salt Typhoon will be evicted from the infrastructure. The group retained access to U.S. telecommunications until late December.

Secretary of the Treasury Janet Yellen delivers remarks at Johns Hopkins University’s School of Advanced International Studies in Washington on April 20, 2023. Anna Moneymaker/Getty Images

January 2025: US Treasury Department Hack

The Treasury Department revealed that Chinese state-backed hackers had breached the department’s networks, gaining access to the servers of an office responsible for administering international sanctions.

The hackers also gained access to the department’s networks by compromising third-party cybersecurity service provider BeyondTrust, stole an as-of-yet unknown number of unclassified documents, and targeted the accounts of Treasury Secretary Janet Yellen.

Tyler Durden

Sat, 01/04/2025 – 23:20

In The Jan 6 Killing Of Ashli Babbitt, A Leftist Double-Standard On Cop Misconduct

In The Jan 6 Killing Of Ashli Babbitt, A Leftist Double-Standard On Cop Misconduct

Via Brian McGlinchey at Stark Realities

Contrary to exaggerated, partisan rhetoric that frames the Jan 6, 2021 Capitol Hill riot as a “deadly insurrection,” the truth is that only one homicide occurred that day. The victim, an unarmed Trump supporter, was shot and killed by a police officer with a history of irresponsible handling of firearms, who opted against a nonlethal response to an act of trespassing, and who fired his weapon in the absence of any imminent threat of death or serious injury to himself or others in his vicinity.

US Capitol Police (USCP) Lieutenant Michael Byrd’s killing of Ashli Babbitt came just six months after George Floyd’s death under the knee of Minneapolis police officer Derek Chauvin, an incident that sparked outrage, widespread calls for police reform, and nationwide rioting. In the case of Babbitt’s killing, however, the collective reaction from the American left and major media at best amounted to an indifferent shrug. Worse, many reflexively heralded Byrd as a hero and viewed Babbitt as a deserving recipient of the bullet that perforated her trachea and lung.

The contrast illustrates how partisan framing short-circuits people’s ability to uniformly and objectively apply principles to the facts before them. Put another way, an intellectually honest person can reject Babbitt’s politics, condemn her unlawful conduct on Jan. 6 and rightly conclude that she was the victim of an unjustified police shooting.

In 2021, the Department of Justice announced it had completed an investigation of the shooting and found “insufficient evidence to support a criminal prosecution.” The DOJ did not, however, assert that Byrd’s use of deadly force was warranted. Last year, Babbitt’s husband filed a civil suit against the federal government, seeking $30 million in damages; the trial is slated to commence in July 2026.

Babbitt, a 35-year-old Air Force veteran from San Diego who operated a pool business with her husband, attended the “Save America” rally in Washington on Jan. 6 before joining others who proceeded to the Capitol grounds. After things escalated and rioters breached the Capitol building, she entered it, and a female police officer reportedly instructed her to walk toward the House side of the complex.

Here’s how the DOJ described what happened next; I’ve bolded three words I’ll address shortly:

Ms. Babbitt was among a mob of people that…gained access to a hallway outside “Speaker’s Lobby,” which leads to the Chamber of the U.S. House of Representatives. At the time, the USCP was evacuating Members from the Chamber, which the mob was trying to enter from multiple doorways. USCP officers used furniture to barricade a set of glass doors separating the hallway and Speaker’s Lobby to try and stop the mob from entering the Speaker’s Lobby and the Chamber, and three officers positioned themselves between the doors and the mob.

Members of the mob attempted to break through the doors by striking them and breaking the glass with their hands, flagpoles, helmets, and other objects. Eventually, the three USCP officers positioned outside the doors were forced to evacuate. As members of the mob continued to strike the glass doors, Ms. Babbitt attempted to climb through one of the doors where glass was broken out. An officer inside the Speaker’s Lobby fired one round from his service pistol, striking Ms. Babbitt in the left shoulder, causing her to fall back from the doorway and onto the floor.

Though it’s not narrowly relevant to Byrd’s decision to pull the trigger, the DOJ’s passive-tense claim that the three officers on Babbitt’s side of the doors “were forced to evacuate” is important because it indicates an extreme inclination to put the best spin possible on officers’ decisions. Video shows those three officers failing to make any meaningful effort to stop those who were hammering the glass doors. After enduring mounting verbal abuse and violations of their personal space, they simply walked away from the doors, clearing the way for the rioters to remove the glass from a side window and for Babbitt to proceed through the opening.

According to the 32-page complaint filed in the civil suit, one of those three officers later told investigators, “I grapple with this, you know, if I should’ve stayed.” More pointedly, one of the members of the Containment and Emergency Response Team (CERT) who ascended the stairs from behind the mob told investigators, “I was thinking why, why the fuck did they leave?”

Some of the most damning information in the civil complaint comes from Byrd’s own mouth. In a 2021 NBC interview conducted by an excessively sympathetic Lester Holt, Byrd said:

-

“I could not see exactly what was happening [on the other side of] the door…it’s impossible for me to see what’s on the other side because we had created such a barricade — it was high enough that the visibility was impossible.”

-

“[Babbitt’s] failure to comply required me to take the appropriate action to save the lives of members of Congress and myself and my fellow officers.”

-

“It was later [that] I found out that the subject did not have a weapon, but there was no way to know that at that time, and I could not fully see her hands or what was in the backpack or what the intentions [were].”

-

“Of course we had our weapons drawn as part of our training. You had [false reports of] shots fired onto the House floor, you’re trained to take a tactical defensive position and prepare for the threat.”

There are many unsettling things about Byrd’s statements, chief among them his admission that he saw no weapon in Babbitt’s hands, and had “no way to know” if she was armed or what her intentions were. “Without additional information indicating that a person is likely armed, officers cannot conclude that someone has a weapon just because they cannot see definitively that the person does not have a weapon,” wrote Geoffrey Alpert, Jeff Noble, Seth Stoughton at Lawfare.

Among other incriminating elements of Byrd’s NBC interview:

-

Byrd asserts that Babbitt’s mere failure to comply with orders not to proceed through the door justified the use of lethal force.

-

He implies that (false) reports of shots fired somewhere else in the Capitol gave him a green light to start shooting noncompliant people in his vicinity; in other words, he seems to have made a blanket assessment that every trespasser in the building posed an imminent danger justifying deadly force.

“Officers cannot rely on generalized assumptions. They must base their conclusions on specific and individualized facts,” the Lawfare authors note.

Unsatisfied with merely defending his killing of Babbitt, Byrd used the NBC interview to declare himself as a hero, telling Holt, “I showed the utmost courage on January 6…I know that day I saved countless lives.” That latter boast is truly extraordinary, especially considering it was made with the benefit of hindsight. It would be one thing for Byrd to try attributing his deadly decision to a reliance on bad information amid the chaos of Jan. 6; it’s another to lionize himself with a baseless claim of rioters’ murderous intent.

Under USCP policy, lethal force is only authorized when “the officer perceives that the subject poses an imminent danger of death or serious physical injury to the officer or to another person.” As Babbitt rose to awkwardly enter through the open window — where she would next have to awkwardly navigate a furniture barricade on the other side — there was no indication that she had the ability to seriously injure or kill anyone.

As seen in video of the shooting, Byrd’s positioning was problematic; the civil complaint characterizes it as an “ambush.” From the perspective of the rioters, Byrd was positioned on the far left, at an angle some 160 degrees from Babbitt, who was on the right side of the doors. Before stepping forward and killing Babbitt, Byrd was tucked inside another doorway, with only his pistol extending past the opening.

It’s very unlikely Babbitt saw his raised pistol and knew she was being threatened with death if she went through the window. Indeed, one of those three officers who inexplicably abandoned the doorway on Babbitt’s side told investigators, “I saw him . . . there was no way that woman would’ve seen that.” What’s more, Byrd told Holt that he repeatedly screamed “get back..stop…get back…no,” but made no claim that he verbally warned Babbitt that she was on the verge of being shot.

By all indications, Babbitt’s unarmed ascent to the window was a circumstance that called for the use of nonlethal force. That could have taken many forms — a firm shove back through the window, yanking her forward to the floor, or perhaps using pepper spray or a taser. While not clear how the various officers were equipped, note that police aren’t justified in resorting to deadly force just because it’s all they have available. It’s telling that, among multiple armed officers on that side of the doorway, Byrd was the only one who opened fire.

The civil complaint also credibly accuses Byrd of failing to handle his firearm in accordance with USCP policy, by:

-

Unholstering it before any imminent threat had emerged to justify doing so

-

Failing to hold his pistol at a “low ready” position and instead pointed it at people who posed no imminent threat

-

Putting his finger inside the pistol’s trigger guard, “tapping it on and off the trigger for at least 14 seconds before he shot and killed Ashli.” Across law enforcement, the military and in civilian self-defense, it’s a universally-embraced principle that one’s finger shouldn’t be put inside the trigger guard until a decision to fire has been made.

After shooting Babbitt, Byrd took to his radio, his voice filled with panic — and a self-serving falsehood. “We got shots fired in the lobby. We got shots, shots fired in the lobby of the House chamber. Shots are being fired at us and we’re sh… uhh, prepared to fire back at them,” he said, seemingly so desperate to justify his action that he falsely reported coming under fire himself.

In the aftermath of incidents involving excessive use of force, we often find the officer in question has a blemished service record. That’s the case with Byrd, whose checkered past includes irresponsible handling of firearms. In 2019, Byrd was suspended for 33 days after he left his loaded weapon in a Capitol Visitor Center complex bathroom for nearly an hour; it was discovered by another officer.

Even more concerning was a 2004 off-duty incident. Byrd fired his service weapon at a stolen car fleeing his neighborhood — hitting it from behind. Investigators said Byrd’s claim that he fired at the car in self-defense as the driver attempted to hit him was “inaccurate.”

They also determined that Byrd put his innocent neighbor in the line of fire as he pulled the trigger. Stray rounds hit nearby homes, according to the Babbitt civil complaint. Foreshadowing Byrd’s decision-making on Jan. 6, the Office of Professional Responsibility (OPR) concluded he’d fired in a “careless and imprudent manner.” That finding was overruled, however, via an appeal to the Disciplinary Review Board.

In another off-duty incident, Byrd was given a seven-day suspension without pay in 2015 after accosting a police officer providing security at a high school football game, showering him with profanities and reportedly calling him “a piece of shit, asshole and racist” who was only concerned with policing the “black side” of the football field.

Further underscoring the double-standards at play in the Babbitt case, imagine the response from the left if there were a controversial shooting in which a white male police officer had demonstrated a similar, racially-charged loss of composure years before killing an unarmed black female trespasser.

“The ironies of Babbitt’s death abound—and not just because in this case the cop with the quick trigger finger was black and his victim was a white woman,” wrote Jonathan Tobin. “Both those who are supporting Byrd and those who consider the pass he got from his superiors an injustice have probably been on the opposite side of similar controversies in the past year. Some of those who think Babbitt was the victim of a police murder have defended officers accused of killing unarmed black persons. And many who are lauding Byrd as a defender of democracy were outraged by the same killings.”

Stark Realities undermines official narratives, demolishes conventional wisdom and exposes fundamental myths across the political spectrum. Read more and subscribe at starkrealities.substack.com

Views expressed in this article are opinions of the author and do not necessarily reflect the views of ZeroHedge.

You may also like:

Tyler Durden

Sat, 01/04/2025 – 22:45

Report: Senate Democrats Open to Confirming RFK Jr.

Some Senate Democrats are reportedly open to confirming Robert F. Kennedy Jr. to be the next Health and Human Services (HHS) secretary, according to a report.

The post Report: Senate Democrats Open to Confirming RFK Jr. appeared first on Breitbart.

Judge Merchan Schedules Trump Sentencing in Hush Money Case for January 10

from Your News: Former President Donald Trump is scheduled to be sentenced next week in the Manhattan District Attorney’s hush money case. By yourNEWS Media Newsroom Former President Donald Trump will be sentenced on January 10, days before his scheduled inauguration, in the Manhattan District Attorney’s high-profile hush money case. Judge Juan Merchan, presiding over […]

Exclusive — Coronavirus Timeline ‘Giant Scandal to Subvert’ Trump

Officials knew about the coronavirus breakout in the fall of 2019 — sooner than they claim — and the biotechnology used to create the virus developed in the U.S. and was then exported to China, Dr. Andrew Huff, author of The Truth About Wuhan: How I Uncovered the Biggest Lie in History, said on Breitbart News Saturday.

The post Exclusive — Dr. Andrew Huff: Coronavirus Timeline ‘Giant Scandal to Subvert’ Trump appeared first on Breitbart.

2024 Review – Another 20% Year. What’s Next?

2024 Review – Another 20% Year. What’s Next?

Authored by Lance Roberts via RealInvestmentAdvice.com,

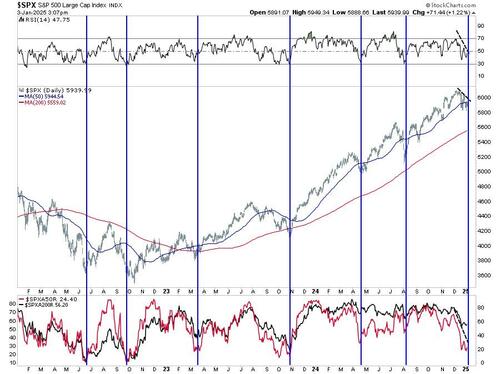

Santa Is A No-Show

Last week, we discussed how it seemed as if Santa arrived on Christmas Eve, pushing the markets back above the important 50-DMA. However, by the end of the year, it seemed investors were naughty this year and received a “lump of coal,“ with markets selling off back toward recent lows. One important note was that momentum and relative strength remained weak, keeping selling pressure intact.

There is no way to sugarcoat the market’s poor performance. While December started with a bang, it ended with a whimper, with a long stretch of daily losses into year-end. Now, 2025 is opening with a whimper. Small caps fell apart after attempting to “make a comeback,” and overall market breadth declined. However, with the markets now oversold, we should expect a rally heading into the Presidential inauguration, which likely started on Friday.

Despite Friday’s impressive reflexive rally, the market fell about 0.5% short of rallying enough to save the “Santa Rally.”

However, although the “Santa Rally” failed to materialize, bullish hopes for 2025 are not yet lost.

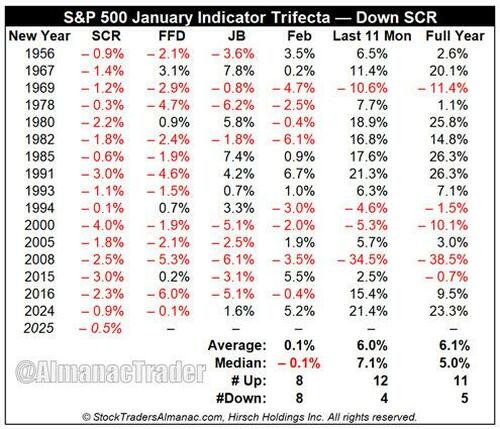

“Since 1950, when all three January indicators (The Santa Claus Rally (SCR), First Five Days (FFD) and the full-month January Barometer (JB)) are up, the S&P 500 was up 90.6% of the time (29 out of 32 years) with an average gain of 17.7%. When one or more of the Trifecta is down, in this case, the SCR, the year is up 59.5% of the time (25 of 42) with a paltry average gain of 2.9%.” – Stocktraders Almanac

While the lack of a Santa rally is disappointing, as noted by Stocktraders Almanac:

“Of the 16 down SCRs since 1950, 11 years have been up and 5 down, but the average gain is a tepid 6.1%.“

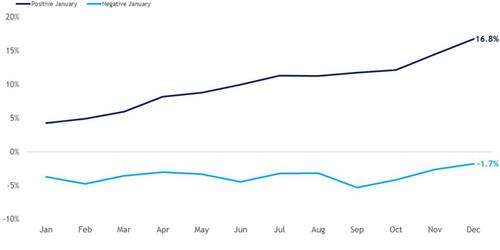

However, even with a failed Santa rally, the January barometer holds the key for the year. Historically, a positive January has been a bullish sign for stocks. The chart below highlights that the popular Wall Street maxim has stood the test of time. Since 1950, the S&P 500 has posted an average annual return of 16.8% during years that included a positive January. Furthermore, the index generated positive returns in 89% of these years. In contrast, when the index traded lower in January, annual returns dropped to -1.7%, with only 50% of occurrences yielding positive results.

With the bulls needing a positive January performance, the market has its work cut out. However, with the market’s short-term oversold and breadth, there is a reasonable technical setup for an improvement in performance in January.

However, will 2025 be another banner year? Maybe. But the market certainly faces headwinds, from elevated earnings expectations to valuations. Our best guess is that while this year will likely see a continuation of the bull market cycle, it will be punctuated by increased bouts of volatility that will weigh on investor sentiment. In other words, “buckle up and keep your arms and belongings inside the vehicle.”

This week, we will do a short 2024 review.

2024 Review – Another 20% Plus Year

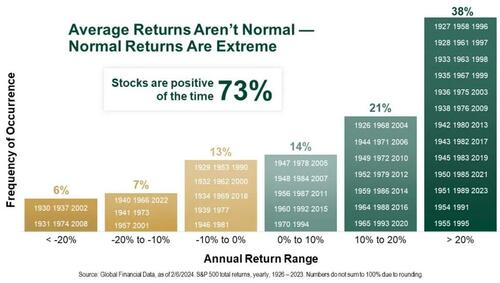

The market had another 20% plus return for the year. As we discussed previously, the market rarely delivers an “average” return of 8-10%. About 38% of the time, the market delivers 20% or more returns.

Since 1900, the stock market has “averaged” an 8% annualized rate of return. However, this does NOT mean the market returns 8% every year. As we discussed recently, several key facts about markets should be understood. Stocks rise more often than they fall: Historically, the stock market increases about 73% of the time. The other 27% of the time, market corrections reverse the excesses of previous advances. The table below shows the dispersion of returns over time.”

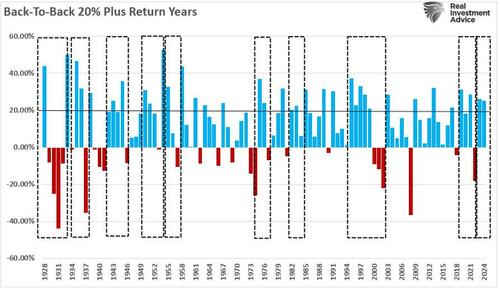

For analysts, being permanently “bullish” leads to a 73% success rate on market calls, which, if you are a professional baseball player, a .730 batting average will enshrine you in the “Hall Of Fame.” However, as investors, the problem with being always bullish is the impact on our portfolios for the “other” 27% of outcomes. This is important in the history of 20% plus annual returns. In the table above, in the far-right column, there are periods where 20% plus gains were clustered.

So, what does that mean?

The Long Term

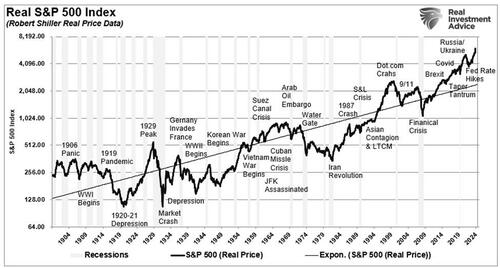

It is worth noting that these periods of “well-above-average” returns were followed by “well-below-average” returns. As shown, these periods of “mean-reversion” were generally triggered by some event that reversed elevated valuation levels.

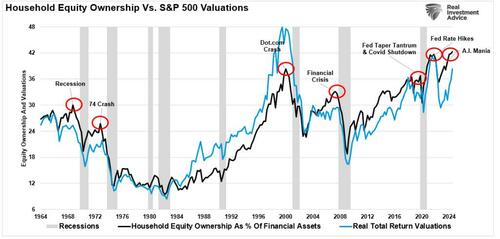

As we see in the market, these periods of excess valuations are a psychological byproduct of investor sentiment. Our 2024 review found that investor allocations to equities reached a record, corresponding to a sharp increase in valuation levels as investors were willing to overpay for earnings growth.

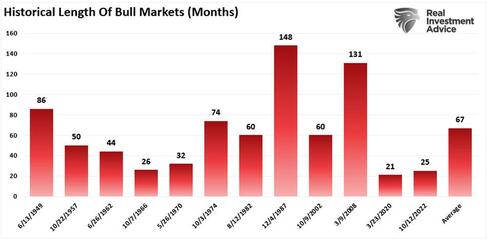

As asset prices rise, speculation. increases, creating a “feedback loop.” The more asset prices rise, the more confident investors become, leading to further price increases fueling a bull market. The chart below shows the length of previous bull markets throughout history, with the average length of bull markets running about 5 1/2 years.

However, while the long duration of bull markets favors being bullish, the problem is that eventually, some “event” occurs that causes a reversal of expectations. When that occurs, investors reprice the market back to reality. As shown, bear markets and the ensuing recessions are generally very short. Most bear markets last less than 18 months and are more painful experiences.

Does that mean 2025 will be a “mean reverting” year? No. However, as discussed in this 2024 review, there are certain warning signs that next year could be very different.

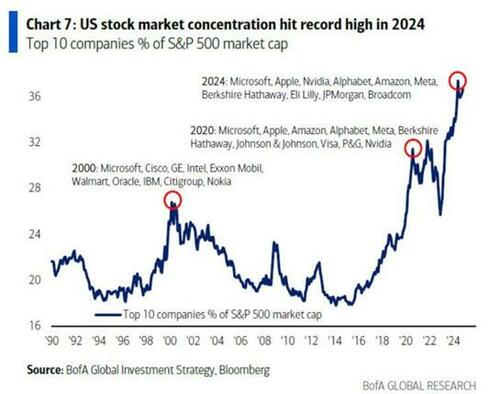

2024 Review – A Year Of Concentration

For the second year in a row, the one big standout was the level of market concentration. The “Mega-cap” stocks have become an ever-increasing percentage of the S&P 500 index. We have not witnessed this since the early 70s with the “Nifty-Fifty” and just before the “Dot.com” crash.

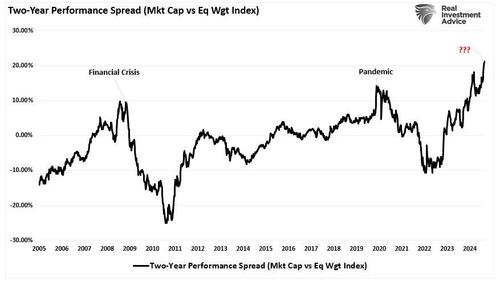

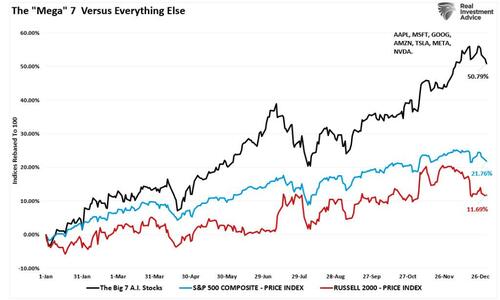

Over the last few years, capital flows into the largest market capitalization stocks have led to an increasing skew between the “have and have nots.” Over the last year, the companies that dominate the market capitalization weighting of the S&P 500 index created a substantial outperformance over the equal-weighted index.

Speaking of the “have-nots,” the 60/40 allocation lagged far behind the S&P 500 index on a performance basis as bonds struggled with “sticky inflation” and continued to push to increase portfolio risk as investors chased asset prices higher.

However, that continued performance chase has led to the most significant rolling two-year performance spread between the market capitalization and equal-weighted index since 2008 and 2019.

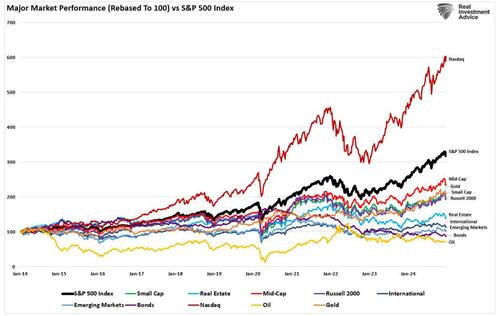

While the surge in market concentration has been notable over the last two years, the chase for performance has been a growing issue since 2014. As shown, the Nasdaq and S&P 500 (both market-capitalization-weighted and dominated by the same stocks) have massively outperformed everything from small and mid-capitalization companies to gold, oil, and bonds.

Notably, in 2024, the “Mega 7” market-capitalization companies returned 50%, while the S&P 500 was higher by 22%, and the Russell 2000 trailed far behind, rising just 12%.

The question is, why is this happening?

2024 Review – Speculation Goes Parabolic

As discussed, the surge in “Exchange-Traded Funds” or “ETFs” has changed the investing landscape.

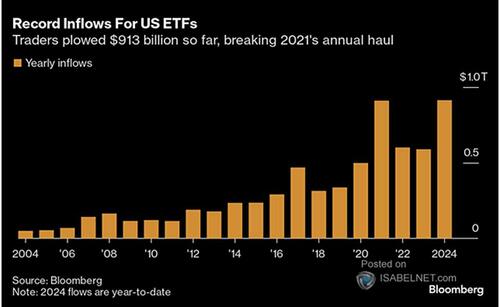

“Following the 2020 pandemic shutdown, the Government and Federal Reserve went into overdrive, providing round after round of fiscal and monetary support. Money flooded the economy, from PPP Loans to rent moratoriums, $1500 checks directly to consumers, debt forgiveness, zero interest rates, and quantitative easing. Unsurprisingly, much of that money entered the financial markets, and retail investors plowed nearly $900 billion in market-related ETFs. Interestingly, in 2024, most of those supports are gone, interest rates have risen sharply, and the Federal Reserve is reducing its balance sheet. Yet, somehow, investors figured out a way to push $913 billion (YTD) into ETFs, which is a record inflow.”

That surge of capital into ETFs contributed to the outsized performance of large capitalization companies, primarily the “Magnificent 7,” relative to the rest of the index, as shown above. This happens because most of these passive ETFs are market capitalization-weighted.

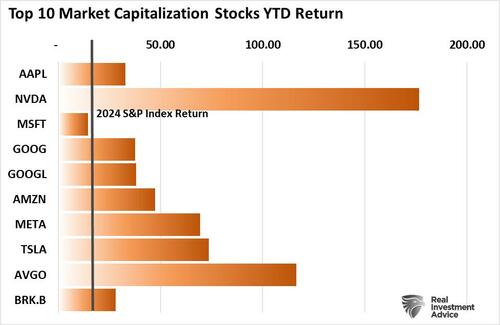

For example, every ETF that tracks the S&P 500 index, the Nasdaq, or some variation thereof has the same top holdings. Currently, the top 10 stocks comprise roughly 40% of those ETFs.

Therefore, every time someone invests $1 into one of those ETFs, roughly 40 cents of that dollar flows into just 10 stocks. Such is why, in our 2024 review, those 10 stocks, except Microsoft, outperformed the S&P 500 index by a wide margin.

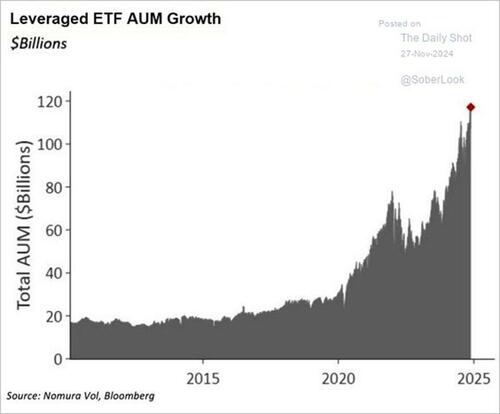

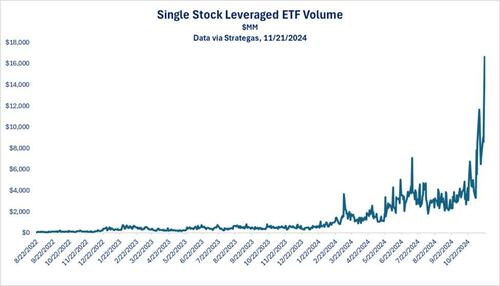

The byproduct of consistently rising prices and investors’ chase for performance creates demand for Wall Street to provide more products for investors to purchase. This is why 2024 saw a massive increase in single-stock ETFs and, more critically, leveraged ETFs.

The growing demand by investors to leverage speculate in the market is a topic we covered recently in our Daily Market Commentary and is the hallmark of our 2024 review:

“We see surging volume in leveraged single-stock ETFs. An example of such an ETF is Granite Shares NVDL. The ETF offers a 2x leveraged holding of Nvidia shares. If Nvidia falls by 3%, the ETF will decline by 6%. Conversely, if Nvidia rises by 5%, the ETF will climb 10%. Accordingly, leveraged single-stock ETFs can be incredibly speculative. Furthermore, the massive surge in volume in such ETFs, as we share below, further confirms speculative behaviors are growing.

Leverage and extreme speculation can drive markets higher than most investors forecast. However, in the process, they create a divergence between fundamentals and valuations, thus exposing the markets to risk. Increased leverage and speculation are not reasons to sell immediately, but they indicate that markets are getting frothy, warranting our close attention.“

The important point is that while 2024 was a great year in the markets, history suggests that expectations for 2025 should likely be tempered. Such brings us to the obvious question, “What should I be watching for to signal a shift in investor sentiment?”

2024 Review – What To Watch For In 2025

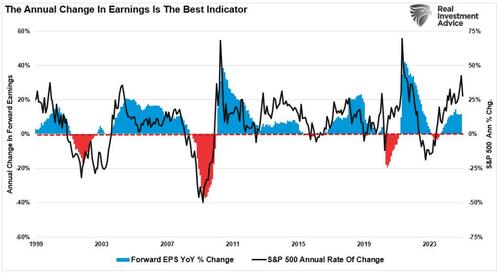

While investors are giddy with returns over the past year, that exuberance has increased the expectation that things will continue in 2025. Of course, earnings growth will be the biggest driver for returns in 2025.

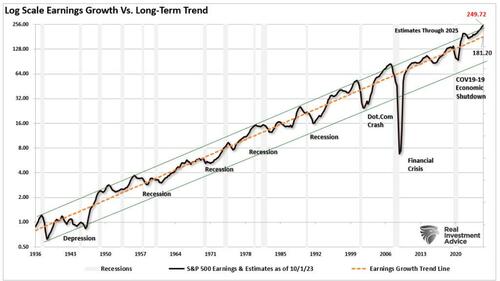

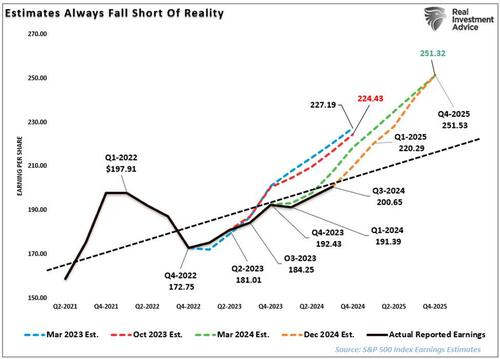

Forward earnings estimates are optimistic and well above their long-term historical logarithmic growth trend. Analysts expect the S&P 500 will see earnings reach $249/share from $208/share at the end of 2024. That is an expected growth rate of 19% for earnings. However, that current estimate is $68/share above historical earnings’ long-term exponential growth trend. While such deviations existed previously, they were usually close to the point where such optimism ended. The ends of those exuberant periods of earnings growth generally coincided with a recession or a mean-reverting event. However, while estimates are currently very elevated, they can remain elevated longer than you think possible.

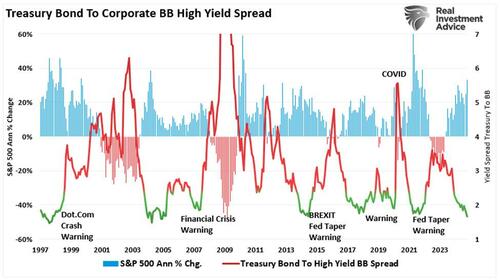

The timing of “the” event that reverses more extreme investor exuberance and speculation is always the most challenging. However, it always occurs when it is least expected. As we enter 2025, investor sentiment of expected stock returns over the next 12 months is near the highest levels on record. At the same time, credit spreads remain near the lowest levels on record, confirming the high degree of complacency in today’s markets.

Such exuberance and overconfidence tend to precede some level of disappointment.

Earnings Matter More Than You Think

The most significant risk in 2025 is an event that causes a significant decline in earnings expectations. As shown, there is a very high correlation between earnings trends and the rate of change in asset prices.

As I discussed in “Predictions For 2025:”

“The problem with current forward estimates is that several factors must exist to sustain historically high earnings growth.

- Economic growth must remain more robust than the average 20-year growth rate.

- Wage and labor growth must reverse to sustain historically elevated profit margins, and,

- Both interest rates and inflation must reverse to very low levels.

While such is possible, the probabilities are low, as strong economic growth cannot exist in a low inflation and interest-rate environment. More notably, if the Fed cuts rates further, as most economists and analysts expect next year, such will be in response to a slowing economic environment or financial stress. Such would not support more optimistic earnings estimates of $251 per share next year. This represents roughly a 19% increase from Q4-2024 levels. (In 2023, estimates for 2024 suggested a 14% increase, which was just 9%. The long-term trend of earnings growth from 1900 to the present is just 7.7%).”

While the bullish predictions for next year are certainly possible, that outcome faces many challenges. This is particularly true given that the market trades at fairly lofty valuations. Even in a “soft landing” environment, earnings should weaken, which makes current valuations at 27x earnings more challenging to sustain. Therefore, assuming earnings decline toward their long-term trend, that would suggest current estimates fall to $220/share by the end of 2025. This substantially changes the outlook for stocks.

Tyler Durden

Sat, 01/04/2025 – 17:30