Authored by Josh Stylman via The Brownstone Institute,

Let me start by saying I loathe politics. I’ve always been drawn to liberal ideas—individual freedom, protecting the vulnerable, questioning authority, and the fundamental belief that consenting adults should be free to live their lives however they choose as long as they’re not harming others. These aren’t political positions to me; they’re basic human principles. But the game of politics itself repulses me. What I’m about to share isn’t about politics; it’s about our shared reality and how we’ve lost touch with it.

The Mindvirus

What’s truly mind-numbing to me is how people don’t see what’s happening right in front of them. The media has devolved into nothing more than a propaganda mouthpiece for the establishment, programming people to react rather than think. I’ve experienced this firsthand: When I drew historical comparisons between vaccine mandates and 1933 Germany’s early authoritarian policies, I was instantly labeled an extremist and cancelled by my NYC community. Yet now, these same people casually call everyone at Trump’s MSG rally Nazis. The irony would be funny if it weren’t so tragic.

My Liberal Foundation

I still believe deeply in core liberal principles:

- Genuine free speech, not the controlled corporate version we see today

- Standing against establishment overreach

- Opposing unchecked corporate power

- Fighting against unnecessary wars

- Complete bodily autonomy – your body, your choice, in ALL contexts

- Defending individual rights consistently, not selectively

These aren’t just political positions—they’re principles about human dignity and freedom.

The Democratic Party’s drift from these values didn’t happen overnight. Many of us, exhausted by Bush’s brutal wars, lies about weapons of mass destruction, and the Patriot Act’s assault on civil liberties, invested our hopes in Obama’s promise of change. But instead of the transformation we sought, we got what felt like Bush’s third and fourth terms.

Under Obama, we watched as corporate influence grew stronger, not weaker. The Snowden revelations exposed massive surveillance programs. The housing crisis devastated ordinary Americans while Wall Street got bailouts. Rather than challenging institutional power, the Democratic establishment became increasingly entangled with it.

The betrayal of liberal values became even clearer with Bernie Sanders. Like Trump, Bernie tapped into something real—a deep frustration with a system that had left ordinary Americans behind. Both men, from vastly different perspectives, recognized that working people were suffering while elites prospered. But the Democratic establishment couldn’t allow an actual progressive challenger. They used every trick in the book—from media manipulation to primary shenanigans—to block him from the nomination. Most disappointing was watching Bernie himself bend the knee to the same establishment he had railed against, leaving millions of supporters feeling betrayed and politically homeless.

When Hillary Clinton emerged as the nominee, we were told rejecting her meant rejecting women’s leadership. But we weren’t rejecting female leadership—we were rejecting warmongering and corporate cronyism. What we needed was a leader embodying the feminine divine: qualities of compassion, understanding, nurturing wisdom, and the ability to truly listen. Instead, we got another hawk in the corporate establishment’s pocket. And when that failed, they doubled down on cynical identity politics with Harris.

Today, the situation relating to Robert F. Kennedy, Jr. perfectly exemplifies how far the party has fallen. Here was a lifelong Democrat, a member of the party’s most popular family, who wanted to challenge these corrupting influences—and they wouldn’t even let him on the debate stage. I firmly believe that had they given him the opportunity, he could have united the country and beaten Trump.

But that reveals the truth: this was never about beating Trump. It was about ensuring they maintained control by installing another establishment stooge who wouldn’t challenge their power structure. His departure from the party isn’t just about one candidate; it’s the culmination of a long betrayal of liberal principles.

The Politics of Distraction vs. Real Issues

Take abortion rights. This is an incredibly nuanced issue with deeply held convictions on all sides. I’ve spoken with several constitutional lawyers who’ve explained that overturning Roe was legally sound—not a political decision but a constitutional one about federal versus state authority. That makes it even more telling that Democrats, when they had a supermajority, chose not to codify these protections into federal law. Instead, they’ve kept this issue unresolved, using it as a reliable tool to drive voter turnout every four years.

While abortion access matters deeply to many Americans, we’re facing multiple crises that threaten the very foundation of our republic: inflation is crushing working families while Wall Street posts record profits; government surveillance of citizens has reached dystopian levels; and our regulatory agencies—the FDA and CDC—have been completely captured by corporate interests, approving one toxic product after another while our children are being poisoned by processed foods, environmental toxins, and experimental drugs.

The climate crisis (or what some see as deliberate geoengineering) threatens our very survival. Our border is in complete chaos—while we send billions to foreign conflicts most Americans barely understand. All this while our own infrastructure crumbles and our nation grows more divided than ever.

The hypocrisy around women’s rights is particularly telling. The same party that claims to champion women’s bodily autonomy pushed for mandatory experimental medical interventions, despite documented evidence of mRNA vaccines affecting women’s reproductive cycles and fertility. These effects were known from early trials, yet raising concerns got you labeled as “anti-science.” Meanwhile, they’ve insisted that biological males have access to women’s spaces—including locker rooms, bathrooms, and sports competitions—prioritizing fashionable ideologies over women’s safety and fair competition.

The Democrats permanently lost any moral authority on bodily autonomy the moment they advocated for mandatory medical procedures—yet they continue to lecture us about it without a hint of self-awareness. Liberal principles aren’t a Chinese menu where you get to pick and choose which freedoms matter.

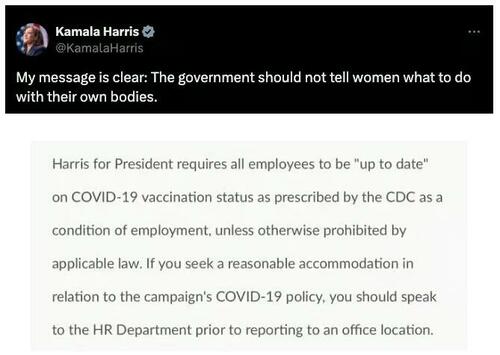

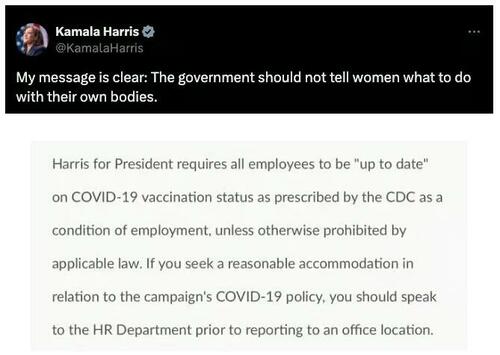

Take Kamala Harris—she literally campaigned on “My body, my choice” while simultaneously mandating experimental Covid shots for her own campaign staff. You can’t claim to champion bodily autonomy in one breath and deny it in the next based on political convenience. Either you believe in individual liberty and bodily autonomy, or you don’t. There’s no à la carte option when it comes to fundamental human rights.

The Corporate-State Fusion

What we’re seeing today aligns disturbingly well with Mussolini’s definition of fascism: the merger of state and corporate power. Look at Klaus Schwab’s World Economic Forum promoting “stakeholder capitalism,” where corporations and governments form partnerships to control various aspects of society. The WEF’s corporate membership reads like a who’s who of Democratic Party megadonors: BlackRock, which donated millions to Biden’s campaign while pushing ESG policies that benefit their bottom line; Pfizer, which poured over $10 million into Democratic coffers while securing massive government contracts; Google and Meta, which not only donate heavily but actively suppress information challenging Democratic narratives.

This isn’t a coincidence; it’s coordination. These same companies shape policy that enriches them: BlackRock advises on financial policy while managing government assets, Pfizer helps write drug approval guidelines while selling mandatory vaccines, and Big Tech collaborates with federal agencies to control information flow. We saw this play out in real time: from day one of the Biden administration, they created backdoor channels into social media companies to censor Americans’ speech about Covid, the 2020 election, and other sensitive topics.

This isn’t a theory—it’s documented fact. Every major policy decision seems to benefit these corporate partners: vaccine mandates, digital currency initiatives, censorship programs, climate policies—all funneling money and power to the same corporations that fund the Democratic machine. When corporations and government work together to control information and behavior, that’s precisely the corporate-state fusion that classical liberals once fought against. The Democratic Party has become the party of corporate fascism while claiming to fight against it.

The Democratic Facade

The current administration embodies everything wrong with our system. Look at Kamala Harris—she dropped out of the 2020 presidential race before any primary, polling below 1%. Biden then selected her solely because he limited his pool to black women—not because of her qualifications, but because of identity politics. Her record as Senator was abysmal—she sponsored zero significant legislation and missed 84% of votes during her brief tenure. Then as Vice President, her role as border czar has been an unprecedented disaster—one the administration now tries to pretend never happened.

And here’s the ultimate irony: this is the party screaming loudest about “threats to democracy,” yet they literally installed Harris as their candidate when nobody voted for her—she dropped out before a single primary vote was cast due to dismal polling. They wouldn’t even let their own members participate in primary debates. They’re lecturing us about democracy while actively suppressing democratic processes within their own party. When they say “democracy is on the ballot,” what they really mean is their controlled version of democracy where they pick the candidates and we’re supposed to fall in line.

Nobody voted for her, and honestly, nobody really likes her—they just hate Trump more. They could prop up a steaming pile of manure as a candidate, and people would vote for it just to vote against Trump. But here’s the real question: If Trump is truly the democracy-ending threat they claim, why didn’t democracy end during his first term? And if Harris is the solution to our problems, why hasn’t she fixed anything while in office?

The Trump Enigma

My view on Trump has evolved, though not in the way many might expect. I didn’t vote for him in 2016 or 2020. Growing up in this region, I knew him only as a second-generation real estate developer—Woody Guthrie had written those critical lyrics about his father, “Old Man Trump.” At the time, I thought Donald was just another entitled heir who happened to opportunistically tap into something real.

But there’s so much more to this story. His connections to secret societies and the occult run surprisingly deep. His Trump Tower penthouse is essentially a Masonic temple, designed as a replica of Versailles with deliberate esoteric symbolism throughout. His mentor was a 33° Scottish Rite, and Roy Cohn’—master of blackmail and dark arts—shaped his early career. Most intriguingly, his uncle John Trump was the MIT scientist tasked with reviewing Nikola Tesla’s papers after his death—papers that allegedly contained world-changing technologies, from free energy to more exotic possibilities. I don’t know what it all means, but there’s clearly more to this story than the “orange man bad” narrative we’re fed.

At this point, I see only three possibilities:

- He’s playing his part in a grand political wrestling match (WWF style)

- He’s a dueling bad guy (genuinely a thorn in the establishment’s side)

- He’s actually the hero of this story (which would be the most hilarious plot twist imaginable from the vantage point of someone like me)

The Path Forward

Candidly, I don’t know and at this point, any of these seem plausible. What I do know is what the blue team represents—their actions have made that crystal clear. But Trump remains a bit of a mystery to me. I have a hard time believing any politician could be our savior—real change has always come from the bottom up, not the top down. But something interesting happened that gave me a glimmer of hope: RFK, Jr. jumping on board.

The RFK, Jr. situation is fascinating. Here’s a Kennedy—essentially Democratic royalty—teaming up with Trump after being shut out by his own party. This isn’t just any political alliance. RFK, Jr.’s deep understanding of the administrative state, from public health institutions to regulatory agencies, combined with his proven track record of exposing corporate capture and fighting pharmaceutical corruption, makes this particularly intriguing. Maybe, just maybe, this alliance could protect our children from harmful policies and unnecessary wars?

I struggle with what comes next because I understand the gravity of our situation. Our republic is incredibly fragile—more fragile than most people realize. The Founders knew this, warning us about the difficulty of maintaining a democratic republic. But I refuse to give up on dialogue, even when it feels hopeless. If people don’t see what’s happening by now—the censorship, the mandates, the war-mongering, what appears to be intentional schismogenesis (I wrote about this idea here)—will they ever?

The powers that profit from our division; they’ve mastered the art of keeping us fighting each other so we don’t look up to see who’s really pulling the strings. These aren’t just political issues—they’re existential challenges that require reasonable people to discuss complex solutions. Your neighbor who voted differently isn’t your enemy—they likely want many of the same things you do: safety, prosperity, freedom, and a better future for their children. They might just have different ideas about how to get there.

I know this is heavy stuff. You might disagree with everything I’ve said, and that’s okay. What’s not okay is letting these disagreements destroy our relationships and communities. The choice isn’t just about who we vote for—it’s about how we treat each other, how we discuss our differences, and whether we can find common ground in our shared humanity.

The way forward isn’t through hatred or fear. It’s through understanding, open dialogue, and most importantly, love. We might be living through the death throes of the American experiment, or we might be witnessing its rebirth. Either way, we’re in this together, and our strength lies in our ability to work through these challenges as a community, as neighbors, and as friends. Let’s choose wisdom over reaction, understanding over judgment, and love over fear. Our future depends on it.

Republished from the author’s Substack