North Korea to completely block border to South Korea amid escalating tensions

Prior to this announcement, North Korea had already begun laying landmines and erecting barriers along its side of the border.

Prior to this announcement, North Korea had already begun laying landmines and erecting barriers along its side of the border.

When discussing the homeless situation in the US, Star Trek does not usually come to mind. However, one episode from about three decades ago was both insightful and prophetic in presenting what would be homelessness in San Francisco.

In less than three days of its release, while still retaining the #1 spot on iTunes, the video for Jon Kahn’s smash hit “FIGHTER” has garnered over 10 million views across social media.

The post Kahn’s Trump Tribute ‘Fighter’ Surpasses 10 Million Views Across Socials in Less than 3 Days appeared first on Breitbart.

Indian Foreign Minister Subrahmanyam Jaishankar arrived in Pakistan on Tuesday for a Shanghai Cooperation Organisation (SCO) summit, state TV showed, the first top Delhi diplomat to visit in nearly a decade. PTV showed images of Jaishankar being greeted by Pakistani officials on the runway after his plane touched down near the capital Islamabad just before […]

The post Indian FM lands in rare visit to Pakistan for SCO summit: state tv appeared first on Insider Paper.

This week sees the UN forces execute Operation Chromite, the amphibious invasion of the port of Incheon, far behind enemy lines. There are many hurdles to clear before this can happen, including the physical one of one of the world’s largest tidal ranges, which leaves many kilometers of mud flats in the approaches. There is also a UN counterattack at the same time, designed to perhaps break out of the Pusan Perimeter, or at least tie down big chunks of the enemy in the south.

Join us on Patreon: https://www.patreon.com/TimeGhostHistory

Or join the TimeGhost Army directly at: https://timeghost.tv/signup/

Check out our TimeGhost History YouTube channel: https://www.youtube.com/c/timeghost

World War Two: https://www.youtube.com/@WorldWarTwo

Follow WW2 Day by Day on Instagram: @ww2_day_by_day

Follow TimeGhost History on Instagram: @timeghosthistory

Follow TimeGhost on Twitter: @TimeGhostTV

Like us on Facebook: https://www.facebook.com/TimeGhostHistory/

Hosted by: Indy Neidell

Director: Astrid Deinhard

Producers: Astrid Deinhard and Spartacus Olsson

Executive Producers: Astrid Deinhard, Indy Neidell, Spartacus Olsson

Creative Producer: Marek KamiÅski

Community Management: Jake McCluskey

Written by: Indy Neidell

Research by: Indy Neidell

Map animations by: Daniel Weiss

Map research by: Tom Aldis and T.J Hennig

Editing and color grading by: Simon J. James

Artwork by: MikoÅaj Uchman

Sound design by: Simon J. James & Marek KamiÅski

Colorizations by: MikoÅaj Uchman

Archive footage: Screenocean/Reuters – https://www.screenocean.com

Soundtracks from Epidemic Sound.

Additional sound effects provided by Zapsplat.com

A TimeGhost chronological documentary produced by OnLion Entertainment GmbH.

Hedge Fund CIO: Europe’s Collapse Is A Healthy Reminder For Americans To Stay True To Their System

By Eric Peters, CIO of One River Asset Management

“For complex reasoning tasks this is a significant advancement and represents a new level of AI capability,” wrote OpenAI, describing its latest model release. “Given this, we are resetting the counter back to 1 and naming this series OpenAI o1.” Such is the pace of advancement (and hype) in AI that we need to rebase our calibrations. o1 answered 78% of PhD-level science questions accurately, compared to 56.1% for GPT-4o and 69.7% for human experts, which confirms that o1 is way smarter than I am.

But for some reason I feel I’m probably more intelligent, at least for now. Even if I couldn’t tell you without the help of o1 the precise difference between smarts and intelligence.

Overall:

“For the first time since the Cold War we must genuinely fear for our self-preservation,” Draghi told reporters, working himself up into another ‘whatever-it-takes” frenzy.

“And the reason for a unified response has never been so compelling and I am confident that in our unity we will find the strength to reform,” said Mario, far from confident, his long-awaited report on EU competitiveness hot off the press. But of course, the stock market provides objective, real-time analysis on national competitiveness, and the European benchmark equity index is now just slightly above where it was at the 2007 market high.

Equities are priced in nominal terms though, and the EU consumer price index is roughly 52% higher since 2007. Which means that European equities have fallen 30% in real terms from where they were 17yrs ago (excluding dividends). Relative to where they were at the 2000 highs, European stocks are worth about half what they were nearly 25yrs ago in real terms.

By the same measure, Chinese stock prices are -67% in real terms from the 2007 nosebleed highs (+44% in real terms since 2000 – just before its WTO entry). And the S&P 500 is +60% in real terms from the 2007 highs (+107% from the 2000 highs). As a general observation, the US invents, China builds, the EU regulates.

And the stock market does an admirable job at indicating which of those activities you want to prioritize, if the goal is to aggressively increase overall national prosperity. But the EU’s goal was never really that. That union was formed to avoid another disastrous continental war, which has been a recurring theme since well before the first Italian started shaving coins. The European project as it is currently constituted has narrowly achieved this primary objective, but at the cost of more chronic economic stasis. Naturally though, national weakness invites discontent from within and aggression from without. Which is where Europe finds itself today.

It’s a healthy reminder for Americans, as we enter our political season, to stay true to our system and to that which has led to our greatness. Innovation, invention, risk taking, entrepreneurialism.

Anecdote

“We have 4% of the world’s population and the dominant economy – almost twice the size of China and 5x the next largest,” said the Chairman, an American patriot, a public servant, realist, capitalist.

“US stock market cap is over $50trln, dwarfing China at $11trln and Japan at $6trln,” he continued. “For over five decades, the US has produced the next generation of great global companies.”

As Nippon Steel begs our politicians to buy US Steel for $14.9bln, Nvidia’s market cap is nearly $3trln, and OpenAI is raising a fresh venture round at a $150bln valuation. “Meta started in 2004 and employs 70k people, producing $134bln in annual revenue, much of it from abroad.” Apple, Google, Netflix, the list goes on.

“Silicon Valley is the world’s premier innovation hub and attracts the best and brightest from across the globe.” Technology is helping lift the world’s poor out of poverty at an unprecedented rate, and in today’s hyper-connected world, every person who comes online, becomes a customer of a US tech company.

“Genentech and Amgen were once startups and are now industry leaders. Without the hundreds of billions in they’d invested in R&D, we would never been able to develop the COVID vaccines in record time,” said the Chairman.

“The flywheel effects of being the world’s innovation and growth engine are breathtaking. And are strongly supported by the tax code.”

Since the Revenue Act of 1921, capital gains have been taxed at a lower rate than ordinary income, providing a powerful incentive for individuals to invest in new, often risky ideas. Fueling an entrepreneurial culture, that is the source of America’s prosperity, strength, power.

“Energy is vital to our enduring strength too, economic and geopolitical. We lifted US domestic oil production between 2016-2020 from 9mm barrels per day to 12mm, and natural gas production by 25%.”

Biden quietly continued Trump’s energy policies, lifting oil production another 1mm barrels and natural gas 15%. “Had we not, our military and economic adversaries would have more control over the future of America and our allies,” said the Chairman.

“We need a coherence across economic, national security, and energy policy that is centered on and builds upon all these strengths.”

Tyler Durden

Mon, 09/16/2024 – 03:30

The Fed Pivots (Panics)

Via Tuomas Malinen’s Forecasting Newsletter,

During the past week, we at GnS Economics forecasted that the Federal Reserve will cut by 25bps. Our reasoning was this:

However, the ‘super-core’, measuring services inflation, less energy services, rose by 4.9%, and 0.4% in month-over-month basis. This was the largest monthly increase in the index since April. We assume that this killed all hopes for a 50bps cut next week, because Fed Chair Jerome Powell has described super-core as the “the most important category for understanding the future evolution of core inflation”.

I still stand by this forecast, from a purely economic perspective, because the numbers were clear. Inflation pressures are picking up again. Moreover, retail sales and industrial production came in stronger than expected (0.1% and 0.8% M-o-M). The ‘green shoots’ of the U.S. economy, I reported a week ago, also suggested that the private sector recession may be ending, while risks are abound. The Fed must have seen the improving credit data.

The last time the Fed cut by 0.5% was in October 8, 2008, three weeks after the collapse of the venerable investment bank Lehman Brothers. This was the time when panic was gripping the markets with the Great Financial Crisis (GFC) surfacing with the failure of Lehman Brothers (the crisis had been brewing under the surface since September 2007).

Make no mistake. 50bps cut, is a panic cut. So, why did the Fed panic?

Most likely, there were four reasons:

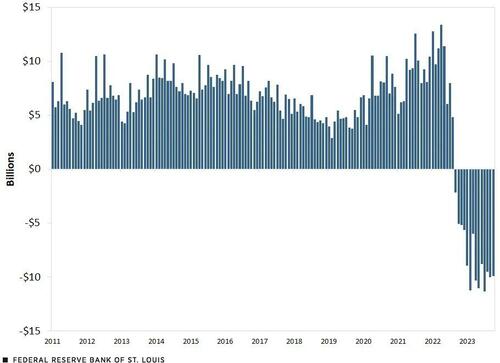

The Fed is racking up massive losses.

Political pressure to not crash the markets before the Presidential elections on November 5 (last FOMC meeting before).

The Federal Reserve is genuinely worried about the economy, but especially about debt levels.

Banking sector fragility.

Like I noted two weeks ago, the Fed is accumulating massive losses from its holdings of Treasuries and corporate bonds. This is because it has bought them when they were much more expensive (rates were lower). When rates rose, the value of Treasuries collapsed, generating heavy losses for the Fed.

Monthly summation of remittances of the Federal Reserve due to the Treasury. Source: Miguel Castro and Samuel Jordan-Wood.

So, the one reason the Fed wants to lower rates (to increase the value of Treasuries) is because it wants to save its own *ss, by increasing the value of the Treasuries it holds. A central bank that holds large quantities of government bonds is never even semi-independent, because their value dictates the credibility of the Bank. The Fed tried to go around this problem by labelling the losses as deferred assets. That is, it marked losses as “assets” in its balance sheet. It is obvious that such blatant accounting fraud can fly only for so long. So, the Fed needed to cut to ease the financial burden, on itself.

Markets were expecting a 50bps cut, and so were some of the politicians. However, in actuality, a 50bps cut may turn up badly for the markets, because it signals that the Fed sees some serious weakness in the economy.

I concluded my last weeks piece by noting:

Banks seem somewhat optimistic and they have eased lending standards. There is not much room for leveraging among corporations and especially among households, though, which shows in the stagnation of borrowing. This indicates that the optimism among banks is likely to be a “false positive”. Their optimism can, for example, be based on the assumption that the Fed easing would create favorable conditions for an economic recovery. Due to the very high level of indebtedness of households and corporations, I consider this to be unlikely. This implies that we could see, possibly a drastic, turn into re-tightening of lending standards and softening of credit demand in the coming quarters.

I think this is the risk the Fed is seeing. There is simply too much private and federal debt and if rates stay high, defaults will start to roll in, with also the likelihood of U.S. sovereign debt rising. This would hurt the economy badly.

U.S. banks continue to struggle under a gargantuan amount of unrealized losses. They arise mostly from the same source as with the Fed, i.e. from Treasuries losing value, en masse. We also noted in the August World Economic Outlook of GnS Economics that the outflow of core deposits seem to have re-started. Deposit outflow is a major risk for the banking sector, because it implies waning trust and, as banking is a business of trust, waning trust implies growing fragility in the banking sector. The Fed cannot stop the outflow of deposits, but it can try to diminish the unrealized losses by cutting interest rates, and hoping that Treasury yields follow. At the time of writing, this was not going well with, e.g. the yield of U.S. 10-year Treasury note shooting up. This is an (early) indication that the bond market now expects inflation to pick up.

Core deposits in the U.S. banking system. Source: GnS Economics, FDIC

Alas, the Fed eased heavily, because of the losses it and U.S. banks are accumulating and because it sees the risk of the economy breaking. These are not encouraging signs.

* * *

P.S. There’s always the possibility that Fed Chair Jerome Powell is a pitiful small man. I don’t believe so, but I of course do not know him personally.

Tyler Durden

Fri, 09/20/2024 – 07:20

Republican vice-presidential nominee Sen. JD Vance (R-OH) said former President Donald Trump is in “good spirits” after what the FBI reports to be a second assassination attempt on the former president in just two months.

The post Vance: Trump Is ‘In Good Spirits’ After Second Assassination Attempt in 2 Months appeared first on Breitbart.

Pierre-Alain Cottineau has since been indicted for rape, torture, and barbarism.