Virginia Mandates Paper Ballots, Tracking, And Proof Of Residency For 2024 Election

Virginia Governor Glenn Youngkin (R) on Wednesday signed an executive order to implement various security measures ahead of the November election – including the use of paper ballots, tracking possession of ballots during early voting, matching the number of ballots casts with then number of voters who have checked in, and the number of ballots sent to voters.

The order also requires absentee ballots to be requested before being mailed to voters, in addition to rejecting ballots mailed back unless the voter provides the last four digits of their Social Security number and birth year.

The state notably uses paper ballot counting machines that aren’t connected to the internet and are tested before elections.

Meanwhile, Youngkin also ordered the state to update its voter rolls – including adding or removing people based on whether they are allowed to vote in the state, removing those unable to prove residency, removing the names of dead voters, and ensuring illegals cannot cast a ballot.

According to Virginia AG Jason Miyares, 6,303 illegals have been removed from the state’s voter rolls during Youngkin’s tenure, and almost 80,000 deceased voters have been removed.

As the Epoch Times notes further, Youngkin instructed the Department of Motor Vehicles to “expedite the interagency data sharing with the Department of Elections of noncitizens by generating a daily file of all noncitizens transactions, including addresses and document numbers.”

The Department of Elections compares a list of noncitizens with a list of those registered to vote. Those who are on both lists get removed from voter rolls. If someone is erroneously removed, he or she has 14 days to prove eligibility to cast a ballot.

Additionally, Virginia has cameras monitoring drop box locations 24/7.

Moreover, according to the executive order, the Department of Elections is to inform voters about prohibited activities including, but not limited to, electoral intimidation, illegally disclosing or using Social Security numbers, unlawful registrations and votes, and tampering with or stealing voting items.

There have been almost two dozen cases of election fraud cases in Virginia since 2007, according to the Heritage Foundation, a conservative think tank in Washington.

Election Integrity

In a statement, Youngkin said that the issue of election integrity isn’t partisan and that elections should be held fairly.

“This isn’t a Democrat or Republican issue, it’s an American and Virginian issue,” he said. “Every legal vote deserves to be counted without being watered down by illegal votes or inaccurate machines. In Virginia, we don’t play games and our model for election security is working.”

While Youngkin and the GOP flipped the gubernatorial mansion and the House of Delegates in November 2021, Democrats have controlled both houses of the state Legislature since earlier this year.

Polling has showed that former President Donald Trump is competitive in the Old Dominion State. More recent polls, after President Joe Biden dropped out and Vice President Kamala Harris received the nomination, have shown a tighter race.

The last time a GOP presidential candidate won Virginia was in 2004, when President George W. Bush won reelection.

In addition to the presidential race, other major races in Virginia in November include the Senate race between incumbent Sen. Tim Kaine (D-Va.) and Republican Hung Cao and key House races in the state’s Second, Seventh, and 10th congressional districts.

The next Virginia gubernatorial election will be held in November 2025. Youngkin is ineligible to run for a second consecutive term in accordance with the state’s constitution. Rep. Abigail Spanberger (D-Va.), who isn’t running for reelection, is seen as the early front-runner for the governor’s mansion.

Loading…

Originally Posted at; https://www.zerohedge.com//

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

California Power Bills Are Soaring

Authored by Tsvetana Paraskova via OilPrice.com,

-

California residents face the second-highest average electricity bills in the U.S., driven by investments in wildfire mitigation, grid upgrades, and renewable energy integration.

-

The surge in electricity costs has left nearly 1 in 5 California households behind on their energy bills.

-

California is transitioning to a new net billing tariff for residential solar and a flat monthly fee structure for electricity in an effort to make electrification more affordable.

Consumers in California have seen their electricity bills surge in recent years and double over the past decade as utilities are investing more in wildfire prevention and transmission lines to accommodate growing renewable energy output.

As these utilities invest billions of U.S. dollars to make the grid more resilient, they pass the higher spending on to consumers.

So California now has the second-highest average electricity bill in the United States, second only to Hawaii.

“Untenable” Surge

California is looking to rapidly shift away from fossil fuels and make its grid more resilient, but these efforts show the other side of the greening of the grid – power generation costs may be plunging, but transmission and distribution costs are rising, leading to higher spending from utilities.

These increased expenditures are passed on to consumers by the investor-owned utilities Pacific Gas & Electric, Southern California Edison, and San Diego Gas & Electric. As a result, electricity bills in California have risen so much in recent years that in some places, the power bill exceeds the cost of rent, The Wall Street Journal reports in a featured article.

The surge in bills has been “untenable,” according to the consumer advocate’s office at California’s utilities regulator.

In its latest 2024 Q2 Electric Rates Report last month, the Public Advocates Office tracked residential electric rate changes across Pacific Gas and Electric (PG&E), San Diego Gas & Electric (SDG&E), and Southern California Edison (SCE) service territories through July 1, 2024.

The report found that over the last few years, California’s electric bills are generally rising due to higher electricity use from things such as air conditioning, and higher overall electricity prices.

Since January 2014, residential average rates for the PG&E service area have jumped by 110%, those of SCE have surged by 90%, and SDG&E rates have soared by 82%.

The primary statewide drivers of soaring rates have been investments in wildfire mitigation, transmission and distribution investments, and rooftop solar incentives or the so-called net energy metering, the Public Advocates Office said.

Overall, residential electricity rates have increased substantially since 2014, surpassing inflation, it noted.

It couldn’t be surprising then that nearly 1 in 5 households are behind on their energy bills, according to the office. A total of 18.4% of the customers of the three investor-owned utilities are in arrears in their energy bills.

Changes in Charging for Electricity

This year, California has changed the way utilities charge for electricity and is transitioning from net energy metering to net billing tariff for residential solar projects. These regulatory changes have hit residential solar installations and are set to change the way power bills are formed starting next year.

The move to the net billing tariff in California dragged down the total U.S. residential solar market, which saw in the second quarter of 2024 its lowest quarter since Q1 2022 at 1.3 GWdc, reflecting a 25% decline year-over-year and 18% quarter-over-quarter.

“While slowdowns are occurring nationwide, these declines were heavily influenced by California, where quarterly installations have shrunk for the last two quarters as NEM 2.0 projects are built out and the state transitions to the net billing tariff,” the Solar Energy Industries Association (SEIA) said in its latest quarterly report.

In another significant change, California’s utilities will charge from next year or 2026 a flat monthly fee of up to $24.15 on all customers while reducing the charges imposed per kilowatt of electricity used.

The California Public Utilities Commission (CPUC) says that the new billing structure “lowers overall electricity bills on average for lower-income households and those living in regions most impacted by extreme weather events, while accelerating California’s clean energy transition by making electrification more affordable for all.”

The usage rate for electricity will be reduced by 5 to 7 cents per kilowatt-hour for all residential customers, which makes it more affordable for everyone to electrify homes and vehicles, regardless of income or location, because the price of charging an electric vehicle or running a heat pump is lower.

However, critics of the new billing structure have said it will hurt customers who live in small homes and have relatively small electricity use as the lower per-kWh rate would not offset the new flat fee.

It remains to be seen how the new billing structure will affect California customers and whether it will lead to the expected mass electrification of homes.

A total of 78% of Americans are concerned about their rising energy bills, an exclusive CNET Money survey has shown. Around 80% of U.S. adults in all regions, including the Northwest, Midwest, South, and West, said that their finances have been impacted by growing home energy costs, according to the survey.

California leads in U.S. solar and battery installations, but the cost of bringing that power generation to consumers has soared with the need to expand, upgrade, and protect the power grid.

Loading…

Originally Posted at; https://www.zerohedge.com//

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

2024 Echoes ‘1984’ | ZeroHedge

Authored by Victor Joecks via American Greatness,

The book “1984” is supposed to be a warning. Today’s leftists are using it as an instruction manual…

George Orwell’s classic novel is set in a dystopian world where Big Brother controls the population through information control and surveillance. See if any of this sounds familiar.

“Doublethink means the power of holding two contradictory beliefs in one’s mind simultaneously, and accepting both of them.”

During her career, especially when running for president in 2020, Kamala Harris took a number of radical positions. She praised efforts to defund the police. She once insinuated that Immigration and Customs Enforcement was comparable to the KKK and suggested the agency should be rebuilt “from scratch.” She wanted to decriminalize border crossings. She co-sponsored the Green New Deal. She supported a mandatory gun buyback program, eliminating private insurance and reparations. She was in favor of banning fracking and plastic straws.

Those policies play great in San Francisco, but not in battleground states. Not to worry. She’s flip-flopped on at least five major policy positions since becoming the presumptive nominee.

Instead of exposing this duplicity, the national mainstream media is participating in it.

“Harris is calibrating her policy pitch for going to battle with Trump,” the Associated Press wrote about her reversals.

“If the Party could thrust its hand into the past and say of this or that event, it never happened — that, surely, was more terrifying than mere torture and death.”

The attempted assassination of Donald Trump happened just over three weeks ago. The iconic photo of a bloodied Trump defiantly standing and pumping his fist went viral. Outside of conservative sites and social media accounts, it’s barely been seen since. The national media has largely moved on, eager to fluff up Harris.

Less than two weeks ago, pro-Hamas rioters stormed Washington, D.C., to protest Israeli Prime Minister Benjamin Netanyahu speaking to Congress. They tore down U.S. flags outside of Union Station and raised Palestinian flags. They burned an American flag, vandalized monuments and assaulted park police. Charges against some of the few people arrested have already been dropped.

An easy prediction: You’ll hear less about these two stories than Trump’s out-of-context “bloodbath” remark and Jan. 6. It’s like events that would make Trump look heroic and hurt the left never happened.

“Every record has been destroyed or falsified, every book rewritten …”

You can see this happening in real time. Last week, I googled “Trump rally.” The top result was “Kamala Harris rally in Atlanta.” The same thing happened to Elon Musk and many others.

Recently, Meta AI refused to acknowledge that Trump was almost assassinated. Meta is the parent company of Facebook. It inaccurately labeled a fist-pumping photo of a bloodied Trump as “altered.” When people used Google to search for information on Trump’s attempted assassination, its auto-fill wouldn’t even suggest his name.

Both companies claim they weren’t trying to rig search results. Those excuses would be more believable if almost all mistakes like these didn’t go in the same direction.

“Don’t you see that the whole aim of Newspeak is to narrow the range of thought? In the end, we shall make thoughtcrime literally impossible, because there will be no words in which to express it.”

Illegal aliens are merely undocumented migrants. Men who claim to be women are women. People voting for Donald Trump are a threat to democracy. Ramming scissors into the skull of an 8-month-old preborn baby and sucking her brains out is health care. Israel is the oppressor for defending itself against genocidal terrorists. Diversity requires ideological conformity.

2024 looks a lot like “1984,” but you get to help write the ending. Choose wisely.

Loading…

Originally Posted at; https://www.zerohedge.com//

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

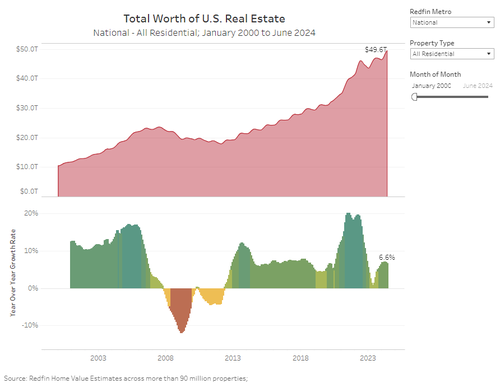

Value Of US Housing Hits Record $50 Trillion, Up 7% In Past Year, Just In Time For Fed Rate Cuts

The Fed’s rate hikes were supposed to slow down the economy and, thanks to soaring interest rates, lower prices and make housing more affordable. That did not happen, and instead housing is now the least affordable it has been in US history.

And while an entire generation of potential buyers will be forced to rent indefinitely, the flip side is that anyone who has been lucky enough to buy a house, is celebrating on a day real-estate brokerage Redfin reports that the total value of U.S homes gained $3.1 trillion over the past 12 months to reach a record $49.6 trillion.

In percentage terms, the total value of the US housing market grew 6.6% year over year, laughing in the face of a Fed chair who kept on hiking rates in hopes of lowering prices. Zooming out further, the total value of U.S. homes has more than doubled in the past decade, climbing nearly 120% from $22.7 trillion in June 2014.

“The value of America’s housing market will likely cross the $50 trillion threshold in the next 12 months as there are not enough homes being listed to push prices down,” said Redfin Economics Research Lead Chen Zhao. “Mortgage rates have started falling, but many potential sellers and buyers are waiting to make a move, meaning we are likely to continue seeing a pattern where prices slowly tick up. That’s great news for the millions of American homeowners who see their equity rising, but first-time buyers are going to keep finding it tough to find an affordable home.”

That, of course, is an understatement: what Zhao meant is that for millions of Americans, the dream of owning a home is now gone for ever, because if they couldn’t afford to buy a house during the most aggressive rate hike cycle since Volcker, the coming rate cuts will certainly not make it easier.

The number of metros where the total value of homes topped $1 trillion grew to eight—doubling from four a year ago—with Anaheim, CA, Chicago, Phoenix and Washington, DC, joining New York, Los Angeles, Atlanta and Boston in the trillion-dollar club. San Diego and Seattle look like they will join them in the next 12 months if home values keep increasing at a similar pace.

It’s worth noting that while San Francisco’s aggregate home value is roughly $700 billion, when combined with neighbors Oakland, CA, and San Jose, CA, the combined Bay Area housing market is worth nearly $2.5 trillion. Likewise, the combined Dallas ($734 million) and Fort Worth, TX ($294 million) metro area also surpasses the $1 trillion mark.

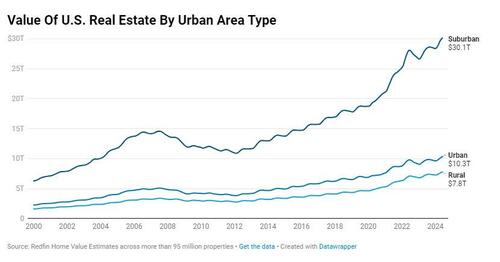

Rural home values outpaced those in urban areas and the suburbs, jumping 7% year over year to $7.8 trillion. The total value of homes in urban areas rose 6% to $10.3 trillion, while the value of homes in the suburbs cracked the $30 trillion mark for the first time, increasing 6.8% to $30.1 trillion.

There are around 57 million homes in the suburbs, compared to 22 million in urban areas and 21 million in rural areas.

Thirteen major metros posted double-digit percentage gains in total property value over the last year, led by relatively-affordable New Jersey metros within commuting distance of New York, where property is more expensive. The value of properties in New Brunswick, NJ rose 13.3% to $582.6 billion, while Newark, NJ climbed 13.2% to $406.2 billion. Anaheim, CA (up 12.1% to $1.1 trillion), Charleston, SC (up 11.8% to $188.9 billion) and New Haven, CT (up 11.8% to $91 billion) rounded out the five metros with the highest gains.

Cape Coral, FL was the only metro to record a fall in total home value, dropping 1.6% to $204.2 billion. Sun Belt metros—especially those in Texas—grew slower than those in other regions, with New Orleans (up 0.8% to $128.2 billion), Austin, TX (up 1.9% to $392.8 billion), North Port, FL (up 2.1% to $251.8 billion) and Fort Worth, TX (up 2.3% to $293.7 billion) rounding out the bottom five metros.

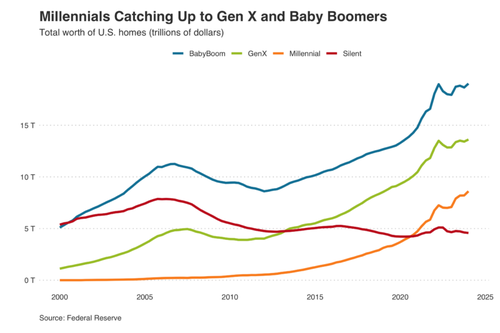

Broken down by age group, the total value of homes owned by millennials rose 21.5% year over year to $8.6 trillion in the first quarter of 2024—the most recent period for which generational data is available—nearly four times as fast as any other generation.

The increase is partly due to the overall growth in home prices, but also because millennials are now the largest generation by population and have reached an age and financial position where they make up a larger share of the homebuying market. Around two-thirds of the mortgages taken out in 2023 were issued to homebuyers under the age of 45.

Meanwhile, the total value of homes owned by the Silent Generation fell for the fifth straight quarter, dropping 1.6% to $4.6 trillion. The value of homes owned by baby boomers increased 6.1% to $19 trillion, while Gen X home values rose 5.9% to $13.6 trillion.

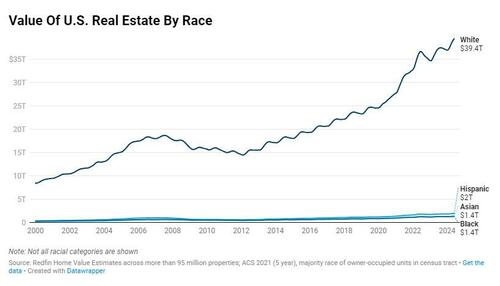

Finally, Asians once again made the best decisions, and after falling in 2022-2023, the total value of homes in neighborhoods that are majority Asian bounced back over the past 12 months, rising 9% to $1.4 trillion. The increased value is being caused by price growth in West Coast cities—where many Asian neighborhoods are located. In comparison, majority white neighborhoods experienced a 6.6% increase in value to $39.4 trillion, while majority Black neighborhoods saw a 5.4% increase in value to $1.4 trillion. The value of homes in majority Hispanic neighborhoods increased 6.4% to $2 trillion.

More in the full report available here.

Loading…

Originally Posted at; https://www.zerohedge.com//

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

Don’t Throw Away A Nest Egg

By Teeuwe Mevissen, senior macro strategist at Rabobank

Don’t throw away a nest egg!

As this week made clear once more, it is always important to keep a nest egg for a rainy day. Being able to whether storms is crucial when one is invested in risky assets so one is not forced to sell risky positions when it hurts most i.e. during sharp corrections as we saw very recently. This is all the more true when people with modest means who try to make some money on the stock market start losing their jobs due to a cooling labour market. Moreover it also teaches us to not put all your eggs in one basket. People who had a concentrated stock portfolio in tech surely must have panicked briefly seeing their stocks tank with double digit percentages.

The same goes for playing a hand in a game like poker. A Chinese variant of poker called throwing eggs has become so popular that China called on officials to stop playing the widely popular poker game because it’s hurting their work. The game has gone viral in the past two years and China now fears that the addictive game is “corrupting the work style of cadres” according to the Beijing Youth Daily earlier this week. Since Xi already urged officials to not misinterpret or procrastinate the party’s orders, it is questionable if party cadres playing guandan are playing the right cards. Indeed, participating in throwing eggs, one would expect to end up egg faced sooner rather than later!

Yesterday, the Bank of Japan (BOJ) showed that it might have scared itself with its previous hawkish tone of less than a week ago. The BoJ raised its interest rate from 0.10% to 0.25% in a surprise hike and initially did not exclude further hikes. Furthermore the BoJ also unveiled plans to halve the pace of its monthly bond buying by the first quarter of 2026.

In an attempt to calm nervous market participants, BoJ Deputy Governor Shinichi Uchida pledged yesterday to refrain from hiking interest rates as long as markets are unstable. Still, these signals from central banks make one question again if central banks are there to protect market participants and to what extent this goes hand in hand with true capitalism. Regardless, markets received the news with enthusiasm and continued recovering from the sharp correction earlier this week.

At the same time US yields have been climbing a bit, which resulted in some support for USD/JPY towards a level of slightly higher than 147. However, markets have still significantly reassessed the Fed’s policy stance and are still expecting more rate cuts than at the start of last month. But as our head of G-10 currency forecasting rightfully mentioned last Tuesday, much remains unclear and next week’s US PPI and CPI data and Jackson hole will likely provide more clarity regarding the Fed’s future path. That has not prohibited her from reviewing our USD/JPY forecast which she now believes will reach a level of about 145 in about three months from now.

This morning important data came in from Japan. As the unwinding of yen carry trades have rattled markets, August saw foreign selling of Japanese bonds and Japan buying foreign bonds. However, there was no noticeable change regarding the volumes traded. In contrast, Japan’s buying of foreign stocks did show a sharp spike and came in at the highest figure since the data is being published.

We also received leading indicators via Japan’s economic watchers surveys that showed that the surveyed managers asses the current situation with a value of 47.5 (as expected) while the outlook came in at 48.3 (slightly lower than expected.) Both still indicate slowing activity but the values were better than the previous month of June

Loading…

Originally Posted at; https://www.zerohedge.com//

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

Israeli Group Practices Red Heifer Ritual In Front Of Al-Aqsa Mosque

A group of religious Israelis have been pictured practicing the ritual of the red heifer, which is meant to herald the building of a new Jewish temple on the site of Al-Aqsa Mosque.

According to Jewish tradition, the ashes of a perfectly red heifer cow are needed for the ritual purification that would allow a third temple to be built in Jerusalem. That temple, say radical Jewish groups, must be constructed on the raised plateau in Jerusalem’s Old City known as the Temple Mount, where Al-Aqsa Mosque and the Dome of the Rock shrine stand today.

Some believe this will herald the arrival of the messiah and possibly even the end of the world.

“Temple worshipers are now practicing the mitzvah [religious duty] of a red cow in front of the Temple Mount, which will enable the return of purity and the observance of all the temple mitzvahs,” posted journalist Yinon Magal on Tuesday, along with a picture of activists from the Temple Institute.

In 2022, five red heifers arrived in Israel from a Texas ranch and are now kept in an archaeological park next to Shilo, an illegal Israeli settlement near the Palestinian city of Nablus.

The Temple Institute imported the heifers for the eventual purpose of using them in a ritual after years of searching for blemish-free cows, without a stray white or black hair.

Their eventual slaughter on the Mount of Olives will – according to advocates – allow Jewish people to be purified so they can perform rites and worship on the site of Al-Aqsa Mosque.

Research by a professor at Bar Ilan University estimated that the ashes of one cow could be made into enough cleansing water for 660 billion purifications. The cow being practiced upon in Magal’s image (below) does not appear to be one of the five red heifers from Shilo.

The traditional site of the ritual, the Mount of Olives, is seen in the background on the other side of Al-Aqsa Mosque, suggesting the practice run was performed within the Old City.

The status quo in Jerusalem has long maintained that Jewish prayer is forbidden on the raised plateau in occupied East Jerusalem.

The site is believed to be the location of two ancient Jewish temples. Jews are permitted to pray at the Western Wall, which runs along one side of the hill and is regarded as the last remaining part of the Second Jewish Temple that the Romans destroyed in 70 CE.

Restrictions on non-Muslims entering the mosque have been in place since the Ottoman status quo designating Jerusalem’s holy sites to its sects was established in 1757.

לקראת תשעה באב: דורשי המקדש מתרגלים כעת מול הר הבית את מצוות פרה אדומה, שתאפשר את חזרת הטהרה וקיום כל מצוות המקדש pic.twitter.com/hgwgKlongz

— ינון מגל (@YinonMagal) August 6, 2024

The Chief Rabbinate of Jerusalem has also, since 1921, officially banned Jews from entering the Temple Mount. It ruled that Jews are forbidden to enter the site unless “ritually clean”, which is impossible without the ashes of a red heifer.

Over the past century, religious Zionist groups – including the Temple Institute – have advocated for the return of Jewish prayer at Al-Aqsa, with some even advocating the demolition of the mosque and reconstruction of the temple.

Loading…

Originally Posted at; https://www.zerohedge.com//

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

The Trigger For WWIII Just Arrived – What Are The Implications For Americans? – Alt-Market.us

Originally Posted at https://alt-market.us/

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers: