Assad’s Fall Is A Major Blow To Russia

Assad’s Fall Is A Major Blow To Russia

Authored by Andrew Latham via RealClearWorld,

Russia’s 2015 military intervention in Syria was a bold assertion of its great power ambitions, rescuing Bashar al-Assad’s regime and projecting influence in the Middle East. However, recent rebel advances and Assad’s sudden deposal threaten to isolate Russia’s Khmeimim airbase and Tartus naval facility, undermining both the practical and symbolic foundations of Moscow’s global power status.

The fall of Assad promises to be a major blow to Russia, which is already bogged down in Ukraine. Its ramifications are likely to be felt across Moscow’s foreign policy, which could soon face some stark and unenviable choices.

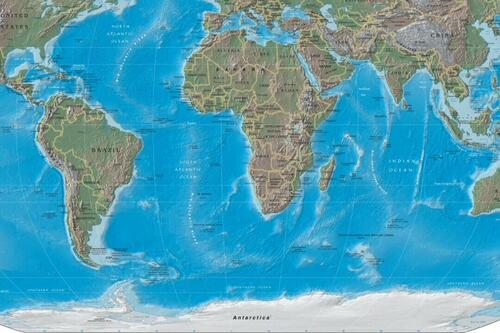

The Russian presence in Syria is central to the Kremlin’s broader strategy of force projection. Its Mediterranean bases allow Moscow to sustain military operations in the Levant, North Africa, and beyond, countering U.S. influence. With the key city of Homs having fallen to the rebels, supply routes to Khmeimim and Tartus have been severed, forcing reliance on vulnerable air and sea routes. This will weaken Russia’s operational readiness and its ability to influence events in neighboring theaters, including Africa.

Khmeimim also serves as a logistical hub for Russian private military contractors (PMCs) like the Wagner Group, active in Libya, Mali, and the Central African Republic. These contractors are central to Moscow’s efforts to expand its influence in Africa, providing security and securing lucrative economic deals. With Khmeimim isolated, sustaining these operations would become costly and inefficient, reducing Moscow’s ability to achieve its geopolitical objectives on the continent.

The isolation of Khmeimim and Tartus will severely constrain Russia’s ability to sustain military operations in Syria and beyond, undermining its ability to conduct airstrikes, reconnaissance, and rapid-response missions. PMCs, reliant on robust logistics, will face disruptions, emboldening opposition forces and exposing the fragility of Russia’s African partnerships. These setbacks will ripple through Moscow’s strategic calculations, undercutting its influence and economic goals.

The symbolic consequences of a rebel victory will be even more damaging. Moscow has portrayed its intervention in Syria as a demonstration of its reliability as an ally and its ability to uphold the sovereignty of client states. The loss in Syria will puncture this narrative, exposing the limits of Russian power and credibility. Regional actors, including Iran, Turkey, and the Gulf states, will recalibrate their perceptions of Moscow’s influence, while African partners might pivot toward more reliable alternatives such as China or the West.

Domestically, the repercussions of a diminished role in Syria will be significant. President Vladimir Putin has marketed the Syrian intervention as a triumph of Russian statecraft, portraying it as a cornerstone of Russia’s resurgence on the global stage. While critics of Russia’s foreign interventions have questioned their costs for years, the fall of Assad could amplify these doubts in ways the prolonged conflict in Ukraine has not. Syria’s collapse would symbolize a failure of Russia’s ability to safeguard allied regimes, striking at the narrative of strategic competence that Putin has worked to project. Public perceptions of Russian strength, carefully curated through state-controlled media, could falter, creating broader political vulnerabilities. Moreover, Syria has served as a testing ground for Russian weapons systems, and reduced visibility in the region would weaken their appeal to buyers, further diminishing Russia’s geopolitical leverage and economic gains from arms exports. The rebel victory in Syria will resonate globally. For the United States and its allies, it will validate strategies to contain Russian influence and embolden further countermeasures. NATO could leverage Russia’s difficulties to underscore the limitations of its global reach, while China might accelerate efforts to dominate regions like Central Asia and Africa, further sidelining Moscow in regions where it traditionally competes.

Russia now faces a stark choice: escalate its military commitment to protect its strategic interests, such as its naval facility in Tartus and airbase in Khmeimim, or accept a diminished role in the region. Escalation would aim to preserve these assets and reassert influence but risks clashes with other regional powers and would strain resources already stretched by commitments in Ukraine and Africa. Retrenchment, however, would signal a devastating blow to Russia’s credibility as a reliable guarantor of allied regimes worldwide, sending a clear message to its partners in Africa, the Middle East, and beyond that Moscow cannot be counted on to defend its allies in times of crisis. This erosion of trust would undermine Russia’s broader global strategy and invite further challenges to its influence elsewhere.

Already there is evidence Russian warships have left Tartus, raising questions about Russia’s commitment to its Syrian bases. As Russia navigates this crisis, it must confront the limits of its resources and the fragility of its aspirations. Great power status requires not just military might but strategic resilience. The outcome of the Syrian conflict will shape the future of Russia’s role in the evolving international order. For Moscow, the stakes could not be higher.

Andrew Latham is Professor of Political Science at Macalester College and a Non-Resident Fellow at Defense Priorities.

Tyler Durden

Sat, 12/14/2024 – 23:20