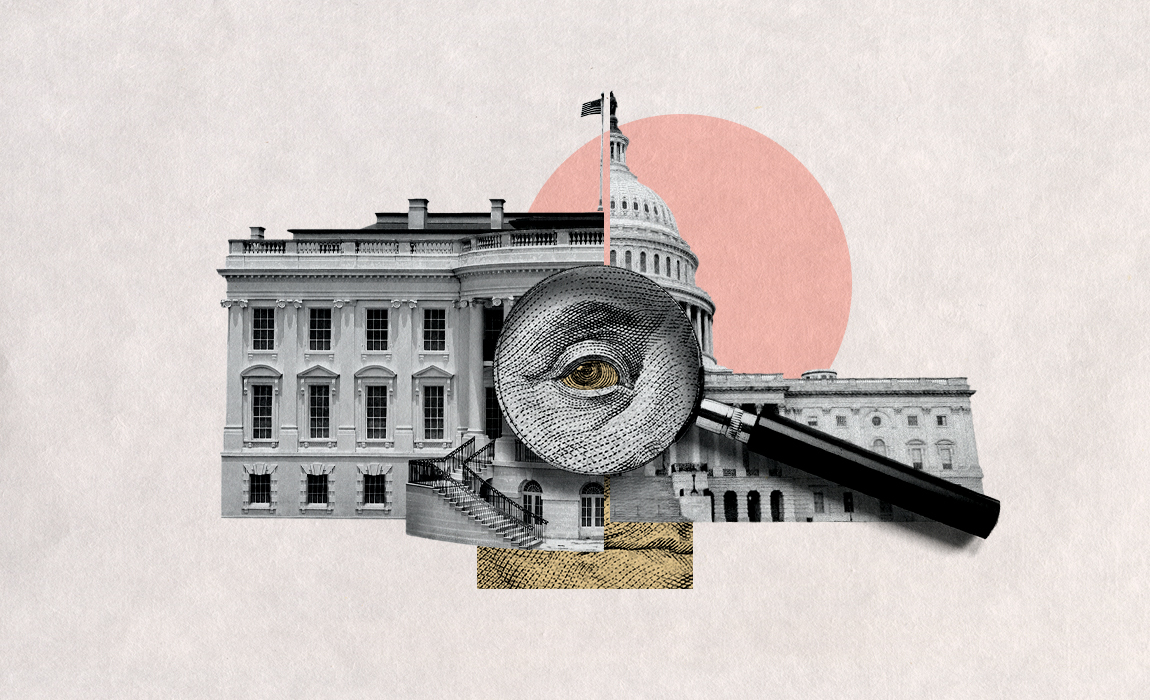

Age Of Transparency: We Need Mass Surveillance Of Governments Instead Of Citizens

By Brandon Smith In the wake of Donald Trump’s return to the White House there has been an atmosphere of…

The post Age Of Transparency: We Need Mass Surveillance Of Governments Instead Of Citizens appeared first on Alt-Market.us.