Potential Tropical Cyclone Fifteen Public Advisory

…DISTURBANCE FORECAST TO BECOME A TROPICAL STORM BEFORE REACHING THE COAST OF BELIZE ON SATURDAY… …HEAVY RAINFALL EXPECTED WITH FLASH FLOODING POSSIBLE IN PORTIONS OF BELIZE AND SOUTHERN MEXICO THIS WEEKEND…

As of 10:00 PM CDT Fri Oct 18

the center of Fifteen was located near 17.6, -86.1

with movement W at 8 mph.

The minimum central pressure was 1005 mb

with maximum sustained winds of about 35 mph.

Trump Campaigns in MI with Arab American Mayor Who Endorsed Him

Former President Donald Trump campaigned in Michigan on Friday with the Arab American mayor who previously endorsed him.

The post Trump Campaigns in Michigan with Arab American Mayor Who Endorsed Him appeared first on Breitbart.

Trump on Claims He’s ‘Exhausted’: Harris ‘Didn’t’ Go to Al Smith Dinner

Former President Donald Trump responded to claims that he was “exhausted” and canceling events, pointing out that Vice President Kamala Harris “didn’t” attend the Al Smith dinner on Thursday night.

The post Trump Slams Kamala Harris Over Claims He’s ‘Exhausted’: ‘She Didn’t’ Come to Al Smith Dinner appeared first on Breitbart.

Potential Tropical Cyclone Fifteen Public Advisory

…HEAVY RAINFALL EXPECTED WITH FLASH FLOODING POSSIBLE IN PORTIONS OF BELIZE AND SOUTHERN MEXICO THIS WEEKEND… …TROPICAL STORM WATCHES ARE ALSO IN EFFECT…

As of 7:00 PM CDT Fri Oct 18

the center of Fifteen was located near 17.5, -85.7

with movement WNW at 7 mph.

The minimum central pressure was 1005 mb

with maximum sustained winds of about 35 mph.

US budget deficit widens to $1.8 tn, third highest on record

The United States on Friday reported a budget deficit of $1.8 trillion for the past year, widening from 2023’s level on greater spending, including for interest on the public debt. The overall deficit expanded by $138 billion for the year ending September 30, said the Treasury Department. The nation’s debt remains a key concern for […]

The post US budget deficit widens to $1.8 tn, third highest on record appeared first on Insider Paper.

Philippine police on manhunt for gang of armed men who allegedly kidnapped an American YouTuber from a remote village

Police identified the victim, who was shot in the leg by the armed gang dressed in all black and whisked away in a speedboat, as 26-year-old Elliot Onil Eastman from Vermont.

JACK POSOBIEC: ‘Bully the vote’

“President Trump isn’t running against Kamala Harris. He’s running against a regime. He’s running against the elites, and that’s why all of us need to be hard-nosed and steely-eyed.”

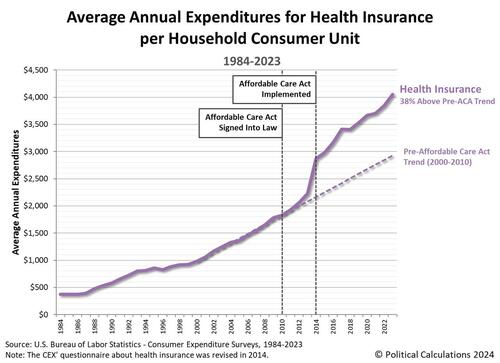

Oh, ‘Bamacare! Visualizing Forty Years Of Health Insurance Cost Inflation

Oh, ‘Bamacare! Visualizing Forty Years Of Health Insurance Cost Inflation

The Consumer Expenditure Survey (CEX) now covers forty years worth of data for how Americans households spend money.

That data includes how much the average “consumer unit” surveyed by the U.S. Census Bureau spends on health insurance, which like many other things in the economy, has seen significant cost inflation over the past four decades.

The following chart, via Political Calculations blog, shows how that cost has changed from 1984, the first year for the CEX, through 2023, the latest, whose data was just released last month.

As you’ll see, over the past 40 years, there has been one major factor that has altered the trajectory for how much American households/consumer units pay on average for health insurance coverage.

Back in 1984, the first year for the CEX, American household consumer units paid an average of $370 for health insurance.

That figure grew steadily over the following years and by 2000, the average cost of health insurance for a U.S. household has risen to $980.

From 2000 through 2010, the average cost of health insurance grew faster, reaching $1,826 by 2010.

Had the 2000 through 2010 growth trend continued, we estimate the average amount American households would pay for health insurance in 2023 would be $2,927.

But it didn’t, thanks to the passage of the Affordable Care Act, which was signed into law in 2010.

It was implemented over several years, going into full effect in 2014.

The claimed goal of the law, as suggested by its name, was to make health insurance more affordable for Americans.

In 2023, the average cost of health insurance paid by American households has more than doubled what it was in 2010.

At an average $4,049 per household, this expense is more than 38% higher than the trend that existed in the decade before the Affordable Care Act became law.

The chart also indicates the cost “curve” for health insurance has bent upward since 2021, which has inflated more quickly over the last few years following 2020’s coronavirus pandemic.

Tyler Durden

Fri, 10/18/2024 – 18:00

Potential Tropical Cyclone Fifteen Public Advisory

…POTENTIAL TROPICAL CYCLONE FIFTEEN EXPECTED TO BRING HEAVY RAINFALL TO PORTIONS OF BELIZE AND MEXICO…

As of 4:00 PM CDT Fri Oct 18

the center of Fifteen was located near 17.5, -85.0

with movement WNW at 7 mph.

The minimum central pressure was 1005 mb

with maximum sustained winds of about 35 mph.

UK man, Mohamed Noor Iidow, convicted of manslaughter after orally raping mother of 3 to death

37-year-old Natalie Shotter was also an NHS worker.