Normal folks rejoiced when the Federal Reserve lowered the only interest rate it controls, Fed Funds, by a surprise 50 basis points. However, since then, the rate on 10-year bonds has increased 70 basis points. Focusing on the positive, Almost Daily Grant’s (ADG) reports “An outbreak of optimism has taken hold across the land, as the Conference Board’s monthly gauge of consumer sentiment painted a pretty picture for the economy and asset prices alike.”

The proportion of consumers anticipating a recession over the next 12 months dropped to its lowest level since the question was first asked in July 2022, as did the percentage of consumers believing the economy was already in recession. Consumers’ assessments of their Family’s Current Financial Situation were unchanged, but optimism for the next six months reached a series high.

Consumers became more upbeat about the stock market: 51.4% of consumers expected stock prices to increase over the year ahead, the highest reading since the question was first asked in 1987. Only 23.6% expected stock prices to decline.

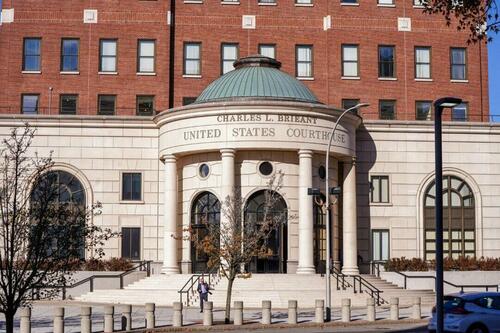

Despite Joe and Jane Doe’s cheery attitude, ATTOM has issued a report indicating that lenders on commercial properties are beating a path to the courthouse steps. Commercial foreclosures totaled 752 in May of this year and remained elevated in September at 695. During COVID, Uncle Sam and Jerome Powell kept zombie properties afloat. “By April 2020, commercial foreclosure activity plummeted to just 144 as government interventions, moratoriums, and economic relief efforts took hold. Throughout 2020 and into early 2021, commercial foreclosure numbers remained at historically low levels. However, as pandemic-related measures were lifted and economic pressures resurfaced, commercial foreclosures began to rise again by mid-2021,” ATTOM staff reports.

Problems are not confined to brick and mortar, ADG reported, “August commercial Chapter 11 filings registered at 634 according to data provider Epiq Bankruptcy, up 17% from July and underpinning the 13th straight month featuring some year-over-year increase in total bankruptcy petitions. Meanwhile, six firms with assets of at least $50 million filed for Chapter 11 last week alone per data from Bloomberg, bringing the August tally to 23.” “I think a lot of it is interest rates,” relays Ed Flynn, consultant at the American Bankruptcy Institute. “There have been an unusually large number of large [restructuring] cases.”

New York Community Bank owned up to having $2.5B worth of nonaccrual loans at the end of the third quarter, $1.5B of which were tied to multifamily properties. That figure is up by nearly $600M from the second quarter and up 487% from December 2023, reports Bisnow.com. Readers may remember that a large loss in the fourth quarter last year forced a billion-dollar injection of rescue capital provided by a group of investors led by former Treasury Secretary Steven Mnuchin.

The New York Fed is on to the banks, issuing a statement “Regional banks are delaying disclosing the distress in their commercial real estate loan portfolios, creating greater fragility in the overall financial system,” reports Bisnow.

“The expansion of the maturity wall represents a financial stability risk as a sizable, and increasing, portion of bank regulatory capital is at risk should these CRE loans default,” N.Y. Fed paper authors Matteo Crosignani and

Saketh Prazad wrote. “The possibility of a large and sudden capital hit for banks becomes more likely as the maturity wall becomes taller.”

Problems also exist across the ocean. In the Land of the Rising Sun, ADG reports “Corporate bankruptcies, meanwhile, topped 5,000 over the six months through September per Tokyo Shoko Research, the highest such tally in a decade.”

In China “Some 75% of real-estate transactions valued at $10 million or above over the first half of 2024 involved financially distressed sellers, data from CBRE Group show, while corporate bankruptcies registered at 305 from January to August, on pace to easily eclipse the 354 logged during all last year – which was the largest tally since 2010. “There are more distressed assets in the market than I have seen in the past 30 years,” relayed Derek Lai, Deloitte’s global insolvency leader and China vice chair in Hong Kong. .

As usual, retail investors are getting revved up at the wrong time. There appears to be danger dead ahead.

Originally Posted at https://mises.org/