MIKA MELTDOWN: Morning Joe Host Fears Trump Will Win, Says ‘It’s Fair for Democrats to be Incredibly Depressed’ (VIDEO)

by Jim Hoft, The Gateway Pundit: Mika Brzezinski of MSNBC’s Morning Joe seems to be coming to grips with the fact that it is looking ever more likely that Donald Trump is going to win the election and she is not happy about it. During a recent monologue, where Mika seemed to be on the verge of […]

Violence Has Been Normalized

Violence Has Been Normalized

Authored by Jeffrey Tucker via DailyReckoning.com,

During the misnamed and mostly preposterous debate between Kamala Harris and Donald Trump, a moderator fact-checked Trump’s claim that crime is up.

In contrast to Trump’s claim, moderator David Muir said that the FBI reports that crime is down, a claim that likely struck every viewer as obviously wrong.

Shoplifting was not a way of life before lockdowns. Most cities were not demographic minefields of danger around every corner. There was no such thing as a drugstore with nearly all products behind locked Plexiglas.

We weren’t warned of spots in cities, even medium-sized ones, where carjacking was a real risk.

It is wildly obvious that high crime in the U.S. is endemic, with ever less respect for person and property. As for the FBI’s statistics, they’re worth about as much as most data coming from federal agencies these days.

They’re there for purposes of propaganda, manipulated to present the most favorable picture possible to help the regime.

Lies, Damn Lies and Government Statistics

This is certainly true of the Bureau of Labor Statistics and the Commerce Department, which have been shoveling out obvious nonsense for years.

Professionals in the field know it but go along for reasons of professional survival. In truth, we’ve never had a real economic recovery since lockdowns.

Crime is up. Literacy is down. Trust has collapsed. Societies were shattered and remain so.

Only a few weeks following the officious fact-check at the debate, we now have new data from the National Crime Victimization Survey.

The Wall Street Journal reports:

“The urban violent-crime rate increased 40% from 2019–2023. Excluding simple assault, the urban violent-crime rate rose 54% over that span. From 2022–2023, the urban violent-crime rate didn’t change to a statistically significant degree, so these higher crime rates appear to be the new norm in America’s cities.”

But the FBI tries to tell you that crime is down. Sure, whatever they say.

The report isolates the “post-George Floyd protests” because no media source wants to mention the lockdowns. It is still a taboo subject.

We somehow cannot say, even now, that the worst abuses of rights in U.S. history in terms of scale and depth were a disaster, simply because saying so implicates the whole of the media, both parties, all government agencies, academia and all the upper reaches of the social and political order.

Politics Has Become Life and Death

The problem of political division is getting alarmingly serious. It’s no longer just about competing yard signs and loud rallies. We now have regular assassination attempts, plus even an extremely strange appearance of a bounty put on a candidate’s head by an official agency.

Surveys have shown that 26 million people in the U.S. believe that violence is fine to keep Trump from regaining the presidency. Where might people have gotten that idea

Probably from many Hollywood movies that fantasize about having killed Hitler before he accomplished his evil plus the nonstop likening of Trump to Hitler, and hence one follows from another.

Liken Trump to Hitler and that is the result you produce.

There’s private violence, public violence and many forms in between including vigilante violence. Rights violations against person and property are now normalized.

This springs from the culture of our times which has been heavily informed and even defined by the deployment of state violence in service of policy goals, at a scale, scope and depth never before seen.

The Role of Censorship

Censorship is a major part of it. Censorship is the deployment of force in service of state power, and other institutions connected to state power, for purposes of culture planning.

It’s exercised by the shallow state, in response to the middle state, and on behalf of the deep state. It’s a form of violence that interrupts the free flow of information: the ability to speak, and the ability to learn.

Censorship trains the population to be quiet, afraid and constantly stressed, and it sorts people by the compliant versus the dissidents. Censorship is designed to shape the public mind toward the end of shoring up regime stability. Once it starts, there’s no limit to it.

I’ve mentioned to people that Substack, Rumble and X could be banned by the spring of next year, and people respond with incredulity. Why? Four years ago, we were locked in our homes and locked out of churches, and the schools for which people pay all year were shut down by government force.

If they can do that, they can do anything.

Remember Free Speech?

Censorship has been so effective that it’s changed the way we engage with each other even in private. Brownstone Institute, which I founded, recently held a private retreat for scholars, fellows and special guests.

One very special guest wrote me that she was completely shocked at the freedom of thought and speech that was present in the room. As a mover in the highest circles, she had forgotten what that was like.

This censorship coincides with a strange valorization of violence that we are presented with from all over the world: Ukraine, the Middle East, London, Paris and many American cities. Never have so many held video cameras in their pockets and never have there been so many platforms on which to post the results.

One does wonder how all these relentless presentations of destruction and killing affect public culture.

Why They’re Doing It

What purpose are all these soft, hard, public and private exercises of violence serving? The standard of living is suffering, lives are shortening, despair and ill health are main features of the population and illiteracy has swept through an entire generation.

The decision to deploy violence to master the microbial kingdom did not turn out well. Worse, it unleashed violence as a way of life.

“When plunder becomes a way of life for a group of men in a society,” wrote Frederic Bastiat, “over the course of time they create for themselves a legal system that authorizes it and a moral code that glorifies it.”

That is precisely where we are. It’s time we talk about it and name the culprit. Liberty, privacy and property were already unsafe before 2020 but it was the lockdowns that unleashed Pandora’s box of evils.

We cannot live this way. The only arguments worth having are those that name the reason for the suffering and offer a viable path back to civilized living.

Tyler Durden

Sun, 10/13/2024 – 23:20

National Border Patrol Council ‘Strongly’ Endorses Trump at Arizona Rally

The National Border Patrol Council issued a strong and emphatic endorsement of former President Donald Trump during an Arizona rally on Sunday.

The post National Border Patrol Council ‘Strongly’ Endorses Trump at Arizona Rally appeared first on Breitbart.

Man Arrested at Trump Coachella Rally Had Shotgun and Handgun

The man arrested Saturday afternoon outside Donald Trump’s Coachella, California, rally had a shotgun and a handgun in his possession, at least one that was loaded.

The post Man Arrested at Trump Coachella Rally Had Shotgun and Handgun, at Least One Was Loaded appeared first on Breitbart.

China says launches military drills around Taiwan

China on Monday launched military drills around Taiwan, Beijing’s defence ministry said, sending planes and ships to encircle the self-ruled island. The exercises, dubbed Joint Sword-2024B, “test the joint operations capabilities of the theater command’s troops”, Beijing said.

The post China says launches military drills around Taiwan appeared first on Insider Paper.

Biden’s Lebanon Envoy, Ex-Israeli Soldier Amos Hochstein, Gave Israel ‘Green Light’ to Invade Lebanon

by Chris Menahan, Information Liberation: President Biden’s Lebanon envoy Amos Hochstein, a former Israeli soldier who was born in Jerusalem, reportedly gave Israel the “green light” to expand their war with Lebanon. Politico reported two weeks ago that Hochstein and presidential advisor Brett McGurk “privately told Israel that the US would support its decision to ramp […]

Netanyahu calls for immediate evacuation of UN peacekeepers from Lebanon amid Hezbollah threat

“Your refusal to evacuate Unifil soldiers has turned them into hostages of Hezbollah. This endangers both them and the lives of our soldiers.”

Why Silver Investors Should Pay Close Attention To Copper

Why Silver Investors Should Pay Close Attention To Copper

Authored by Jesse Colombo via Substack

For most investors, gold and silver are inseparable, like peanut butter and jelly or two peas in a pod. This mindset leads them to look at gold for signals on silver’s future price movements, and vice versa. Although silver’s price is indeed strongly influenced by gold, few realize the significant role that copper also plays in shaping silver’s price movements. In this article, I’ll examine how copper prices impact silver and show how bullish trends in copper should help drive silver prices higher in the coming years.

To understand the price relationship between two assets, examining their correlations can be highly insightful. Not surprisingly, gold and silver exhibit a strong correlation—.771 over the past five years and an even higher .917 over the past year. What’s particularly striking, however, is the strong correlation between copper and silver—.725 over the past five years and an impressive .878 over the past year. This strong correlation is a compelling reason for silver investors to monitor copper as closely as they do gold.

The strong price relationship between silver and copper is clearly reflected in long-term charts of the silver-to-copper ratio, which has remained remarkably consistent over time, despite periodic fluctuations around the average of 6:

The close relationship between silver and copper can be attributed to factors influencing both supply and demand. From a supply standpoint, silver is seldom mined on its own. Instead, it is typically a byproduct of copper and other metal mining, such as lead, zinc, and gold. On the demand side, both silver and copper have substantial industrial applications, driving significant industrial demand for both metals.

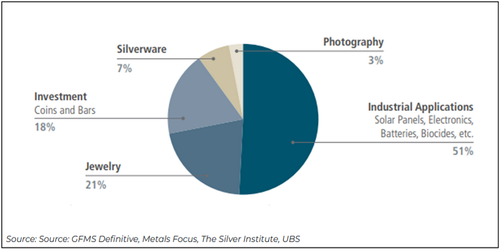

While silver is often grouped with gold, it differs significantly in its demand profile. The majority of silver demand (51%) comes from industrial use, compared to just 18% from investment. Furthermore, the rapid growth in industrial demand for silver likely explains the rising correlation between silver and copper in recent years. In contrast, gold demand is largely fueled by investment (44.57%) and jewelry (48.74%)—with much of that jewelry also serving as a form of investment, especially in developing countries like India and China.

Both copper and silver are far more sensitive to the economic cycle compared to gold. For instance, when a recession looms, both copper and silver prices tend to decline in anticipation of reduced industrial demand. Conversely, when the economic cycle is on an upswing, both copper and silver prices typically rise in anticipation of increased industrial demand. Gold, by contrast, is traditionally viewed as a safe-haven asset that investors turn to during times of crisis.

The strong price relationship between silver and copper is likely amplified by trading algorithms that predict movements in one metal based on the price of the other, often creating a self-fulfilling prophecy. For instance, when copper begins to rally, certain algorithms will buy silver, causing both metals to rise in tandem. Although anecdotal, I’ve often observed silver track copper even more closely than gold, both on intraday movements and over longer timeframes. For instance, I’ve often seen silver rise with copper while gold stayed flat or declined, and at other times, I’ve observed silver dropping along with copper even as gold rallied. I’ll highlight a recent noteworthy example of this phenomenon using the charts below.

As you are probably aware, gold has experienced a remarkable surge over the past year, climbing by $860 per ounce—a nearly 50% increase:

Like gold, copper experienced a strong rally in the spring, but it peaked on May 20th and quickly reversed, wiping out most of its gains—unlike gold, which continued to rise. Copper bottomed on August 8th and has rebounded quite a bit since then and is now in a confirmed uptrend once again:

Finally, we come to silver, which, like gold and copper, saw a sharp rally in the spring. Like copper, silver peaked on May 20th and experienced a sharp decline, though not as severe as copper’s drop. While silver and copper suffered throughout the summer, gold steadily continued its ascent. Silver, like copper, bottomed on August 8th and has been staging an impressive recovery ever since.

Silver’s price movements are essentially a hybrid of both gold and copper’s market trends. To test this theory, I averaged the prices of gold and copper, adjusting copper’s price (by multiplying by 540) to prevent gold’s higher price from exerting undue influence. Then, I created a chart based on that adjusted average. Sure enough, the resulting chart bears a striking resemblance to silver’s price chart:

Moreover, the five-year correlation with silver stands at a solid 0.842, while the one-year correlation is an even more impressive 0.956. This is higher than the correlation between gold and silver (0.771 over five years and 0.917 over the past year) and even stronger than the correlation between copper and silver (0.725 over five years and 0.878 over the past year). This analysis highlights the importance of monitoring both gold and copper to gain a clearer understanding of silver’s price movements. In addition, performing technical analysis on the chart of the copper-gold average seems to be a useful tool for confirming and anticipating silver’s price movements

Along with bullish technicals, copper’s fundamentals also point to a positive outlook. As the world increasingly embraces AI and “green” technologies such as electric vehicles, solar energy, and wind farms, demand for copper is expected to surge due to its essential role in wiring and other electrical applications.

For example, copper demand in the transport sector is expected to rise 11.1 times by 2050 compared to 2022, thanks to electric vehicles that contain over a mile of copper wiring. Additionally, demand for copper to expand the global electricity grid is projected to increase 4.8 times by 2050. By 2030, a copper supply gap nearing 10 million tonnes is forecasted. French billionaire and commodities trader Pierre Andurand recently predicted that copper prices could soar to $40,000 per tonne in the coming years—a more than fourfold increase from the current price of $9,308 per tonne. All of these factors should be bullish for both silver and copper.

In conclusion, the overlooked relationship between copper and silver plays a critical role in understanding silver’s price movements, alongside the more commonly recognized influence of gold. As copper continues to rebound, both technical and fundamental factors suggest that silver is poised to benefit as well. With increasing industrial demand, especially in sectors like electric vehicles and renewable energy, copper’s expected boom is likely to drive silver prices higher as well. Investors would do well to monitor copper closely, as its future movements may signal the next major leg up in silver’s bull market.

Also watch the video presentation about this concept:

If you enjoyed this article, please visit Jesse’s Substack for more content like this

Tyler Durden

Sun, 10/13/2024 – 17:30

The Age of Confusion

Talks with Professor Clancy. Human History: Palaeolithic, Mesolithic, Neolithic (stone age), Bronze Age, Iron Age, Dark Ages, Middle Ages, Enlightenment, Age of Confusion.

Tensions Rise Between Biden Staff and Harris Campaign, Sources Reveal

Tensions are rising between President Joe Biden’s administration and Vice President Kamala Harris’s campaign, with Biden’s senior staffers being labeled as too “in their feelings” to fully support Harris after he was pushed out of the race, inside sources revealed to Axios.

The post Tensions Rise Between Biden Staff and Harris Campaign, Sources Reveal appeared first on Breitbart.