Seemingly defying logic and common sense, many fashionistas vie to pay $12,000 (and even up to as much as $100,000 for versions made of exotic skins such as snake or alligator), for a women’s leather purse known as the “Birkin bag.” Handmade by the French firm Hermes, and named after British pop star Jane Birkin, who popularized the bag several decades ago, these bags today grace the arms of celebrities such as Jennifer Lopez and Kim Kardashian.

Anna Shnaidman nicely explains this backstory in her Mises Wire contribution “The Secret Economic Theory Behind the $100,000 Birkin Bag.” As she explains, both Carl Menger and Ludwig von Mises revealed why prices of highly desirable products like Birkin bags can reach such lofty levels.

Not only do Birkin bags fetch these initial prices, but over time a flourishing resale market for the bags has evolved in which these bags change hands at prices equal to or even higher than their initial retail level, making them a potential investment opportunity for some owners. The bags are of such quality in both craftsmanship and materials that they are meant to last a lifetime.

The Economic History Behind Such High Prices

About 100 years before Austrian economist Carl Menger (1840-1921) offered his explanation of the pricing phenomenon, Adam Smith (1723-1790) in his 1776 ground-breaking book An Inquiry into the Nature and Causes of the Wealth of Nations mused that water is virtually free in nature, whereas diamonds sell for very high prices. Yet water is necessary for life whereas diamonds are merely flashy baubles with no life-sustaining properties.

This is known as Smith’s diamond-water paradox, which he and several other economists were unable to resolve. The answer to the paradox, of course, is that water is ubiquitous (and thus the utility or usefulness of a marginal unit is quite low), whereas diamonds are scarce (and thus offer high utility from a marginal unit). This answer had to wait until 100 years after Smith wrote his book, when the Marginal Revolution—which included the Austrian Carl Menger—established that consumers make purchasing decisions at the margin, that is, based on marginal utility rather than total utility. Smith died without having grasped the answer to his own diamond-water riddle, but the Austrians were able to explain it decisively.

Notwithstanding that Hermes bags are beautifully made by skilled artisans of the finest quality materials, those features alone cannot account for the bag’s lofty prices. But luxury-good businesses like Hermes have shown that if a producer is able to restrict the supply of an item, create sufficient cachet for it, and impose other requirements on potential buyers, it is possible to raise the market-clearing price very high.

There is nothing illegal about this marketing strategy; no one is accusing Hermes of “price gouging.” In fact, the very price point in itself is considered a status symbol, only adding to the bag’s cachet among those seeking to differentiate themselves from the hoi polloi.

And here is the kicker to the story: Hermes does, in fact, impose other purchase requirements on buyers, qualifying customers to buy a Birkin bag only if they have previously purchased other Hermes products (scarves, jewelry, shoes), a restrictive marketing policy that sticks in the craw of some aspiring Birkin bag shoppers.

Hermes Bag Purchasers File Lawsuit

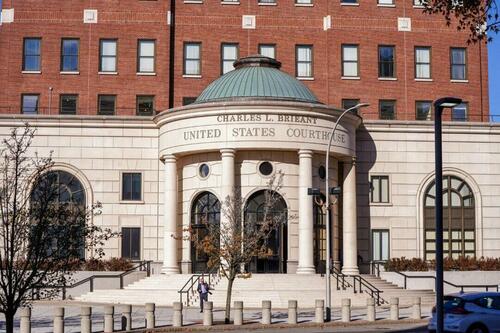

But apparently unaware of the long history of price-determination for scarce, coveted products, in March 2024, two aspiring California Hermes customers who were not allowed to buy Birkin bags filed a class action lawsuit in US District Court for the Northern District of California against Hermes, alleging that the company violated federal and California antitrust laws when marketing its Birkin bags.

The relevant federal law is the Sherman Antitrust Act of 1890, which prohibits activities that restrict interstate commerce and competition. In particular, this law prohibits “tie-in” sales, when a seller offers products together as part of a package and requires buyers to purchase other products to qualify to purchase the item that they ultimately desire. If a seller offering a tied-product has sufficient market power, these arrangements can violate antitrust laws. The Clayton Act of 1914 further strengthened the Sherman Act’s prohibition of “tying” agreements. The relevant California law is the Cartwright Act, which prohibits agreements that restrain trade or limit production and agreements to increase or fix prices or otherwise prevent competition.

One of the two plaintiffs was allegedly not allowed to purchase a Birkin bag because he had not purchased other Hermes products as required. The second plaintiff had spent thousands of dollars on Hermes products, including Birkin bags, but was allegedly told that only “clients who have been consistent in supporting our business” were eligible to make the purchase. This requirement, the plaintiffs alleged, led to a charge of unlawfully “tying” Birkin bag purchases to other prior Hermes purchases, violating the US Sherman Antitrust Act.

In May 2024, Hermes asked the Court to dismiss the lawsuit, calling it “far-fetched” and claiming that the plaintiffs had failed to show how sales of the handbags violated US antitrust law. The company, moreover, argued that the plaintiffs had not met the legal test to show that the company unlawfully tied the sale of two distinct products.

Then, in October 2024, the plaintiffs filed an amended lawsuit, hoping to persuade the judge that the company unlawfully gives customers with “sufficient purchase history” a chance to buy a Birkin bag, adding this time charges of false advertising and fraud claims, asserting that Hermes sales staff induce extra purchases knowing in advance that customers will in fact not get an opportunity to buy a Birkin bag.

Hermes continued to deny any wrongdoing, and the judge responded that, “Hermes can run its business any way it wants…the fact that a lot of Hermes customers may not be able to get a Birkin bag is not a Hermes antitrust problem.”

It now appears that this lawsuit is going nowhere within the current legal framework. Yet the plaintiff’s three court appearances within the past year indicate the lengths to which some frustrated customers will go in order to spend a small fortune on a handbag, an objective that now appears to have become an end in itself.

The story also indicates the over-use that some Americans increasingly make of the judicial system to resolve personal grievances. It also speaks to the persistence of ambitious lawyers who believe they can design ground-breaking legal strategies that may provide the relief their clients desire. In any case, it is an intriguing example of the intersection of economic history and theory, existing US antitrust law, and human attempts to manipulate free market outcomes along lines they would prefer rather than those that result from natural forces.

Originally Posted at https://mises.org/