US Homeowners Must Earn $50,000 More Than Renters To Cover Shelter Payments: Report

Authored by Naveen Athrappully via The Epoch Times,

American homeowners need to earn about $50,000 more than the typical renter to be able to afford monthly mortgage payments, according to new data from real estate brokerage Redfin.

“Americans need to earn $116,633 per year to afford the median-priced home for sale, 81.8 percent more than the $64,160 needed to afford the typical apartment for rent,” Redfin said in an April 10 statement.

In 2024, a person looking to buy a typical U.S. home could do so with earnings of about $110,808, $5,825 lower than this year. The amount needed to rent remained about the same.

According to the brokerage, a home is considered affordable when the homeowner spends no more than 30 percent of their income on the monthly housing payment.

Home prices have been going up at a swift pace with Freddie Mac-backed 30-year fixed-rate mortgage rates remaining above the 6 percent level for all of 2024 and 2025.

Redfin said an individual needed to earn just $63,925 to afford the typical home for sale in 2021. The latest data indicate an increase of more than 82 percent in the income required to purchase a home since then, based on current market conditions. The amount needed for a typical rental was then $54,520.

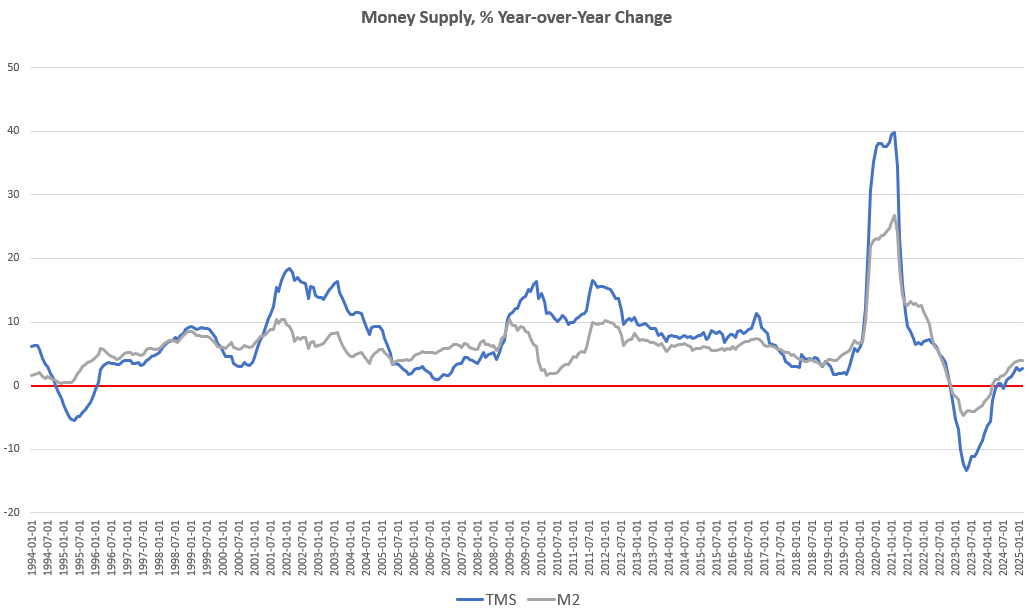

Mortgage rates have been undergoing considerable fluctuations recently, with broader economic uncertainty following President Donald Trump’s tariffs strategy to level the playing field for American exports.

The implementation of reciprocal tariffs was announced on April 2.

Rates jumped over the 7 percent level Friday, according to data from aggregator Mortgage News Daily.

The volatility in rates has been supported by corresponding movements in the U.S. Treasury bond yields.

The 10-year treasury yield has been on the increase since April 4, when it closed at 3.99 percent. As of April 11, it is at 4.50 percent.

Inflation Fears

When the 10-year Treasury yield increases, mortgage rates tend to follow. According to Mortgage News Daily, the yield saw its biggest week-over-week increase since 1981, indicating a subsequent uptick in mortgage rates, which have now crossed the 7 percent level.

Economic uncertainty has caused market turbulence with investors worrying about a possible spike in inflation. This has resulted in bond prices falling. Bond prices have an inverse relationship to treasury yields. Hence, yields have risen, lifting mortgage rates.

Defying market expectations, producer prices registered an unexpected drop in March, suggesting a lower chance for increased inflation.

The White House commended the inflation report in an April 10 statement, stating that it was “the first drop in consumer prices in several years.”

U.S. consumer optimism declined in April, according to the latest University of Michigan sentiment survey. Inflation fears had risen to the highest level in more than four decades, owing mainly to tariff uncertainty and the falling stock and bond markets.

Americans have been standing on the sidelines, unsure of making home purchases due to the persistently elevated mortgage rates.

When rates went down consecutively for three weeks, the number of mortgage purchase applications went up.

“Mortgage…