Worm meds

Repositioning of Anthelmintic Drugs for the Treatment of Cancers of the Digestive System

https://pmc.ncbi.nlm.nih.gov/articles/PMC7404055/

Tumours of the digestive system,

their incidence continues to increase.

The process discovering and validating novel and effective drugs against these malignancies, lengthy and costly

Drug repositioning (drug repurposing), finding new uses for approved drugs,

provides the opportunity to expedite promising anti-cancer agents into clinical trials.

Some classes of anthelmintics

Infections caused by parasitic worms (helminths)

Meds have shown pronounced anti-tumor activities

Ability to target key oncogenic signal transduction pathways.

Benzimidazoles

Some have been successfully tested for the treatment of gastrointestinal, liver and pancreatic cancers.

Mebendazole

Blocks tubulin polymerization, compromise microtubule function

Seen to inhibit cell growth and invasion of ascites cell line derived from a primary gastric tumor,

whether used alone or in combination with chemotherapeutic

Treatment was also successfully tested in five CRC cell lines,

showed no cytotoxic activity against three cell lines with non-malignant phenotype

Induced remission of lung and lymph node metastases, and a partial remission of liver metastases, in a patient with refractory metastatic colon cancer

Showed anti-cancer properties in the treatment of hepatocellular carcinoma

Emerging Perspectives on the Antiparasitic Mebendazole as a Repurposed Drug for the Treatment of Brain Cancers

https://pmc.ncbi.nlm.nih.gov/articles/PMC9862092/

Albendazole

Cytostatic effect on the human cancer cell lines

Potential anti-cancer agent also for the treatment of HCC

Pancreatic cancer lines

Positive mice studies, some early human studies

Ivermectin

CRC, gastric cancer

(vitro and in vivo)

Ivermectin, a potential anticancer drug derived from an antiparasitic drug

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7505114/

Mechanisms of action

IVM induces different programmed cell death patterns, e.g. apoptosis.

Forms of cancer

Breast cancer

Digestive system cancer

Gastric cancer

Hepatocellular carcinoma

Urinary system cancer

Renal cell carcinoma

Prostate cancer

Hematological cancer

Leukemia

Reproductive system cancer

Cervical cancer

Ovarian cancer

Brain glioma

Glioblastoma

Respiratory system cancer

Nasopharyngeal carcinoma

Lung cancer

Melanoma

Right to Try

https://trumpwhitehouse.archives.gov/briefings-statements/president-donald-j-trump-sign-right-try-legislation-fulfilling-promise-made-expand-healthcare-options-terminal-americans/

Kathleen T Ruddy, MD

https://twitter.com/DocRuddy

Trump and team get warm welcome at UFC fight night

US President-elect Donald Trump was greeted by chanting fans as he attended the Ultimate Fighting Championship heavyweight bout at New York’s Madison Square Garden on Saturday. Trump entered the arena shortly before the start of the main card accompanied by UFC chief executive Dana White, who was a prominent backer during his election campaign. Several […]

The post Trump and team get warm welcome at UFC fight night appeared first on Insider Paper.

Hollywood actors want to move to Canada after Trump got elected.

#FormerNetworkExec #CallMeChato #trump

So many Hollywood actors said they'd move if Trump got elected. I got a lot of phone calls.

Thanks for watching my channel. Please subscribe, SHARE and touch yourselves.

Call Me Chato T-shirt

https://my-store-6121db.creator-spring.com/listing/ppc-cartoon-t-colour

If you want to contact me:

http://www.paulchato.com

Globalist Trudeau Went All in With Feeding Insects to Canadians – Embattled Prime Minister Blew $9 Million in Failed Edible Cricket Factory

by Paul Serran, The Gateway Pundit: You are never a complete Globalist leader until you attempt to feed insects to the citizens with some ‘Global Warming’ excuse. Unpopular Canadian Prime Minister Justin Trudeau is a bona-fide Globalist poster-boy and would not be kept away from this new hellish fad. And it makes a lot of […]

Trump Team Making List of US Officials Involved in Afghanistan Withdrawal

President-elect Donald Trump’s transition team is putting together a list of United States military officers who were involved in the Biden Administration’s botched withdrawal from Afghanistan, according to a recent report.

The post Report: Trump Team Putting Together List of Military Officers Involved in Afghanistan Withdrawal appeared first on Breitbart.

Trump Can Help A New Generation Learn To Appreciate Our Veterans

Trump Can Help A New Generation Learn To Appreciate Our Veterans

Authored by Tom Ruck via RealClearDefense,

Following President Donald Trump’s extraordinary victory over Kamala Harris, President Joe Biden addressed the nation. His message was simple: “setbacks are unavoidable, but giving up is unforgivable,” and he concluded by saying, “may God protect our troops.”

Unfortunately for President Biden, however, many people in his party have given up on fighting for America and have even given up on supporting our troops. Indeed, this anti-American and anti-military sentiment in the Democratic party undoubtedly contributed to President Trump’s victory.

This is a shame because veterans represent the very best of America. From the sandy beaches of Normandy and the wet jungles of Vietnam to the hot deserts of Iraq and harsh mountains of Afghanistan, they have fought and died for our freedom. Their courage, honor, and selflessness are unmatched, and they should serve as an example for every American today, especially young people.

With that in mind, in light of this recent Veteran’s Day, it is worth asking what our new president can do to restore a sense of gratitude in all Americans for our military servicemen and women.

There are many answers to that question, of course. For example, his administration could put a stop to the politicization of the military through wokeness, which would ensure that our veterans can be proud of the branches they served. Likewise, President Trump could use his bully pulpit to remind the American people of the virtues of our military men and women. This White House could also revisit its previous plans to build the National Garden of American Heroes, and honor some of our country’s greatest veterans there.

These are all excellent initiatives, but one of the simplest — and subtlest — ways that President Trump can restore respect for our troops and veterans is by preserving and enhancing the beauty of our national cemeteries. The United States and its territories contain 164 national cemeteries. Some are well-known, such as the Arlington National Cemetery and Gettysburg National Cemetery, and others are more inconspicuous, but each cemetery is — in the words of President Lincoln — “hallowed ground.”

My father is buried at Jefferson Barracks National Cemetery in St. Louis, Missouri, so I know from the personal experience of many visits that these cemeteries are more than places of rest — they are the final resting place of our country’s heroes and sacred symbols of American freedom.

We must never forget these men and women. We must also introduce a new generation of Americans to these cemeteries, as I am convinced that walking through those beautiful, straight, uniform rows of fallen soldiers is such a powerful experience that it could make any American grateful for our veterans.

To do this, President Trump cannot only ensure that these cemeteries are well maintained, he can promote programming that introduces Americans — especially young Americans — to the profound sacrifices that sustain our liberty. Hosting more roll-call events, concerts, and other community initiatives can help keep the spirt of service alive in the hearts of all Americans and change the minds of this new generation.

Doing so will not only give veterans the respect and honor they so thoroughly deserve, but it will also make our country better. Gratitude is the character trait that seems to be desperately missing from our national dialogue, but it doesn’t have to be this way. The first step to making America great again is remembering the greatest people in our country’s past: our veterans.

Preserving and enhancing our national cemeteries is an excellent way to do that. Next Veteran’s Day, visit a cemetery near you and say a prayer of thanks for the men and women that gave everything for our freedom.

Tom Ruck is the award-winning author of “Sacred Ground: A Tribute to America’s Veterans.”

Tyler Durden

Sat, 11/16/2024 – 23:20

Trump Makes Triumphant Return to Madison Square Garden for UFC 309

President-elect Donald Trump made a triumphant return to Madison Square Garden Saturday night, days removed from his landslide victory, for UFC 309.

The post President-Elect Trump Makes Triumphant Return to Madison Square Garden for UFC 309 appeared first on Breitbart.

CHRISSY CLARK: Michigan woman awarded almost $13 million after being fired by BCBS for refusing Covid vaccine

Lisa Domski worked at Blue Cross Blue Shield of Michigan as an IT specialist for 38 years.

Right to try

Right to Try

https://trumpwhitehouse.archives.gov/briefings-statements/president-donald-j-trump-sign-right-try-legislation-fulfilling-promise-made-expand-healthcare-options-terminal-americans/

Kathleen T Ruddy, MD

https://twitter.com/DocRuddy

BCA: Bitcoin Closes In On $100,000, But The Ultimate Destination Is Over $200,000+

BCA: Bitcoin Closes In On $100,000, But The Ultimate Destination Is Over $200,000+

By Dhaval Joshi of BCA Research

Executive Summary

-

The value of both gold and bitcoin comes from their so-called ‘network effect’.

-

The network effect of both gold and bitcoin comes from the collective belief that they are the non-confiscatable assets to own in a fiat monetary system, as an insurance against hyperinflation, banking system failure, or state expropriation.

-

As global wealth rises, the value of the network effect of both gold and bitcoin will also rise.

-

But as bitcoin takes market share from gold, bitcoin has considerably more upside than gold.

-

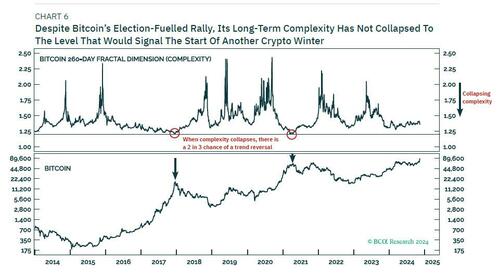

Despite bitcoin’s election-fuelled rally, its 260-day complexity is not yet close to the 1.2 level that would signal the start of another crypto winter.

-

Hence, while we should expect a near-term retracement, bitcoin’s structural uptrend is intact with an ultimate destination of $200,000+

-

10-year T-bonds and Portuguese stocks are tactically oversold.

Back in 2021, I penned a report explaining why bitcoin was headed to $100,000+. Suffice to say, my $100,000+ forecast stirred a hornets’ nest, even here at BCA. The naysayers pushed back hard, claiming that bitcoin was a ‘Ponzi scheme’ or, at the very least, a dangerous bubble.

Yet three years on, my prediction has been vindicated both for its price forecast and its underlying justification. Now, with the bitcoin price closing in on $100,000, is it time to take profits? The answer depends on whether you are a trader or a long-term holder.

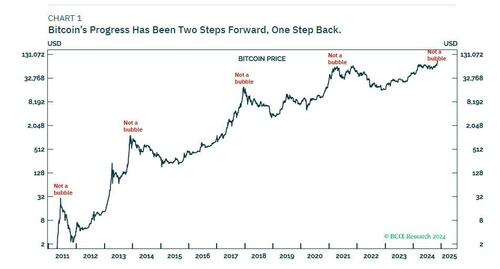

Bitcoin’s progress has always been two steps forward, one step back. After its recent surge, premised on the more ‘bitcoin friendly’ candidate winning the US presidency, we can expect some near-term retracement – as was the case in April this year. On a multiyear horizon though, bitcoin’s structural uptrend is intact and will ultimately take it to $200,000+ (Chart 1).

The Value Of Gold And Bitcoin Come From Their ‘Non-Confiscatability’

To understand the value of bitcoin we must understand the value of gold. With gold predominantly used as jewellery, many people think that the value of gold comes from its properties as a precious metal, especially the chemical inertness that keeps it eternally beautiful. But this is a misunderstanding.

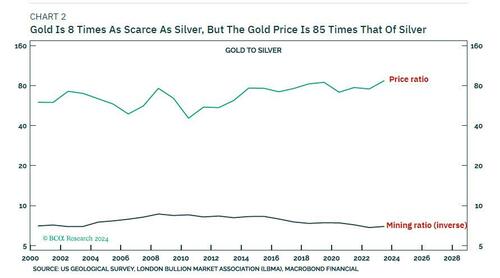

The other precious metals that are gold’s neighbours in groups 10 and 11 of the periodic table – silver, platinum, and palladium – possess identical properties to gold. This means that we can quantify gold’s value as a precious metal as being gold’s relative scarcity versus, say, silver multiplied by the price of silver.

Today, gold is roughly eight times as scarce as silver, so gold’s value as a precious metal is the price of silver, $30/oz, times eight, which equals $240/oz. This comprises just 10 percent of gold’s current market price of $2550/oz (Chart 2).

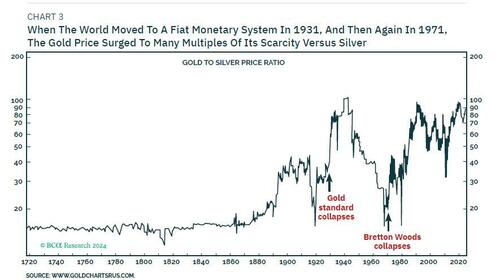

Yet for centuries, the gold price did just equal its scarcity versus silver multiplied by the silver price. The relationship ended only when the world moved to a fiat monetary system in 1931, and then again in 1971. In a fiat monetary system, the gold price surges to many multiples of its scarcity versus silver (Chart 3).

This provides the compelling proof that in a fiat monetary system, most of gold’s value comes not from its use as a precious metal. Most of gold’s value comes from the network of marginal buyers who are holding it for what I call its ‘non-confiscability’. Unlike financial assets, bank deposits, or cash, the state cannot confiscate gold via fiat monetary inflation. This is ensured by gold’s limited supply. Nor can gold be confiscated by the higher risk of a banking system failure that a fiat monetary system aggravates.

Can we justify the price of gold instead by the high cost of mining it? No, the causality runs the other way. The cost of mining gold is driven by its market price, as miners grab the largest share of its selling price that they can.

What about central bank purchases of gold? Central bank reserves also hold gold rather than foreign fiat currencies for gold’s non-confiscatability. A foreign fiat currency can be confiscated via devaluation by its government or central bank, but gold cannot.

All of which brings us to two key points:

First, given that gold’s above-ground market value is $19 trillion,1 the majority, around $17 trillion comes from the network of holders who value gold for its non-confiscatability.

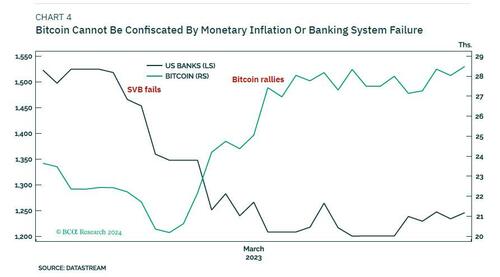

Second, just like gold, bitcoin cannot be confiscated by monetary inflation or banking system failure (Chart 4). Additionally, and

unlike gold, it is difficult for the state to confiscate it by outright expropriation. Yet bitcoin, with a market value of $1.5 trillion comprises less than 10 percent of the total market for non-confiscatable assets. As bitcoin’s share of this market increases, and the supply of bitcoins reaches its upper limit, bitcoin’s price has substantial upside.

The Value Of Bitcoin’s ‘Network Effect’ Has Substantial Upside

In essence, the value of both gold and bitcoin comes from their so-called ‘network effect’. A network effect creates a self-reinforcing cycle of value where each new user makes the network more valuable for everyone.

In the case of both gold and bitcoin, their network effect come from the collective belief that they are the non-confiscatable assets to own in a fiat monetary system. And that a certain proportion of total wealth must be held in these non-confiscatable assets as an insurance against hyperinflation, banking system failure, or state expropriation.

You might ask, what is the difference between a network effect based on collective belief and a Ponzi Scheme? The answer is that a Ponzi Scheme relies on an exponential growth of its network on a promise to get-rich-quick. Once that exponential growth ends, as it must, the value of the network collapses.

By contrast, gold’s network effect has existed in relatively stable form since 1971, and bitcoin’s network effect has existed for over ten years. And their entire raison d’être is an insurance against the get-poor-quick that comes from hyperinflation, banking system failure, or state expropriation.

The upshot is that we can value the gold and bitcoin networks as the product of three terms:

-

Global wealth

-

Global wealth share held in the non-confiscatable asset-class

-

Non-confiscatable asset-class share held in gold/bitcoin

For gold, this means that if global wealth rose by say, 20 percent in the coming 2-3 years and the global wealth share held in the non-confiscatable asset-class held constant, while bitcoin eroded the non-confiscatable asset-class share held in gold from 90 to 80 percent, then the gold price would nevertheless increase by about 7 percent. Under the same premise though, the bitcoin price would increase by about 140 percent3 to $200,000+.

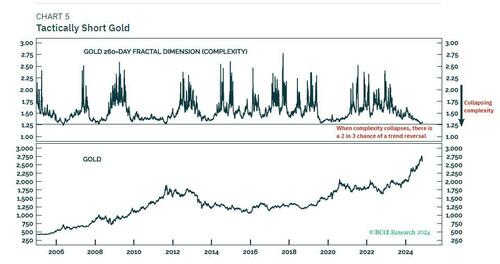

What does our proprietary analysis of price trend complexity reveal for gold and bitcoin? Gold’s 260-day price rally complexity (fractal dimension) recently reached the point of collapse that has reliably signalled tactical retracements. This justifies our current tactical short position in gold (Chart 5).

In the case of bitcoin, its major structural downtrends – so-called ‘crypto winters’ – have started when the preceding rally’s 260-day complexity collapsed to a level of 1.2 (Chart 6).

Despite bitcoin’s election-fuelled rally, its long-term complexity has not collapsed to the level that would signal the start of another crypto winter. Hence, while we should expect a near-term retracement, bitcoin’s structural uptrend is still intact with an ultimate destination of $200,000+.

Tyler Durden

Sat, 11/16/2024 – 17:30