Ukraine launches drone attack on Moscow, killing at least one woman: report

Moscow’s regional governor Andrey Vorobyov said that a 46-year-old woman was killed and several people were wounded from a UAV blast.

Moscow’s regional governor Andrey Vorobyov said that a 46-year-old woman was killed and several people were wounded from a UAV blast.

Is The “Everything Bubble” About To Pop?

Authored by Charles Hugh Smith via OfTwoMinds blog,

Among the big winners of the Everything Bubble is–yes, I know you’re shocked–Wall Street.

Is the “Everything Bubble” about to pop? Let’s start with what we’re told: there is no bubble , all the assets soaring to unprecedented heights are reasonably priced at a “permanently high plateau” because of AI, scarcity of housing, scarcity of Ferraris, interest rates trending down, the Fed waving dead chickens around the campfire, people buying toothpaste, and so on: you name it, it’s a reason for assets to drift higher.

This all sounds rather splendid, but somehow the pump inflating the bubble goes unmentioned: it’s the money, Honey , the tens of trillions of yen, yuan, euros, dollars, pesos, etc., being borrowed or conjured into existence since the last spot of bother in 2008, where each unit of currency enters the global free-for-all chasing assets.

Thanks to historically low yields, cash is trash and the way to make a killing is to rotate from AI chip makers to Ferrari to Colgate, and then on to the next hot sector: maybe uranium, maybe bat guano, maybe a new doggy-themed crypto, maybe the next iteration of the yen carry trade, it doesn’t really matter because capital is digital and therefore mobile.

Hand-in-hand with the endless spew of new “money” and credit are financialization and globalization , which have transformed every asset into a fully globalized, commoditized asset that can be securitized, packaged, collateralized and leveraged in a financier’s Heaven of finance becoming the measure of all things .

The house across the street is no longer shelter: it’s a financialized asset that’s now part of a portfolio of rental properties owned (and leveraged) by some entity based in Dubai, which might securitize the portfolio and sell it to pension funds in Norway.

Or it’s one of dozens of short-term vacation rentals (STVR) in a wealthy family’s private wealth management portfolio.

The same holds true for every asset on the planet. Farmland isn’t for growing food–it’s for growing wealth as the global “scarcity” of places to stash capital drives its value out of the reach of those who would actually like to use the land to grow food.

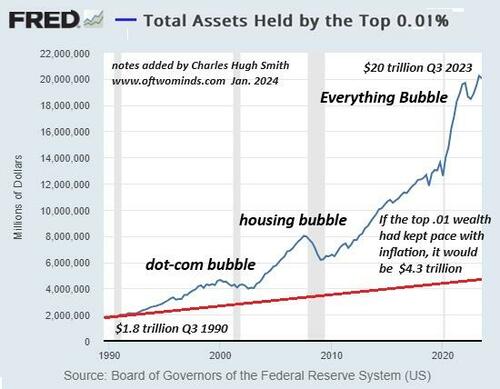

For the wealthy, what’s abundant is credit, and what’s scarce is assets to soak up the sea of capital sloshing around the wealth management funds, philanthro-capitalist foundations, and other outposts of the top 0.1%, which as this chart illustrates, have ridden the credit-fueled Everything Bubble to unprecedented heights of private wealth.

We’re told the bubble is a tide raising all boats, but this is, ahem,misinformation, as the bottom 50%’s share of the financial windfall remains a signal-noise of 2.6%.

The primary effect of the Everything Bubble is an extreme of wealth-power inequality. As the chart above illustrates, the wealthy got much richer while everyone else acquired more debt, ie the obligation to pay more of one’s earnings to the wealthy who own the mortgage, auto loan, student loan. etc.

There’s a funny little effect of extreme wealth-power inequality known as social disorder which can manifest in all sorts of equally funny ways, as popular uprising, wildcat strikes, opting out , civil disobedience, and various other ways of expressing no mas .

Here we see just how extreme the Everything Bubble has become in residential real estate, nearly doubling the insanity of the 2006 housing bubble. Recall that the Case-Shiller Index tracks the market price of the same houses over time, so there’s no way to game the statistics.

Among the big winners of the Everything Bubble is–yes, I know you’re shocked–Wall Street , as the broker-dealer index has outpaced even the bubblicious S&P 500 stock index.

The Everything Bubble is global , which means its deflation is going to hurt the entire global economy. Consider this chart reflecting the concentration of China’s household wealth in housing: almost 80% of all household wealth is in housing, a bubble which is now popping despite the authorities’ efforts to reinflate the bubble. Prices are off 25% to 37% in Tier 1 cities, and even more in Tier 2 and 3 cities.

The reverse wealth effect as the primary store of household wealth wilts will be monumental. Trust isn’t just personal? trust is the critical glue in markets and governance. Once trust is lost, it’s somewhere between difficult and impossible to win it back.

That the bloom is off the Everything Bubble Rose is visible in anecdotal evidence dribbling in from the real world: housing valuations in various markets are off 25% from their peak, housing inventories are rising, sales are slowing, restaurant chains are going belly-up , credit card debt is soaring to new heights, dollar-store stocks are cratering, and so on.

But hey, the real world doesn’t count? the only thing that matters is financialized assets going up. If the yen-quatloo pair is taking off, everything’s good.

There are a couple of funny things about amassing $315 trillion in debts globally to drive “growth”: one is the interest due on all that debt , which becomes unsustainable should yields rise, and inflation, which either pushes yields higher, making it impossible to continue funding “growth” with more debt, or it lays waste to the purchasing power of wage earners’ incomes, popping the bubble of free-spending consumption propping up the global economy and debt bubble .

Gordon Long and I explain these dynamics in our new podcast :

To summarize: will the Everything Bubble pop? Yes.

Will the authorities try to reinflate the bubble? Yes.

Will it work? No.

* * *

Tyler Durden

Fri, 09/06/2024 – 06:30

The New York Times removed a controversial headline of a column critical of Sen. JD Vance (R-OH), Donald Trump’s running mate.

The post New York Times Removes Nazi Language from Headline on Column Criticizing JD Vance appeared first on Breitbart.

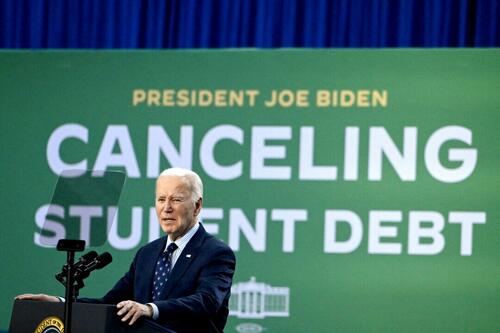

One In Five Student Loan Borrowers Avoid Making Payments: Report

Authored by Bill Pan via The Epoch Times (emphasis ours),

One in five borrowers with outstanding student loans have made no payments, as many hold out for potential debt relief, a recent survey reveals.

The survey, published on Sept. 5 by Intuit Credit Karma, found that 20 percent of student loan borrowers said they have yet to make any payments on their loans. This figure rises to 27 percent among borrowers with a household income of less than $50,000.

More than half (55 percent) of respondents reported being unable to afford their student loan payments, while nearly half (49 percent) said they feel “financially unstable.”

The survey underscores the financial strain faced by borrowers, with affordability challenges largely attributed to the high cost of living (69 percent). Many loan holders said they are forced to make difficult trade-offs, with 38 percent saying they are falling behind on other bills—such as auto loans, mortgages, or credit card payments—to meet their student loan obligations. Additionally, 39 percent of borrowers said they are prioritizing paying off higher-interest debt over their student loans.

The report also highlights the difficult financial situations of younger borrowers. Notably, 44 percent of Gen Z and 41 percent of millennial borrowers said they have depleted their savings to manage student loan payments. Overall, about one-third (34 percent) of all borrowers surveyed reported having $0 in savings.

Borrowers who haven’t been making payments should be on high alert, as their credit scores could be impacted once the federal government’s “on-ramp” grace period ends, the survey warns.

During this one-year transition period, payments are due and interest accrues, but missed payments won’t be considered delinquent, placed in default, or reported as such to creditors or debt collectors.

When the grace period ends on Sept. 30, borrowers will again face the usual consequences of missed payments, including default. Defaulting on a loan can damage one’s credit score and may result in the federal government garnishing wages, seizing tax returns, and intercepting Social Security benefits.

The survey suggests that some borrowers appear to have taken “irresponsible advantage” of the soon-to-expire relief. About one in seven (15 percent) of those who have not been making consistent on-time payments admitted they were intentionally avoiding payments, knowing their credit scores would not be impacted during the grace period.

“With Biden’s SAVE plan in limbo, many borrowers face uncertainty about whether they will benefit from lower monthly payments and a clear path to loan forgiveness,” said Courtney Alev, a consumer financial advocate at Intuit Credit Karma, referencing the Biden administration’s income-driven repayment plan currently blocked by court orders.

“While it’s understandable to hope for potential loan forgiveness, borrowers shouldn’t rely solely on it,” Alev said in the survey release. “Those struggling to make payments should proactively reach out to their lenders to explore available options.”

The SAVE plan was designed to reduce monthly payments for borrowers and accelerate the path to having their balance discharged. Approximately 7.5 million borrowers have already signed up for the SAVE plan, and 150,000 have had their debt erased.

Two groups of Republican state attorneys general challenged the plan in two federal district courts. They argued that the Biden administration lacks the legal authority to implement the plan and that it contradicts the U.S. Supreme Court’s decision last summer that struck down an earlier attempt at large-scale student loan cancellation.

On Aug. 28, the Supreme Court denied the Biden administration’s emergency request to temporarily reinstate the SAVE plan. This is not a final ruling, and either or both cases could return to the high court once the federal appeals courts rule on the merits of the dispute.

The survey was conducted online within the United States by Qualtrics on behalf of Intuit Credit Karma between Aug. 3 and Aug. 19 among 1,995 adults ages 18 and older with outstanding student loan debt.

Tyler Durden

Tue, 09/10/2024 – 17:15

One of the outcomes of the American Civil War was the movement toward centralization of political power in Washington. The Reconstruction regime imposed upon the former Confederate states following the war was an overt attempt to further impose federal power there.

…JOHN BECOMING BETTER ORGANIZED… …A HURRICANE WATCH AND TROPICAL STORM WARNING HAVE BEEN ISSUED FOR PORTIONS OF SOUTHERN MEXICO…

As of 3:00 AM CST Mon Sep 23

the center of John was located near 14.4, -98.5

with movement NNE at 3 mph.

The minimum central pressure was 1000 mb

with maximum sustained winds of about 45 mph.

…MILTON WILL BRING LIFE-THREATENING STORM SURGE AND WINDS TO PORTIONS OF THE FLORIDA GULF COAST…

As of 7:00 PM CDT Tue Oct 8

the center of Milton was located near 23.0, -86.9

with movement ENE at 10 mph.

The minimum central pressure was 902 mb

with maximum sustained winds of about 165 mph.

Progressives claim that the state grants us our rights, and that liberty can flourish only in the presence of a powerful state. The truth runs in the opposite direction.

Donald Trump will make a defiant return Saturday to the small town in Pennsylvania where an assassin tried to shoot him dead during a rally attended by thousands of supporters. The former president will appear alongside J.D. Vance, his running mate in the November election, as well as family members of those hurt in the […]

The post ‘Bullet for democracy’: Trump returns to site of rally shooting appeared first on Insider Paper.