‘Left Is A Vicious Wounded Tiger’ – Larry Klayman Warns “They Want Us Dead”

‘Left Is A Vicious Wounded Tiger’ – Larry Klayman Warns “They Want Us Dead”

ViaGreg Hunter’s USAWatchdog.com,

Renowned Attorney Larry Klayman, founder of Judicial Watch and later Freedom Watch, has been fighting government corruption and winning for decades.

Today, the fight has turned into an all-out war and fight to the death. Klayman explains, “Bottom line is we have been in a war, but now we are at red alert…”

” The fact that Donald Trump has been reelected the 47th President of the United States with the popular vote and an overwhelming landslide in the Electoral College, the Left is on the run, but it’s stung. It’s like a wounded tiger. It’s vicious. It will fight back…

You are going to see the Left in the streets, ultimately. It will probably be in days, if not weeks. You are going to see a repeat of what we saw with Black Lives Matter, ANTIFA, radical Palestinians and others. They are going to be coming for us.

Frankly, and this sounds extreme, we saw the assassination attempts… and Kamala Harris and Biden calling Trump Hitler, calling them garbage and calling us garbage, they want us dead. Let me repeat that. They want us dead…They are like rats leaving the ship.

The time to peacefully and legally crush them is now.”

Klayman also sees that things may not stay peaceful.

Klayman points out, “It’s only a matter of time because they are whipping up the hatred right now against all of us garbage men…”

” It’s only a matter of time that he (President Trump) may have to declare martial law to reestablish order here. I hope it doesn’t get to that. But he (the President) has that authority as well.

So, I want people to realize that there may be a calm in the storm right now, but the communists, the atheists, the radicals and the Left are coalescing. They are plotting, and they are planning.

This is like the ‘Force’ in ‘Star Wars’ and ‘Darth Vader.’ They intend to come back anyway they can.

If they can’t do it peacefully and legally, which they can’t, they are going to get violent, and we better be prepared for that.”

Klayman also points out that President Trump cannot turn America around without the help of millions of patriots. Klayman says,

“He needs us to back him. We need to fight for him if necessary. Here’s the scary thing. God forbid, but I don’t think this is the last assassination attempt. I think there will be more. . . . This kid that took a crack at Trump in Butler, we don’t know what his motive was today. . . . We’ve never gotten the truth about anything.

We don’t know who killed John F. Kennedy. Even Bobby Kennedy Jr. does not believe that Sirhan Sirhan killed his father.

Martin Luther King’s family does not believe that James Earl Ray was the assassin of Martin Luther King. It was probably Edgar Hoover the FBI Director. . . .

We don’t know anything about the two people that tried to assassinate Donald Trump because our government is corrupt to the core, and that is why the Left is going to resist. Our government needs to be reconstituted. Embedded in government is the Deep State, and it is more powerful than the President.”

Klayman is appealing to the incoming Trump Administration to make him the Czar in charge of picking judicial appointments.

Klayman says too many RINO judges were put on the bench during Trump’s first Administration.

Klayman is also representing Laura Loomer in a $150 million defamation lawsuit against HBO and Bill Maher. Klayman is also the lawyer of record on many other groundbreaking cases. Klayman also talks about the need for donations as the 2024 Election cycle took donations away from FreedomWatchUSA.org. Klayman makes an appeal for badly needed funds so he can continue his work for “We the People” against government corruption.

There is much more in the one-hour in-depth interview.

Join Greg Hunter as he goes One-on-One with renowned lawyer and government corruption fighter, Larry Klayman, founder of FreedomWatchUSA.org as he lays out the evil that criminals on the Left and RINO’s are planning for America.

* * *

Tyler Durden

Sun, 11/17/2024 – 23:20

UK approves record number of asylum seekers claiming to face LGBTQIA+ persecution in their home countries

“While it’s impossible to be sure of the genuineness of applicants claiming asylum based on their sexuality, there are too many examples of our being too ready to give the benefit of the doubt.”

Zelensky says war will come to a ‘faster’ end under Trump’s leadership

“This is the kind of America that Europe needs. And a strong Europe is what America needs, to my mind.”

3D Chess Or 52-Card Pickup

3D Chess Or 52-Card Pickup

By Peter Tchir of Academy Securities

3D Chess or 52-Card Pickup?

3D Chess always makes me think of Star Trek and wonder who the heck thinks that we need a game more complex than chess? 52-Card Pickup is a game most frequently played by siblings, and even then, only once or twice. Typically, the older sibling asks the younger one if they want to play 52-card pickup. Without knowing the game, but excited that their older sibling wants to do anything with them, the younger one instantly agrees. At which point the older sibling throws a deck of cards across the room and yells – there you go, 52-card pickup!

Depending on who you listen to, talk to, or follow, in its first full week, the Trump team is either playing an incredible game of 3D Chess, or is playing the equivalent of 52-Card Pickup with the nation.

It is far too early to say which side is right, and the final answer will likely fall somewhere in the middle. Having said that, there are a few things that have come up consistently in meetings, calls, and interactions with clients.

-

There are various processes in place to effectively protect the system. Could they be bypassed by using Recess Appointments? I have to admit that Congress getting recess, like schoolchildren, has always amused me, but recess appointments would be a very aggressive tactic. They allow Trump to bypass the confirmation process (for up to a year) for some positions, presumably the most difficult/contentious ones. For some reason, this is also “part of the system and process,” so someone must have thought that there was a need for this. To me, this, like many things (including the 2+ month timeframe between the election and the inauguration) is likely a function of how difficult it was to travel across the country back in the day. It will be interesting to see how the appointments go, to say the least.

-

If you are going to try to radically change D.C., often described as “draining the swamp,” it does make sense that non-traditional candidates would be selected. Yes, there are people with more experience than some of the nominees, but are they too close to the system to try and change it?

-

D.O.G.E (the Department of Government Efficiency) has generated a lot of buzz. It seems to be the one thing that everyone is curious about and wants to see how it all plays out (even with a tinge of optimism that some spending can be cut without reducing or hurting services). It is also quite clear that Musk, one of the richest people on the planet, will play a major role in this administration, as a key advisor to President-Elect Trump.

Thinking about this dovetails well with last weekend’s Learning to Speak Trump Again. For better or worse, we should expect D.C. headlines to continue to create volatility for the markets.

Having said that:

-

The 10-year Treasury is back to 4.44%, basically where it closed on November 7th. We’ve had some pretty big swings on a daily and even intraday basis, but wound up unchanged. I remain firmly in the camp that the deficit fears (and concerns about inflation from tariffs) are more than priced in right now.

-

The S&P 500 and Nasdaq 100 are both below where they closed on November 7th (for all the “growth” hype, that certainly grabs your attention). Maybe even more surprising, given the attention, is that the Russell 2000 is back to below its November 7th close, having dropped over 5% since it hit a high on Monday (maybe a good reminder that equity markets should shut down along with the bond market on Veterans Day).

-

Gold was strong into the election, but has faded hard since then. Copper, which should benefit from growth if the “Dr. Copper” people are correct, is down over 12% since the start of the month. Oil has struggled, but energy stocks have done well, with XLE holding onto its gains. This makes some sense (see “Drill Baby Drill” from Fox Business this summer) as energy production should increase, helping to keep energy prices at bay, but creating some potentially strong profit growth.

-

Bitcoin. Bitcoin has been incredibly strong. Yes, some volatility, but it has clung to the idea that a Trump administration will be very positive for crypto in general and Bitcoin (and Dogecoin) in particular. Given how many of the people in Trump’s inner circle are very positive on Bitcoin, it makes sense. On the other hand, Trump doesn’t control Bitcoin at all, and he does seem to like to control things, which may tarnish his current love affair over time. Also, for all the chatter about the U.S. government building up a “Bitcoin reserve” (it is hard to miss it, if you spend any time at all on X), I have not heard from anyone that this is really feasible. Most, which includes me, think that there will be an immense amount of resistance to government adoption (yes on clearer and helpful rules and regulations, but no on adoption by the government). You cannot fight this rally right now and maybe it is 3D Chess being played out, but it has the smell of 52-Card Pickup to me.

-

Many of the Commercial Real Estate ETFs have done poorly. In some cases, they are much closer to their annual lows than highs, even as stocks in general perform well. I think that this is actually a very interesting opportunity as yield fears are overdone, and Work From Home is really going to struggle next year. More and more companies are limiting work from home as they push for a return to the office. That momentum feeds on itself. Many who were afraid to push for work from office will be emboldened. I cannot see a world where the Department of Government Efficiency (I’m not sure it is an actual department, but that doesn’t really matter given the attention that it’s getting) won’t be looking at getting more government workers back into the office. Everyone has focused on the potential for layoffs dragging down D.C.-focused real estate valuations, but I think that net/net over time, it will turn out to be good for D.C. commercial real estate. I see CRE as where I have the biggest difference of opinion with consensus views right now.

One Chart That I Cannot Stop Thinking About

We included this chart in our NFP reaction, but I feel a sense of urgency to highlight it again. Maybe this is our attempt to play 3D Chess, or maybe we are getting ourselves overly wound up about a non-event. Since we often discuss how dubious the Jobs Available calculation is for the JOLTS report, it may seem weird that the QUIT rate, from that same report, has grabbed our attention. My take on the QUIT rate is that it is “crowd sourced” data. Every individual has a pretty good idea about their own job prospects and that gets reflected in the QUIT rate.

During the financial crisis, the QUIT rate didn’t get this low until May 2008. If I remember correctly, we technically were not in a recession at the time, and only later did the powers that be declare that we actually were in a recession. That fits with my view that this rate is important and may have a predictive element to it.

I certainly think that when anyone and everyone felt like they could quit and get a better job, it was extremely difficult for management to take away work from home. I suspect that plans to offer severance packages to reduce the workforce voluntarily (one idea floated around by DOGE) won’t be that effective when workers don’t see outside opportunities readily available (that is my interpretation of the QUIT rate).

If we see a lot of progress made on the “Make America Great” front, this could change abruptly. There might be plenty of new jobs created. There might be jobs that were being done by undocumented workers becoming available. A lot could happen, but so far, I think the outlook on jobs is following the same path as stocks – initial jubilation has turned into a wariness about what might actually be achievable, let alone accomplished.

Bottom Line

Expect more volatility. We are going to get headlines and announcements that are difficult to interpret. What do they really mean? How likely is it to get accomplished? We know this administration is looking for CHANGE, but exactly what type of change they want is still a bit unclear in many areas. What they can achieve is even more unclear.

There is a clear sense of “urgency” as I cannot recollect any other election winner coming out so quickly with so many announcements!

I think we want to “fade” growth. We can buy dips in Treasuries and sell rips in stocks.

Maybe we will get a clearer picture, but I suspect in the coming days and weeks, the market will have more questions than answers. The fact that the original reaction to the election was so strong (with so many shorts being taken out, and so many newly minted bulls emerging) leaves us with potentially treacherous positioning. While legend has it that Wall Street likes to Climb a Wall of Worry, I don’t think it likes the current level of uncertainty. Maybe it is all 3D Chess, and we are just too naïve to see the master plan, or maybe we are all seeing enough things to question how effective this master plan will be?

While I like being overweight duration and underweight equities, I would not be a very aggressive overweight or underweight. It is more of an attempt to trade the volatility that is likely to continue.

On Bitcoin, if I hear one more $1 million price target, my head might explode, but for now, I can’t think of what will slow this down given the team around Trump, but then again, Trump himself might say something showing that he has had a change of heart (which is what I suspect will happen, but it seems too early for that to occur).

I did not focus on inflation, jobs, or other economic data (except to highlight the QUIT rate). I think that the data of the past few months will likely be irrelevant early next year as policies become clear and we can focus on what those policies will do to the economic data, and not worry about economic data that probably reflects a set of policies that will no longer be relevant.

We do get the most important earnings report for the AI story this week. Everything seems rosy in the space, but it is increasingly difficult to guess what has already been priced in.

Good luck and don’t stray too far from the desk, because you never know what headline might come out next! If you missed our Around the World Podcast from earlier in the week, it is a good listen.

Tyler Durden

Sun, 11/17/2024 – 17:30

G7 Vows To Keep Imposing ‘Severe Costs’ On Russia As War Reaches 1,000 Days

G7 Vows To Keep Imposing ‘Severe Costs’ On Russia As War Reaches 1,000 Days

Leaders of the Group of Seven (G7) have issued a Saturday statement vowing to support Ukraine as long as it takes to defeat Russia, vowing to impose severe costs on Moscow, in line with prior Washington statements vowing to ‘weaken’ Russia.

This comes amid growing Western behind the scenes action to engage Putin on the diplomatic front, in response to President-elect Donald Trump preparing to enter the White House, where a top priority is to negotiate a swift end to the war in Ukraine. This coming Tuesday will mark 1,000 days since Russia’s full-scale invasion in February 2022.

“Russia remains the sole obstacle to just and lasting peace,” the new joint statement says. It pledges to support more measures “in support of Kyiv as the thousandth day of Russia’s war of aggression against Ukraine approaches.”

The group major industrial countries consists of the US, France, Canada, Germany, Italy, Japan, and the UK. Currently Italy holds to the rotating presidency.

“The G7 confirms its commitment to imposing severe costs on Russia through sanctions, export controls and other effective measures. We stand united with Ukraine,” the statement added.

The European Union is a ‘non-enumerated’ member of the G7. The European Commission’s chief Ursula von der Leyen issued a simultaneous statement on X saying the “G7 reiterates its unflinching support to Ukraine.”

As we are nearing the 1000th day of Russia’s full-blown war, the G7 reiterates its unflinching support to Ukraine.

We’re committed to continue imposing severe costs on Russia through sanctions, export controls & other measures.

G7 partners stand with the brave Ukrainian nation.

— Ursula von der Leyen (@vonderleyen) November 16, 2024

“G7 partners stand with the brave Ukrainian nation,” von der Leyen concluded, at a moment there is widespread recognition that Russia is steadily advancing in the east, and will soon solidify control over the whole of the Donbass.

On the nuclear front, the Pentagon has issued a more measured and somewhat conciliatory statement in a report to Congress:

“The United States will abide by the central limits of the New START Treaty for the duration of the Treaty as long as it assesses that Russia continues to do so,” the Pentagon said in the report on the nuclear weapons employment strategy of the United States.

The US is also committed to future arms control with its nuclear-armed competitors, but any future accords will “need to account for US deterrence requirements and other strategic threats globally,” the report said.

Since Trump’s election the ratcheting nuclear rhetoric and warnings from the Russian side appear to have cooled. A key rationale of Trump’s team in making the case for a necessary and quick winding down of the war is that the West must avoid nuclear confrontation or a WW3 scenario with Russia at all costs.

War-weary populations across Europe and the West are also in favor of peace, all recent polling shows, and Trump has been given a clear mandate by US voters to seek a diplomatic end to the war.

President Zelensky has also admitted this past week that the war will likely end sooner under Trump. He is pressing for a “just peace” – but is unlikely to assent to anything without firm security guarantees from NATO countries. Still, Zelensky is warning allies not to appease Putin by hasty engagement on the diplomatic front. “What is needed are concrete, strong actions that will force him to peace, not persuasion and attempts at appeasement, which he sees as a sign of weakness and uses to his advantage,” a statement from Zelensky’s office said Friday.

Tyler Durden

Sun, 11/17/2024 – 07:35

Trump Can Help A New Generation Learn To Appreciate Our Veterans

Trump Can Help A New Generation Learn To Appreciate Our Veterans

Authored by Tom Ruck via RealClearDefense,

Following President Donald Trump’s extraordinary victory over Kamala Harris, President Joe Biden addressed the nation. His message was simple: “setbacks are unavoidable, but giving up is unforgivable,” and he concluded by saying, “may God protect our troops.”

Unfortunately for President Biden, however, many people in his party have given up on fighting for America and have even given up on supporting our troops. Indeed, this anti-American and anti-military sentiment in the Democratic party undoubtedly contributed to President Trump’s victory.

This is a shame because veterans represent the very best of America. From the sandy beaches of Normandy and the wet jungles of Vietnam to the hot deserts of Iraq and harsh mountains of Afghanistan, they have fought and died for our freedom. Their courage, honor, and selflessness are unmatched, and they should serve as an example for every American today, especially young people.

With that in mind, in light of this recent Veteran’s Day, it is worth asking what our new president can do to restore a sense of gratitude in all Americans for our military servicemen and women.

There are many answers to that question, of course. For example, his administration could put a stop to the politicization of the military through wokeness, which would ensure that our veterans can be proud of the branches they served. Likewise, President Trump could use his bully pulpit to remind the American people of the virtues of our military men and women. This White House could also revisit its previous plans to build the National Garden of American Heroes, and honor some of our country’s greatest veterans there.

These are all excellent initiatives, but one of the simplest — and subtlest — ways that President Trump can restore respect for our troops and veterans is by preserving and enhancing the beauty of our national cemeteries. The United States and its territories contain 164 national cemeteries. Some are well-known, such as the Arlington National Cemetery and Gettysburg National Cemetery, and others are more inconspicuous, but each cemetery is — in the words of President Lincoln — “hallowed ground.”

My father is buried at Jefferson Barracks National Cemetery in St. Louis, Missouri, so I know from the personal experience of many visits that these cemeteries are more than places of rest — they are the final resting place of our country’s heroes and sacred symbols of American freedom.

We must never forget these men and women. We must also introduce a new generation of Americans to these cemeteries, as I am convinced that walking through those beautiful, straight, uniform rows of fallen soldiers is such a powerful experience that it could make any American grateful for our veterans.

To do this, President Trump cannot only ensure that these cemeteries are well maintained, he can promote programming that introduces Americans — especially young Americans — to the profound sacrifices that sustain our liberty. Hosting more roll-call events, concerts, and other community initiatives can help keep the spirt of service alive in the hearts of all Americans and change the minds of this new generation.

Doing so will not only give veterans the respect and honor they so thoroughly deserve, but it will also make our country better. Gratitude is the character trait that seems to be desperately missing from our national dialogue, but it doesn’t have to be this way. The first step to making America great again is remembering the greatest people in our country’s past: our veterans.

Preserving and enhancing our national cemeteries is an excellent way to do that. Next Veteran’s Day, visit a cemetery near you and say a prayer of thanks for the men and women that gave everything for our freedom.

Tom Ruck is the award-winning author of “Sacred Ground: A Tribute to America’s Veterans.”

Tyler Durden

Sat, 11/16/2024 – 23:20

CHRISSY CLARK: Michigan woman awarded almost $13 million after being fired by BCBS for refusing Covid vaccine

Lisa Domski worked at Blue Cross Blue Shield of Michigan as an IT specialist for 38 years.

BCA: Bitcoin Closes In On $100,000, But The Ultimate Destination Is Over $200,000+

BCA: Bitcoin Closes In On $100,000, But The Ultimate Destination Is Over $200,000+

By Dhaval Joshi of BCA Research

Executive Summary

-

The value of both gold and bitcoin comes from their so-called ‘network effect’.

-

The network effect of both gold and bitcoin comes from the collective belief that they are the non-confiscatable assets to own in a fiat monetary system, as an insurance against hyperinflation, banking system failure, or state expropriation.

-

As global wealth rises, the value of the network effect of both gold and bitcoin will also rise.

-

But as bitcoin takes market share from gold, bitcoin has considerably more upside than gold.

-

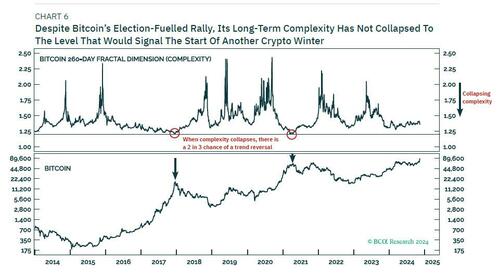

Despite bitcoin’s election-fuelled rally, its 260-day complexity is not yet close to the 1.2 level that would signal the start of another crypto winter.

-

Hence, while we should expect a near-term retracement, bitcoin’s structural uptrend is intact with an ultimate destination of $200,000+

-

10-year T-bonds and Portuguese stocks are tactically oversold.

Back in 2021, I penned a report explaining why bitcoin was headed to $100,000+. Suffice to say, my $100,000+ forecast stirred a hornets’ nest, even here at BCA. The naysayers pushed back hard, claiming that bitcoin was a ‘Ponzi scheme’ or, at the very least, a dangerous bubble.

Yet three years on, my prediction has been vindicated both for its price forecast and its underlying justification. Now, with the bitcoin price closing in on $100,000, is it time to take profits? The answer depends on whether you are a trader or a long-term holder.

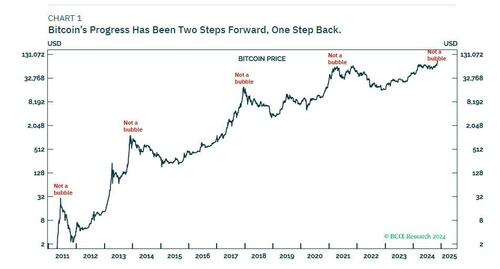

Bitcoin’s progress has always been two steps forward, one step back. After its recent surge, premised on the more ‘bitcoin friendly’ candidate winning the US presidency, we can expect some near-term retracement – as was the case in April this year. On a multiyear horizon though, bitcoin’s structural uptrend is intact and will ultimately take it to $200,000+ (Chart 1).

The Value Of Gold And Bitcoin Come From Their ‘Non-Confiscatability’

To understand the value of bitcoin we must understand the value of gold. With gold predominantly used as jewellery, many people think that the value of gold comes from its properties as a precious metal, especially the chemical inertness that keeps it eternally beautiful. But this is a misunderstanding.

The other precious metals that are gold’s neighbours in groups 10 and 11 of the periodic table – silver, platinum, and palladium – possess identical properties to gold. This means that we can quantify gold’s value as a precious metal as being gold’s relative scarcity versus, say, silver multiplied by the price of silver.

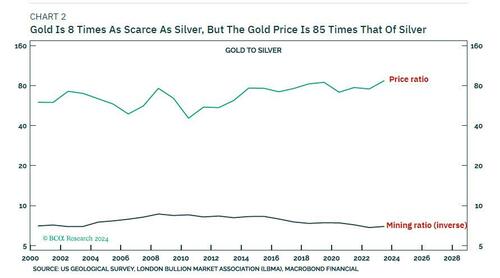

Today, gold is roughly eight times as scarce as silver, so gold’s value as a precious metal is the price of silver, $30/oz, times eight, which equals $240/oz. This comprises just 10 percent of gold’s current market price of $2550/oz (Chart 2).

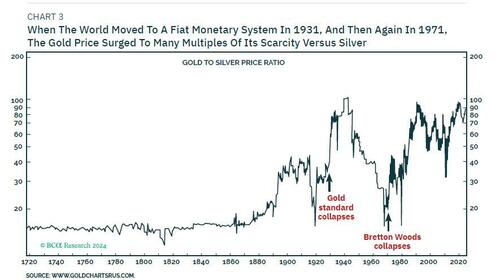

Yet for centuries, the gold price did just equal its scarcity versus silver multiplied by the silver price. The relationship ended only when the world moved to a fiat monetary system in 1931, and then again in 1971. In a fiat monetary system, the gold price surges to many multiples of its scarcity versus silver (Chart 3).

This provides the compelling proof that in a fiat monetary system, most of gold’s value comes not from its use as a precious metal. Most of gold’s value comes from the network of marginal buyers who are holding it for what I call its ‘non-confiscability’. Unlike financial assets, bank deposits, or cash, the state cannot confiscate gold via fiat monetary inflation. This is ensured by gold’s limited supply. Nor can gold be confiscated by the higher risk of a banking system failure that a fiat monetary system aggravates.

Can we justify the price of gold instead by the high cost of mining it? No, the causality runs the other way. The cost of mining gold is driven by its market price, as miners grab the largest share of its selling price that they can.

What about central bank purchases of gold? Central bank reserves also hold gold rather than foreign fiat currencies for gold’s non-confiscatability. A foreign fiat currency can be confiscated via devaluation by its government or central bank, but gold cannot.

All of which brings us to two key points:

First, given that gold’s above-ground market value is $19 trillion,1 the majority, around $17 trillion comes from the network of holders who value gold for its non-confiscatability.

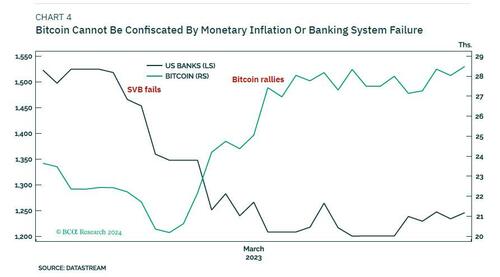

Second, just like gold, bitcoin cannot be confiscated by monetary inflation or banking system failure (Chart 4). Additionally, and

unlike gold, it is difficult for the state to confiscate it by outright expropriation. Yet bitcoin, with a market value of $1.5 trillion comprises less than 10 percent of the total market for non-confiscatable assets. As bitcoin’s share of this market increases, and the supply of bitcoins reaches its upper limit, bitcoin’s price has substantial upside.

The Value Of Bitcoin’s ‘Network Effect’ Has Substantial Upside

In essence, the value of both gold and bitcoin comes from their so-called ‘network effect’. A network effect creates a self-reinforcing cycle of value where each new user makes the network more valuable for everyone.

In the case of both gold and bitcoin, their network effect come from the collective belief that they are the non-confiscatable assets to own in a fiat monetary system. And that a certain proportion of total wealth must be held in these non-confiscatable assets as an insurance against hyperinflation, banking system failure, or state expropriation.

You might ask, what is the difference between a network effect based on collective belief and a Ponzi Scheme? The answer is that a Ponzi Scheme relies on an exponential growth of its network on a promise to get-rich-quick. Once that exponential growth ends, as it must, the value of the network collapses.

By contrast, gold’s network effect has existed in relatively stable form since 1971, and bitcoin’s network effect has existed for over ten years. And their entire raison d’être is an insurance against the get-poor-quick that comes from hyperinflation, banking system failure, or state expropriation.

The upshot is that we can value the gold and bitcoin networks as the product of three terms:

-

Global wealth

-

Global wealth share held in the non-confiscatable asset-class

-

Non-confiscatable asset-class share held in gold/bitcoin

For gold, this means that if global wealth rose by say, 20 percent in the coming 2-3 years and the global wealth share held in the non-confiscatable asset-class held constant, while bitcoin eroded the non-confiscatable asset-class share held in gold from 90 to 80 percent, then the gold price would nevertheless increase by about 7 percent. Under the same premise though, the bitcoin price would increase by about 140 percent3 to $200,000+.

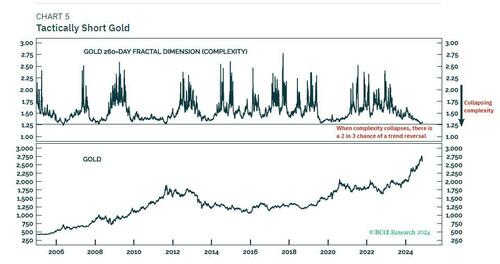

What does our proprietary analysis of price trend complexity reveal for gold and bitcoin? Gold’s 260-day price rally complexity (fractal dimension) recently reached the point of collapse that has reliably signalled tactical retracements. This justifies our current tactical short position in gold (Chart 5).

In the case of bitcoin, its major structural downtrends – so-called ‘crypto winters’ – have started when the preceding rally’s 260-day complexity collapsed to a level of 1.2 (Chart 6).

Despite bitcoin’s election-fuelled rally, its long-term complexity has not collapsed to the level that would signal the start of another crypto winter. Hence, while we should expect a near-term retracement, bitcoin’s structural uptrend is still intact with an ultimate destination of $200,000+.

Tyler Durden

Sat, 11/16/2024 – 17:30

London professor claims geology — the study of rocks — is racist, linked to ‘white supremacy’

Professor Kathryn Yusoff contends that the field of geology is driven by “systemic racism” and has roots in colonialism.

FRONTLINES: Arizona mandates life imprisonment for child sex traffickers

60 percent of Arizona voters supported the proposition on Election Day.