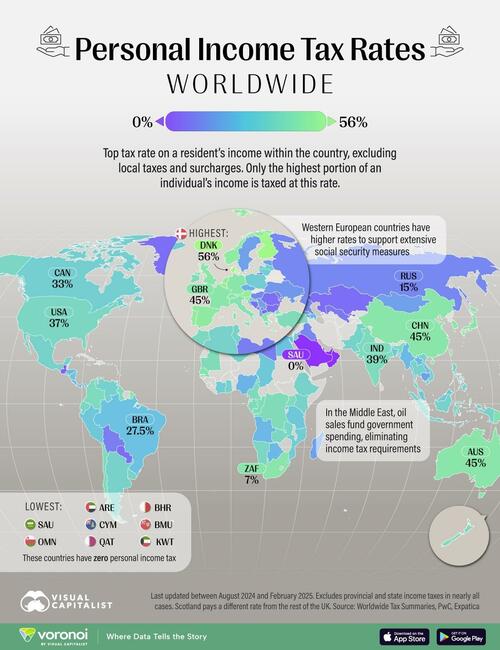

These Are The Nations With The Highest (And Lowest) Marginal Income Tax Rates

These Are The Nations With The Highest (And Lowest) Marginal Income Tax Rates

It’s tax filing time for quite a few countries, as their financial year comes to end.

How differently do countries tax their citizens? Visual Capitalist’s Pallavi Rao took a look at the top marginal individual income tax rates of nearly 150 countries to compare and contrast differences.

Data for this map is sourced from PwC’s Worldwide Tax Summaries, updated between Aug 2024–Feb 2025.

Of course there are limitations to the data. Only the highest portion of an individual’s income is taxed at this rate, and brackets vary significantly on how much money falls into that pool.

Furthermore, property, sales, or other indirect taxes are not included. It also omits state, provincial, and municipal taxes

Ranked: Countries by their Highest Personal Income Tax Rate

Western European countries on average have the highest headline income tax rates in the world.

Per the source, seven countries have a 50%+ top rate, and six of those are in Europe, led by Denmark at 55.9%.

Rank

Country

ISO Code

Headline Personal Income Tax Rate

1

DNK

55.9

2

FIN

55

3

LUX

51

4

AUT

50

5

BEL

50

6

ISR

50

7

SVN

50

8

NLD

49.5

9

PRT

48

10

NOR

47.4

11

ESP

47

12

CHE

45.5

13

AUS

45

14

CHN

45

15

DEU

45

16

FRA

45

17

GBR

45

18

JPN

45

19

KOR

45

20

ZAF

45

21

GRC

44

22

ITA

43

23

SEN

43

24

PNG

42

25

CHL

40

26

COD

40

27

COG

40

28

GAB

40

29

GUY

40

30

IRL

40

31

MRT

40

32

NCL

40

33

TUR

40

34

TWN

40

35

UGA

40

36

COL

39

37

IND

39

38

NZL

39

39

CMR

38.5

40

MAR

38

41

ECU

37

42

NAM

37

43

USA

37

44

ZMB

37

45

URY

36

46

HRV

35.4

47

ARG

35

48

CYP

35

49

DZA

35

50

ETH

35

51

GHA

35

52

IDN

35

53

KEN

35

54

MEX

35

55

MLT

35

56

PAK

35

57

PHL

35

58

THA

35

59

TUN

35

60

VNM

35

61

VEN

34

62

CAN

33

63

LVA

33

64

PRI

33

65

SWZ

33

66

CIV

32

67

LTU

32

68

MOZ

32

69

POL

32

70

ISL

31.35

71

BGD

30

72

JAM

30

73

JOR

30

74

KNA

30

75

MYS

30

76

NIC

30

77

PER

30

78

RWA

30

79

SLV

30

80

TCD

30

81

TZA

30

82

BRB

28.5

83

BRA

27.5

84

CPV

27.5

85

EGY

27.5

86

AGO

25

87

AZE

25

88

BWA

25

89

CRI

25

90

DOM

25

91

GIB

25

92

GNQ

25

93

HND

25

94

LAO

25

95

LBN

25

96

MMR

25

97

PAN

25

98

SVK

25

99

TTO

25

100

NGA

24

101

SGP

24

102

ALB

23

103

CZE

23

104

LIE

22.4

105

IMN

22

106

ARM

20

107

EST

20

108

GEO

20

109

GGY

20

110

JEY

20

111

KHM

20

112

MDG

20

113

MNG

20

114

MUS

20

115

SRB

20

116

SWE

20

117

UKR

18

118

HKG

16

119

HUN

15

120

IRQ

15

121

MNE

15

122

PSE

15

123

RUS

15

124

BOL

13

125

LBY

13

126

MAC

12

127

MDA

12

128

UZB

12

129

BGR

10

130

BIH

10

131

GRL

10

132

KAZ

10

133

MKD

10

134

PRY

10

135

ROU

10

136

TLS

10

137

XKX

10

138

GTM

7

139

ARE

0

140

BHR

0

141

BMU

0

142

CYM

0

143

KWT

0

144

OMN

0

145

QAT

0

146

SAU

0

Note: Denmark’s figure includes a mandatory labor market tax for all wage earners in the country. Scotland pays a different rate than the rest of the UK.

But as always, the fine print contains more useful information. For example, in Denmark, the top bracket for employment income is 15%. However, this combines with the bottom bracket tax and mandatory healthcare and municipal contributions to raise the income tax ceiling. Finally, income from shares and dividends also attracts a high rate of 42%.

In the U.S., the 37% headline rate is only applicable to income above $609,000 for individuals. Of course, U.S. states tax their residents as well.

And finally, several Middle Eastern countries—also oil producers—don’t charge an income tax.

The Pros and Cons of Western Europe’s High Tax Rates

Individual income taxes often make up the largest source of government revenues.

Thus, higher taxes help fund extensive public services like healthcare, education, and social security.

It can also potentially reduce income inequality by redistributing wealth, supporting lower-income citizens, and fostering social cohesion.

However, less disposable income…