Originally_Posted_At_Doomcocks_YouTube_Channel

Year: 2024

NewsWare’s Trade Talk: Friday, November 8

S&P Futures are flat to lower in a reaction to corporate earnings. On the earnings front ABNB, ANET, ARRY, DKNG, FTNT, AKAM & TTD are moving lower after announcements. China announced a new stimulus plan which focuses in on debt refinancing. NVDA & SHW ar added to the Dow Jones Industrial Average replacing INTC & DOW. Fed Speaker on watch today as the FOMC announced its 25 basis point rate reduction yesterday. In Europe, stocks are lower as China’s stimulus announcement was not as powerful as expected. Oil prices are lower as concerns on a Hurricane in the Gulf of Mexico are falling.

NewsWare’s Trade Talk: Thursday, November 7

S&P Futures are displaying gains this morning after yesterday impressive rally. The markets are awaiting a monetary policy decision from the FOMC today. On the earnings front APP, ELF, LYFT, MCK, QCOM, DDOG & RL are higher after announcements. After the bell today, ANET, ABNB, TTD, SQ, DKNG & RIVN are scheduled to release. Data on Jobless Claims & 3Q Productivity & Cost to be released before the opening bell. In Europe, stocks are higher, The FTSE is only showing a minor gain ahead of today’s BOE decision. Oil prices are showing some weakness this morning.

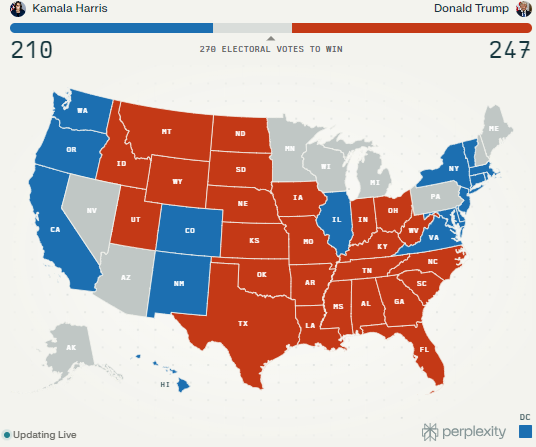

U.S. General Election 2024 Map

Here is a link to the perplexity AI’s Election map: https://tinyurl.com/37x64nzd

Just Too Damn Good Not To Share!

Originally Posted at Dr Phoxotic’s You Tube Channel Links Buy me a coffee? 😀 paypal.com/paypalme/phoxotic Twittertwitter.com/Phoxotic Tiktoktiktok.com/@dr_phoxotic Instagraminstagram.com/dr.phoxotic

NewsWare’s Trade Talk: Friday, November 1

S&P Futures are higher this morning in reaction to earnings reports. AMXN, INTC, CVX, CAH and XPM are higher after earnings, AAPL is lower as the street was not impressed with their forward guidance. Today attention will be on the Non-Payrolls report which is expected to come in lower from the Sept figures which would be positive for the markets as it would provide additional confidence for a rate cut next week by the Fed. Shares of Boeing are active as the company has issued a new proposal in an effort to end strike. Vote is Monday and appears likely to pass. Markets will soon start to display caution ahead of the election. The race is too close to call and markets do not like uncertainty. In Europe, markets are rebounding with all three major indexes in the green. Oil prices are spiking higher on reports that Iran is planning retaliatory strikes in the next few days.