Value Of US Housing Hits Record $50 Trillion, Up 7% In Past Year, Just In Time For Fed Rate Cuts

The Fed’s rate hikes were supposed to slow down the economy and, thanks to soaring interest rates, lower prices and make housing more affordable. That did not happen, and instead housing is now the least affordable it has been in US history.

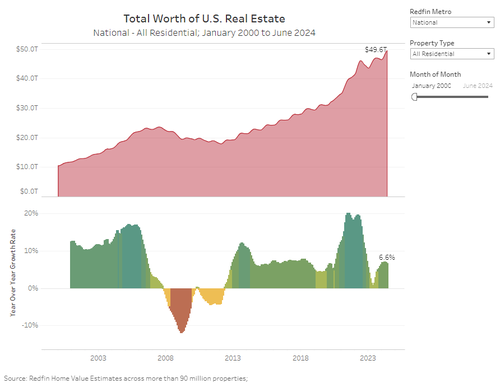

And while an entire generation of potential buyers will be forced to rent indefinitely, the flip side is that anyone who has been lucky enough to buy a house, is celebrating on a day real-estate brokerage Redfin reports that the total value of U.S homes gained $3.1 trillion over the past 12 months to reach a record $49.6 trillion.

In percentage terms, the total value of the US housing market grew 6.6% year over year, laughing in the face of a Fed chair who kept on hiking rates in hopes of lowering prices. Zooming out further, the total value of U.S. homes has more than doubled in the past decade, climbing nearly 120% from $22.7 trillion in June 2014.

“The value of America’s housing market will likely cross the $50 trillion threshold in the next 12 months as there are not enough homes being listed to push prices down,” said Redfin Economics Research Lead Chen Zhao. “Mortgage rates have started falling, but many potential sellers and buyers are waiting to make a move, meaning we are likely to continue seeing a pattern where prices slowly tick up. That’s great news for the millions of American homeowners who see their equity rising, but first-time buyers are going to keep finding it tough to find an affordable home.”

That, of course, is an understatement: what Zhao meant is that for millions of Americans, the dream of owning a home is now gone for ever, because if they couldn’t afford to buy a house during the most aggressive rate hike cycle since Volcker, the coming rate cuts will certainly not make it easier.

The number of metros where the total value of homes topped $1 trillion grew to eight—doubling from four a year ago—with Anaheim, CA, Chicago, Phoenix and Washington, DC, joining New York, Los Angeles, Atlanta and Boston in the trillion-dollar club. San Diego and Seattle look like they will join them in the next 12 months if home values keep increasing at a similar pace.

It’s worth noting that while San Francisco’s aggregate home value is roughly $700 billion, when combined with neighbors Oakland, CA, and San Jose, CA, the combined Bay Area housing market is worth nearly $2.5 trillion. Likewise, the combined Dallas ($734 million) and Fort Worth, TX ($294 million) metro area also surpasses the $1 trillion mark.

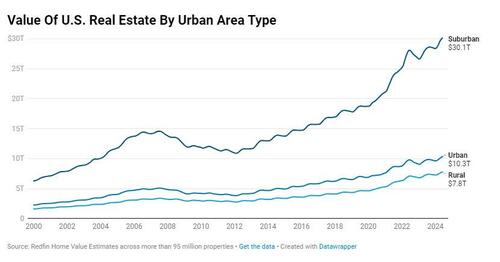

Rural home values outpaced those in urban areas and the suburbs, jumping 7% year over year to $7.8 trillion. The total value of homes in urban areas rose 6% to $10.3 trillion, while the value of homes in the suburbs cracked the $30 trillion mark for the first time, increasing 6.8% to $30.1 trillion.

There are around 57 million homes in the suburbs, compared to 22 million in urban areas and 21 million in rural areas.

Thirteen major metros posted double-digit percentage gains in total property value over the last year, led by relatively-affordable New Jersey metros within commuting distance of New York, where property is more expensive. The value of properties in New Brunswick, NJ rose 13.3% to $582.6 billion, while Newark, NJ climbed 13.2% to $406.2 billion. Anaheim, CA (up 12.1% to $1.1 trillion), Charleston, SC (up 11.8% to $188.9 billion) and New Haven, CT (up 11.8% to $91 billion) rounded out the five metros with the highest gains.

Cape Coral, FL was the only metro to record a fall in total home value, dropping 1.6% to $204.2 billion. Sun Belt metros—especially those in Texas—grew slower than those in other regions, with New Orleans (up 0.8% to $128.2 billion), Austin, TX (up 1.9% to $392.8 billion), North Port, FL (up 2.1% to $251.8 billion) and Fort Worth, TX (up 2.3% to $293.7 billion) rounding out the bottom five metros.

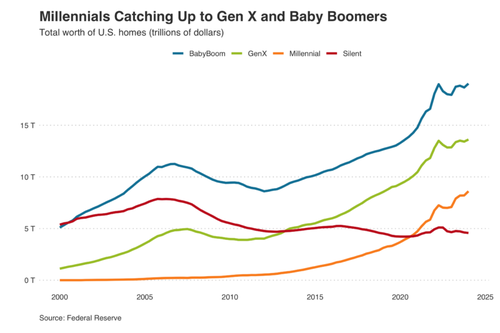

Broken down by age group, the total value of homes owned by millennials rose 21.5% year over year to $8.6 trillion in the first quarter of 2024—the most recent period for which generational data is available—nearly four times as fast as any other generation.

The increase is partly due to the overall growth in home prices, but also because millennials are now the largest generation by population and have reached an age and financial position where they make up a larger share of the homebuying market. Around two-thirds of the mortgages taken out in 2023 were issued to homebuyers under the age of 45.

Meanwhile, the total value of homes owned by the Silent Generation fell for the fifth straight quarter, dropping 1.6% to $4.6 trillion. The value of homes owned by baby boomers increased 6.1% to $19 trillion, while Gen X home values rose 5.9% to $13.6 trillion.

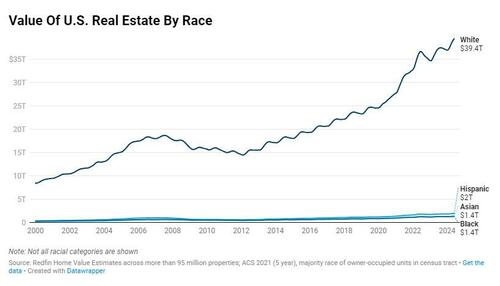

Finally, Asians once again made the best decisions, and after falling in 2022-2023, the total value of homes in neighborhoods that are majority Asian bounced back over the past 12 months, rising 9% to $1.4 trillion. The increased value is being caused by price growth in West Coast cities—where many Asian neighborhoods are located. In comparison, majority white neighborhoods experienced a 6.6% increase in value to $39.4 trillion, while majority Black neighborhoods saw a 5.4% increase in value to $1.4 trillion. The value of homes in majority Hispanic neighborhoods increased 6.4% to $2 trillion.

More in the full report available here.

Loading…

Originally Posted at; https://www.zerohedge.com//

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

Trump: Harris ‘Not Smart Enough to Do a News Conference’

Former President Donald Trump on Thursday mocked Vice President Kamala Harris’s apparent strategy of avoiding unscripted interviews as the Democrat nominee.

Harris has not given one interview or press conference since she joined the presidential race 18 days ago and may continue to avoid the press until Labor Day, 25 days away, a longtime Harris ally told Politico’s West Wing Playbook on Wednesday.

When was the last time Kamala Harris held a solo press conference? Nov. 12, 2021 in France?

— Charlie Spiering (@charliespiering) August 8, 2024

“Excuse me, what are we doing right now? Trump questioned during a press conference at Mar-a-Lago. “She’s not doing any news conference.”

“You know why she’s not doing it? Because she can’t do a news conference,” Trump said. “She doesn’t know how to do a news conference. She’s not smart enough to do a news conference.”

“I’m sorry,” Trump continued. “We need smart people to lead this country because our country has never been in this danger before, both economically and from an outside from an outside perspective.”

NOW – Trump says Kamala Harris is “not smart enough to do a news conference.” pic.twitter.com/rQKVKDZ6zI

— Disclose.tv (@disclosetv) August 8, 2024

Harris is starting to face more questions about why she isn’t doing more press, which are only bound to grow louder. Our West Wing Playbook colleagues report that her campaign is thinking about setting up a big joint interview with her and Walz — but they’re generally skeptical that such moments provide much electoral value.

Harris, known for word salads, committed two gaffes in August when speaking off-script. She accidentally called herself “president” during the late Rep. Sheila Jackson Lee’s eulogy and delivered a word salad during an unscripted comment about a hostage deal with Russia.

“This is just an extraordinary testament to the importance of having a president who understands the power of diplomacy and understands the strength that rests in understanding the significance of diplomacy…” she rambled.

More Harris word salads are here.

Harris could be avoiding the media out of fear of answering questions about her radical-left policies. Harris already appears to be backpedaling on many policies she previously championed, raising concerns about whether voters can trust her. Neither Harris nor campaign aides have yet to fully embrace the changed policy positions in on-the-record, public statements.

President Trump addresses sanctuary cities in final question of Mar-a-Lago press conference pic.twitter.com/wxNPUn7M0b

— RSBN 🇺🇸 (@RSBNetwork) August 8, 2024

Wendell Husebo is a political reporter with Breitbart News and a former RNC War Room Analyst. He is the author of Politics of Slave Morality. Follow Wendell on “X” @WendellHusebø or on Truth Social @WendellHusebo.

Originally Posted At www.breitbart.com

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

Flying’s never been safer, says MIT study

Flying can be a nerve-wracking experience for many people — but a new study out Thursday finds commercial air travel keeps getting safer, with the risk of death halving every decade.

The fatality rate fell to 1 per every 13.7 million passenger boardings globally in the 2018-2022 period, a major improvement from 1 per 7.9 million boardings in 2008-2017, according to a paper by researchers from the Massachusetts Institute of Technology (MIT).

It’s also a far cry from the dawn of commercial air travel: fatalities per passenger were 1 per 350,000 boardings in 1968-1977.

“Aviation safety continues to get better,” said MIT professor Arnold Barnett, who co-authored the research that appeared in the Journal of Air Transport Management, adding the chance of dying “continues to go down by a factor of two every decade.”

Barnett compared the trend to “Moore’s Law,” the famous prediction by Intel founder Gordon Moore that the computing power of chips doubles roughly every 18 months.

From 1978-1987 the risk of dying was 1 per 750,000 boarding passengers; from 1988-1997 it was 1 per 1.3 million; and in 1998-2007, 1 per 2.7 million.

The last major commercial airline disaster in the United States was in 2009, when Colgan Air flight 3407 crashed, killing 50 people.

Barnett cautioned however that ongoing progress is not assured. Recent near-collisions on US runways this year have made headlines, while federal investigators have been pressing Boeing on why a door-plug aboard a 737 MAX 9 aircraft came off mid-flight on an Alaskan Airlines plane in January.

Headline numbers also obscure vast global disparities in air safety, with the study dividing countries into three tiers based on their safety records.

The top tier includes the United States, European Union countries and other European nations including Montenegro, Norway, Switzerland, and the United Kingdom. Australia, Canada, China, Israel, Japan and New Zealand round out this group.

Tier two consists of Bahrain, Bosnia, Brazil, Brunei, Chile, Hong Kong — counted distinctly from China — India, Jordan, Kuwait, Malaysia, Mexico, the Philippines, Qatar, Singapore, South Africa, South Korea, Taiwan, Thailand, Turkey and the United Arab Emirates.

The world’s remaining countries fall into tier three. Encouragingly, although the risk of dying is far greater in these countries, their air travel fatalities per boardings were also cut roughly in half during the 2018-2022 period.

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

Ghana opens new gold refinery

Ghana on Thursday opened a new gold refinery, the first of its kind in West Africa, to bring more value from the natural resource and solidify its standing as continent’s top gold producer.

The Royal Ghana Gold Refinery is set to become only the second in Africa to achieve the prestigious London Bullion Market Association (LBMA) Good Delivery Bar Certification.

The state-of-the-art refinery, located in Accra, was commissioned on Thursday by Vice President Mahamudu Bawumia, who hailed it as a “historic achievement… towards economic transformation and industrialisation.”

The refinery, a partnership with the Bank of Ghana and Rosy Royal Minerals Limited, has the capacity to refine up to 400 kilogrammes of gold per day.

This amounts to an annual capacity of 120 tons, sufficient to process all of Ghana’s gold production, which averages around four million ounces per year.

Currently, Ghana’s gold is exported in unprocessed form, meaning the country misses out on significant revenue that could be retained through local refining.

Finance minister Mohammed Amin Adam said while gold accounts for approximately 96 percent of Ghana’s minerals exports, the raw state of the commodity limits the country’s revenue potential.

“The new refinery opens many doors for economic transformation by creating jobs that will have a multiplying effect on the local economy,” he said.

Ghana is Africa’s leading gold producer, with the precious metal accounting for over half of the country’s total exports.

In the first half of 2024, gold exports soared, driven by a surge in global gold prices and increased production.

The spike in prices, which saw gold reach a record $2,338 an ounce in the second quarter, contributed to gold exports totalling $5bn, or 54 percent of the country’s total exports.

Illegal mining has been a major problem of the West African country as it tries to address environmental degradation and pollution of water bodies.

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

Taking Back Economics Education

I am excited to announce our next major project here at the Mises Institute, the Lessons for the Young Economist video series. This will be designed for homeschoolers and young people. It will be something they will actually want to watch! And with the Mises Institute’s name on it, parents, grandparents, and educators will know they can trust the content.

The latest estimates reveal that nearly 2.7 million students have exited government public schools. These students’ families have rejected the state’s indoctrination and now they need solid instructional materials, especially in economics.

Early in my university teaching career (which started in 1979), I noticed that the campus Marxists would essentially prey on the students they perceived to be the most gullible and easiest to manipulate. These predators included professors and various on-campus bureaucrats, and the predation began with the so-called freshman orientation. Freshman indoctrination would be more accurate. They would preach socialism to the students, never mentioning the realities and actual history of socialism but instead spinning tall tales of utopian nirvana.

One student told me that in his junior year of a liberal arts curriculum, he had been assigned The Communist Manifesto to read in four different classes. Capitalism was of course condemned as immoral and an enemy of ordinary people, and economics and economists were dismissed as tools of capitalism.

Some students arrived on campus open-minded and eager to learn about the world. But they were captured by the campus Marxists and turned into miniature versions of their perpetually angry leftist professors, who were political activists first and scholars a faint and distant second. You probably saw thousands of them on TV participating in the “antifascist” riots of the summer of 2020. Over the past twenty years, I have noticed that there is less and less need to indoctrinate the incoming freshmen; they have already been thoroughly indoctrinated by their K-12 education.

If you’re wondering why some opinion polls show that more than half of today’s college students claim to prefer the economic hell and impoverishment of socialism to economic freedom and capitalist prosperity—that they prefer omnipotent government to freedom—look to the last sixty years of intense socialist indoctrination at all levels of schooling.

This is the legacy of the “counterculture” of the 1960s, which was itself a product of the liberal educational bureaucracy. Indeed, in his day, Ludwig von Mises called universities “nurseries of socialism.” He added, however, that there has always been a remnant of students who question their professors’ advocacy of socialism and interventionism and educate themselves in economics and economic reality.

We at the Mises Institute are devoted to increasing the size and influence of this remnant. The Lessons for the Young Economist video series is aimed at homeschoolers—and indeed young people anywhere.

The project consists of a series of 15–20-minute videos inspired by Dr. Milton Friedman’s 1979 Free to Choose television series that aired on PBS. Directed by Dr. Jonathan Newman and based on Dr. Bob Murphy’s textbook, Lessons for the Young Economist, these short videos will consist of discussions and interviews shot in a relaxed classroom atmosphere.

Bob Murphy’s book has twenty-three chapters, and our plan is to produce a short video for each one. Each video will be free to all students, parents, grandparents, and everyone interested in learning about economics.

Economics education is essential if the next generation is to be saved from the clutches of the conniving commies on campuses, in the teachers’ unions, and throughout society. These videos will educate students in the economics and realities of economic freedom, socialism, and interventionism. They will teach them the economic way of thinking, which will benefit them for their entire lives and prevent them from being bamboozled into supporting the destruction of their own livelihoods.

There’s no organization better equipped to educate students and parents in economics than the Mises Institute. We know we can do this. Our Beginners video series (mises.org/begin) had over five million views just last year. We’re on to something big, and now is the time to keep our foot on the gas!

We need your help to fight this battle. Please join our effort to educate America’s youth in the economics of freedom by donating whatever you can to this important project. Thanks for your consideration.

Originally Posted at https://mises.org/

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

Americans are poorer: the United States Misery Index rises again

I frequently receive comments about the strength of the United States economy and the unfairness of perceiving things as less than stellar. Is it really the “strongest economy ever”? It’s evident that it’s far from being the “strongest economy ever.”

The United States unemployment rate has risen to 4.1%, the highest in three years, which is also significantly higher than the level seen in 2019. In June, a 70,000 increase in government jobs boosted payroll employment by 206,000. One-third of job creation is public sector jobs paid with more debt. Both the employment-to-population ratio and the labor force participation ratio are below the pre-pandemic level, and immigrants account for all the labor force growth since the pandemic, according to the Bureau of Labor Statistics and Ned Davis Research.

Inflation remains persistent and citizens have lost more than 24% of their purchasing power since 2019, with a 0.6% negative real wage growth in the January 2021–June 2024 period. Real wage growth in 2024 is rising only 0.8% year-on-year.

This shows why the United States Misery Index is rising to 7.4% in June from 6.8% in January. The Misery Index, which measures unemployment and inflation, bottomed out at 6.8% in 2023 and has been worsening since then. Furthermore, the index is far away from the pre-pandemic level of 5.4%.

All these measures allow us to understand why Americans are negative about the economy. Despite messages of redistribution, social policies, and equality, the average citizen is poorer, and only the wealthy have been able to improve their position and navigate high rates and inflation thanks to investments in the stock market. While this shouldn’t come as a surprise, it’s important to remember. There is nothing social about increasing debt, deficit spending, and taxes.

The problem for most Americans is that it is increasingly difficult to make ends meet despite record government spending, or because of its negative impact on inflation and taxes.

There is a reason why we should be worried about rising discontent and impoverishment. The placebo effect of government spending on GDP is declining. Real gross domestic income (GDI) increased by 1.3 percent in the first quarter, a downward revision of 0.2 percentage points from the previous estimate and a market slowdown. The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased by 1.4 percent in the first quarter, according to the Bureau of Economic Analysis.

If we look forward, Americans are going to have to choose between two options: further impoverishment with Keynesian policies or making a dramatic pro-growth turn where policy is targeted at improving disposable income, increasing investment, and strengthening productivity and real economic growth.

We know that it will be impossible to cut the current deficit with tax hikes. There is no revenue measure that will generate two trillion U.S. dollars per year, and it is impossible to increase taxes further without punishing investment. The problem in the United States is mandatory spending, as the CBO expects outlays to reach 24.9% of GDP in 2036, while revenues will reach a record but insufficient 18%. If the Federal Reserve continues to monetize debt, Americans will suffer from the inflation impact as well as the rising cost of housing. The U.S. dollar’s purchasing power will continue to decline. However, it is easier to create two trillion U.S. dollars of productive GDI than to tax two additional trillion dollars per year out of the existing fiscal base.

Yes, the only solution for the United States is pro-growth, pro-business policies that defend the purchasing power of the U.S. dollar. So-called social policies have only made everyone poorer and hurt the middle class.

Originally Posted at https://mises.org/

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

NewsWare’s Trade Talk: Thursday, August 8 | NewsWare‘s Trade Talk

S&P Futures are lower this morning as the market awaits this morning Jobless Claims report. JP Morgan CEO Jamie Dimon remain positive on economy, remains cautious on inflation hitting 2% in the Feds timeframe. Earnings from LLY came in better than anticipated, company also raised guidance. Warner Brothers (WBD) is writing down the value of its traditional tv networks by 9.1b. In Europe, stocks are lower, and oil prices are moving slightly lower after yesterday’s big gains.

Home for this information is at NewsWare‘s Trade Talk homepage at this link

Stay Updated with News.FreePtomaineRadio’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

What’s the Real Story Behind the Market’s Crazy Week

On this episode of Radio Rothbard, Ryan McMaken and Tho Bishop are joined by friend of the show, Peter St. Onge. The three recap the highs and lows of the past week, look at the real state of the economy, and why Americans are forced to care about Japanese monetary policy.

“A Fed rate cut will not solve our economic problems” by Connor O’Keeffe: https://Mises.org/RR_198_A

“Is it Black Monday or Another 2008?” by Peter St. Onge: https://Mises.org/RR_198_B

Follow Peter on X: https://x.com/profstonge

Subscribe to Peter’s Substack: https://www.profstonge.com

Get free copies of What Has Government Done to Our Money? at https://Mises.org/RothPodFREE

Get your ticket to Elections and the Economy: Do They Really Matter? in Fort Myers, Florida: https://Mises.org/Myers

Registration for the 2024 Mises Institute Supporters Summit is open for Mises Members: https://Mises.org/SS24

Be sure to follow Radio Rothbard at https://Mises.org/RadioRothbard

Radio Rothbard mugs are now available at the Mises Store. Get yours at https://Mises.org/RothMug

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard.

Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order. We believe that our foundational ideas are of permanent value, and oppose all efforts at compromise, sellout, and amalgamation of these ideas with fashionable political, cultural, and social doctrines inimical to their spirit.

Originally Posted at https://mises.org/

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

NewsWare’s Trade Talk: Wednesday, August 7 | NewsWare‘s Trade Talk

S&P Futures are positive as global sentiment turns bullish after positive comments from a BOJ official. The BOJ official essential said that no immediate tighten action should be expected, the will reduce the market volatility caused by the carry trades. Seeing Positive earnings announcements for DIS, LPX & LRN. ABNB and SMCI were underwhelming. Markets could see another bout of volatility later this month with the Jackson Hole conference set to take place. In Europe, stocks are higher and oil prices are displaying strong gains.

Home for this information is at NewsWare‘s Trade Talk homepage at this link

Stay Updated with News.FreePtomaineRadio’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

NewsWare’s Trade Talk: Tuesday, August 6 | NewsWare‘s Trade Talk

S&P Futures are displaying a move higher this morning as Japan’s markets gained +10% overnight. No fundamental changes overnight, and Fed officials talked down the sensationalized stories related to a pending recession. Positive earnings announcements for CAT, H, OC. TAP & UBER this morning. Google lost lawsuit as judges calls in a monopoly. Russia top defense officials are said to be in Iran meeting with Iranian military leaders. In Europe, markets are moving between gains and losses. Oil prices are moving higher as Middle East tensions are elevated.

Home for this information is at NewsWare‘s Trade Talk homepage at this link

Stay Updated with News.FreePtomaineRadio’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers: