S&P Futures are trending higher this morning as the market prepares for this afternoon announcement on monetary policy from the Fed. No changes in rates or Dot Plot expectations are likely. President Trump’s pending tariff action remains a key pending factor for the economy which Fed Chairman Powell will likely avoid commenting on during his press conference. President Trump is scheduled to meet with top U.S. oil executives today to discuss boosting domestic energy production. ADSK is higher as Starboard Value is expected to launch a proxy fight. Fitch Ratings lowered its outlook on global growth & raised its inflation expectations for the U.S. SIG is higher after its earnings release this morning. After the bell today, FIVE will report and tomorrow morning ACN, DRI, FDS & JBL are scheduled to report.

Economics

Chatting with A Dead Economist: Charles Rist

Charles Rist was an economist of nearly a century ago who recognized the dangers behind President Franklin Roosevelt‘s attempts to demonetize gold. We are still paying the price for FDR‘s actions.

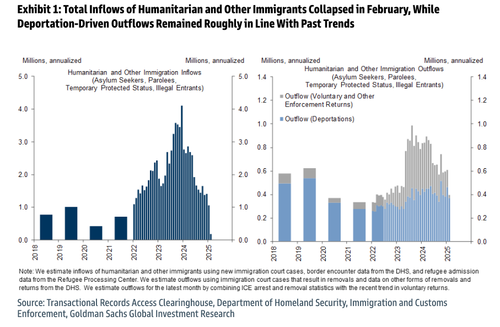

Goldman Slashes US Immigration Forecast As ‘America First’ Agenda Takes Hold

Goldman Slashes US Immigration Forecast As ‘America First’ Agenda Takes Hold

Vice President JD Vance spoke earlier to companies working “in the national interest” at the American Dynamism Summit, sponsored by venture capital firm Andreessen Horowitz. In his address, he highlighted the significant progress achieved in just two months under a competent administration in securing the southern border and strengthening national security—following the previous administration’s globalist policies that sparked an illegal alien invasion crisis.

“Last month, migrant crossings were down 94%, to their lowest number all time, and that happened just in two months of serious border enforcement… Last month, for the first time in over a year, the majority of job gains went to American citizens born on US soil,” VP Vance told the crowd at the summit in Washington, DC, earlier this morning.

.@VP: “Last month, migrant crossings were down 94%, to their lowest number all time, and that happened just in two months of serious border enforcement… Last month, for the first time in over a year, the majority of job gains went to American citizens born on U.S. soil.” pic.twitter.com/syjhDBXeVi

— Rapid Response 47 (@RapidResponse47) March 18, 2025

Providing more context on VP Vance’s immigration figures, analysts from Goldman, including Jan Hatzius, Alec Phillips, and others, stated that US immigration policy has tightened significantly over the past two months, reducing the annualized inflow of humanitarian and other non-visa immigrants from 1.4 million to 200k. They noted that while deportation levels remained stable, total net immigration fell from 1.7 million in December to 700k in February.

Given the faster-than-expected decline in immigration, the analyst expects net inflows to reach 500k by the end of the year, down from a previous estimate of 750k. The contribution of immigration to labor force growth is also expected to slide and provide more job opportunities for Americans.

Further color from analysts…

How Much Has Immigration Fallen Since the Inauguration?

Immigration policy in the US tightened considerably in the first two months of 2025. We estimate that this resulted in a decline in annualized inflows of humanitarian and other immigrants (asylum seekers, parolees, people receiving temporary protected status, and illegal entrants; this includes all immigrants other than visa and green card recipients) to an annualized 0.2mn in February, down from 1.4mn in December 2024 (left, Exhibit 1).

While official statistics from Immigration and Customs Enforcement (ICE) show a moderate increase in arrests of unauthorized immigrants since early January, the increase has not led to a notable change in the number of deportations. The right side of Exhibit 1 shows that total immigrant outflows due to deportations remained in line with past trends. The number of outflows due to voluntary and other enforcement returns—which tend to be proportional to immigration inflows—declined over the past two months as inflows moderated.

Even though the number of deportations did not increase meaningfully, the sharp decline in immigration inflows still brought net immigration into the US down to an annualized pace of 0.7mn in February, from 1.7mn in December 2024 (Exhibit 2).

In our prior report, we highlighted the risk that the…

US attorney general calls Tesla vandalism ‘domestic terrorism’

US Attorney General Pam Bondi said a recent spate of attacks on Tesla property, owned by key Donald Trump ally Elon Musk, was akin to “domestic terrorism” and vowed to impose severe punishments on perpetrators. “The swarm of violent attacks on Tesla property is nothing short of domestic terrorism,” Bondi said in a statement Tuesday. […]

The post US attorney general calls Tesla vandalism ‘domestic terrorism’ appeared first on Insider Paper.

The Delusional Dating Mindset Of Today’s Women

Originally posted at MenNeedToBeHeard YouTube Channel

About

Raising Awareness on the many issues affecting men & boys in today’s society

including the societal and media bias against men, the issues father’s face, dating & relationships, men’s mental health issues, & other issues that affect men such as men’s mental health, homelessness, family court bias, & sadly men un-aliving themselves

Join our Brotherhood of Men Patreon Group: https://www.patreon.com/MenNeedToBeHeard

Follow us:

Instagram: https://www.instagram.com/menneedtobeheard/

Tik Tok: https://www.tiktok.com/@menneedtobeheard3

Twitter: https://twitter.com/MenNeed2BeHeard

Facebook: https://www.facebook.com/MenNeedToBeHeard/

Don’t Forget to Subscribe!

Disclaimer:

Some of these links go to one of my websites and some are affiliate links where I’ll earn a small commission if you make a purchase at no additional cost to you.

The information provided on this website or in any video does not, and is not intended to, constitute legal or theraputic advice.

Links:

Patreon Group

patreon.com/MenNeedToBeHeard

TikTok

tiktok.com/@menneedtobeheardtoo

Instagram

instagram.com/menneedtobeheard

Twitter

twitter.com/MenNeed2BeHeard

Facebook

facebook.com/MenNeedToBeHeard

Trump Adopts the Democrats’ Terrible Yemen Policy

While the Trump administration claims it is breaking with the policies of Joe Biden, it is continuing US attacks on the Houthis of Yemen supported by the previous president.

Europe Goes Full Totalitarian And Puts The Entire Western World At Risk

By Brandon Smith It’s happening again. Europe is once again going totalitarian and this time there’s a decidedly familiar communist…

The post Europe Goes Full Totalitarian And Puts The Entire Western World At Risk appeared first on Alt-Market.us.

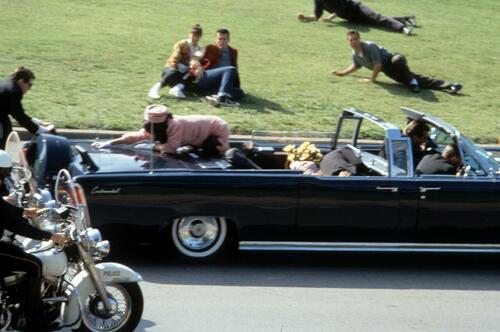

JFK Files Released… Here They Are

JFK Files Released… Here They Are

Update (2120ET): Roughly 80,000 pages of JFK files have finally been released in the form of 1,123 PDF files on the National Archives website, after President Donald Trump announced on Monday that they would be made public.

Click Here to access

“So, people have been waiting for decades for this, and I’ve instructed my people… lots of different people, [director of national intelligence] Tulsi Gabbard, that they must be released tomorrow,” Trump said during a visit to the Kennedy Center in Washington.

“You got a lot of reading. I don’t believe we’re going to redact anything. I said, ‘just don’t redact, you can’t redact.'”

The files, so far, still point to Lee Harvey Oswald as the culprit. That said, Jefferson Morley, VP of the Mary Ferrell Foundation, said in a statement that it’s still missing a lot of information…

“The first JFK files release of 2025 is an encouraging start. We now have complete versions of approximately a third of the redacted JFK documents held by the National Archives (1,124 of approximately 3,500 documents ). Rampant overclassification of trivial information has been eliminated and there appear to be no redactions, though we have not viewed every document. Seven of ten JFK files held by the Archives and sought by JFK researchers are now in the public record. These long-secret records shed new light on JFK’s mistrust of the CIA, the Castro assassination plots, the surveillance of Oswald in Mexico City, and CIA propaganda operations involving Oswald. The release does not include two thirds of the promised files nor any of 500-plus IRS record, nor any of the 2,400 recently discovered FBI files. Nonetheless, this is most positive news on the declassification of JFK files since the 1990s.”

A few notable findings:

Cuban diplomats initially assumed the CIA killed JFK in order to get revenge on the botched Bay of Pigs invasion.

“If the Yankees or CIA assassinated Kennedy to resume the assault on Cuba, then a third world war would start,” one diplomat said, according to journalist Sean Davis.

In a separate deposition, one American intelligence operative noted that multiple CIA assets connected to a particular CIA agent had been spreading “misinformation” that Cuba was behind the assassination in the immediate wake of JFK’s murder. -Sean Davis, X

Upon learning of JFK’s assassination, Cuban diplomats immediately assumed the CIA killed JFK for the purpose of finishing what it started with the Bay of Pigs invasion: “If the Yankees or CIA assassinated Kennedy to resume the assault on Cuba, then a third world war would start.”… pic.twitter.com/nZQhWEWUSU

— Sean Davis (@seanmdav) March 19, 2025

A topic of note is Lee Harvey Oswald’s trip to Mexico City just months before the assassination.

Oswald visited the Soviet embassy in Mexico, looking for a visa, and his request was handled by a loose-cannon USSR intelligence officer.

Oswald was presumably looking for a visa to… pic.twitter.com/udnnFBfyZx

— Clandestine (@WarClandestine) March 19, 2025

This file has CIA, FBI and Secret Service interviews.

* * *

Save 25% on one of ReadyWise’s most popular products:

Click pic… add to cart… enjoy!

Here’s…

US threatens ‘severe’ sanctions if Venezuela refuses migrants

US Secretary of State Marco Rubio on Tuesday threatened new sanctions against Venezuela unless its leftist President Nicolas Maduro agrees to accept citizens deported by Washington. US President Donald Trump over the weekend invoked rare wartime legislation to fly more than 200 alleged members of a Venezuelan gang to El Salvador, which has offered to […]

The post US threatens ‘severe’ sanctions if Venezuela refuses migrants appeared first on Insider Paper.

No Ladies… It’s Not Men Making You Do It!

Originally posted at MenNeedToBeHeard YouTube Channel

About

Raising Awareness on the many issues affecting men & boys in today’s society

including the societal and media bias against men, the issues father’s face, dating & relationships, men’s mental health issues, & other issues that affect men such as men’s mental health, homelessness, family court bias, & sadly men un-aliving themselves

Join our Brotherhood of Men Patreon Group: https://www.patreon.com/MenNeedToBeHeard

Follow us:

Instagram: https://www.instagram.com/menneedtobeheard/

Tik Tok: https://www.tiktok.com/@menneedtobeheard3

Twitter: https://twitter.com/MenNeed2BeHeard

Facebook: https://www.facebook.com/MenNeedToBeHeard/

Don’t Forget to Subscribe!

Disclaimer:

Some of these links go to one of my websites and some are affiliate links where I’ll earn a small commission if you make a purchase at no additional cost to you.

The information provided on this website or in any video does not, and is not intended to, constitute legal or theraputic advice.

Links:

Patreon Group

patreon.com/MenNeedToBeHeard

TikTok

tiktok.com/@menneedtobeheardtoo

Instagram

instagram.com/menneedtobeheard

Twitter

twitter.com/MenNeed2BeHeard

Facebook

facebook.com/MenNeedToBeHeard