China & Canada Retaliate Against Trump’s Tariff War As Global Stocks Slide

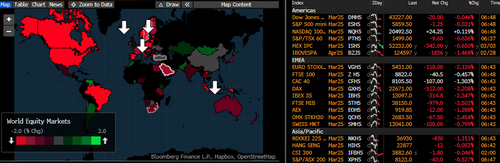

Asian markets closed lower, European stocks are in the red, and US equity futures are trending lower this morning as worsening global trade war concerns weigh on risk sentiment.

On Monday, President Trump reiterated that he would impose tariffs on imports from Canada and Mexico starting Tuesday, stating that there was “no room left” for negotiation. He also noted that an additional 10% levy would be applied to imports from China.

Fast-forward to Tuesday morning. Trump’s 25% tariffs on goods from Mexico and Canada took effect, prompting Canada to retaliate with 25% tariffs on $100 billion worth of US imports. Mexico is expected to respond later.

Trump also introduced an additional 10% tariff on Chinese imports early Tuesday, bringing the total tax to 20% following a similar increase last month. China swiftly retaliated with tariffs on US food and agricultural products and an export ban on some defense firms.

According to an announcement by the Chinese Ministry of Finance, Beijing imposed new duties of 10% to 15% on US food and agricultural products.

Here’s an excerpt from the announcement:

15% tariff will be imposed on chicken, wheat, corn, and cotton.

10% tariff will be imposed on sorghum, soybeans, pork, beef, aquatic products, fruits, vegetables, and dairy products

For the imported goods listed in the appendix originating from the United States, corresponding tariffs will be levied on the basis of the current applicable tariff rates. The current bonded and tax reduction and exemption policies remain unchanged, and the additional tariffs will not be reduced or exempted

Goods that have been shipped from the place of departure prior to March 10, 2025, and imported from March 10, 2025 to April 12, 2025, shall not be subject to the additional tariffs prescribed in this announcement

Commenting on China’s retaliatory tariffs, Lynn Song, chief economist for Greater China at ING Bank, told clients: “The measures are still relatively measured for now. I think this retaliation shows China remains patient and has refrained from ‘flipping the table’ so to speak despite the recent escalation.”

“China’s hit-back isn’t exactly aggressive — a 15% tariff on US agricultural goods, but nothing broad-based on tech or autos, suggests to me they’re leaving room for negotiation,” said Billy Leung, an investment strategist at Global X ETF, adding, “That’s probably why Chinese stocks are rebounding instead of selling off harder.”

Dilin Wu, a research strategist at Pepperstone Group Ltd., said, “The immediate impact of these new tariffs on China remains manageable — the measures are currently concentrated in specific areas.”

“Should Beijing roll out additional pro-growth measures — such as large-scale fiscal stimulus or targeted support for high-tech industries and domestic consumption — it could further bolster market confidence,” Wu said.

Sea of red for global equity futures across most regions.

China’s Ministry of Finance warned: “The US’s unilateral tariff increase damages the multilateral trading system, increases the burden on US companies and consumers, and undermines the foundation of economic and trade cooperation between China and the US.”

Should Trump respond with retaliatory tariffs, the risk of sentiment continuation could continue. In the US, the growth…