Turkey Instagram ban ‘violates’ free speech: Human Rights Watch

Turkey on Friday marked a week since the authorities blocked access to Instagram, with Human Rights Watch (HRW) saying the suspension violated free speech.

The authorities have also frozen popular online video game Roblox.

The rights watchdog urged the government to restore access to US-owned Instagram, which President Recep Tayyip Erdogan has accused of “fascism” and ministers have blamed for failing to remove posts the authorities deem offensive.

“Blocking everyone’s access to an entire social media platform is a grossly disproportionate measure that violates the right to free expression and information of millions of users,” HRW’s Deborah Brown said.

“(It) should be reversed immediately.”

Last week, Erdogan’s communications director Fahrettin Altun accused Instagram of censorship.

He complained the platform had prevented people posting messages of condolence over the assassination of Ismael Haniyeh.

Haniyeh, the political leader of Palestinian group Hamas, was killed in Tehran in an attack blamed on Israel.

Erdogan, an ally of Haniyeh’s, said on Monday social media networks “cannot even tolerate photos of Palestinian martyrs without immediately banning them”.

Instagram has an estimated 50-60 million subscribers in Turkey and is used by numerous businesses to trade and find customers.

The Turkish e-commerce operators’ association has calculated the ban is costing around 1.9 billion Turkish lira, or nearly $57 million, per day in lost business.

Yaman Akdeniz, a co-founder of the Freedom of Expression Association (IFOD), said the freeze on Instagram was “disproportionate and arbitrary”, stressing that it had been introduced “without a (prior) court order”.

Transport and Infrastructure Minister Abdulkadir Uralolu met Instagram representatives on Monday but their differences have yet to be resolved.

Uraloglu said last week the platform, which is owned by US tech giant Meta, had been suspended for ignoring demands to remove “criminal content”.

An anonymous source at Turkey’s BTK communications authority said these included “insults to Ataturk”, the founding father of modern Turkey, “drugs (and) paedophilia”.

Meta said it had taken down more than 2,500 posts flagged by the government in the first six months of the year.

On Wednesday, the authorities also banned Roblox, a platform that allows players to create their own games and has been downloaded more than 41 million times in Turkey.

Justice Minister Yilmaz Tunc alleged “it contains content that will cause abuse of children”.

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

The myth of fair trade

Fair trade is an increasingly politically popular idea, and opponents of the free market see it as a moral way to fix market abuse. Proponents of fair trade argue that free trade favors developed countries or bigger corporations and that steps should be taken to correct the balance of power to ensure equitable outcomes. However, fair trade fails to work because of misplaced grievances toward the free market.

The idea of fair trade rejects the free market as a viable mechanism for the facilitation of goods and services. Fair-trade supporters argue that the free market does not lead to equitable outcomes and therefore is not suitable for modern society. In effect, they essentially argue that the free market does not lead to outcomes that they would prefer. Barring coercion, the free market presents the best opportunity for producers and consumers to seek deals that they both find to their individual benefit. An exchange requires two willing parties, ensuring that neither party is involved in trading unless they wish to. While there may be circumstances in which one party has greater bargaining power than the other party, this does not cause an exchange to become immoral as long as it was completely voluntary. Fair-trade organizations often fail because they seek higher prices for the producers they support. This prices them out of the market since consumers seek better deals on similar products.

Supporters of fair trade also argue for “fair prices.” They consider the purchase of products from developing nations at low prices to be exploitative and argue for these products to be paid for at higher prices. These supporters argue that consumers from developed countries ought to pay more and that producers from developing countries should be paid more than they are already because of inequality. Once again, the fair-trade movement labels outcomes it does not personally like as exploitative. It states that free market prices are too low and prolong the suffering of those from developed nations, but free market prices are always necessarily fair.

A product being placed for sale at a particular price implies that the producer values the amount of money he receives in the exchange greater than he values the product. Similarly, the purchase of a product at a particular price implies that the consumer values the product greater than the money that he pays to buy it. Therefore, a free market exchange leads to a trade that benefits both parties as they trade something they value less than what they receive. This can hardly be considered “exploitative.”

Fair-trade programs are also notorious for pricing out the producers they support as the programs’ certification and compliance protocols add costs toward the producer’s operations. This can be particularly disastrous as companies from developing countries are competitive in global markets often because of their low price points. Therefore, taking away from or minimizing their biggest advantage does not and has not boded well for free-trade initiatives.

This isn’t to say that fair trade certification is completely useless, as it can be of value in a free market scenario. Consumers who are happy and willing to pay more for products certified by a fair-trade organization ought to be able to do so. However, the general ineffectiveness of these programs without government help can be attributed to their misplaced hatred of the free market and the subsequent errors they commit as a result. They aren’t ineffective because their competitors are more ruthless or exploitative but rather because they ignore economic reality in favor of pushing outcomes they find preferable.

Note: The views expressed on Mises.org are not necessarily those of the Mises Institute.

Originally Posted at https://mises.org/

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

NewsWare’s Trade Talk: Friday, August 9 | NewsWare‘s Trade Talk

S&P Futures are moving higher this morning as yesterday positive momentum continues. Positive action this morning after earnings releases from GILD, TTD, SG, AKAM & EXPE. China’s consumer inflation rose more than expected last month, highlighting some improving trends in the country. Middle East tensions are elevated as Israel is expecting hostile actions from Iran or one of its proxies over the weekend. In Europe, stocks are gaining but have come down from their highs, and oil prices are moving ticking higher.

Home for this information is at NewsWare‘s Trade Talk homepage at this link

Stay Updated with News.FreePtomaineRadio’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

California Power Bills Are Soaring

Authored by Tsvetana Paraskova via OilPrice.com,

-

California residents face the second-highest average electricity bills in the U.S., driven by investments in wildfire mitigation, grid upgrades, and renewable energy integration.

-

The surge in electricity costs has left nearly 1 in 5 California households behind on their energy bills.

-

California is transitioning to a new net billing tariff for residential solar and a flat monthly fee structure for electricity in an effort to make electrification more affordable.

Consumers in California have seen their electricity bills surge in recent years and double over the past decade as utilities are investing more in wildfire prevention and transmission lines to accommodate growing renewable energy output.

As these utilities invest billions of U.S. dollars to make the grid more resilient, they pass the higher spending on to consumers.

So California now has the second-highest average electricity bill in the United States, second only to Hawaii.

“Untenable” Surge

California is looking to rapidly shift away from fossil fuels and make its grid more resilient, but these efforts show the other side of the greening of the grid – power generation costs may be plunging, but transmission and distribution costs are rising, leading to higher spending from utilities.

These increased expenditures are passed on to consumers by the investor-owned utilities Pacific Gas & Electric, Southern California Edison, and San Diego Gas & Electric. As a result, electricity bills in California have risen so much in recent years that in some places, the power bill exceeds the cost of rent, The Wall Street Journal reports in a featured article.

The surge in bills has been “untenable,” according to the consumer advocate’s office at California’s utilities regulator.

In its latest 2024 Q2 Electric Rates Report last month, the Public Advocates Office tracked residential electric rate changes across Pacific Gas and Electric (PG&E), San Diego Gas & Electric (SDG&E), and Southern California Edison (SCE) service territories through July 1, 2024.

The report found that over the last few years, California’s electric bills are generally rising due to higher electricity use from things such as air conditioning, and higher overall electricity prices.

Since January 2014, residential average rates for the PG&E service area have jumped by 110%, those of SCE have surged by 90%, and SDG&E rates have soared by 82%.

The primary statewide drivers of soaring rates have been investments in wildfire mitigation, transmission and distribution investments, and rooftop solar incentives or the so-called net energy metering, the Public Advocates Office said.

Overall, residential electricity rates have increased substantially since 2014, surpassing inflation, it noted.

It couldn’t be surprising then that nearly 1 in 5 households are behind on their energy bills, according to the office. A total of 18.4% of the customers of the three investor-owned utilities are in arrears in their energy bills.

Changes in Charging for Electricity

This year, California has changed the way utilities charge for electricity and is transitioning from net energy metering to net billing tariff for residential solar projects. These regulatory changes have hit residential solar installations and are set to change the way power bills are formed starting next year.

The move to the net billing tariff in California dragged down the total U.S. residential solar market, which saw in the second quarter of 2024 its lowest quarter since Q1 2022 at 1.3 GWdc, reflecting a 25% decline year-over-year and 18% quarter-over-quarter.

“While slowdowns are occurring nationwide, these declines were heavily influenced by California, where quarterly installations have shrunk for the last two quarters as NEM 2.0 projects are built out and the state transitions to the net billing tariff,” the Solar Energy Industries Association (SEIA) said in its latest quarterly report.

In another significant change, California’s utilities will charge from next year or 2026 a flat monthly fee of up to $24.15 on all customers while reducing the charges imposed per kilowatt of electricity used.

The California Public Utilities Commission (CPUC) says that the new billing structure “lowers overall electricity bills on average for lower-income households and those living in regions most impacted by extreme weather events, while accelerating California’s clean energy transition by making electrification more affordable for all.”

The usage rate for electricity will be reduced by 5 to 7 cents per kilowatt-hour for all residential customers, which makes it more affordable for everyone to electrify homes and vehicles, regardless of income or location, because the price of charging an electric vehicle or running a heat pump is lower.

However, critics of the new billing structure have said it will hurt customers who live in small homes and have relatively small electricity use as the lower per-kWh rate would not offset the new flat fee.

It remains to be seen how the new billing structure will affect California customers and whether it will lead to the expected mass electrification of homes.

A total of 78% of Americans are concerned about their rising energy bills, an exclusive CNET Money survey has shown. Around 80% of U.S. adults in all regions, including the Northwest, Midwest, South, and West, said that their finances have been impacted by growing home energy costs, according to the survey.

California leads in U.S. solar and battery installations, but the cost of bringing that power generation to consumers has soared with the need to expand, upgrade, and protect the power grid.

Loading…

Originally Posted at; https://www.zerohedge.com//

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

The “unuseful” tautology

A tautology is a law of logic, part of a law of logic, or a definition. Some people do not think that tautologies tell us anything useful, pointing out that if someone inquires about the weather, to be told, “Either it’s raining or it’s not raining,” is not very helpful.

Ludwig von Mises disagrees with this view. He would readily acknowledge that there are useless tautologies, but he suggests in Human Action that there are also useful tautologies. (Whether he changed his mind on the status of the propositions of praxeology in works written after Human Action isn’t a topic that will be addressed in this article).

Mises says:

“Aprioristic reasoning is purely conceptual and deductive. It cannot produce anything else but tautologies and analytic judgments. All its implications are logically derived from the premises and were already contained in them. Hence, according to a popular objection, it cannot add anything to our knowledge.

All geometrical theorems are already implied in the axioms. The concept of a rectangular triangle already implies the theorem of Pythagoras. This theorem is a tautology, its deduction results in an analytic judgment. Nonetheless nobody would contend that geometry in general and the theorem of Pythagoras in particular do not enlarge our knowledge. Cognition from purely deductive reasoning is also creative and opens for our mind access to previously barred spheres. The significant task of aprioristic reasoning is on the one hand to bring into relief all that is implied in the categories, concepts, and premises and, on the other hand, to show what they do not imply. It is its vocation to render manifest and obvious what was hidden and unknown before.”

Mises proceeds to give an example of useful tautologies in praxeology. He says:

“In the concept of money all the theorems of monetary theory are already implied. The quantity theory does not add to our knowledge anything which is not virtually contained in the concept of money. It transforms, develops, and unfolds; it only analyzes and is therefore tautological like the theorem of Pythagoras in relation to the concept of the rectangular triangle. However, nobody would deny the cognitive value of the quantity theory. To a mind not enlightened by economic reasoning it remains unknown. A long line of abortive attempts to solve the problems concerned shows that it was certainly not easy to attain the present state of knowledge.

It is not a deficiency of the system of aprioristic science that it does not convey to us the full cognition of reality. Its concepts and theorems are mental tools opening the approach to a complete grasp of reality; they are, to be sure, not in themselves already the totality of factual knowledge about all things. Theory and the comprehension of living and changing reality are not in opposition to one another.”

What is the explanation for the fact that the tautologies of praxeology are useful and not useless? In a fascinating passage, which would have to be unpacked to understand its full meaning, Mises finds the answer in an affinity between action and thinking:

“The real thing which is the subject matter of praxeology, human action, stems from the same source as human reasoning. Action and reason are congeneric and homogeneous; they may even be called two different aspects of the same thing. That reason has the power to make clear through pure ratiocination the essential features of action is a consequence of the fact that action is an offshoot of reason. The theorems attained by correct praxeological reasoning are not only perfectly certain and incontestable, like the correct mathematical theorems. They refer, moreover with the full rigidity of their apodictic certainty and incontestability to the reality of action as it appears in life and history. Praxeology conveys exact and precise knowledge of real things.

The starting point of praxeology is not a choice of axioms and a decision about methods of procedure, but reflection about the essence of action. There is no action in which the praxeological categories do not appear fully and perfectly. There is no mode of action thinkable in which means and ends or costs and proceeds cannot be clearly distinguished and precisely separated. There is nothing which only approximately or incompletely fits the economic category of an exchange. There are only exchange and nonexchange; and with regard to any exchange all the general theorems concerning exchanges are valid in their full rigidity and with all their implications. There are no transitions from exchange to nonexchange or from direct exchange to indirect exchange. So experience can ever be had which would contradict these statements.”

In the space remaining, I’d like to elucidate the very interesting ideas Mises suggests about why the tautologies of praxeology are useful. I take him to be arguing in this way: if a proposition is really a tautology, then its truth can’t be questioned, though its usefulness might be. But maybe some of the propositions of praxeology aren’t really tautologies, contrary to appearance. Maybe they contain vague or fuzzy terms; if so, we can’t be sure that future testing of them won’t falsify them. But, Mises suggests, the terms in praxeology aren’t vague or fuzzy. Either they apply or they don’t, and this is immediately evident.

If you study Human Action, you will always find new insights that you missed. I have certainly found this to be true in my sixty years of reading the book.

Originally Posted at https://mises.org/

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

Samsung recalls 1 million US stoves over fire hazard

Samsung is recalling more than one million electric stoves in the United States following reports of accidental fires that injured 40 people and killed pets, the US Consumer Product Safety Commission said Friday.

Owners of one of the 30 models affected by the voluntary recall are advised to contact Samsung for free replacement knob locks or covers, according to the commission’s statement.

More than 1.1 million slide-in electric ranges sold between 2013 and 2024 fall under the recall.

Samsung said the announcement was issued due to reports the knobs could be accidentally activated by people or pets bumping into them. The company did not mention fires or pet deaths in its press release.

According to the safety commission, the Samsung stoves have been involved “in approximately 250 fires,” which led to about 40 injuries, eight of which required medical attention.

The commission said there were also reports of seven fires involving pet deaths and 18 instances of “extensive property damage”.

People continuing to use the recalled models were cautioned to keep children and pets away from the front-range knobs, and to check them before going to bed.

The South Korean electronics and appliances manufacturer said “consumers may continue to use their slide-in electric ranges while awaiting their set of free knob locks or covers.”

Samsung’s safety reputation suffered a major blow from a worldwide recall of its flagship Galaxy Note 7 smartphone over exploding batteries in 2016, which cost the company billions of dollars.

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

As the US dollar falls into ruin

Luke Gromen told Dale Pinkert on the Forex Analytics July 22nd F.A.C.E. show that the U.S. went to China last fall and asked the Chinese to strengthen the Yuan. The Chinese said if the United States wants a weaker dollar, they need to let it go versus gold, implying that the gold market is influenced by the government’s hand.

Pinkert, being a currency trader, expressed concern that the dollar could be devalued overnight by government fiat, and asked how the executive branch could engineer such a devaluation. Groman matter-of-factly pointed to Section 2.10 of the Financial Accounting Manual of the Federal Reserve Banks and said the President could tell the Treasury Secretary to tell the chairman of the Federal Reserve to remonetize gold.

Indeed, the first paragraph of Section 2.10 reads:

“The Secretary of the Treasury is authorized to issue gold certificates to the Reserve Banks to monetize gold held by the U.S. Department of the Treasury (Treasury). At any time, Treasury may reacquire the gold certificates by demonetizing the gold.”

Gromen is well respected in mainstream financial circles, speaking often on financial networks. He told Mr. Pinkert that the Fed had 260 million ounces of gold and if the dollar were revalued vis-à-vis gold, a la FDR in 1933 or Nixon in 1971, unilaterally to, say, $20,000 an ounce by government edict, for every $4,000 increase in gold $1 trillion would be created. So, in the case of Gromen’s hypothetical $20,000 revaluation, five trillion would be created to go in the Treasury’s General Account (TGA) “free and clear” as he says. The Treasury could then retire $5 trillion of debt and Uncle Sam’s debt-to-GDP ratio would drop from 122% to 70%.

Gromen called this a “Nixonian Shock” that possibly a Trump Administration would implement in the first half of 2025. Once the debt was reduced by $5 trillion the Federal government could then ramp up its debt level again. Dollar weaker, debt level lower. It’s a win-win. Except, of course, this would be very inflationary. But so is the U.S. financing its debt with short-term T-Bills. Gromen makes the point that countries which finance deficits with short-term debt, because no one will buy their long bonds, are known as “banana republics.” This is the current path of the U.S.

In “The Case Against the Fed,” Murray Rothbard wrote that the 260 million ounces of gold held at the Fed were statutorily valued $42.22 per ounce and the price he said was, and he was writing in 1994, an “absurd undervaluation on its face, considering that the gold price on the world market has been varying from $350 to $380 an ounce in recent years.” Turns out that those were the good old days. Now gold trades for more than $2,400 per ounce.

Murray’s plan was to end the Fed by selling its assets and to liquidate the central bank’s liabilities. Its gold would have to be revalued to provide the capital to repay the liabilities. When he wrote in 1994, the amount of the then Fed liabilities, $404 billion, would have to be divided by the 260 million ounces of gold to produce a per ounce required revalued gold price, $1555 per ounce. “If we revalue the Fed gold stock at the ‘price’ of $1555 per ounce,” Rothbard wrote, “then its 260 million ounces will be worth $404 billion. Or, to put it another way, the ‘dollar’ would then be defined as 1/1555 of an ounce.”

Using today’s figures per the Federal Reserve’s H4.1 report of June 12, 2024, to update Rothbard’s calculation, the Fed’s liabilities are $5,515,715,000,000. The Fed hasn’t bought any more gold unlike some other central banks. Gold would now have to be revalued at $5,634,761 per ounce or a dollar would be defined as 1/5,634,761 of an ounce.

The dollar’s value has been demolished in just the 30 years since Rothbard wrote “The Case Against the Fed.” While the candidates argue about the border and the rights of the unborn, who will speak up for a currency that continues to have its purchasing power ruined? Imagine what little value will be left three decades from now.

Originally Posted at https://mises.org/

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

The Federal Reserve Does Not Own Gold

Historically—especially during the days of the classical gold standard—central banks maintained stocks of gold to facilitate the conversion of gold-backed national currencies. Those days are long gone, but in modern times, many central banks continue to own gold, and many central banks buy gold as part of their open-market operations. For example, in his article last week—”Central banks purchase gold to offset their own money destruction“—Daniel Lacalle writes:

The rising purchases of gold by central banks are an essential factor justifying the recent increase in demand for the precious metal. Central banks, especially in China and India, are trying to reduce their dependence on the dollar or the euro to diversify their reserves. However, this does not mean full de-dollarization. Far from it.

According to the World Gold Council, central banks have accelerated their gold purchases to more than 1,000 tonnes per year in 2022 and 2023. …

The goal of this central bank trend is to increase the weight of an asset that does not fluctuate with the price of government bonds. It is not about de-dollarization but about balancing the balance sheet from the volatility created by their own misguided expansionary policies.

The US’s central bank, the Federal Reserve, is not among these banks buying gold. Obviously, the Fed has no interest in buying up gold as a means of “de-dollarization.” Moreover, the Fed is presently concerned with purchasing more dollar-denominated government debt to keep interest rates low on the Federal government’s huge deficits.

But we must also note that another reason the Fed isn’t buying gold is that the Fed hasn’t been in the gold-owning business for a very long time.

That is, the Fed has owned no gold since 1934, when the Fed handed over all its gold in exchange for gold certificates. This is how the Fed’s Board of Governors summarizes the situation:

The Federal Reserve does not own gold.

The Gold Reserve Act of 1934 required the Federal Reserve System to transfer ownership of all of its gold to the Department of the Treasury. In exchange, the Secretary of the Treasury issued gold certificates to the Federal Reserve for the amount of gold transferred at the then-applicable statutory price for gold held by the Treasury.

Gold certificates are denominated in U.S. dollars. Their value is based on the statutory price for gold at the time the certificates are issued. Gold certificates do not give the Federal Reserve any right to redeem the certificates for gold.

The statutory price of gold is set by law. It does not fluctuate with the market price of gold and has been constant at $42 2/9, or $42.2222, per fine troy ounce since 1973. The book value of the gold held by the Treasury is determined using the statutory price.

Although the Federal Reserve does not own any gold, the Federal Reserve Bank of New York acts as the custodian of gold owned by account holders such as the U.S. government, foreign governments, other central banks, and official international organizations. No individuals or private sector entities are permitted to store gold in the vault of the Federal Reserve Bank of New York or at any Federal Reserve Bank.

A small portion of the gold held by the U.S. Treasury (roughly $600 million in book value)–about five percent–is held in custody for the Treasury by the Federal Reserve Banks, as fiscal agents of the United States. The vast majority of this gold is located in the vault at the Federal Reserve Bank of New York, and a very small portion is on display in several Federal Reserve Banks. The remaining 95 percent of U.S. Treasury gold ($10.4 billion in book value) is held in custody for the Treasury by the U.S. Mint.

It is possible to imagine that the Fed could start buying gold, but it’s hard to see why the Fed would be motivated to do so.

Moreover, given that the Fed’s gold certificates have essentially no connection to the actual market price of gold, changes in the price of gold have virtually no effect on the value of the Fed’s assets.

The only way gold prices would become relevant to the Fed’s portfolio would be for the Congress to change the statutory price of gold from $49.2222. If the Fed wanted to actually take possession of that gold, the Congress would also have to authorize the Fed to redeem its certificates in gold.

This is all very unlikely barring a very big change in the ideology of the ruling regime. Indeed, barring said ideological change, I suspect that in a true crisis, the Fed’s extremely tenuous claim to owning its pre-1934 gold stockpile would be null and void altogether. If the Treasury finds itself truly strapped for cash, the Congress would only have to declare the Fed’s gold certificates permanently unredeemable. Or, the Treasury could simply buy back the gold certificates at the ridiculously low statutory price. Then there would be no doubt about who owns that gold. The Treasury could then simply sell off all the gold to Wall Street banks in exchange for dollars that would go to luxury hotels for illegal immigrants or more bombs for the State of Israel.

Originally Posted at https://mises.org/

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

The Fed is warping the shape of the yield curve

Many commentators consider the spread between the long-term interest rate and the short-term interest rate as an important indicator to establish the future course of economic activity. An increase in the spread is seen as pointing toward good economic times ahead. Conversely, a declining spread raises the likelihood of an economic recession.

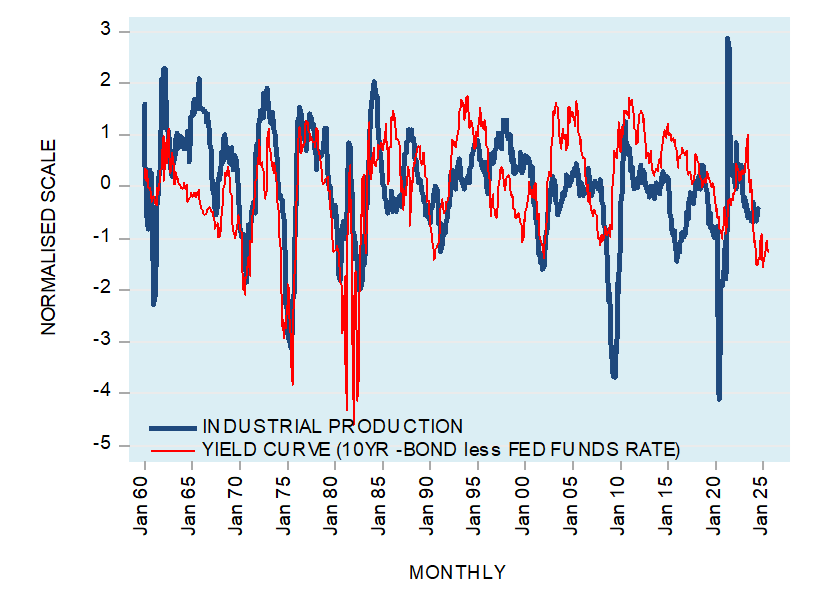

Historically, in the U.S., the differential between the yield on the 10-year T-bill and the federal funds rate was leading the yearly growth rate of industrial production by 12 months (see Figure 1).

Figure 1: Year-over-year U.S. industrial production versus 12-month yield curve lag (%)

Source: Federal Reserve Bank of St. Louis (FRED)

A popular explanation for the determination of the shape of the yield spread is provided by expectations theory. According to this theory, the key to the shape of the spread — also known as the yield curve — is that the long-term interest rates are the average of the present and the expected short-term interest rates.

Thus, if today’s one-year rate is 4% and the next year’s one-year rate is expected to be 5%, then the two-year rate today should be 4.5%, or (4 + 5) / 2 = 4.5. Here, the long-term interest rate (i.e., the two-year rate today) is higher than the present short-term interest rate (i.e., the one-year rate).

It follows then that expectations for increases in the short-term interest rate will make the yield curve upward sloping, as the long-term interest rate is higher than the short-term interest rate. Conversely, expectations for a decline in the short-term interest rate is going to result in a downward-sloping yield curve, as the long-term interest rate is lower than the short-term interest rate.

If today’s one-year interest rate is 4% and the next year’s one-year interest rate is expected to be 3%, then the two-year interest rate today should be 3.5%, or (4 + 3) / 2 = 3.5. The long-term interest rate (i.e., the two-year interest rate today) is lower than the present short-term interest rate.

According to expectations theory, whenever investors expect economic expansion, they anticipate rising short-term interest rates. Consequently, the long-term interest rate is going to be higher than the short-term interest rate — hence, an upward-sloping yield curve emerges.

Conversely, an economic slump is associated with the expectations for a declining short-term interest rate. As a result, according to expectations theory, the long-term interest rate today will be lower than the short-term interest rate — a downward-sloping yield curve emerges.

A good correlation between the yield curve and economic activity does not explain, however, why the yield curve is a good predictor of economic activity. The correlation only describes it.

Shape of the yield curve in an unhampered market

Ludwig von Mises concluded that in a free, unhampered market economy, the natural tendency of the shape of the yield curve is neither toward an upward-sloping curve nor toward a downward-sloping curve but rather toward a flattening one.

Mises wrote:

“The activities of the entrepreneurs tend toward the establishment of a uniform rate of originary interest in the whole market economy. If there turns up in one sector of the market a margin between the prices of present goods and those of future goods which deviates from the margin prevailing on other sectors, a trend toward equalization is brought about by the striving of businessmen to enter those sectors in which this margin is higher and to avoid those in which it is lower. The final rate of originary interest is the same in all parts of the market of the evenly rotating economy.”

Also, Murray Rothbard held that in a free, unhampered market economy, an upward-sloping yield curve cannot be sustained because it would set in place an arbitrage between short- and long-term securities.

This would lift the short-term interest rates and lower the long-term interest rates, resulting in the tendency toward a uniform interest rate. Arbitrage will also prevent the sustainability of a downward-sloping yield curve by shifting funds from long maturities to short maturities — thereby flattening the curve. Hence, in a free, unhampered market economy, an upward- or a downward-sloping yield curve cannot be sustained.

What is the mechanism that generates a sustained upward- or downward-sloping yield curve? The shape of the yield curve is the outcome of the Federal Reserve’s monetary policies.

How the Fed’s tampering generates an upward- or a downward-sloping yield curve

While the Fed can exercise control over the short-term interest rates via the federal funds interest rate, it has less control over the longer-term interest rates. In this sense, the long-term interest rates can be seen as partially reflecting the time preferences of individuals.

The Fed’s interest rate policy disrupts the natural tendency toward the uniformity of interest rates. This leads to the deviation of the short-term interest rates from individuals’ time preferences as partially mirrored by the relatively less-manipulated long-term interest rate.

When the Fed lowers the policy interest rate target, this almost instantly lowers the short-term interest rates, while to a lesser extent affecting the longer-term interest rates. As a result, an upward-sloping yield curve develops. (The interest rate differential between the long-term interest rate and the short-term interest rate widens.)

Conversely, when the Fed reverses its stance and lifts the policy interest rate target, this lifts the short-term interest rates. As a result, a downward-sloping yield curve emerges. (The differential between the long-term interest rate and the short-term interest rate narrows.)

The deviation of short-term interest rates from long-term rates due to the Fed’s tampering falsifies the signals issued by consumers to producers. This, in turn, culminates in the misallocation of resources and leads to economic impoverishment. Consequently, producers generate products that are not in line with the consumers’ instructions.

For example, when the Fed lowers its policy interest rate to encourage an expansion in the production structure, it does so in contrast to consumers’ time preferences. Consumers have not allocated an adequate amount of real savings. Hence, producers do not have enough real savings to undertake the expansion of the infrastructure, which leads to an economic bust.

The Fed’s interest rate framework is not based upon individuals’ time preferences but rather on political factors. By using the expectations-theory framework, the Fed sets long-term interest rates. Hence, according to expectations theory, the Fed is a major factor in setting the shape of the yield curve. The Mises-Rothbard framework also assumes the Fed influences the shape of the yield curve. However, the Fed does this by disrupting the natural tendency of the curve to gravitate toward being horizontal.

Why do changes in the shape of the yield curve precede economic activity?

Whenever the central bank reverses the interest rate stance, altering the shape of the yield curve, it leads to either an economic boom or an economic bust, although they do not arise immediately. The reason is that the effect of a change in the interest rate policy shifts from one market to another market.

For example, during an economic slump, the central bank reduces the policy interest rate. Consequently, a steepening of the yield curve emerges. This, however, has a minimal effect on economic activity, which is still dominated by the previous tight interest rate stance. It is only later, once the easy stance begins to dominate the economy that economic activity starts improving. If the pool of real savings is declining, then — notwithstanding the increase in the yield curve — economic activity is likely to remain under pressure. Hence, the historical correlation between the yield curve and economic activity is going to provide misleading reading.

Conclusion

Historically, in the U.S., there has been a good visual correlation between the yield curve and economic activity. However, correlation can only describe but not explain. The economic bust is likely to emerge notwithstanding an upward-sloping yield curve if the pool of real savings is declining or exhausted. Expectations theory, which is based on historical good visual correlation between the yield curve and economic activity, cannot provide a trustworthy explanation regarding the boom-bust cycles.

Originally Posted at https://mises.org/

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

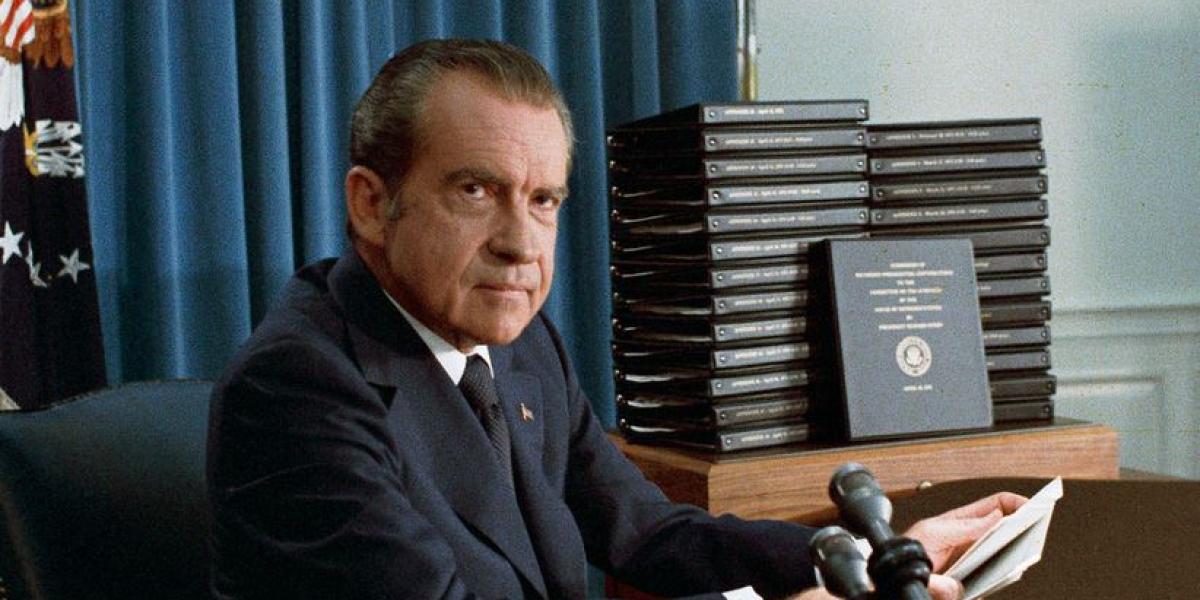

Yankees vs. Cowboys: Rothbardian elite theory on Watergate

Editors note: The following article was published in July 1974 in The Libertarian Forum titled “One Heartbeat Away.” In it, Murray Rothbard provides elite theory analysis of Watergate after the selection of Nelson Rockefeller as Gerald Ford’s Vice President. While Rothbard’s fear of a Rockefeller presidency did not come to fruition, his post-political life included the creation of the Trilateral Commission which continued to have incredible influence over future presidential administrations.

For more Rothbardian elite analysis similar to what is provided below, readers are encouraged to read Origins of the Federal Reserve and Wall Street, Banks, and Foreign Policy, the latter of which continues this analysis into 1984.

****

As the Watergate revelations poured out in the last years, our esteemed publisher, Joe Peden, began to say, in some awe, “all the most flagrant ‘paranoia’ of the New Left turns out to be correct analysis’” Of course, he could have substituted or added the Birchers for the New Left. “Paranoia” lives! and after the Pentagon Papers and the Watergate revelations the fashionable sneering at the “conspiracy theory of history” will never sit quite so smugly again. The “conspiracy theory of history” – which is really only praxeology applied to human history, in assuming that men have motives on which they act – has never looked so good or so rational.

Being away in Europe at the time of the amazing, cataclysmic appointment of Nelson Rockefeller to the Vice Presidency, I did not have a chance to observe the reactions of American opinion. But as far as I know, no one has pointed to the most important aspect of the appointment: that it provides a remarkable empirical confirmation of the leading “conspiracy thesis” about the Watergate Affair: the Oglesby-Sale, “Cowboy vs. Yankee” hypothesis. The appointment of the man who embodies the Big Business Corporate State, the living representative of the corporate statism that has grown like a cancer since the Progressive Period In America (after about 1900), to be the heir apparent, and a heartbeat away from the most powerful post in the world, is enough to give any American, let alone any libertarian, the heebie-jeebies. The accession of Nelson Rockefeller to total power would mean the final fusion of the most colossal aggregation of political and economic power that the world has ever seen. And the only groups that have warned us of this coming event have been the major groups totally outside the American Dower structure: the extreme left and the “extreme”. or Birchite, right, who in their different yet complementary ways have been writing unheeded about the menace of the “Rockefeller World Empire” and its drive for total dominion.

*****

When Nelson Rockefeller first appeared on the electoral scene in his successful race for the New York governorship in 1958, Frank S. Meyer, the valiant leader of the quasi-libertarian wing of the National Review clique, denounced Rockefeller as “Caesar Augustus”, the destroyer of the American Republic. The feeble and perfunctory opposition that NR has put up to Rockefeller now (combined with its kept Conservative Party’s endorsement of Rocky’s stooge Malcolm Wilson) only indicates how far National Review has gone in its urge to join the ruling Establishment. In addition to Meyer, there emerged also an eccentric (to use a charitable term) eye doctor in New York named Dr Emanuel M. Josephson, a conspiracy theorist to end all conspiracy theories, a “paranoid” among the paranoids. But while the good doctor’s historiographical methodology left a great deal to be desired (e.g. his idea that the Rockefellers run world Communism, plus many other aberrations), he was and probably still is the world’s outstanding “Rockefeller-batter”, an enthusiastic collector of any and all facts about the Rockefeller family At any rate, Josephson sprang into action, declaring that the Rockefellers felt so secure of their political control of the country that they were now ready to reach for open (in contrast to their previously hidden) political power, in the shape of Nelson as President. Not only that six years earlier, in 1952, Dr Josephson had written, In his magnum opus, Rockefeller “Internationalist”: The Man Who Misrules the World, the following paragraph, which now seems remarkably prophetic:

“The pattern of his activities indicates that it is the objective of the Rockefellers to place Nelson Rockefeller in the White House by some means, whether direct, indirect or cataclysmic. Direct election as President is now possible with the sham ‘philanthropic’, ‘benevolent’ and ‘public spirited’ build up he has had; but it is improbable. More probable would be his nomination as Vice Presidential candidate on one of their ‘bipartisan’ or ‘omnipartisan’ tickets at the side of a Presidential candidate whom they know to be tottering at the edge of the grave, or who could be disposed of by some other of the methods of purging that have become so commonplace during the New and Fair Deals.” (p. 49)

Before proceeding to the Nelson appointment and its background, a brief but vitally important sketch is in order of what I believe to be a sound “conspiracy” analysis of the essence of twentieth century political and politico-economic history. By the late nineteenth century, the Democratic Party was largely in the control of the Morgan financial empire, and of its financial and industrial allies. Augustus Belmont, a Morgan ally, was the secretary of the national Democratic Party for decades, and an analysis of the Cleveland Administration’s (the only Democratic regimes from the Civil War to Woodrow Wison) shows Morgan partners and lawyers dominant in the key Cabinet positions. By the latter years of the century, on the other hand, the Republican Party became more loosely under the control of the Rockefellers, through Rockefeller domination of the Ohio Republican Party (old John D.’s original home and economic base was in Cleveland. Note that Ohio Republicans formed ‘every Republican-Administration since and including Benjamin Harrison (e.g. Willlam McKinley, WilIiam Howard Taft. and Warren G. Harding.) While both the Morgans and the Rockefellers used their political power for subsidies and contracts, and for imperial expansion- abroad, the roughly laissez-faire system meant that the evil effects on the country and the economy of these power plays were relatively limited. Then, around 1900, the Big Business interests, especially those grouped around Morgan, having failed dism_ally to achieve monopolies in each industry on the free market,_ decided to change the American system into a corporate. state, into a neo mercantilist Big Government which would cartelize the economy for their benefit. While Rockefeller did not fight this trend, the Morgans were far more assiduous in pushing the new system and the new theory.

The delicate political balance of power was broken with the assassination of Rockefeller’s man William McKinley, for, as a gesture to appease the Morgans, who had fought the McKinley nomination, the Republicans had chosen the young Morgan man, Theodore Roosevelt, for the seemingly harmless post of Vice President. (The Morgans were forced to shift, at least temporarily, to the Republicans because of the capture of the Democratic machinery by the leftist populist William Jennings Bryan). As soon as Teddy Roosevelt became President by the accident of (Yes, another!) “lone nut”, he began to wield the Sherman Antitrust Act, which had been a literal dead letter until then, as a political club. The club was used savagely’ to batter – guess who? – the Rockefellers, leading to the coerced dissolution of the Standard Oil combine by the federal government. It was at this point, Dr. Josephson speculates – probably correctly – that old John D. decided to beat his enemies at their own game, to become even more statist than they, to use every political and public relations weapon at his and his allies’ command. Roosevelt’s successor, William Howard Taft, an Ohio – and therefore Rockefeller – Republican, also wielded the antitrust weapon, to try to dissolve some other “bad” trusts. And what were these trusts? Again, you guessed it: key flagships in the Morgan empire: U. S. Steel, and International Harvester. The war of the titans was on, masked as high devotion to the antitrust ideal.

In retaliation for the Taft-Rockefeller policies, the Morgans and their numerous allies engineered the creation of the Progressive Party, which nominated Teddy Roosevelt for President for the successful purpose of destroying Taft. The Progressives, who not coincidentally had as their national chairman Morgan partner George W. Perkins, also served the ancillary goal of ideologically fostering the proto-New Deal system of the corporate state in America. The breaking of Taft swept into office Woodrow Wilson, who was also an ally of the Morgans, and who served to institute corporate state and Big Government policies in America, in both domestic institutions and in an interventionist and globalist foreign policy. By this time, the Morgans were losing ground in the competitive financial race to Kuhn-Loeb and the Jewish investment banking firms; but the·Morgans were able to recoup by pushing the Wilson Administration into war with Germany, a war necessary to the Morgans because the latter were the financial agents of the British and French governments, and had loaned heavily to Britain and France. Furthermore, the Morgans and their allies were heavily invested in the American export industries which received a great shot in the arm from Allied purchases and· government war contracts. Among big businessmen, only Rockefeller was hostile to the American entry into the war.

During the interwar years, with both financial groups converted to statism, the Morgans, still heavily invested.in Britain and France, began to drive toward American war with Germany:, which, with its bilateral economic agreements, remained stubbornly outside the Morgan financial ambit. On the other: hand, “the Rockefellers, with financial ties to L G. Farben in Germany were isolationists in Europe; with top Rockefeller ideologist (we’Il see why a bit later) John Foster Dulles – later the chief spokesman for pietistic global war writing a realistic book, War, Peace, and Change; calling for peaceful revision of the Versailles Treaty to meet legitimate German territorial demands in Europe. On the other hand, the Rockefeller’s, with heavy investments and financial ties with China, were pushing for war with Japan, while the European-centered Morgans were in favor of peaceful coexistence in Asia (thus, virtually the only high State Department official opposing war with Japan was Ambassador to Japan, Joseph C. Grew, a Morgan partner.)

World War II, which ended any sort of rieo-populist phase the New Deal may have had, and cemented the corporatist Big Business alliance with the Welfare-Warfare State, may be considered to be a deal between the Rockefellers and Morgans, with both getting a piece of the pie: the Morgans their war in Europe, and the Rockefellers their war in Asia.

Since World War II, American political history can no longer be analyzed in terms of a stark Morgan-Rockefeller conflict; instead, with of course shifting marginal influence, both groups have settled down into a happy joint “Eastern Establishment” rule over the United States, an “East” which more and more has included Chicago and the Old Middle West. In domestic affairs, this meant running an increasingly mighty Leviathan Corporate State; in foreign affairs, it meant global imperialism and the waging of counter-revolution and the Cold War throughout the globe. The final victory of this Eastern team was the literal stealing of the 1952 Republican nomination from Senator Taft (no longer a Rockefeller ally), by means of savage Wall St. banker pressure on the delegates who had been committed to the isolationist Taft.

One stark example of Rockefeller influence on American politics – particularly in the higher administrative positions – was the makeup of the Eisenhower Administration. The powerful Secretary of State and virtual maker of foreign policy was John Foster Dulles. Who was Dulles? A partner, in the first place, of the Rockefeller Wall St. law firm of Sullivan and Cromwell; but, in addition to that, and a little known fact, Dulles was married to Janet Pomeroy Avery, first cousin of John D. Rockefeller, Jr. Thomas E. Dewey’s political mentor was Rockefeller kinsman, Winthrop W. Aldrich, head of the extremely powerful Chase National Bank (its successor, Chase Manhattan, is now of course openly headed by David Rockefeller.) Head of the extraordinarily powerful and secret CIA was Dulles’ brother Allen, and their sister Eleanor was at the Asian desk of the State Department. To top it all off, Under Secretary of State was Christian Herter, whose wife was a member of the Pratt family, which has been intimately associated with the Rockefellers since old John D. got his start a century ago.

Even the New York Times cottoned to the egregious nature of Nelson’s claim that his personal stockholdings give him no major control over large corporations. First, we must realize that the Rockefeller Family votes and acts together through their family corporation; when we add Nelson’s, David’s, Laurence’s, and John’s holdings, plus their family trusts. plus the enormous stock held by the numerous Rockefeller Foundations. µlus their extremely powerful Chase Manhattan Bank, with its loans. holdings, and trust department, plus their long-time allied families (the Pratts, Flaglers, Whitneys, Bedfords, et al), plus their looser allies, plus the fact that working control of modern corporations does not need 51 % on the stock, we get an idea of the enormous Rockefeller power. From a free-market point of view, of course, there is nothing wrong with economic “power” per se; but when we realize the intimate connection between the Rockefellers and the corporate State of the U. S. government, our view changes. This is not free market money but intimate government-business partnership and control. (For the most recent scholarly study of current Rockefeller financial control, see James C. Knowles, “The Rockefeller Financial Group,” in R. Andreano, ed., Superconcentration Supercorporation (Andover, Mass.: Warner Modular Publications, 1973).

* * * *

This brings us to the great Nixon Caper. One of the glories of the market is that, even when greatly hobbled, competition and new wealth can break through. During the 1960’s, a loosely allied variety of new wealth and new industrial firms arose to challenge the dominance of the old Rockefeller-Morgan Eastern Establishment. The new -money was centered in such new industries as plastics, computers, and electronics, defense firms such as aircraft, in real estate, and in Texas oil (hide-bound Standard Oil, originally centered in Cleveland and western Pennsylvania oilfields, had been slow to realize the potential of the newly discovered Texas and· Oklahoma oil fields.) Geographically, the new wealth was centered in what Kirkpatrick Sale has called “the Southern Rim’’: Texas, Southern California, and Florida. Much of the new “wealth” was Texas-centered, and the political rise of Lyndon Johnson and John Connally was both fostered and encouraged by the economic rise of the new wealth.

Carl Oglesby’s happy term for the two new conflicting groups was the “Yankees” and the “Cowboys”. The fact of old vs. new wealth also engendered a difference in ideology, in attitudes, and lifestyles between the two groups. The Eastern Establishment Yankees, entrenched for generations, was and is aristocratic, smooth, cosmopolitan, well-educated, and highly sophisticated: able to mask their power and government loot behind a façade of intellectual apologetics, set forth by kept intellectuals, experts, and university professors. Being less hungry and more far-sighted, furthermore, the Yankees are typically willing to allow more dissent, civil liberties, and adherence to democratic forms, so long as their power remains essentially undamaged. The Southern Rim “Cowboys”, on the other hand, symbolized again by Johnson and Connally, take on the typical characteristics of the nouveau riche: hungrier, less sophisticated, more immediately grasping, and more willing to scuttle civil liberties in their thirst for power.

After Yankee Jack Kennedy was deposed by a “lone nut”, Cowboy Johnson was catapulted to power. What of the Nixon Administration? While Nixon himself was personally Cowboy (Southern California), his administration was clearly a Cowboy-Yankee coalition, with foreign policy wrapped up by the Rockefellers (Henry Kissinger was for years Nelson Rockefeller’s personal foreign policy adviser.) Economic policy was also basically Rockefeller, Arthur Burns having long been in the Dewey-Rockefeller ambit, and George Shultz being a member of the Pratt family (his middle name is Pratt). But the rest of the Administration was Cowboy, a designation that clearly applies to the West Coast and USC White House power boys, as well as Connally, and to Bebe Rebozo (Florida and Cuba: how Southern Rimmy can one get?)

The interesting focal question about the great media revelations on Watergate is: how come the powerful Establishment press (the New York Times, Washington Post, CBS, NBC) suddenly got honest? How come, that after years of supinely accepting federal government press handouts, they suddenly became demon investigative reporters in the great old, but forgotten, tradition? The point is not that the press was wrong and Nixon victimized about Watergate, but that how come the press suddenly got right? A conspiracy analysis provides the only plausible explanation: namely, that the press expose was the spearhead of a massive Eastern Establishment-Yankee counterrevolution to smash the Nixonite cowboys: almost all of whom are now banished, under indictment. or in jail. Why the Yankees concluded that they must take such drastic measures, even unto impeachment, is not completely clear: part of it was certainly the naked grab for power, the burgling and the espionage on the part of the Nixon Cowboys. But another part centers on the still mysterious role of the CIA, which was strongly if muddily concerned with Watergate. The catalyst seems to have been Nixon’s appointment of James Schlesinger to head the CIA, after which Schlesinger began to purge the “Old Guard” of the CIA, which had always been thoroughly Yankee-Eastern Establishment. It is certainly possible that James McCord, who finally blew the whistle on the plot, was a double agent of his beloved Yankee-controlled CIA, in bringing down Nixon and his Plumbers.

At any rate, we come down to the great empirical test of the Yankee Cowboy conspiracy analysis of the Watergate Struggle: if true, if the fight over Watergate was a massive counter-revolution engineered by the Rockefeller-Morgan Yankees, then who would be appointed Vice President by the cipher Jerry Ford (who himself was a political disciple of Yankee-controlled Arthur Vandenberg?) If the conspiracy thesis were correct, then either Yankee Brahmin Eliot Richardson, or, even more blatantly, Nelson himself, would be appointed. And the rest is history. With Rockefeller receiving general hosannahs as heir-apparent, with Donald Rumsfeld now in and Kissinger still around, the Yankees have now taken over completely. Dr. Josephson’s seemingly paranoid analysis of twenty-two years ago has virtually come true; the man who could not have been nominated, let alone elected, on his own, is only a heartbeat away from total power, and is the front-runner for 1976.

As a corollary of this mammoth fusion of political and economic power, it is not surprising that Nelson Rockefeller, as much as Scoop Jackson, is Mr. State: in every policy field. Rockefeller opts for statism and Big Government. High taxes, high government spending, fiat paper over gold, jail for drug addicts, compulsory racial integration; military-industrial complex. Cold War and global intervention, you name it, Nelson Rockefeller is in the forefront of the drive for Leviathan State power. The monstrous choice of Nelson Rockefeller and the confirmation of the conspiracy thesis, does not of course mean that we libertarians should retract our hosannahs over the bringing down of the corrupt and tyrannical Nixon gang. No group of men have more richly deserved such a fate. But the State of course rolls on, albeit under rather different management. The Yankees may be smoother and more civil libertarian, but they are in the long run more dangerous, and this especially applies to Nelson. Now that we have used the once rusty impeachment weapon so successfully: let us keep it revved up and at the. ready. Boy are we going to need it.

Originally Posted at https://mises.org/

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers: