Potential Tropical Cyclone Five Forecast Discussion

836 WTNT45 KNHC 121456 TCDAT5 Potential Tropical Cyclone Five Discussion Number 4 NWS National Hurricane Center Miami FL AL052024 1100 AM AST Mon Aug 12 2024 Data from the NOAA Hurricane Hunter aircraft investigating the storm indicate a low-level center could be attempting to form closer to some increased convective activity within the northern semicircle of the disturbance. While the disturbance appears to be gradually becoming better organized in satellite imagery, the lack of a well-defined center means it will remain a potential tropical cyclone for this advisory. Based on the flight-level winds and some distant scatterometer data over the eastern part of the circulation, the initial intensity is set at 30 kt. An Air Force Reserve Hurricane Hunter aircraft will investigate the system this afternoon and help us assess any changes to the low-level wind field. Overall, the disturbance has moved a little faster to the west than previous estimates, and the initial motion remains quickly westward (280/23 kt). A westward to west-northwestward motion with some decrease in forward speed is expected during the next couple of days while the system moves around the southwestern extent of the subtropical ridge. This will bring the center over portions of the Leeward Islands late tonight into Tuesday, and then near or over the Virgin Islands and Puerto Rico late Tuesday night and Wednesday. By midweek, the system will reach a weakness in the mid-level ridge caused by a mid-latitude trough moving across the western Atlantic. This should induce a northwestward to northward motion during the latter half of the forecast period. The track guidance envelope has shifted to the left of the previous track, likely a product of the faster forward speed and the weaker initial state of the system. Only small adjustments were made to the near-term NHC track forecast, with a slightly larger westward adjustment at days 3-5. Until the disturbance becomes better organized, the large radius of maximum wind and some northeasterly shear should only allow for modest strengthening during the next 24-48 h. The NHC forecast shows it becoming a tropical storm in 24 h and continuing to slowly strengthen while it passes over the northeastern Caribbean Sea. Once the system reaches the western Atlantic, the intensity guidance favors more significant strengthening, and the system is forecast to become a hurricane in 3 days and continue intensifying thereafter. No major changes were made to the NHC intensity forecast this cycle, which remains close to the multi-model consensus. Key Messages: 1. The disturbance is expected to become a tropical storm as it reaches the Leeward Islands. Tropical Storm Warnings are in effect for most of these islands, where tropical storm conditions are expected to begin late tonight. 2. Heavy rainfall may result in locally considerable flash flooding and mudslides in areas of the Leeward and Virgin Islands by later today into Wednesday, and over Puerto Rico late Tuesday into Thursday. 3. A Tropical Storm Warning is now in effect for the Virgin Islands and Puerto Rico, where tropical storm conditions are expected to begin Tuesday night or early Wednesday. FORECAST POSITIONS AND MAX WINDS INIT 12/1500Z 15.1N 55.6W 30 KT 35 MPH...POTENTIAL TROP CYCLONE 12H 13/0000Z 15.5N 58.8W 35 KT 40 MPH...POTENTIAL TROP CYCLONE 24H 13/1200Z 16.3N 62.2W 35 KT 40 MPH 36H 14/0000Z 17.3N 64.6W 40 KT 45 MPH 48H 14/1200Z 18.8N 66.4W 45 KT 50 MPH 60H 15/0000Z 20.5N 67.6W 55 KT 65 MPH 72H 15/1200Z 22.7N 68.2W 65 KT 75 MPH 96H 16/1200Z 27.0N 67.5W 85 KT 100 MPH 120H 17/1200Z 31.5N 65.0W 95 KT 110 MPH $$ Forecaster Reinhart

Originally Posted at:

NATIONAL HURRICANE CENTER and CENTRAL PACIFIC HURRICANE CENTER

At The NATIONAL OCEANIC AND ATMOSPHERIC ADMINISTRATION

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

Ukrainian troops hold 1,000 square kilometres of Russia: military chief

This is a developing story.. check back for updates.

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

Potential Tropical Cyclone Five Advisory Number 4

000

WTNT35 KNHC 121456

TCPAT5

BULLETIN

Potential Tropical Cyclone Five Advisory Number 4

NATIONAL WEATHER SERVICE, National Hurricane Center Miami Florida AL052024

11:00 A.M. Atlantic Standard Time Mon Aug 12 2024

- TROPICAL STORM WARNINGS ISSUED FOR THE VIRGIN ISLANDS AND PUERTO RICO

- DISTURBANCE STILL MOVING QUICKLY WESTWARD

SUMMARY OF 11:00 A.M. Atlantic Standard Time 15:00 COORDINATED UNIVERSAL TIME INFORMATION

LOCATION 15.1 NORTH 55.6 WEST

ABOUT 435 MILES, 700 KILOMETERS EAST SOUTHEAST OF ANTIGUA ABOUT 730 MILES, 1175 KILOMETERS EAST SOUTHEAST OF SAN JUAN PUERTO RICO

MAXIMUM SUSTAINED WINDS 35 MILES PER HOUR, 55 KILOMETERS PER HOUR

PRESENT MOVEMENT WEST, OR 280 DEGREES AT 26 MILES PER HOUR, 43 KILOMETERS PER HOUR

MINIMUM CENTRAL PRESSURE 1010 MILLIBAR, 29.83 INCHES

WATCHES AND WARNINGS

CHANGES WITH THIS ADVISORY:

- The Tropical Storm Watch for the U.S. Virgin Islands and Puerto Rico, including Vieques and Culebra, has been upgraded to a Tropical Storm Warning.

- The government of Antigua has upgraded the Tropical Storm Watch to a Tropical Storm Warning for the British Virgin Islands.

SUMMARY OF WATCHES AND WARNINGS IN EFFECT:

A Tropical Storm Warning is in effect for

- Saint Kitts, Nevis, Montserrat, Antigua, Barbuda, and Anguilla

- Guadeloupe Saint Martin and Saint Barthelemy

- Sint Maarten

- British Virgin Islands

- U.S. Virgin Islands

- Puerto Rico

- Vieques

- Culebra

- A Tropical Storm Warning means that tropical storm conditions are expected somewhere within the warning area within 36 hours.

- Interests elsewhere in the northeastern Caribbean should monitor the progress of Potential Tropical Cyclone Five.

- For storm information specific to your area in the United States, including possible inland watches and warnings, please monitor products issued by your local National Weather Service forecast office.

- For storm information specific to your area outside of the United States, please monitor products issued by your national meteorological service.

DISCUSSION AND OUTLOOK

- At 11:00 A.M. Atlantic Standard Time (15:00 COORDINATED UNIVERSAL TIME), the disturbance was centered near latitude 15.1 North, longitude 55.6 West.

- The system is moving toward the west near 26 Miles Per Hour, (43 Kilometers Per Hour).

- A westward to west northwestward motion with some decrease in forward speed is expected during the next couple of days.

- On the forecast track, the disturbance is expected to move across portions of the Leeward Islands late tonight or Tuesday and approach the U.S. and British Virgin Islands and Puerto Rico Tuesday evening.

- Then, the disturbance is forecast to move away from Puerto Rico over the western Atlantic through midweek.

Maximum sustained winds have increased to near 35 Miles Per Hour, (55 Kilometers Per Hour) with higher gusts. - Some strengthening is forecast during the next couple of days, and the disturbance is expected to become a tropical depression later today or tonight and become a tropical storm as it nears the Leeward Islands.

- Formation chance through 48 hours high 90 percent.

- Formation chance through 7 days high 90 percent.

- The estimated minimum central pressure is 1010 Millibar, (29.83 inches).

HAZARDS AFFECTING LAND

Key messages for Potential Tropical Cyclone Five can be found in the Tropical Cyclone Discussion under AWIPS header MIATCDAT5 and WMO header WTNT45 KNHC and on the web at

hurricanes.gov/text/MIATCDAT5.shtml

RAINFALL:

- Potential Tropical Cyclone Five is expected to produce total rain accumulations of 4 to 6 inches over portions of the Leeward and Virgin Islands.

- For Puerto Rico, 3 to 6 inches of rainfall, with maximum amounts of 10 inches, is expected.

Elsewhere in the Caribbean, Potential Tropical Cyclone Five is expected to produce the following rain accumulations through Friday morning:- Windward Islands 1 to 4 inches

- Eastern Hispaniola 2 to 4 inches

- For a complete depiction of forecast rainfall associated with Potential Tropical Cyclone Five, please see the National Weather Service Storm Total Rainfall Graphic, available at

hurricanes.gov/graphics_at5.shtml?rainqpf

WIND:

- Tropical storm conditions are expected in the warning area for the Leeward Islands beginning late tonight or Tuesday.

- Tropical storm conditions are expected to begin spreading over the Virgin Islands and Puerto Rico on Tuesday night or early Wednesday.

STORM SURGE:

- A storm surge will raise water levels by as much as 1 to 3 feet above ground level for the eastern coast of Puerto Rico from San Juan to Guayama, including the islands of Culebra and Vieques and in the U.S.Virgin Islands, including Saint Thomas, St.John, and Saint Croix.

- A storm surge will raise water levels by as much as 1 to 3 feet above normal tide levels in the British Virgin Islands.

- Near the coast, the surge will be accompanied by large and destructive waves.

SURF:

- Swells generated by the system will likely begin to affect portions of the Leeward Islands beginning tonight.

- These swells are likely to cause life threatening surf and rip current conditions.

- Please consult products from your local weather office.

NEXT ADVISORY

- Next intermediate advisory at 2:00 P.M. Atlantic Standard Time .

- Next complete advisory at 5:00 P.M. Atlantic Standard Time .

$$

Forecaster Reinhart

Originally Posted at:

NATIONAL HURRICANE CENTER and CENTRAL PACIFIC HURRICANE CENTER

At The NATIONAL OCEANIC AND ATMOSPHERIC ADMINISTRATION

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

Potential Tropical Cyclone Five Forecast Advisory

000 WTNT25 KNHC 121455 TCMAT5 POTENTIAL TROPICAL CYCLONE FIVE FORECAST/ADVISORY NUMBER 4 NWS NATIONAL HURRICANE CENTER MIAMI FL AL052024 1500 UTC MON AUG 12 2024 POTENTIAL TROP CYCLONE CENTER LOCATED NEAR 15.1N 55.6W AT 12/1500Z POSITION ACCURATE WITHIN 40 NM PRESENT MOVEMENT TOWARD THE WEST OR 280 DEGREES AT 23 KT ESTIMATED MINIMUM CENTRAL PRESSURE 1010 MB MAX SUSTAINED WINDS 30 KT WITH GUSTS TO 40 KT. 12 FT SEAS..150NE 0SE 0SW 0NW. WINDS AND SEAS VARY GREATLY IN EACH QUADRANT. RADII IN NAUTICAL MILES ARE THE LARGEST RADII EXPECTED ANYWHERE IN THAT QUADRANT. REPEAT...CENTER LOCATED NEAR 15.1N 55.6W AT 12/1500Z AT 12/1200Z CENTER WAS LOCATED NEAR 14.8N 54.6W FORECAST VALID 13/0000Z 15.5N 58.8W...POTENTIAL TROP CYCLONE MAX WIND 35 KT...GUSTS 45 KT. FORECAST VALID 13/1200Z 16.3N 62.2W MAX WIND 35 KT...GUSTS 45 KT. 34 KT... 60NE 0SE 0SW 40NW. FORECAST VALID 14/0000Z 17.3N 64.6W MAX WIND 40 KT...GUSTS 50 KT. 34 KT... 80NE 20SE 0SW 40NW. FORECAST VALID 14/1200Z 18.8N 66.4W MAX WIND 45 KT...GUSTS 55 KT. 34 KT...100NE 60SE 20SW 50NW. FORECAST VALID 15/0000Z 20.5N 67.6W MAX WIND 55 KT...GUSTS 65 KT. 50 KT... 30NE 40SE 0SW 0NW. 34 KT...150NE 120SE 50SW 70NW. FORECAST VALID 15/1200Z 22.7N 68.2W MAX WIND 65 KT...GUSTS 80 KT. 50 KT... 50NE 50SE 20SW 30NW. 34 KT...160NE 150SE 80SW 90NW. EXTENDED OUTLOOK. NOTE...ERRORS FOR TRACK HAVE AVERAGED NEAR 125 NM ON DAY 4 AND 175 NM ON DAY 5...AND FOR INTENSITY NEAR 15 KT EACH DAY OUTLOOK VALID 16/1200Z 27.0N 67.5W MAX WIND 85 KT...GUSTS 105 KT. 50 KT... 80NE 90SE 40SW 60NW. 34 KT...150NE 160SE 100SW 110NW. OUTLOOK VALID 17/1200Z 31.5N 65.0W MAX WIND 95 KT...GUSTS 115 KT. 50 KT... 90NE 90SE 60SW 60NW. 34 KT...160NE 170SE 120SW 120NW. REQUEST FOR 3 HOURLY SHIP REPORTS WITHIN 300 MILES OF 15.1N 55.6W INTERMEDIATE PUBLIC ADVISORY...WTNT35 KNHC/MIATCPAT5...AT 12/1800Z NEXT ADVISORY AT 12/2100Z $$ FORECASTER REINHART

Originally Posted at:

NATIONAL HURRICANE CENTER and CENTRAL PACIFIC HURRICANE CENTER

At The NATIONAL OCEANIC AND ATMOSPHERIC ADMINISTRATION

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

Homebuyers Get Creative Amid Historically High Property Values

Authored by Michael Washburn via The Epoch Times (emphasis ours),

The dramatic rise in median home prices in New York City and other busy real estate markets from pre-pandemic levels, and the intense competition for desirable properties, has driven buyers throughout the country to pursue a range of innovative solutions they might never have considered four or five years ago, brokers and real estate lawyers have told The Epoch Times.

With the median home listing price in New York City at $825,000, and a median sale price of $776,100, according to realtor.com figures, the Big Apple stands out as one of the most expensive and competitive markets in the nation.

By comparison, the median price stood at $615,000 in January 2019.

But that does not mean that buyers elsewhere have it easy. Throughout the rest of the country, they are looking long and hard for affordable deals with average home prices poised at $412,300.

The pandemic was something of a turning point. In the period from the first quarter of 2020 to the end of 2024, for example, the average price rose nearly 50 percent, from $329,000 to $479,500, according to data from the Federal Reserve Bank of St. Louis.

Mark Scheier, cofounder of Acton, Massachusetts-based real estate law firm Scheier Katin & Epstein, said recent analyses that describe the current market as a buyer’s market—where inventory volume and a relatively low bar for access favor buyers over sellers—are mistaken.

“I’m not experiencing a buyer’s market at all, I’m still experiencing a seller’s market here,” he told The Epoch Times.

Until recently, about 10 percent of the deals Scheier brokered for clients were all-cash deals, while the rest involved some mixture of financing—typically, bank loans—and cash.

“Almost 40 percent of my deals are cash deals, which was never the case before. People are doing everything they can, breaking into their retirement money, pooling all their assets together, to try to make cash deals,” Scheier said.

With prices rising so rapidly, one factor is fear of missing out (FOMO)—an acute sense on the part of many buyers that if they don’t get in now, they will face an even more fiercely competitive market in the near future, he stated.

A corollary to this perception, he said, is the need to acquire properties whose value is increasing dramatically and take advantage of the price appreciation while they still can.

“I’ve been practicing for 51 years, and I’ve seen all the ups and downs, and right now, I think there’s a lot of FOMO going on,” said Scheier.

“The train is leaving without them and if they don’t rush to get on the train, they’re going to lose out on that appreciation. People are feeling that way, so they’re moving ahead, they’re jumping off the cliff.”

Many people in the market are coming to realize that mortgage rates are unlikely to fall back to 2.5 percent in the foreseeable future and that they will have to accept rates of 6.5–7.0 percent, which might have previously put them off trying to close a deal, Scheier noted.

But the historically high prices and the competition requires a diversification of strategy that brokers say they have rarely seen before.

Tough Times

Some real estate industry professionals hailed the $418 million settlement in March of a long-running lawsuit against the National Association of Realtors (NAR), Sitzer/Burnett v. NAR Commission.

The lawsuit took issue with agents’ use of the association’s Multiple Listing Service (MLS) and the practice of charging 6 percent commissions, often split evenly between sellers’ and buyers’ brokers, in property sales.

Michael Downer, a broker at Coldwell Banker Realty in Naples, Florida, said the settlement means that buyers’ brokers can no longer pretend to their clients that they are acting pro bono while in fact automatically getting half of the 6 percent commission paid to sellers’ brokers at closing.

Buy-side brokers will have to be more transparent about what they are actually doing and what compensation they should rightfully receive for their role in a deal.

At the same time, others criticized the outcome on the grounds that purchasers who cease finding a buy-side broker using the MLS will begin working directly with sellers’ brokers, which poses a conflict of interest given those brokers’ preexisting relationships with their own clients.

“From a legal perspective, I don’t know that there has been that significant of a change in laws. Obviously, there was the recent NAR settlement, but it’s just with respect to the use of the MLS,” Zachary Schorr, a real estate lawyer and partner of the Los Angeles-based firm Schorr Law, told The Epoch Times.

In this highly competitive environment, some buyers are even going so far as waive the loan and appraisal contingencies that many have relied upon in the past to guarantee that they can get their deposit back if the mortgage financing they seek doesn’t get approved, or if the appraisal turned up unexpected issues at the property, said Schorr.

It can be a big mistake to waive these things or skirt due diligence—which may lead to serious problems after a sale, and cases of buyer’s remorse. Yet some people these days are acutely conscious of the disadvantage they face with respect to other buyers who are able to present themselves to sellers as unencumbered by any need to secure financing.

“It’s a more strategic way to do it if you’re in the all-cash market, or you’ll be beaten out by all-cash,” said Schorr.

“This is a higher-end market, too. If you’re way above the median price, there are more all-cash buyers.”

Lara Mizrack, a broker at Brown Harris Stevens in New York City, described many buyers’ unease as largely a function of high interest rates, the upcoming election, and international uncertainty. Mizrack acknowledged the distinct advantage that cash buyers hold in the current market.

“An all-cash deal has a faster application process, easier closing, and a seller does not have concerns about bank rejections,” she said.

Creative Approaches

The key for buyers in the current market who are not super-wealthy is to show a high degree of flexibility both with regard to the types of properties they set out to acquire no less than the terms and structures of financing, said Cara Ameer, a broker with Coldwell Banker Vanguard Realty in Ponte Vedra Beach, Florida.

Finding prices in the range they can afford may sometimes require buyers to look beyond the area where they live and to consider, say, a townhouse or condo unit rather than a single-family home, Ameer told The Epoch Times.

Another option is to buy a property in order to rent it out and use the revenue from the rental to pay off the mortgage and increase their share in the equity of the property in question, she said.

“There are affordable opportunities in virtually every city and state, you just have to know where to look. Smaller towns near colleges and universities are often promising opportunities,” Ameer stated.

“Buyers should also work with a lender well versed in low- to no-downpayment loans, as well as first-time homebuyer programs and creative lending options that can help them access financing.”

Ameer noted that one Southern California lender she works with makes use of a program where buyers do not need to put any money down on a first mortgage and can take out a second mortgage using 3.5 percent in gift funds directly from the lender. The buyer must have funds to cover the closing costs.

The total paid at closing runs to around 3–4 percent of the purchase price, she said. Buyers who do not have the means even to cover that expense at closing can request a cost credit from the seller.

Ameer also pointed to Federal Housing Administration (FHA) loan programs that require 3.5 percent down, and conventional loan programs with low down payments that cover anywhere from 5 percent to 100 percent of the total purchase price.

Yet another option for buyers who do not have deep pockets is to seek out a property in a state of disrepair, whether that means something as serious as a missing roof or as cosmetic as broken air conditioning, and to apply for a renovation loan, Ameer said.

Read more here…

Loading…

Originally Posted at; https://www.zerohedge.com//

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

NewsWare’s Trade Talk: Monday, August 12 | NewsWare‘s Trade Talk

S&P Futures are positive this morning as the markets prepares for a host of key economic reports due out this week. Economic data

in the next few days, particularly Wednesday’s inflation numbers, may lead to more big swings. Starbucks is higher this morning as Starboard Value is said to have taken in position in the stock. Disney unveils theme park expansions. In Europe, stocks are mixed to higher and oil prices are higher as OPEC lowers its demand forecast in its monthly report which was just released.

Home for this information is at NewsWare‘s Trade Talk homepage at this link

Stay Updated with News.FreePtomaineRadio’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

Potential Tropical Cyclone Five Public Advisory

000

WTNT35 KNHC 121153

TCPAT5

BULLETIN

Potential Tropical Cyclone Five Intermediate Advisory Number 3A

NATIONAL WEATHER SERVICE, National Hurricane Center Miami Florida AL052024

8:00 A.M. Atlantic Standard Time Mon Aug 12 2024

- TROPICAL STORM WARNINGS ISSUED FOR PORTIONS OF THE LEEWARD ISLANDS

- NOAA HURRICANE HUNTERS CURRENTLY INVESTIGATING THE DISTURBANCE

SUMMARY OF 8:00 A.M. Atlantic Standard Time 12:00 COORDINATED UNIVERSAL TIME INFORMATION

LOCATION 14.6 NORTH 54.3 WEST

ABOUT 525 MILES, 845 KILOMETERS EAST SOUTHEAST OF ANTIGUA

ABOUT 830 MILES, 1335 KILOMETERS EAST SOUTHEAST OF SAN JUAN PUERTO RICO

MAXIMUM SUSTAINED WINDS 30 MILES PER HOUR, 45 KILOMETERS PER HOUR

PRESENT MOVEMENT WEST, OR 280 DEGREES AT 26 MILES PER HOUR, 43 KILOMETERS PER HOUR

MINIMUM CENTRAL PRESSURE 1009 MILLIBAR, 29.80 INCHES

WATCHES AND WARNINGS

CHANGES WITH THIS ADVISORY:

- The government of Antigua has upgraded the Tropical Storm Watch to a Tropical Storm Warning for Antigua, Barbuda, Montserrat, St. Kitts, Nevis, and Anguilla.

- The government of the Netherlands has upgraded the Tropical Storm Watch to a Tropical Storm Warning for Saba and Saint Eustatius.

- The government of France has upgraded the Tropical Storm Watch to a Tropical Storm Warning for Guadeloupe, Saint Martin, and St. Barthelemy.

- The government of Sint Maarten has upgraded the Tropical Storm Watch to a Tropical Storm Warning for Sint Maarten.

SUMMARY OF WATCHES AND WARNINGS IN EFFECT:

A Tropical Storm Warning is in effect for

- Saint Kitts, Nevis, Montserrat, Antigua, Barbuda, and Anguilla

- Guadeloupe

- Saint Martin and Saint Barthelemy

- Sint Maarten

A Tropical Storm Watch is in effect for

- British Virgin Islands

- U.S. Virgin Islands

- Puerto Rico

- Vieques

- Culebra

- A Tropical Storm Warning means that tropical storm conditions are expected somewhere within the warning area within 36 hours.

- A Tropical Storm Watch means that tropical storm conditions are possible within the watch area, generally within 48 hours.

- Interests in elsewhere in the northeastern Caribbean should monitor the progress of Potential Tropical Cyclone Five.

- Additional watches or warnings could be required later today.

- For storm information specific to your area in the United States, including possible inland watches and warnings, please monitor products issued by your local National Weather Service forecast office.

- For storm information specific to your area outside of the United States, please monitor products issued by your national meteorological service.

DISCUSSION AND OUTLOOK

- At 8:00 A.M. Atlantic Standard Time (12:00 COORDINATED UNIVERSAL TIME), the disturbance was centered near latitude 14.6 North, longitude 54.3 West.

- The system is moving toward the west near 26 Miles Per Hour, (43 Kilometers Per Hour), and a westward to west northwestward motion is expected with some decrease in forward speed during the next couple of days.

- On the forecast track, the disturbance is expected to move across portions of the Leeward Islands late tonight or Tuesday and approach the U.S. and British Virgin Islands and Puerto Rico Tuesday evening.

- Maximum sustained winds are near 30 Miles Per Hour, (45 Kilometers Per Hour) with higher gusts.

- Some strengthening is forecast during the next couple of days, and the disturbance is expected to become a tropical depression later today or tonight and become a tropical storm as it nears the Leeward Islands.

- Formation chance through 48 hours high 90 percent.

- Formation chance through 7 days high 90 percent.

- The estimated minimum central pressure is 1009 Millibar, (29.80 inches).

HAZARDS AFFECTING LAND

Key messages for Potential Tropical Cyclone Five can be found in the Tropical Cyclone Discussion under AWIPS header MIATCDAT5 and WMO header WTNT45 KNHC and on the web at

hurricanes.gov/text/MIATCDAT5.shtml

RAINFALL:

- Potential Tropical Cyclone Five is expected to produce total rain accumulations of 4 to 6 inches over portions of the Leeward Islands.

- For Puerto Rico, 3 to 6 inches of rainfall, with maximum amounts of 10 inches, is expected.

- Elsewhere in the Caribbean, Potential Tropical Cyclone Five is expected to produce the following rain accumulations through Friday morning:

- Windward Islands 1 to 4 inches

- Eastern Hispaniola 2 to 4 inches

- For a complete depiction of forecast rainfall associated with Potential Tropical Cyclone Five, please see the National Weather Service Storm Total Rainfall Graphic, available at

hurricanes.gov/graphics_at5.shtml?rainqpf

WIND:

- Tropical storm conditions are expected in the warning area beginning late tonight or Tuesday.

- Tropical storm conditions are possible within the watch area beginning on Tuesday.

STORM SURGE:

- A storm surge will raise water levels by as much as 1 to 3 feet above ground level for the eastern coast of Puerto Rico from San Juan to Guayama, including the islands of Culebra and Vieques and in the U.S. Virgin Islands, including Saint Thomas, St.John, and Saint Croix.

- A storm surge will raise water levels by as much as 1 to 3 feet above normal tide levels in the British Virgin Islands.

- Near the coast, the surge will be accompanied by large and destructive waves.

SURF:

- Swells generated by the system will likely begin to affect portions of the Leeward Islands beginning tonight.

- These swells are likely to cause life threatening surf and rip current conditions.

- Please consult products from your local weather office.

NEXT ADVISORY

- Next complete advisory at 11:00 A.M. Atlantic Standard Time.

$$

Forecaster Reinhart

Originally Posted at:

NATIONAL HURRICANE CENTER and CENTRAL PACIFIC HURRICANE CENTER

At The NATIONAL OCEANIC AND ATMOSPHERIC ADMINISTRATION

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

Donald Trump Jr. Warns That the Fuse Is Already Lit on America’s Economic Time Bomb

The following article by Donald Trump Jr. is sponsored by Birch Gold.

Donald Trump Jr. here, with an urgent warning that Americans need to know before it’s too late.

The elites have set the dollar on an irreversible path to destruction. The damage runs deeper than most people realize, and time is running out to protect your hard-earned savings.

Let me lay out the harsh reality:

- The Obama administration kicked off an era of reckless spending and easy money policies.

- For four long years, the Biden administration has flooded the economy with trillions of increasingly worthless dollars.

- Our national debt has skyrocketed to unimaginable heights.

- The resulting inflation is eating away at your savings every single day.

We’re facing an economic time bomb, and the fuse is already lit. The truth is, there is no stopping what’s coming. The wheels are in motion, and the dollar’s decline may be unstoppable.

That’s why I’m urging you to take action NOW to protect your savings and your family’s future because time is running out.

So what should you do? For many Americans with an IRA or 401(k), I believe a gold IRA is the answer. Physical gold has intrinsic value that has withstood the test of time for thousands of years. Plus, it can’t be printed into oblivion like our fiat currency.

A gold IRA is a tax-sheltered retirement account that offers you protection against inflation and the death of the dollar, a hedge against economic uncertainty, and a tangible asset that will always have value!

Want to learn more? My friends at Birch Gold Group have prepared a crucial info kit on how gold IRAs work – at zero cost or obligation to you. Get your free info kit on gold here.

Don’t wait another day. Tomorrow, your savings will be worth even less. The dollar’s fate may be sealed, but your financial future doesn’t have to go down with it. Get this no-cost info kit on gold and explore your options!

Originally Posted At www.breitbart.com

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

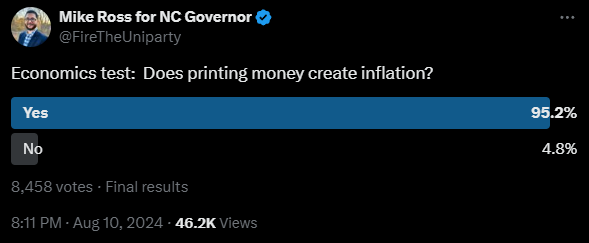

Does Printing Money Create Inflation?

The Libertarian Party candidate for governor of North Carolina posed this question on Twitter a few days ago:

The question is poorly worded, but that is mainly the fault of the way the term “inflation” has fared in common parlance. Ross probably got the poll results he desired – he was trying to reinforce the idea that increasing the supply of money results in higher prices. The issue, however, is that those who understand that relationship are also usually the ones who think inflation ought to refer to increases in the money supply. For them, the question reads, “Does increasing the money supply create increases in the money supply?” The answer to the question now depends on how one interprets “create” instead of one’s understanding of economic cause-and-effect. Indeed, many of the discerning commenters said something to the effect of “printing money IS inflation.”

Ludwig von Mises lamented these terminological shifting sands in Human Action:

The semantic revolution which is one of the characteristic features of our day has also changed the traditional connotation of the terms inflation and deflation. What many people today call inflation or deflation is no longer the great increase or decrease in the supply of money, but its inexorable consequences, the general tendency toward a rise or a fall in commodity prices and wage rates. This innovation is by no means harmless. It plays an important role in fomenting the popular tendencies toward inflationism.

First of all there is no longer any term available to signify what inflation used to signify. It is impossible to fight a policy which you cannot name. Statesmen and writers no longer have the opportunity of resorting to a terminology accepted and understood by the public when they want to question the expediency of issuing huge amounts of additional money. They must enter into a detailed analysis and description of this policy with full particulars and minute accounts whenever they want to refer to it, and they must repeat this bothersome procedure in every sentence in which they deal with the subject. As this policy has no name, it becomes self-understood and a matter of fact. It goes on luxuriantly.

I’m reminded of Ronald Reagan’s pithy way of saying the same thing: “If you’re explaining, you’re losing.” Mises realized that jumbling up the meanings of economic terms makes it easier for the state to implement disastrous policies. It’s difficult to criticize a policy when there is no consensus on what words mean.

The difficulty has only intensified over the years. Today, “inflation” is used by politicians, economists, commentators, and the public to refer to a host of different causes and even more effects.

- Robert Reich refers to inflation as the higher prices caused by corporate greed and consolidation.

- Kamala Harris, in her typical unscripted word salad, said inflation is “the cost of living going up,” and that it is “something that we take very seriously, very seriously.”

- Paul Krugman thinks about inflation through the Keynesian aggregate supply and demand framework. For him, inflation is whatever is revealed in the various official price level statistics.

- Jerome Powell also looks to the official statistics, but with an eye toward manipulating interest rates to minimize the difference between the year-over-year changes and the central bank’s two percent target.

Michael Bryan documented the evolution of the term inflation in three phases. Its original definition involved “a change in the proportion of currency in circulation relative to the amount of precious metal that constituted a nation’s money.” Later, economists started using the term to refer to increases in the supply of money relative to “the needs of trade” or the demand for money. Over the course of the 20th century, inflation became synonymous with price increases, “and its connection to money is often overlooked.”

Rothbard favored the original definition. Mises mainly dealt with the second. Modern Austrian economists make use of both definitions, but overwhelmingly reject the last. You will often hear modern Austrian economists (somewhat awkwardly) deal with the terminological problem by adding clarifiers: “monetary inflation,” “price inflation,” or “in this context, by ‘inflation’ I mean _____.”

The third definition (inflation is an increase in prices) has many serious problems. Chief among them, according to Mises, is that it conjures an

image of a level of a liquid which goes up or down according to the increase or decrease in its quantity, but which, like a liquid in a tank, always rises evenly. But with prices, there is no such thing as a “level.” Prices do not change to the same extent at the same time. There are always prices that are changing more rapidly, rising or falling more rapidly than other prices.

Another problem is that it leads the public and politicians to think that the consequences of monetary expansion can be arrested by further interventions like price controls: “While merely fighting symptoms, they pretend to fight the root causes of the evil. Because they do not comprehend the causal relation between the increase in the quantity of money on the one hand and the rise in prices on the other, they practically make things worse.”

Finally, the definition is causally naked. If inflation is an increase in prices, then anything that results in higher prices can be called “inflationary.” This became obvious in recent years when covid-era supply chain disruptions were said to have caused inflation. The same reasoning, with a dash of Marxist class conflict, allows the Robert Reichs and Elizabeth Warrens of the world to blame inflation on corporate greed. It has led to the segmentation of “inflation” by sector or industry: we have health care inflation, shelter inflation, inflation in higher education, energy inflation, and on and on. While disaggregation can be analytically useful, and often it is necessary when countering the highly-aggregated mainstream macroeconomics, this kind is not. It muddles the water regarding the nature of inflation, and it can’t capture the step-by-step process by which new money results in a “price revolution.” Fiat money inflation distorts the market as individuals receive it in exchange and then use it to increase their demands for goods produced in a variety of industries. Money goes from individual to individual, not industry to industry.

Mises was absolutely right when he concluded: “It is obvious that this new-fangled connotation of the terms inflation and deflation is utterly confusing and misleading and must be unconditionally rejected.”

Originally Posted at https://mises.org/

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers:

Greece orders evacuations near Athens over wildfires: fire brigade

Greece ordered the evacuation Monday of multiple communities northeast of Athens as wildfires raged, the fire brigade said.

“Forest fire near you. Follow the instructions of the authorities,” said SMS messages sent to people in the Attica region, indicating in which direction to flee.

Stay Updated with news.freeptomaineradio.com’s Daily Newsletter

Stay informed! Subscribe to our daily newsletter to receive updates on our latest blog posts directly in your inbox. Don’t let important information get buried by big tech.

Current subscribers: