Submitted by Newsquawk

- ECB policy announcement due Thursday December 12th; rate decision at 13:15GMT/08:15EST, press conference from 13:45GMT/08:45EST

- Expectations are for the ECB to cut the Deposit Rate by 25bps to 3.00%

- The backdrop of the meeting comes amid a highly uncertain growth outlook for the Eurozone

OVERVIEW: The ECB is expected to follow up the October rate cut with another 25bps reduction, its 4th rate cut in a row, disappointing some of those looking for a deeper cut of 50bps on account of ongoing growth concerns. The ECB will most likely maintain a gradual approach to rate cuts with accompanying macro projections potentially set to not fully reflect recent negative events in the Eurozone. If the GC surprises markets by going for 50bps it will be a highly pre-emptive move and a step away from data-dependency. In order to get a consensus for such a move, the doves will need to convince the hawks that this is not a precursor for a move into sub-neutral territory.

PRIOR MEETING: As expected, the ECB opted to cut the Deposit Rate by 25bps. Despite the bank seemingly positioning itself for an unchanged rate in the wake of the September meeting, soft outturns for inflation and survey data forced the hand of the Bank into easing policy. Accordingly, the ECB reaffirmed its data-dependent credentials and reiterated that it will keep policy rates sufficiently restrictive for as long as necessary. The only minor tweak in the policy statement was that the Bank now sees inflation at 2% in the course of 2025 vs. previous guidance of H2 2025. At the follow-up press conference, Lagarde noted that there will be a lot more data available before the December 12th meeting, which suggests that there is not a preset expectation on the GC over what happens at the final meeting of the year. Furthermore, Lagarde stated that she has not opened the door to another rate reduction in December. That being said, she noted that there is no question that policy is currently restrictive. With regards to the decision, the President noted that it was a unanimous one on the GC.

RECENT ECONOMIC DEVELOPMENTS: On the inflation front, headline Y/Y CPI rose in November to 2.3% from 2.0%, which was largely expected on account of base effects. Core inflation remained at a stubborn level of 2.7% whilst services inflation ticked marginally lower to 3.9% from 4.0%. The ECB’s Consumer Expectations Survey saw the 12-month inflation forecast rise to 2.5% from 2.4% with the 3yr forecast holding steady at 2.1%. The 5y5y inflation forward has pulled back to 2.00% from the 2.14% seen at the time of the last meeting. On the growth front, Q3 GDP came in at 0.4% Q/Q, whilst the November Eurozone Composite PMI slipped to 48.1 from 50.0 amid heavy pessimism surrounding the French economy. The accompanying release noted “the eurozone’s manufacturing sector is sinking deeper into recession, and now the services sector is starting to struggle after two months of marginal growth.” In the labor market, the unemployment rate remains at a historic low of 6.3%.

RECENT COMMUNICATIONS: Since the prior meeting, President Lagarde has noted that the medium-term economic outlook is uncertain and therefore the Bank is not pre-committing to a particular rate path. Chief Economist Lane said while inflation had fallen close to the ECB’s target of 2%, there is a little bit of distance to go. He added that while data dependence falls down in priority, the new challenge would be assessing the incoming risks on a meeting-by-meeting basis, via FT. The influential Schnabel of Germany has stated that she sees only limited room for additional cuts, adding that the ECB should take a gradual approach and not go to an accommodative stance. In the hawkish camp, Austria’s Holzmann has said that a 25bps rate cut is conceivable in December but not more. Interestingly, the typically centrist Villeroy of France said interest rates should clearly go to the neutral rate and would not exclude going below the neutral rate in the future. He added that negative rates should remain in the ECB’s toolkit. Elsewhere, Italy’s Panetta has said that the ECB should move to a neutral monetary stance, or expansionary if necessary, adding that the ECB is still a long way away from neutral.

RATES/ECONOMIC PROJECTIONS: Expectations are for the ECB to cut the deposit rate by 25bps to 3.0% with markets assigning a circa 82% chance of such an outcome (with an 18% probability for a 50bps rate cut). Despite the weak growth outlook for the Eurozone, which is also complicated by Trump’s return to the White House, developments on the inflation front suggest there is still more work done to return inflation to target. In recent weeks, policymakers have also stressed the need for the Bank to step away from recent data dependency and focus on forward-looking expectations. On which, the accompanying macro projections are likely to be viewed as stale given that the cut-off date did not encapsulate the latest French political woes, whilst as highlighted by ING, “the ECB normally also applies a ‘no policy change’ assumption to its forecasting”. ING expects projections to be little changed vs. September (other than a slight downward revision for growth and inflation in 2025). As such, those on the GC looking for a 50bps cut are unlikely to be supported by the latest forecasts. If the GC surprises markets by going for 50bps it will be a highly pre-emptive move and a step away from data- dependency. In order to get a consensus for such a move, the doves will need to convince the hawks that this is not a precursor for a move into sub-neutral territory. Looking beyond the upcoming meeting, assuming the ECB cuts by 25bps, an additional 125bps of loosening is seen by the end of 2025.

Current forecasts:

- HICP INFLATION: 2024: 2.5%, 2025: 2.2%. 2026: 1.9%

- HICP CORE INFLATION (EX-ENERGY & FOOD): 2024: 2 9%, 2025: 2.3%, 2026: 2.0%

- GDP: 2024: 0.8%, 2025: 1.3%, 2026: 1.5%

* * *

How to trade today’s ECB rate cut?

Here is Bloomberg’s Vassilis Karamanis explaining why “Euro Traders Brace For Risk In Lagarde Guidance”

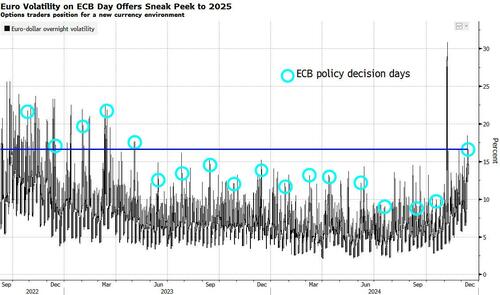

Options traders see the euro moving by the most since May 2023 on the day of a European Central Bank meeting, even amid market consensus on the policy decision. It’s mostly about forward-guidance expectations and a new FX volatility environment that’s been shaping up since the US elections.

Euro-dollar overnight volatility rises to 16.56%, the fifth highest reading in the past 19 months, pointing to a potentially game-changing moment for investors. Money markets fully price a quarter-point interest rate cut by the ECB later Thursday, assigning next to zero chances of a larger cut.

The updated inflation and growth projections are one part of the uncertainty surrounding the decision. The biggest surprise would of course come from a jumbo rate cut, but it’s mostly down to what President Christine Lagarde will offer to the market in terms of verbal projections.

Questions include whether the central bank sticks to restrictive-rates language and delivers a modest hawkish surprise, or if officials are comfortable in communicating that a move below neutral levels is on the cards by the summer of 2025. Traders may be also looking for clear guidance on what the ECB has in store in case of a global trade war or should political risks in the euro area’s largest economies spill over to spreads.

Lagarde has been careful in maintaining full flexibility during the press conferences that follow a policy decision, sporadically offering only subtle messaging on the Governing Council’s thinking for the next move. While options pricing points to chances that today’s messaging could be more revealing, high euro hedging costs also reflect the shaping up of expectations for higher volatility next year.

Chances of a global trade war, lingering geopolitical risks and diverging inflation paths for the world’s largest economies — and in turn monetary policy, make the case for long-volatility exposure in the currency space which is seen once again as a strong alpha-generating asset class. Interbank traders say that positioning is now much lighter in the euro, as many desks have trimmed exposure ahead of year-end, and that leaves room for a wide move, even if it all goes according to consensus.